Preparing Student Hiring Documents

advertisement

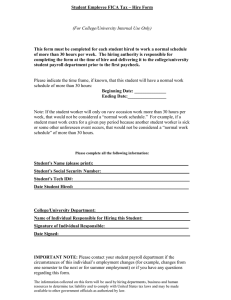

Student Employment PREPARING HIRING DOCUMENTS FOR STUDENT EMPLOYEES Learning Objectives Prepare a Payroll Action Form (PAF) New Hire Previously Employed Extension Federal Work Study Change of Account Merit Increase Termination Learning Objectives Prepare additional student employment required forms: Eligibility and Application Form New Hire Policy and Acknowledgement Forms Drug/Alcohol Free Work Place Sexual Harassment Work Place Safety Learning Objectives Prepare an I-9 for: U.S. Citizen Permanent Resident Foreign National What dates can be used Signature dates (employee and employer) Certification The goal of Student Employment is to make preparing hiring documents a easy process. How we do not want you to feel when preparing hiring documents • How we do want you to feel when preparing hiring documents Hiring documents: Employers are responsible for submission of original, complete and accurate employment documents. For a student employee to receive a paycheck, all the hiring documents must be received, reviewed and approved by the Student Employment staff prior to the student’s first day work. Hiring documents must be completed within three (3) working days prior to the students first day on the job. Hiring documents A student PAF can extend for three academic terms/semesters, which includes the current term/semester. There are three (3) terms within the academic year. Term 1 (FALL): 8/16 – 12/31 Term 2 (SPRING): 1/1 – 5/15 Term 3 (SUMMER): 5/16 – 8/15 (These date will change yearly. Please refer to the Academic Calendar on the UNR website) Hiring Documents Copies of the following documents may be kept in the student’s personnel file within your department. • Payroll Action Form (PAF) • Eligibility and Application Form • New Hire Policy and Acknowledgment Form Copies of the following documents may not be kept in student’s personnel file within your department. • I-9 Employment Eligibility Verification Form • I-9 Employment Eligibility Verification Documents • W-4 Employee’s Withholding Allowance Certification Hiring documents The effective date of hire can be no earlier than the “Payroll Start Date” listed on the Payroll Action Form (PAF). If the student is not eligible to work in a student employee category and hours have been reported, those hours must be paid by the department as a temporary worker through Business Center North (BCN). A student cannot hold a classified position or Letter of Appointment position with a student position. Position Control Numbers The department must include a position control number (this is not the job board number) on each PAF. Position control numbers are assigned to the department by Planning, Budget and Analysis: 7846516 5XXXX Position Control Numbers Our office cannot process the hiring documents unless Planning, Budget and Analysis has “linked” the position number with the department’s account number. Since all student employment positions are temporary, all account lines on the PAF must have an end date. A student PAF can extend for three academic terms/semesters. Earning Codes The following earning codes are used on the PAF to identify the amount of wages charged to the departments budgets. STU = department is charged 100% of student wages. Work Study (FW1 or FW2) = the department is charged 25% of student wages and the federal pays 75% of student wages. o FW1 = Fall Work Study o FW2 = Spring Work Study o In some rare cases Non-Need Based Work Study may be awarded to the student by financial aid in this case the earnings codes will be SN1 for Fall and SN2 for Spring. New Hire Documents required for a New Hire are: • • • • • Payroll Action Form (PAF) Eligibility and Application Form I-9 (Employment Eligibility Verification) W-4 (Employee’s Withholding Allowance Certificate) New Hire Policies and Acknowledgement Form It is highly recommended that the forms are downloaded from our website to assure the most current forms are being used. http://www.unr.edu/hr/forms/forms.aspx New Hire 1. Prepared By - enter the department representives that is preparing the PAF, name (first and last), phone extension and mail stop. This will be the contact for any problems with the paperwork submitted. 2. Name - enter the student’s name (Last, First MI) *it is important to list the student’s middle initial so that we can locate the appropriate student if more then one. 3. Effective Date – enter the actual date that the student will begin working 1 2 Worker, Student E. Your name here, 784-6082, MS 0238 3 8/05/2010 New Hire 4. ID – Since the employee is new please leave this section blank. Please do not enter a social security # and/or Student R # as the ID on PAFs. The student will not have an Employee Identification Number (ID) until they are entered in the HRMS system so the HR office will fill this in once the paperwork is entered. 