Project Accountant

advertisement

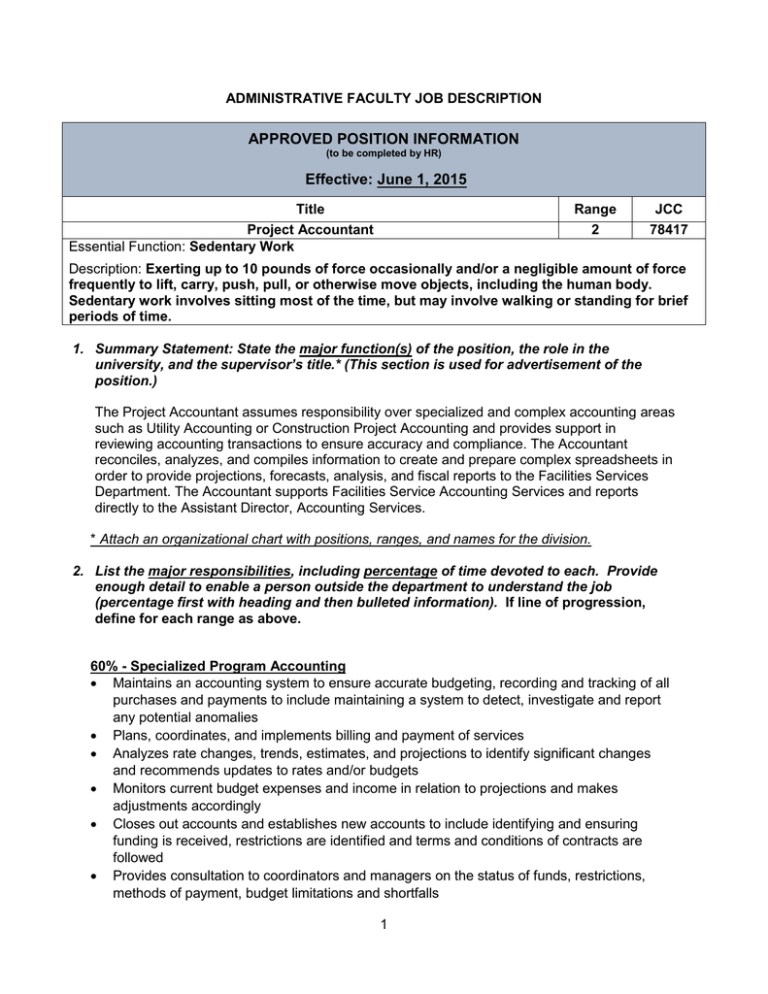

ADMINISTRATIVE FACULTY JOB DESCRIPTION APPROVED POSITION INFORMATION (to be completed by HR) Effective: June 1, 2015 Title Range JCC 2 78417 Project Accountant Essential Function: Sedentary Work Description: Exerting up to 10 pounds of force occasionally and/or a negligible amount of force frequently to lift, carry, push, pull, or otherwise move objects, including the human body. Sedentary work involves sitting most of the time, but may involve walking or standing for brief periods of time. 1. Summary Statement: State the major function(s) of the position, the role in the university, and the supervisor’s title.* (This section is used for advertisement of the position.) The Project Accountant assumes responsibility over specialized and complex accounting areas such as Utility Accounting or Construction Project Accounting and provides support in reviewing accounting transactions to ensure accuracy and compliance. The Accountant reconciles, analyzes, and compiles information to create and prepare complex spreadsheets in order to provide projections, forecasts, analysis, and fiscal reports to the Facilities Services Department. The Accountant supports Facilities Service Accounting Services and reports directly to the Assistant Director, Accounting Services. * Attach an organizational chart with positions, ranges, and names for the division. 2. List the major responsibilities, including percentage of time devoted to each. Provide enough detail to enable a person outside the department to understand the job (percentage first with heading and then bulleted information). If line of progression, define for each range as above. 60% - Specialized Program Accounting Maintains an accounting system to ensure accurate budgeting, recording and tracking of all purchases and payments to include maintaining a system to detect, investigate and report any potential anomalies Plans, coordinates, and implements billing and payment of services Analyzes rate changes, trends, estimates, and projections to identify significant changes and recommends updates to rates and/or budgets Monitors current budget expenses and income in relation to projections and makes adjustments accordingly Closes out accounts and establishes new accounts to include identifying and ensuring funding is received, restrictions are identified and terms and conditions of contracts are followed Provides consultation to coordinators and managers on the status of funds, restrictions, methods of payment, budget limitations and shortfalls 1 Project Accountant 25% - Accounting Reconciliation and Audit of Transactions Coordinates with other departments and reconciles funds for complex projects with diverse funding sources (i.e. state taxes, donations, bonds) Oversees the implementation of subordinate Facilities Services budget and activities which may include, but is not limited to, travel and training, fixed assets and sensitive equipment budgets Provides higher level consultation in regards to complaints, complex problems and proper procedures 15% - Leadership Mentors and provides direction to Facilities Services Accounting Services staff assistants in accounting, office technology, and software use Creates and provides training to Facilities Services staff on financial and budget topics Collaborates with co-workers and the Assistant Director of Accounting Services in creating and implementing process improvements and best practices Creates and updates department policies and procedures Prepares reports, analysis and special projects for Facilities Services and University Management Oversee reporting and adherence to compliance 3. Describe the types of decisions the position(s) makes independently as part of the core responsibilities. Provide examples. If a line of progression, describe the decisions made at the highest level. The Accountant may determine when fund drawdowns are necessary and which expenditures are applied to differing funding types such as: o determine when sufficient donations have been received on a construction project to submit a drawdown on a note or bond o determine the timing of additional funds to