Advisor, Financial Aid (LoP)

advertisement

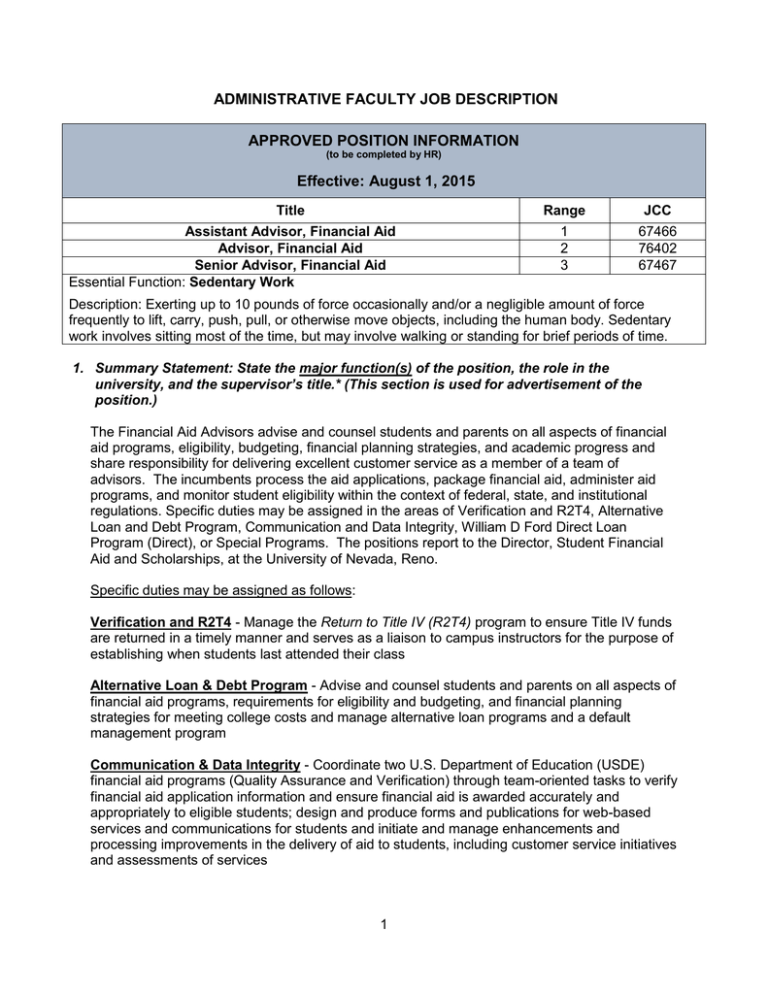

ADMINISTRATIVE FACULTY JOB DESCRIPTION APPROVED POSITION INFORMATION (to be completed by HR) Effective: August 1, 2015 Title Assistant Advisor, Financial Aid Advisor, Financial Aid Senior Advisor, Financial Aid Essential Function: Sedentary Work Range JCC 1 2 3 67466 76402 67467 Description: Exerting up to 10 pounds of force occasionally and/or a negligible amount of force frequently to lift, carry, push, pull, or otherwise move objects, including the human body. Sedentary work involves sitting most of the time, but may involve walking or standing for brief periods of time. 1. Summary Statement: State the major function(s) of the position, the role in the university, and the supervisor’s title.* (This section is used for advertisement of the position.) The Financial Aid Advisors advise and counsel students and parents on all aspects of financial aid programs, eligibility, budgeting, financial planning strategies, and academic progress and share responsibility for delivering excellent customer service as a member of a team of advisors. The incumbents process the aid applications, package financial aid, administer aid programs, and monitor student eligibility within the context of federal, state, and institutional regulations. Specific duties may be assigned in the areas of Verification and R2T4, Alternative Loan and Debt Program, Communication and Data Integrity, William D Ford Direct Loan Program (Direct), or Special Programs. The positions report to the Director, Student Financial Aid and Scholarships, at the University of Nevada, Reno. Specific duties may be assigned as follows: Verification and R2T4 - Manage the Return to Title IV (R2T4) program to ensure Title IV funds are returned in a timely manner and serves as a liaison to campus instructors for the purpose of establishing when students last attended their class Alternative Loan & Debt Program - Advise and counsel students and parents on all aspects of financial aid programs, requirements for eligibility and budgeting, and financial planning strategies for meeting college costs and manage alternative loan programs and a default management program Communication & Data Integrity - Coordinate two U.S. Department of Education (USDE) financial aid programs (Quality Assurance and Verification) through team-oriented tasks to verify financial aid application information and ensure financial aid is awarded accurately and appropriately to eligible students; design and produce forms and publications for web-based services and communications for students and initiate and manage enhancements and processing improvements in the delivery of aid to students, including customer service initiatives and assessments of services 1 Line of Progression – Financial Aid Advisors William D Ford Direct Loan Program (Direct) – Direct the complex Direct Loan program that provides long-term loans to 5500 students and totally nearly $60 million dollars annually Scholarship Management - Assist with managing that donor criteria is honored in all scholarship selections and monitoring of scholarship recipients’ satisfactory academic progress Work Study and Regent Services Program - Coordinate and assist with the 1 million+ Work Study funds are awarded in compliance with federal and institutional policies to include federal community service requirements. For the Regent Services Program, solicit proposals and coordinate selection process and ongoing administration of funds for a quarter of a million annual funds. Special Programs – Manage special programs such as Bureau of Indian Affairs (BIA), University Studies Abroad Consortium (USAC) agreements, National Student Exchange, and Semester at Sea, and coordinate with the respective campus offices to ensure compliance with federal regulations governing financial aid for such programs Financial Literacy Administer the Financial Education program including Individual Financial Counseling, Financial Coaching and Support Groups and Financial Workshops Recruit, train and supervise all volunteer financial counselors, workshop presenters and program interns Compile up-to-date financial information for use by Individual Financial Counseling volunteers, Financial Aid team, and clients Coordinate workshops on financial topics Maintain documentation of client contacts and monitor the evaluation of the program Participate in meetings or working groups related to financial education as necessary to ensure high quality programming Advises students and parents regarding financial aid programs, application procedures, award packaging and debt management Conducts financial aid outreach programs at local and area high schools, outside agencies, and community groups Applies federal and state regulations to all aspects of financial aid programs Assists with liaising between the Financial Aid office and various departments within the College As required, assists with general reporting and maintenance of databases Range 1 – Assistant Advisor: The Assistant Advisor provides support to the Advisors and Senior Advisors in any of the above areas and are assigned duties relating to a specific program(s). Range 2 – Advisor (in addition to R1 above): The Advisor is responsible for implementing an assigned program from above and assists the Senior Advisor and Director in strategic planning of the unit’s mission. Range 3 – Senior Advisor (in addition to R1 and 2 above): The Senior Advisor implements an assigned program(s) and assists the Director with other programs requiring assistance. The Senior Advisor also assists with the development of unit policies and procedures and in strategic planning of the unit’s mission. * Attach an organizational chart with positions, ranges, and names for the division. 