5. Campus – enter UNR, it will always be UNR for the University of Nevada, Reno Employees. 6. Employee Type – enter Student Worker I, II or III 4 6 5 Student Worker I UNR New Hire 7. Vice President –enter code for your Vice President Office 8. College –enter code for the College/Dean you are under 9. Dept. Code – enter your department code. This MUST be filled in and it is very important to have the correct department code listed because this is where the student’s timesheet will be sent when generated, you can always find your correct department code in CAIS under Human Resources. 10. Dept. Name – enter the full name of the hiring department. 7 VPAF 8 AVPH 9 HR - UNR 10 Human Resources - UNR New Hire 11. Position Number (Pos No) – enter the position number (5XXXX). This is the student’s pool number and not the job board number. If you do not know your position number, you can contact Planning Budget and Analysis at 784-6516 if state account, Sponsored Projects Office 7844040 if a grant or gift account. 12. Begin Date – This is the date the student physically begins working in his/her position. 13. End Date – This is the last date of employment and can only extend the maximum of the three term/semester limit. 11 50122 12 10/20/08 13 8/15/09 New Hire 14. Job Class Code – The job class code is based on the student job classification and would be the same job class code that you used when assigning/posting the job on Career Navigator. • 888111 = Student Worker I • 888222 = Student Worker II • 888333 = Student Worker III 15. Job Title – Job Title is the job title listed when you assigned/posted the job on Career Navigator (clerical, lab assistant, tutor, etc.) 14 888111 15 Front Desk Clerk New Hire 16. Account Number – the account number is the account number that has been set up for your department to pay student wages and is a 10 digit number. Make sure that the account(s) is: • A valid account number • Budgeted account • Account is linked to your department position number 17. Earnings Code – “STU” is the most common earnings code used for students. If the student has been awarded work study the earnings code will not be STU (refer to work study section on work study earnings code). The earnings code MUST be listed on the PAF. 18. Hourly or Pay Amount – List the student’s hourly wage amount. Student’s do 16 not earn a salary amount. The hourly wage amount may not be less than the federal/state minimum wage amount and may not exceed the maximum wage amount for a student employee without approval from the director. 1101-104-0401 17 STU 18 9.00 New Hire 19. Payroll Start Date – The payroll start date is the date the employee fiscally begins working on the job with your department. 20. Payroll Stop Date – The payroll stop date is the last date the student employee is expected to work (sample “A”). • The payroll stop date cannot exceed the last date of the third semester max extension limit. If you choose to prepare the payroll stop date for the full three terms it is recommended that each term be on it’s own account line (sample “B”). • The student must remain eligible in order to work as a student employee from one term to the next. HR will run report to see if the student falls below the eligibility and will first notify the department then terminate the employment. Sample “A” 19 Sample “B” Fall Spring Summer 10/20/08 1/1/09 5/16/09 12/31/08 5/15/09 8/15/09 10/20/08 20 Term Schedule Fall: 8/16 – 12/31 Spring: 1/1 – 5/15 Summer: 5/16 – 8/15 11/30/08 New Hire 21. Cert Method –the cert method box is where you will put the job board number (6 digit number) assigned/posted on Career Navigator for the position in which the PAF is being prepared for. If the student is working more than one job within your department each job needs to: • Have it’s own job board number assigned/posted • Have a separate PAF with a separate job board number listed on the PAF 22. Comments – the comment section can be used to add any additional information that may find helpful, such as: • New Hire Student Employee • New Hire within this department, I-9 and W-4 on file with Student Employment x696391 21 22 New Hire 23. Signatures and Date – Chairs, department heads, or their equivalents may sign Student Employment Personnel Action Forms (PAF) as the appointing authority for their organizational units; or they may delegate that authority to the individual