Request for Payment Instructions

advertisement

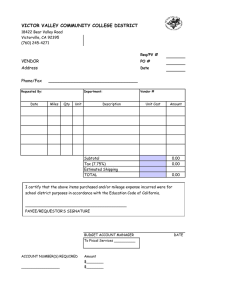

1 __ __ PV # 3 00000__ __ University of Nevada, Reno Request For Payment 2 Date:____________________ Make Payment To: 3 Name Address Employee ID No/Federal Tax ID: 5 4 not required for refunds Phone/Fax/Email 6 Disposition of Check: Is payee/individual recipient of this payment a U.S. citizen or lawful permanent resident (green card holder)? Yes_____ No_____ 7 8 Mail as addressed Picked up by Payee Department: Dept. Contact Name & Phone #: 9 Picked up by Department Campus Mail Stop _______ 10 Fund Agcy Org Obj Sobj 11 11 11 12 12 BS Acct Description 13 Amount 14 15 Total 16 In payment of the following (see reverse side of form for authorized uses): 17 Reason for not using a purchasing card or requisition/purchase order: 18 If vendor does not accept Mastercard (purchasing card): Vendor contact name: 19 Telephone #: 20 ( ) Printed Name of Authorized Signer 21 Date 22 Printed Name of Additional Authorized Signer 23 Signature Authorization Date Signature of Additional Approval (if required) - Date Date NOTICE TO VENDORS: • This form may be used for purchases up to $2000 with vendors who do not accept credit card payments. • A purchase order is required for ALL purchases $2000 and over. • All invoices, packages and correspondence must reference the reference number shown above in the upper right hand corner of this form. • The University of Nevada, Reno is exempt from State of Nevada sales tax. FEIN #: 886000024. • An original and duplicate invoice should be mailed to: University of Nevada, Reno, Controller's Office/124, Reno, NV 89557. 1 INSTRUCTIONS: The original and yellow copy of this form must be received in Accounts Payable at least 72 hours before a check is needed. All requests for payments must include supporting documentation such as original invoices/receipts/sales slips, etc. If payment is for hosting, attach "Host Expense Documentation" form (www.howler.unr.edu/forms/) and obtain required approvals. The "Request for Payment" form may be used for any single small dollar purchases up to $2,000 for which the vendor will not The “Request for Payment” form may be used for any single small dollar purchases up to $2,000 for which the vendor will not accept credit card payments or for reimbursements of expenses up to $2,000. It may also be used for the following types of payments if credit card payments are not accepted: • Advantage cash payments and meal plan payments • Application fees* • Appraisal fees* • Attorney fees (subject to Chancellor’s Office approval) • Cattle purchases • City/county fees/taxes • Federal employee retirement benefit, life and health insurance payments • Hay purchases • Insurance premium payments* • Intercollegiate Athletics event ticket purchases and ticket sales on behalf of other institutions • Intercollegiate Athletics game guarantees • Lawlor Events Center Bass Outlet sales payments • Lawlor Events Center event settlements • Legal settlements • Medical school resident insurance • Medical student emergency loans • Memberships, dues and licenses (see section 1,068 of the UNR Administrative Manual)* • Personal moving expense reimbursements to employees • Rentals/leases* • Royalties* • Medical student emergency loans • Service/maintenance agreements* • Special use fees* • State of Nevada agency billing claims (insurance, motor pool, unemployment claims, Public Works Board, etc.) • Student athlete insurance payments and medical claims • Student athlete stipends, allowances, lab fees, testing fees, special assistance • Tobacco Grant Award payments • UCCSN intra-institution billings (CCSN, DRI, GBC, TMCC, UNLV, WNCC) • UNR Foundation reimbursements/payments • USAC foreign university tuition • USAC foreign director advances • Utility bills (including telephone and cell phone bills)* • WAC athletic dues • WAC officials • Workers' Compensation Insurance claims If the estimated annual payments for regular recurring expenses exceeds $10,000, a blanket purchase order is required. * If individual payments exceed $2.000 a purchase order or blanket purchase order is required. Distribution: Original to Accounts Payable Copy to vendor - if required Copy retained by department 2 Request for Payment Instructions The request for payment form is used for several purposes: A. Reimbursement to employees for (non-travel related) out-of-pocket expenses incurred on behalf of the university. B. Payment to outside vendors for small dollar purchases (under 2,000.00), who DO NOT accept the university purchasing card as a method of payment. C. Reimbursement to job candidates for out-of-pocket expenses incurred relative to the interview (hotel, car rental, meals, airfare, etc.). Cannot be used to reimburse or pay non-employees (except “C”) for expenses incurred or for services who are working under their social security number and not a federal tax id. Refer to independent contractor, guest speaker and participant support payment forms. This transaction will post to the balance and activity report as a “PV” transaction code. 1. PV #123456 __ __ __ __: The “Request for Payment” number is assigned when you access it in the Forms Directory on the web. The four spaces (underscores) are for departmental reference and is an optional field. Enter up to a fourcharacter code identifying your department/center or leave blank. 