2 Line of Progression – Financial Aid Advisors 2. List the major responsibilities, including percentage of time devoted to each. Provide enough detail to enable a person outside the department to understand the job (percentage first with heading and then bulleted information). If line of progression, define for each range as above. Range 1: 40% - Advising/Counseling Works as a member of the advising team suggesting changes for improved customer service, advising and counseling students, parents, and others in the reception area and over the phone Educates and counsels students and their families about the financial aid application process as well as eligibility requirements for federal and state financial assistance programs Process assigned less complex applications and packaging aid for students 30% - Specific Program Management (all programs) Provides support to the Advisors and Senior Advisors in any of the specific program areas and complete assigned actions 15% - Needs Analyses and Compliance Assists staff with preparation of documents to support needs analyses and compliance issues 10% - Communications Management Assists with management of communications to students, whether by print, Web, or electronic delivery 5% - Faculty Liaison Act as liaison to faculty, other student services, and campus staff to resolve individual problems related to financial aid Range 2 (in addition to above R1): 40% - Advising/Counseling Assumes responsibility for an alphabetical section of students processing their applications and packaging aid, providing advice and counsel throughout the year on academic issues that relate to aid eligibility, revising aid as necessary, and problemsolving financial concerns such as budgeting, consumer credit orientation, and other money management sessions for students, parents, and interested publics Evaluates and processes aid applications for assigned caseload for student advising Revises aid packages as student financial and academic circumstances change Serves as a liaison to faculty, other student services, and campus staff to resolve individual problems related to student aid Represents the office in outreach and at recruiting events, campus committees and with community organizations Designs and implements communications to all students regarding financial aid information, eligibility, and processing status 3 Line of Progression – Financial Aid Advisors 30% - Specific Program Management (for each area assigned) Design and Implementation of QA program Downloads student application data from the Federal database, an analysis of errors and their consequence in awarding federal aid, the designing of parameters for selecting error-prone data items, and implementing preventative measures to eliminate student error Designs the timelines, forms, procedures, and training for support staff involved in the analyses Submits periodic required reports to the USDE and recommends regulatory changes based on QA findings Return of Title IV Funds Ensures that return of Title IV funds are done within the required timeframe established by the USDE Serves as a liaison to campus instructors for the purpose of establishing when students last attended their class Monitors 100% withdrawals throughout the semester; Federal regulations permit 30 days to verify attendance, calculate repayment and return funds Maintains federally mandated data in the R2T4 software Special Programs Management Manages special programs in which the student may participate and receive financial aid, such as Bureau of Indian Affairs, National Student Exhange, Semester at Sea, USAC, consortium agreements with other universities, and coordinates with the appropriate office staff Processes Graduate Record Examination (GRE) and institutional fee waivers Loan Programs and Debt Management Researches and recommends private educational loan programs provided by lenders that are beneficial for students and maintains program information, eligibility oversight, reconciliation and reporting Monitors changes in program regulations and suggest enhancements to procedures and policies Provides oversight for the Alaska Loan Program including program information and student eligibility and serves as office contact for the Alaska Student Loan Commission Implements a debt management system in which borrowers who are delinquent in repayment are contacted to forestall their defaulting on student loans Works with the loan guarantor agency to resolve issues and problems with the borrower Challenges the annual cohort rate calculated by USDE Monitors trends in loan borrowing and repayment Direct Loan Management Reviews annually and makes improvements to policies and procedures for processing loan applications and the delivery of loan funds to students within the context of federal regulations Trains other advisor(s) on certifying eligibility, “packaging” loans, schedules the workflow, and ensures quality and compliance 4 Line of Progression – Financial Aid Advisors Monitors changes to Direct Loan regulations, interprets and implements necessary changes; trains staff so everyone is conversant with the new requirements; act as “resident” expert Coordinates office procedures