Economic integration: a policy maker s guide to the state of the art or what have we learned from the Sussex Framework [PPT 115.00KB]

advertisement

![Economic integration: a policy maker s guide to the state of the art or what have we learned from the Sussex Framework [PPT 115.00KB]](http://s2.studylib.net/store/data/014979475_1-d3dc3f8336c6310b427601e371dffafb-768x994.png)

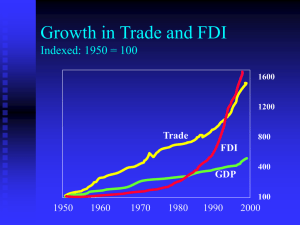

Economic integration: a policy maker’s guide to the state of the art or what have we learned from the Sussex Framework Over view – Shallow integration, gains from trade and the theory of second best – Intra industry trade – Integration, productivity and growth – The disappearing (?) monetary union effect • beyond the tariff equivalent – Regulation – simply a cost of doing business? – The services puzzle Shallow integration, gains from trade and the theory of second best • Old news but what we know best: trade creation and trade diversion – Easy ways to detect by examination of the trade and protection numbers • size of tariffs and NTB • Share of partner trade • Overlap of trade structures and RCA – Also know what to do in FTA to reduce the bad impacts • Cut mfn tariffs/NTB and especially tariff/NTB peaks in areas where partner competitive Intra industry trade • The Balassa discovery – This is the beginning of looking for deep integration • Grubel Lloyd indices adapted to discriminate by vertical and horizontal IIT ie supply chain trade versus varieties trade Integration and growth • More uncertain mechanisms and models via endogenous growth type models – Usual routes through increased innovation and specialisation driven by competition and economies of scale in turn driven by increased trade and FDI The (disappearing (?)) monetary union effect • Rose (2000,2003) claims large effects on trde from monetary integration from gravity modelling. Mechanism not clear – Started in xs of 100% increases in trade as a result of monetary union – By time of UK treasury’s 5 tests (2003) on EMU range in order of 5-50% increase – Now doubt that increase in trade detected after formation of EMU real. Known Unknowns or beyond the tariff equivalent Regulation – simply a cost of doing business? • • • Regulation can add to costs and for foreign entrants to market may be de facto discriminatory – but that is not (always or even often) their purpose so measuring the price wedge does not catch their potential benefits The focus needs to be on the output of the regulation and perhaps the inputs required to deliver it and whether they generate externalities, higher quality, new varieties and markets, supply chain integration Generates a number of puzzles – How to measure outputs of regulation and their implications for production methods – food and SPS standards may require up rating of water purity with externalities for unrelated industries or even human health or production methods that shift production function out to set against costs – This may require too much information to produce other than case studies which may be suggestive but hard to generalise – a missing theory although if enough case studies may be possible by qualitative research to try to pull out underlying regularities – Search for precursors of deep integration may be way to go so look at IIT and FDI indicators to identify ‘green shoots’ where deep integration may be underway and look for examples there – at least for goods The services puzzle • Services are subject to regulation and that is the main obstacle to trade so all the same issues arise as on goods • But hampered by lack of statistical fine grain on either production or trade to pursue the potential from deep integration. • FDI one clear indicator but only for one mode of provision