2. Date: Date of preparation and the web version infers today’s date for you. 3. Name: Enter the complete name of an employee, Vendor, or job candidate. 4. Address: Enter complete address on campus mail stop or off campus business address, Vendor address or mailing address for job candidate. 5. Employee ID/Federal Tax ID: Enter the employee ID for an UNR employee or Student R number for a student. If it is for a reimbursement for a job candidate, we do not require a tax ID number. Enter Federal Tax ID for vendor. If the vendor is not set up in the vendor database a federal W-9 form must be completed and signed by a representative of the business. A legible faxed copy is acceptable. 6. Phone/Fax/Email: Enter the telephone number, fax number and/or email address of the payee. 7. Is payee/individual recipient of this payment a U.S. citizen or lawful permanent resident?: Appropriate box must be checked if paying an individual who is not an employee job candidate or if purchasing a product from an entity doing business under a social security number. 8. Disposition of Check: On campus employee reimbursements may be sent to the Cashier’s for department or payee pickup or mailed through campus mail to their mail stop. Off Campus employee reimbursements may be picked up at Cashier’s by the department or payee or U.S. mail to their duty station. Vendor payments are mailed U.S. mail to the vendor’s remittance address. Any exception must be justified in writing and approved by the Accounts Payable manager, Controller, or Deputy Controller. Job Candidate reimbursements may be sent to Cashier’s for department pickup or mailed U.S. mail to the candidate. Check appropriate box. 9. Department: Print/type department name 10. Department Contact Name & Phone #: Print/type contact name and phone number of an employee who may be able to assist Accounts Payable in clarifying the purchase/reimbursement. 11. Fund/Agency/Organization: Enter appropriate account number(s) to be charged. If charging a balance sheet account, enter only the appropriate fund number. 12. Object/Sub-Object Code: Enter the appropriate object code and sub-object code for the type of purchase/reimbursement. Refer to Appendix A. If charging a balance sheet account, leave these two fields blank. 13. BS Account: If charging a balance sheet account, enter the four-digit account. If charging an operating account, leave blank. 14. Description: Optional field used as department reference – Print/type a reference (i.e. If you are reimbursing hosting to Jane Doe the reference could be the name or date of the event). 15. Amount: Enter amount to be charged for each account listed. 3 16. Total: If using the RFP form through the web, this field will calculate for you. This total is to equal the amount to be paid the payee and the amount referenced on the appropriate backup (receipts, invoices). 17. In payment of the following: Employee reimbursement and Vendor payment – General description of purchase or reimbursement. Backup (invoices/receipts) must be detailed. If reimbursement/vendor payment for hosting a “Hosting Documentation” form must be completed and attached for each event being reimbursed. Job candidate reimbursement – reference the position and dates of the interview. 18. Reason for not using a purchasing card or requisition/purchase order: Employee – Justification as to why normal purchasing procedure was not followed. Vendor small dollar purchase – only justification is they do not accept the university purchasing card (MasterCard) as a method of payment. Item 19 must be completed for vendor contact. Job candidate – not applicable, leave blank. 19. If vendor does not accept MasterCard (purchasing card): Print/type name of contact and their phone number. 20. Printed Name of Authorized Signer: Print/type name of signature of employee authorizing payment. 21. Authorized By: Signature and date of authorized signer on account(s) charged. 22. Printed Name of Additional Authorized Signer: Employee reimbursement – non-hosting, employee’s supervisor is required to sign RFP form. If the supervisor were not available the supervisor’s supervisor would sign. Employee reimbursement – hosting, the dean or vice president is required to sign all hosting expenditures. The Dean/VP’s signature may be on the completed “Hosting Documentation” form or the RFP form; it does not have to be on both. The signature exception is for “Participant Funded” (paid through registration fees) events. Vendor payment – non-hosting, no additional signature required. Vendor payment – hosting, a “Hosting Documentation” form must be completed and attached. The Dean or Vice President must sign either the RFP or the Hosting Documentation form. Job Candidate reimbursement – not additional signatures required. 23. Additional Approval (if required): If required, signature and date of supervisor, dean or vice president. Reimbursement Documentation: All reimbursements to employees or job candidates must be original and detailed. If there are multiple receipts, attach a calculator tape to show the total being reimbursed. Vendor payment – Original detailed vendor invoice(s) must be attached. If multiple invoices indicate number of invoices in section 17 of form, highlight or circle number. 4