11-18-2014 Informational Session Slides.pptx

advertisement

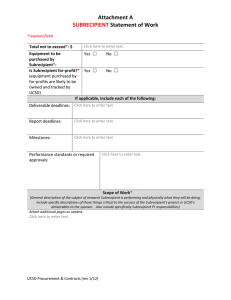

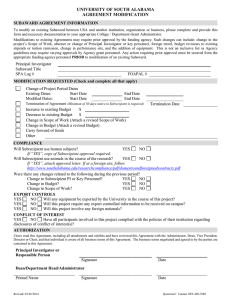

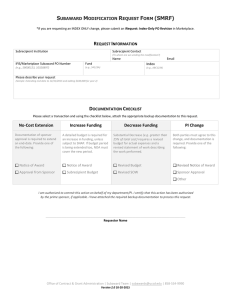

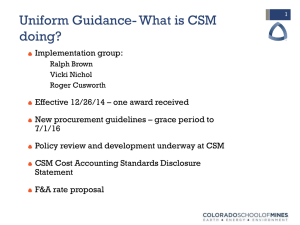

The Office of Management and Budget’s (OMB) New Uniform Guidance Informational Session for UH Faculty and Staff November 18,2014 Agenda • • • • • • 2 Background Application Pre-award changes Cost Principle changes Post-award changes Q&A Background Primary Objective: Reduce both administrative burden and risk of waste, fraud and abuse for Federal awards. 3 Background – Reform Timeline 4 Background • 2 CFR 200 (Uniform Guidance) – replaces OMB Circulars A-21, A-110, and A-133 • Though parts still live on: – Subpart C (Pre-award) – Subpart D (Post-award) – Subpart E (Cost Principles) – Subpart F (Audit) 5 Application • New awards issued on or after 12/26/14 • Increments to existing awards issued after 12/26/14, if Federal awarding agency modifies terms and conditions (T&C) • Existing Federal awards that do not receive incremental funding with new T&C will continue to be governed by original award 6 Application • Grants and Cooperative Agreements • Contracts follow Federal Acquisition Regulations (FAR) and UG for cost principles – (e.g. use of electronic records not explicitly formalized in FAR) NOTE: As always, award terms and conditions prevail over UG 7 Pre-award Changes • • • • 8 Simplify Applications Give More Time to Apply Clarify Entitlement to F&A Voluntary Cost Sharing Simplify Applications Federal awarding agency must: • display standard information on OMBdesignated government-wide website • use OMB approved application forms – ORS will notify once forms are available 9 Give More Time to Apply • Funding opportunities must be open for at least 60 calendar days • Federal awarding agency may decide to post funding opportunities for less than 60 calendar days but never less than 30 calendar days, unless exigent circumstances arise and are approved by the agency head 10 Clarify Entitlement to F&A UH should receive Full F&A as a prime or subrecipient unless: • prohibited by Federal law for a class of Federal awards or a single Federal award or • approved by a Federal awarding agency Head - OMB’s intention is for all sponsors to recognize negotiated rates 11 Voluntary Cost Sharing • not expected • cannot be used as a factor during the merit review unless criteria for consideration and award determination factors are explicitly included in the funding announcement • highly discouraged by UH if no incentives 12 Cost Principle Changes • • • • • 13 Admin/clerical support Computing devices Conferences Participant support costs Publication and printing costs Cost Principle Changes • Terminal Vacation Leave Rate • Visa Costs 14 Admin/clerical support • No longer need to prove “major project” status (as described in A-110); must show it is “integral” and can be specifically identified to project • Must be explicitly budgeted or have prior written approval 15 Computing devices • Such as laptops, netbooks, smart phones, & tablet computers – hardware costs • Must be essential, though not solely dedicated, to the performance of a Federal award • OMB expects UH policies (E2.214 Security and Protection of Sensitive Information) on safeguarding the devices and data are followed 16 Conferences • Allowable only when purpose is for dissemination of technical information beyond UH and necessary and reasonable for successful performance under a Federal award – Interpret “beyond UH” = collaborators, beneficiaries, and general public 17 Participant support costs • Allowable with prior approval on conferences or training projects, not research • MTDC exclusion for participant support costs applies only to conference grants or training grants 18 Publication and printing costs • Now can be incurred outside the performance period of the award • Costs must be charged prior to closeout of award 19 Terminal vacation leave rate • Cannot charge last account; must be either indirect costs or via fringe benefit rate • Change in Federal regulations means RCUH will now have to create a terminal vacation leave rate like UH • UH will need to make its rate uniform for all funds 20 Visa Costs • For projects that need skills from foreign persons, short-term visa fees if applicable can be proposed as direct costs • Criteria for directly charging of visa costs must be: – Critical and necessary for the conduct of the project; – Allowable under the applicable cost principles; – Consistent with UH cost accounting practice and policy (i.e., handling of short-term visa costs for non-extramural activities); and – Meet the definition of direct cost in the applicable cost principles Examples include TN, J-1, O, and H-1B visas 21 Post-award changes • • • • 22 Reporting Prior approvals Record Retention Subrecipient Monitoring Reporting • Requirement to relate performance to financial information has not changed • NEW: Use of OMB-approved governmentwide standard report formats such as Research Performance Progress Report (RPPR), Federal Financial Report (FFR) ORS will notify if any additional changes 23 Financial Reporting – Required Certifications • Old Language: • OMB Circular A-21 § K. Certification of charges: …"I certify that all expenditures reported (or payment requested) are for appropriate purposes and in accordance with the provisions of the application and award documents." New Language: ‘‘By signing this report, I certify to the best of my knowledge and belief that the report is true, complete, and accurate, and the expenditures, disbursements and cash receipts are for the purposes and objectives set forth in the terms and conditions of the Federal award. I am aware that any false, fictitious, or fraudulent information, or the omission of any material fact, may subject me to criminal, civil or administrative penalties for fraud, false statements, false claims or otherwise. (U.S. Code Title 18, Section 1001 and Title 31, Sections 3729–3730 and 3801– 3812).’’ Significantly new language required for annual and final financial reports and invoices is shown in bold. 24 Prior Approvals Welcome changes: • PI’s “disengagement” (v. absence) for more than 3 months Am I Disengaged? • No prior approval required for re-budget from direct to indirect 25 Prior Approvals (Cont’d) • NEW – Prior approval required for changes to approved cost sharing • Issue – Expanded authorities expire 12/26/14; Will agencies implement Research Terms & Conditions by then? 26 Record Retention • Allows for electronic record retention • Federal award-related information should be collected, transmitted and stored in open and machine readable formats • ORS will update related policies and procedures 27 Subrecipient Monitoring Subrecipient vs. Contractor Determination • Perform and document a case-by-case determination • Subrecipient v. Contractor Determination Checklist available on ORS website – required for all service or subaward agreements 28 Subrecipient Monitoring – F&A • De minimis rate of 10% of MTDC for subawardees that have never received a negotiated F&A rate • UH no longer has to negotiate rates with subrecipients 29 Subrecipient Monitoring and Management – Fixed Price Subawards • With prior written approval from the Federal awarding agency, UH may provide subawards based on fixed amounts up to the Simplified Acquisition Threshold (currently $150,000) • Payments based on meeting specific requirements • Accountability based on performance and results • Mandatory Cost Sharing not allowed and Voluntary Cost Sharing not encouraged 30 Subrecipient Monitoring Required Information • Pass Through Entities (PTE) must provide certain subaward information to the subrecipient • ORS developed a Subaward Information Checklist tool for internal use - available on ORS website 31 Subrecipient Monitoring Risk Assessment • Risk Assessment must be performed and documented for each subrecipient – refer to Subrecipient Monitoring Flowchart • ORS will perform the risk assessment and notify the project of the risk level and monitoring procedures – refer to Monitoring Procedures 32 Subrecipient Monitoring Monitoring Procedures • Invoices should be accompanied by performance and financial reports • Project must review the subrecipient’s performance and financial reports in a timely manner prior to reimbursement 33 Subrecipient Monitoring – Payments PTE must make payment to subrecipients within 30 calendar days after receipt of an invoice, unless there are outstanding performance or financial issues. 34 Subrecipient Monitoring Tax Clearance Subrecipient must obtain Hawaii State and IRS Tax Clearance in accordance with HRS §103-53. Projects should advise their potential subrecipients to obtain tax clearances as soon as possible (during the proposal stage) to enable timely payments. 35 Q&A • Q: OMB is leaving it up to non-Federal entities to decide whether it wants to manage two sets of rules (before UG and after UG). What is UH planning to do? • A: For simplicity, UH intends to apply entity-wide system changes (i.e. Effort Reporting) to all Federal awards, effective 12/26/14. 36 Q&A • Q: Do I have to keep my old funding in a separate account from my new funding after the UG goes into effect? • A: No! 37 Q&A • Q: Now that agencies are giving us more time to apply, does that change the ORS deadline for proposal submission? • A: No. ORS still requests that you notify us as soon as you intend to apply and submit the application at least five business days prior to the due date. 38 Q&A • Q: What happens if the Federal awarding agency doesn’t honor the UH negotiated rate? • A: The project should request documentation of the Federal awarding agency head’s approval for the lower rate. If unavailable, please notify ORS for follow up. 39 Q&A • Q: What counts as prior approval? For example, if I state my intention to charge a cost in my progress report and Federal agency issues award without mention, is that approval? • A: It depends. Check terms & conditions or refer questions to the Federal awarding agency. 40 Q&A • Q: A portion of the budget on an award with Cost Sharing was deobligated during the project period. Can Cost Sharing be reduced? • A: Yes. With prior agency approval, Cost Shared amounts can be proportionately reduced. 41 Q&A • Q: Are we really allowed to eliminate time and effort reporting? • A: Yes! (They say). However, adequate internal controls must be in place to support compensation for personal services charged to the award. UH will need to evaluate before making any revisions to our current time and effort reporting system. 42 Q&A • Q: Should I wait until the subaward is executed before notifying the subrecipient to obtain a Hawaii State Tax Clearance? • A: No! This process should be initiated at the proposal development stage. 43 Q&A • Q: Are we allowed to make payments to a subrecipient prior to review of the performance and financial reports? • A: No. As part of the required monitoring procedures, these reports must be reviewed prior to payment. 44 Contact Information • Dennis Nakamura, Compliance Officer – dnakamu@hawaii.edu or 956-5893 • Dawn Kim, Compliance Manager – dawnkim@hawaii.edu or 956-0396 45 Procurement • • • • Grace period to July 1, 2016 General Standards Methods of Procurement UH – Eff. July 1, 2016, require sealed bids for construction > $150,000 (currently $250,000) using Federal funds • RCUH - Update of RCUH Procurement & Disbursing Policies posted October 29, 2014 http://www.rcuh.com/wps/portal/RCUH 46 Procurement General Standards and Methods 47 Procurement - Methods 48