Soal Minggu ke 11, Chapter 6 dan Chapter 7

advertisement

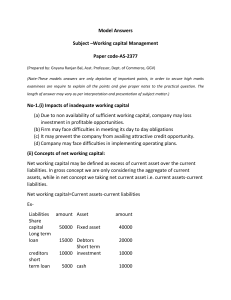

Soal Minggu ke 11, Chapter 6 dan Chapter 7 1. Explain the concept of ‘fair value’ as defined in IAS 16/AASB 116 and outline the benefits to financial statement users of continually revaluing assets to their current value. 2. Problem 7.2 Consider the current cost balance sheet of Reflex Ltd at 1 July 2007, the beginning of the 2007–08 financial year. The perpetual LIFO inventory system is used. Assume the current cost of the inventory is also its historical cost at 1 July 2003. The building was purchased for $100 000, the land for $10 000 and the bonds sold at par when the general price index was 90, on 1 July 2006. The building is depreciated at 10% per year. All other items were acquired at the beginning of the 2007–08 financial year. The general price index is 100 at the beginning of the year. The following events are mentioned in chronological order for the year ending 30 June 2008. 1. 2. 3. 4. 5. 6. Purchased on account 5000 units of inventory at $6 each. The general price index is 105. Sold on account 5000 units for $15 each. Current cost is $9 each at this time. The general price index is 105. At year-end, the building’s current cost is $200 000 and the value of the land is $20 000. The current cost of the inventory is $12 each. The market price of the share investment is $25 000. The market price of the bonds is $45 032 on 30 June. The current rate of interest is 12%. The average market rate of interest was 11% for the year. The remaining life of the bond issue is 8 years on 30 June 2004. On 30 June, half of the land is sold for $10 000. On 30 June, operating expenses of $15 000 are paid. Interest of $5000, which is not included in the $15 000, is also paid. The general price index at the end of the year is 120. The average for the year is 108. Required: A. Prepare journal entries to record the events mentioned, as well as the statement of financial performance for the year ended 30 June 2008 and the statement of financial position as at 30 June 2008, under the following methods: (a) conventional accounting: historical cost, financial capital, nominal dollars (b) current cost accounting: current cost, financial capital, nominal dollars. Distinguish between realised and unrealised holding gains or losses. B. Convert the current cost financial statements to a constant dollar (end-ofcurrent-year) basis.