responsible for the account from which the student is paid. 24. Employee Signature and Date – the student must sign and date their new hire PAF. We can not process without the student’s signature and date. 23 24 New Hire The new hire PAF is complete and should look similar to the PAF on the right Rehire/Reinstatement Rehire or reinstatements are the same as: previously employed Documents required are: Payroll Action Form (PAF) Eligibility and Application Form *I-9 (Employment Eligibility Verification) *W-4 (Employee’s Withholding Allowance Certificate) *New Hire Policies and Acknowledgement Form *They do not always require a I-9, W-4 and New Hire Policies and Acknowledgement form. If the student has had more than a 90 day lapse in employment the forms are required. If the student was previously terminated the forms may be required or a new hire packet. You can contact the Student Employment office to make sure the forms are necessary. It is highly recommended that the forms are downloaded from our website to assure the most current forms are being used. http://www.unr.edu/vpaf/hr/forms/forms.asp Rehire/Reinstatement A rehire/reinstatement PAF is done the same way as a new hire. The difference is the forms that are required and are not required depending on the date the employee was terminated from their last position. If you are not sure which forms will be needed for a re-hire student employee contact the Human Resources department and we will be happy to let you know what is needed. When preparing a PAF for a rehire/reinstatement, follow the new hire procedures. Extension A Extension PAF is used when extending an end date for an employee who is currently employed as a student employee within your department. Extension PAFs are prepared the same as a new hire PAF. The effective date, begin/end date and payroll start/stop dates will change. The student does not need to sign and date the PAF On most occasions only a PAF is required. Extension 1. Prepared By - enter the department representives that is preparing the PAF, name (first and last), phone extension and mail stop 2. Name - enter the student’s name (Last, First MI) *it is important to list the student’s middle initial so that we can locate the appropriate student if more then one. 3. Effective Date – enter the date of when the extension date will take effect. 1 2 Worker, Student E. Jannine Haggard, 43598, MS 0105 3 10/20/08 Extension 4. ID - Leave blank unless you have the employee number, social security #’s. and Student R #’s are not allowed on PAFs. 5. Campus – enter UNR, it will always be UNR for the University of Nevada, Reno Employees. 6. Employee Type – enter Student Worker I, II or III 4 6 5 Student Worker I UNR Extension 7. Vice President –enter code for your Vice President Office 8. College –enter code for the College/Dean you are under 9. Dept. Code – enter your department code. This MUST be filled in and it is very important to have the correct department code listed because this is where the student’s timesheet will generate, you can always find your correct department code in CAIS under Human Resources. 10. Dept. Name – enter the department. 7 VPAF 8 AVPH 9 HR - UNR 10 Human Resources - UNR Extension 11. Position Number (Pos No) – enter the position number (5XXXX). This is the student’s pool number and not the job board number. If you do not know your position number, you can contact Planning Budget and Analysis at 784-6516 if state account, Sponsored Projects Office 7844040 if a grant or gift account. 12. Begin Date – This is the date the student’s extension date begins for his/her position. 13. End Date – This is the last date of employment and can only extend the maximum of the current academic year. 11 50122 12 10/20/08 13 8/15/09 Extension 14. Job Class Code – The job class code is based on the student job classification and would be the same job class code that you used when assigning/posting the job on Career Navigator. • 888111 = Student Worker I • 888222 = Student Worker II • 888333 = Student Worker III 15. Job Title – Job Title is the job title listed when you assigned/posted the job on Career Navigator (clerical, lab assistant, tutor, etc.) 14 888111 15 Front Desk Clerk Extension 16. Account Number – the account number is the account number that has been set up for your department to pay student wages and is a 10 digit number. Make sure that the account(s) is: • A valid account number • Budgeted account • Account is linked to your department position number 17. Earnings Code – “STU” is the most common earnings code used for students. If the student has been awarded work study the earnings code will not be STU (refer to work study section on work study earnings code). The earnings code MUST be listed on the PAF. 18. Hourly or Pay Amount – List the student’s hourly wage amount. Student’s do 16 not earn a salary amount. The hourly wage amount may not be less than the federal/state minimum wage amount and may not exceed the maximum wage amount for a student employee without approval from the director. 