with those of each of four lenders, the three guarantors, and several servicers of loans to ensure students receive accurate and timely customer service from those organizations and that UNR is consistent and congruent with their systems Coordinates loan disbursements, return of funds, and reconciliation with Cashier’s office to ensure accuracy and compliance with required federal timelines for those activities Acts as the administrator for Education Loan Management Resources (ELM), which is an internet-based system that transmits loan data and disbursement information from SFS to lender and guarantor; trains other staff in use of system Scholarship Management Ensures that donor criteria are honored in all scholarship selections Integrates scholarship awards with need based aid to ensure compliance with federal rules and regulations Monitors scholarship recipients’ satisfactory academic progress Provides outreach to students, faculty, staff, and community regarding the university’s scholarship opportunities Work Study Program Ensures 1 million+ Work-Study funds are awarded in compliance with federal and institutional policies to include federal community service requirements Develops and maintains communications to students and campus departments regarding Work-Study Conducts monthly/annual reconciliation and FISAP reports Responds to any audit related inquiries Regent Service Program Solicits proposals, coordinates selection process and ongoing administration of funds with grantees for a quarter of a million of annual funds Develops and maintains communications to students and campus departments regarding the Regent’s Service Program 15% - Needs Analyses and Compliance Reviews needs analysis and aid awards to insure compliance with state and federal laws, regulations, policies and procedures Applies professional judgment as defined within federal guidelines as required to remedy student specific financial aid circumstances Applies federal requirements for “verification” of applicant information; reviews documents for accuracy in reporting and makes corrections as necessary Ensures loans are processed in a timely manner Follows procedures for the application of professional judgment in individual circumstances and documents rationale for the exception Reviews and adjusts aid for Chapter 30 veterans’ benefits students 10% - Communications Management Manages all communications to students, whether by print, Web, or electronic delivery 5 Line of Progression – Financial Aid Advisors Designs forms and publications for print and web-based access and retrieval Creates e-mail lists for targeted messages to students Suggests customer service enhancements, manages the phone system, conducts online assessments of services 5% - Faculty Liaison May supervise student(s) and other employees Range 3 (in addition to above R2): 40% - Advising/Counseling Provides oversight of advising and counseling information being disseminated to ensure compliance with state and federal regulations 30% - Specific Program Management (all programs) Manages one or more of the assigned programs Provide oversight of other programs as needed on more complex issues 15% - Needs Analyses and Compliance Develop needs assessments for programs and provide instructions for implementation of changes or new developments 10% - Communications Management Develops standard language communications and provides oversight of dissemination 5% - Faculty Liaison Assigns and supervises work of Assistant Advisors and Advisors 3. Describe the types of decisions the position(s) makes independently as part of the core responsibilities. Provide examples. If a line of progression, describe the decisions made at the highest level. The Financial Aid Advisors must provide accurate, complete, and current financial aid information to students, parents, and faculty, i.e., University, State, and Federal regulations, types of programs; student eligibility, etc. The Assistant Advisor and Advisor complete a variety of difficult but usually fairly well-defined tasks and must make independent decisions on analyzing the needs of the students and recommending options, i.e., program eligibility and budgeting, financial planning strategies, and academic progress, etc. The Senior Advisor is expected to provide leadership to other advisors which involves analyzing the situation or problem, gathering needed information, and communicating options to the advisor, student, parent, or faculty. The Advisors must follow strict federal regulations regarding financial aid programs in order to maintain its ability to award Title IV funds. The Financial Aid Advisor has the ability to work independently and handle decisions regarding a student’s financial aid awards. The Advisors can determine if the aid should be disbursed or pulled back. They can manually change a student’s budget when they have the appropriate documentation to warrant the change. 6 Line of Progression – Financial Aid Advisors 4. Describe the types of problems, issues, action, communications this position typically takes to the supervisor for resolution and/or consultation. Provide examples. If a line of progression, describe the supervisory consultation at the highest level. The incumbents complete specific but multiple tasks with adherence to strict financial aid regulations and receive the manager’s guidance concerning priorities and procedures to be used. The Advisors consult with the supervisor in more complex areas of financial aid advising and collaborate on strategic planning of the unit and development of new procedures or guidelines. The Advisors are not able to change a student’s satisfactory academic status. This needs to be given to their supervisor to handle. They also are not able to change a student’s dependency status this is done by their supervisor. 