ensure funds are available for expenses and maximizes earned interest o ensure restricted funds are used only on the appropriate expenditures The Accountant may adjust calculation models based on new information and also determine when budget adjustments are necessary such as: o adjust interest rate calculations for construction retainage when interest rates increase or decrease o adjust utility projection models based on rate changes and/or changes is space o adjust funding models based on changing sources of funds or changes in expected revenue from fund sources 4. Describe the types of problems, issues, action, communications this position typically takes to the supervisor for resolution and/or consultation. Provide examples. If a line of progression, describe the supervisory consultation at the highest level. The Accountant consults with the Assistant Director of Accounting Services on all issues that fall outside of established policies, procedures and accounting practices and when issues of noncompliance are suspected. Such as: Obtain clarification of funding changes and discuss the impact to budgets. For example, discuss how to handle the impact of reduced donation to a project budget. 2 Project Accountant Discuss changes in space funding and the impact to Operations and Management budget and how to accommodate the changes. 5. Select the applicable competencies required to successfully perform the job. The selected competencies will be evaluated within the Administrative Faculty evaluation as Competencies for Success. Competency Required Adaptability ☒ Analytical Thinking ☒ Communication ☒ Diversity and Inclusion ☐ Financial Responsibilities ☒ Human Resource Responsibilities ☐ Leadership ☒ Program/Project/Functional Knowledge ☒ Resource Responsibilities ☒ Serving Constituents ☒ Teamwork ☒ Other (specify) ☐ 6. Minimum requirements of the position. Minimum requirements should be consistent with the Job Evaluation Model. If Line of Progression, minimum requirements must be defined for each range. Education Experience Bachelor’s Degree Two years of relevant work experience Master’s Degree One year of relevant work experience Relevant Experience: in general accounting, project accounting, cost accounting, and/or utility accounting Certification and Licensure: (bulleted) Nevada Class “C” or higher operator’s license within 30 days of appointment Schedule or Travel Requirements: (bulleted) 3 Project Accountant Optional Addendum: If the job description is generic for use across multiple departments, the department is free to add an addendum for departmental specific duties which may be performed. Generic job descriptions for a limited number of titles are available at www.unr.edu/hr. Optional Addendum: Describe the knowledge, skills, and abilities required to successful performance of this job (in bullet format). Knowledge of: Generally Accepted Accounting Principles (GAAP) Higher education accounting requirements and financial policies and procedures Fund accounting concepts, with emphasis in college/university, governmental or nonprofit environment Purchasing rules, regulations and policies Financial and accounting internal control standards Accounts payable and accounts receivable processing Accounting, forecasting, budgeting, project accounting and cost accounting principles and processes, financial statement preparation and evaluation, account reconciliation, fund accounting and budgeting. Higher education accounting and business procedures Skills: Expertise in quantitative and qualitative data reporting and analysis using current spreadsheet (Excel) and database (Access) applications. Proficiency in use of a personal computer and current software applications including but not limited to Microsoft Office Suite (Word, Access, Excel, PowerPoint, and Outlook), CIAS and Advantage Ability to: Understand and interpret formalized policies, guidelines, rules and regulations Gain and understanding of complex issues and analyze complex data Interact effectively with administrative faculty and staff and other employees at all levels of responsibilities Explain complex processes and procedures Write reports, business correspondence and procedures 4