1101-104-0401 17 STU 18 9.00 Extension 19. Payroll Start Date – The payroll start date is the extension date. If the previous job ended on 10/19/08, the new payroll start date will be 10/20/08. 20. Payroll Stop Date – The payroll stop date is the last date the student employee is expected to work (sample “A”). • The payroll stop date cannot exceed the three semester term limit. If you choose to prepare the payroll stop date for the three term limit, it is recommended that each term be on it’s own account line (sample “B”). • The student must remain eligible in order to work as a student employee from one term to the next. Sample “A” 19 Sample “B” Fall Spring Summer 10/20/08 1/1/09 5/16/09 12/31/08 5/15/09 8/15/09 10/20/08 20 Term Schedule Fall: 8/16 – 12/31 Spring: 1/1 – 5/15 Summer: 5/16 – 8/15 8/15/09 Extension 21. Cert Method –the cert method box is where you will put the job board number (6 digit number) assigned/posted on Career Navigator for the position in which the PAF is being prepared for. If the student is working more than one job within your department each job needs to: • Have it’s own job board number assigned/posted • Have a separate PAF with a separate job board number listed on the PAF 22. Comments – the comment section can be used to add any additional information that may find helpful, such as: • New Hire Student Employee • New Hire within this department, I-9 and W-4 on file with Student Employment x696391 21 22 Extension 23. Signatures and Date – Chairs, department heads, or their equivalents may sign Student Employment Personnel Action Forms (PAF) as the appointing authority for their organizational units; or they may delegate that authority to the individual responsible for the account from which the student is paid. 24. Employee Signature and Date – the student does not have to sign his/her name on an extension PAF. 23 24 Federal Work Study The Federal Work Study Program is a “need-based” financial aid program designed to assist students in earning money to meet their college expenses. To be eligible, a student must have filed a FAFSA (Free Application for Federal Student Aid) and have a work study allocation of funds. Each eligible student is awarded an amount of funds per semester that determines the maximum number of hours per week that may be worked. For on-campus positions, the federal funds pay 75% of the student’s wage and the employer matches the other 25% of the wage and worker’s compensation, which is 1.5%. Federal Work Study recipients may also work off-campus. Off-campus positions require a contract with the University and a deposit for the required matching funds prior to employment. The percentage of an employer contribution for wages differs by agency type- non-profit or for-profit. The off-campus Work Study agreement must be renewed annually. Contact the Student Financial Aid and Scholarships Office at (775) 784-4666 for more information. Federal Work Study Prepare the PAF the same way you would a new hire, except for on the accounting lines. Account Number – the account number is the account number that has been set 16. up for your department to pay student wages and is a 10 digit number. Make sure that the account(s) is: • A valid account number • Budgeted account • Account is linked to your department position number Earnings Code – “FW1” is for fall and “FW2” is for spring. You will use a pay line for each earnings code. The earnings code MUST be listed and correct on the PAF in order for us to process. 17. 16 1101-104-0401 17 FW1 1101-104-0401 FW2 Federal Work Study 18. Hourly or Pay Amount – List the student’s hourly wage amount. Student’s do not earn a salary amount. The hourly wage amount may not be less than the federal/state minimum wage amount and may not exceed the maximum wage amount for a student employee without approval from the director. 