5. Select the applicable competencies required to successfully perform the job. The selected competencies will be evaluated within the Administrative Faculty evaluation as Competencies for Success. Competency Required Adaptability ☒ Analytical Thinking ☒ Communication ☒ Diversity and Inclusion ☒ Financial Responsibilities ☐ Human Resource Responsibilities ☐ Leadership ☒ Program/Project/Functional Knowledge ☒ Resource Responsibilities ☐ Serving Constituents ☒ Teamwork ☒ Other (specify) ☐ 6. Minimum requirements of the position. Minimum requirements should be consistent with the Job Evaluation Model. If Line of Progression, minimum requirements must be defined for each range. Range 1: Education Experience Bachelor’s Degree One year of relevant work experience Master’s Degree Related degree program Relevant Experience: Related to the position 7 Line of Progression – Financial Aid Advisors Range 2: Education Experience Bachelor’s Degree Three years of relevant work experience Master’s Degree Two years of relevant work experience Relevant Experience: Related to the position to include one year of financial aid experience in higher education Range 3: Education Experience Bachelor’s Degree Four years of related professional experience Master’s Degree Two years of related professional experience Relevant Experience: Related to the position to include one year of financial aid experience in higher education Certification and/or Licensure: None Schedule or Travel Requirements: None Optional Addendum: Describe the knowledge, skills, and abilities required to successful performance of this job (in bullet format). Knowledge of: Range 1: Familiarity with laws, regulations, and policies of federal, state, and university financial aid programs State and Federal laws and regulations concerning Federal Educational Rights and Privacy Act (FERPA) Higher education policies and procedures in area of student recruitment, admissions, and retention Range 2 (in addition to R1 above): Laws, regulations, and policies of federal, state, and university financial aid programs Financial aid packaging, verification, and needs analysis U.S. Department of Education computing software Higher education student information systems Needs of diverse populations with regard to financial aid Range 3 (in addition to R1 and 2 above): Program management and oversight Strategic planning Higher education general administrative policies and procedures especially those related to financial aid and student counseling Data evaluation or program assessment and reporting to university, State, and/or Federal agencies Skills: Range 1: Proficiency in use of a personal computer and current software applications including but not limited to Microsoft Office Suite (Word, Access, Excel, PowerPoint, and email) 8 Line of Progression – Financial Aid Advisors Excellent verbal and written communication to include individual and group presentations Excellent customer service skills Interpersonal and human relations skills Range 2 (in addition to R1 above): Analytical, decision-making, and problem solving and conflict resolution skills for students’ issues and concerns and resolution Time management skills for managing multiple tasks simultaneously, achieving results and objectives, and completing work within allocated time frames Range 3 (in addition to R1 and 2 above): Supervisory skills, including an ability to teach and mentor staff and students Ability to: Range 1: Maintain confidentiality of sensitive information Work effectively with diverse populations of students and families, individually and in groups, especially from underrepresented populations, on matters relating to aid Maintain positive working relationships with all entities and be sensitive to cultural and ethnic diversity issues Use technology to deliver efficient services Exhibit initiative to improve service and to willingly accept challenges Apply established rules and procedures and make decisions that affect quality, accuracy, or effectiveness of results Range 2 (in addition to R1 above): Exercise professional judgment in understanding, interpreting, implementing, and ensuring compliance with regulations and policies Work and sustain high levels of performance in a highly stressful environment with conflicting demands Direct or administer programs and conduct budget reconciliations Manage, prioritize, and complete multiple projects/tasks in an efficient and timely manner while maintaining focus on organizational goals Exercise sound judgment to make objective, fair and consistent decisions with accuracy and completeness Analyze situations, often under pressure, and act with tact and diplomacy and in the best interests of the unit, institution and/or the system Range 3 (in addition to R1 and 2 above): Provide relevant input to the policy development process Manage and assess goals and objectives of staff’s program and/or work Stay current in discipline by seeking out and learning new information pertinent to performance of duties Contribute to and support the department, college, and university strategic plan Facilitate exchange, coordination, and collaboration of information, work, and projects/events 9