18. Payroll Start Date – The payroll start date is the date the student was awarded his/her work study. Most fall work study begins on 8/16 and the spring begins on 1/2. These dates may change each year depending on the academic calendar an update of these changes will be put on the student employment web site each year. 20. Payroll Stop Date – The payroll stop date is the last date the student employee can earn work study for the fall term the last date is 12/31 for spring term the last date is 5/15. • The student must remain eligible in order to work as a student employee from one term to the next. 18 9.00 9.00 Fall Spring 19 8/22/08 1/2/09 20 12/31/08 5/15/09 Federal Work Study Cert Method –the cert method box is where you will put the job board number (6 digit number) assigned/posted on Career Navigator for the position in which the PAF is being prepared for. If the student is working more than one job within your department each job needs to: 21. • Have it’s own job board number assigned/posted • Have a separate PAF with a separate job board number listed on the PAF Comments – the comment section can be used to add any additional information that may find helpful, such as: 22. • Work study student employee • Changing to work study x696391 21 22 Federal Work Study 23. Signatures and Date – Chairs, department heads, or their equivalents may sign Student Employment Personnel Action Forms (PAF) as the appointing authority for their organizational units; or they may delegate that authority to the individual responsible for the account from which the student is paid. 24. Employee Signature and Date – the student does not have to sign his/her name on a work study PAF. 23 24 Account Change Prepare the PAF the same way you would a new hire, except for on the accounting lines. Account Line 1 1. Account Number–enter the current account number that you are going to change. 2. Payroll Stop Date – enter the last date that the current account number is ending. If the new account begins 10/20 the payroll stop date will be 10/19. Account Line 2 3. Account Number – enter the new account number • • • 4. 5. A valid account number Budgeted account Account is linked to your department position number Payroll Start Date – enter the start date for the new account number in system to begin. Payroll Stop Date – The payroll stop date is the last date the student employee is expected to work. 1 3 • The payroll stop date cannot exceed the last date (8/15) of the current academic year. If you choose to prepare the payroll stop date for the full current academic year, it is recommended that each term be on it’s own account line • The student must remain eligible in order to work as a student employee from one term to the next. 2 1101-104-0401 1320-115-0006 3 10/20/08 4 10/19/08 8/15/09 Merit Increase 8.8 Merit The employer determines frequency and manner in which merit raises are made within the job classification schedule. Student employees should be evaluated on a regular basis, typically once a semester. If the evaluation is satisfactory, a merit increase within the classification wage range might be appropriate. A new PAF is required to submit this change. If the classification changes a new Job Board number must be obtained. If the PAF is submitted after timesheets have been generated, the wage on the pre-printed timesheet must be manually changed to the new rate. The employer makes the change on the timesheet prior to submitting it to the Payroll office. Retroactive pay raise adjustments must be calculated by the employer and submitted on a PR-29 or added to the employer’s student timesheet with a separate notation for previous hours. Contact Payroll at 784-6653 or specific instructions. 8.9 Promoting a Student Employee To upgrade an existing position or if the job description changes substantially, a new PAF is required To process this change. If the increase is greater than 10%, approval for a promotion is required by the director of Human Resources. A 10% increase is only allowed once per academic year. Merit Increase Prepare the PAF the same way you would a new hire, except for on the accounting lines. Account Line 1 1. Hourly or Pay Amount–enter the current wage amount that you are going to change. 2. Payroll Stop Date – enter the last date that the current wage amount is ending. If the new wage amount begins 10/20 the payroll stop date will be 10/19. Account Line 2 3. Hourly or Pay Amount– enter the wage amount 4. 5. Payroll Start Date – enter the start date for the wage amount to begin. Payroll Stop Date – The payroll stop date is the last date the student employee is expected to work. 1 3 • The payroll stop date cannot exceed the last date (8/15) of the current academic year. If you choose to prepare the payroll stop date for the full current academic year, it is recommended that each term be on it’s own account line • The student must remain eligible in order to work as a student employee from one term to the next. 1101-104-0401 1101-104-0401 9.00 10.00 2 3 10/20/08 4 10/19/08 8/15/09