Cover/Signature Page – New Programs Follow-up Report Template Institution Submitting Request:

advertisement

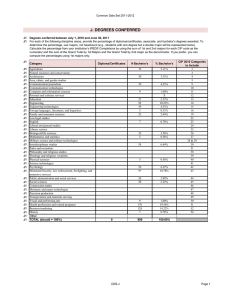

Cover/Signature Page – New Programs Follow-up Report Template Institution Submitting Request: Utah Valley University Program Title: Bachelor of Science and Bachelor of Arts in Finance School: Woodbury School of Business Department: Finance and Economics Recommended Classification of Instructional Programs (CIP) Code1: 52.0801 Board of Regents’ Approval Date: 07/17/2009 Proposal Type (check all that apply): R401-4 Items submitted will be reviewed by OCHE and posted on a website for PRC member review. If there are any issues, the proposal will be returned for clarification/correction. If no issues, the proposal will be returned with a note of approval and the request will be placed on the General Consent Calendar of the next Regents’ agenda. Section Item # Three-Year Follow-Up Report of 4.1.10 Recently Approved Programs Two-year Follow-up Report of Fast4.3.3 tracked Certificate Chief Academic Officer (or Designee) Signature: I certify that all required institutional approvals have been obtained prior to submitting this request to the Office of the Commissioner. ______________________________________ Signature Date: 08/31/2012 Printed Name: Ian Wilson 1 CIP codes must be recommended by the submitting institution. For CIP code classifications, please see http://nces.ed.gov/ipeds/cipcode/Default.aspx?y=55. Report – Third-Year Report Template Utah Valley University Bachelor of Science and Bachelor of Arts in Finance 06/22/2012 Program Description The Bachelor of Science and Bachelor of Arts degrees in Finance were approved by the Board of Regents on July 17, 2009. The first students were admitted into the program fall semester 2009. The program is designed to provide students with a variety of intellectual and applied skills in order to prepare them for significant professional careers in business, banking, investment, insurance, actuarial science, real estate, and teaching and research in the academic community. Graduates have been placed in both public and private sector organizations and several students have also chosen to do graduate work in finance and other related business disciplines. Enrollment and Revenue Data Prior to Program Implementation Departmental/Unit Enrollment and Staffing Data Total Department Student FTE (Based on Fall Third Week Data) Total Department Faculty FTE (A-1/S-11/Cost Study Definition) Student FTE per Faculty FTE (from Faculty FTE and Student FTE above) Program Level Data Total Number of Declared Majors in Program Total Number of Program Graduates Departmental Revenue Total Revenue to Department (Total of Funding Categories from R401 Budget Year 1 2009-10 Year 2 2010-11 Year 3 2011-12 Est. Actual Est. Actual 395 398.6 377 399 456 13.6 14 14.3 14 15.5 14 17.8 29.05 28.48 26.37 28.50 29.42 28.58 27.08 X 18 28 38 154 45 212 X n/a 1 n/a 11 n/a n/a Est. Actual Est. Actual Est. Actual 1,569,780 1,549,117 1,570,090 1,962,949 1,570,412 n/a 1,561,538 Est. 400 Actual 482 Projection Table) Departmental Instructional Cost per Student Credit Hour (per Institutional Cost Study Definition) 4,340 X 3,942 X 3,908 X n/a Institutional Analysis of Program to Date There are four full-time faculty specifically assigned to support the finance degrees. All four have Ph.D.’s and meet the Academically Qualified (AQ) or Professionally Qualified (PQ) standards specified by the Woodbury School of Business (WSB) accreditation requirements. In addition, there is a breadth of skill sets among those faculty members; which enable students to learn from individuals who have specialized skills not only in corporate financial management but also in investment theory, financial institutions, international finance, and other specialized topics such as derivative securities, and other quantitative financial courses. Many of our finance students can also enroll in courses with the allied economics faculty, where they have access to advanced quantitative analytical courses such as mathematical model building, econometrics, game theory and related topics. The first educational objective outlined in the assessment process described in the R401 proposal for this degree was that students should “have basic discipline knowledge…and...apply that knowledge”. Between 2009 and 2011, WSB students completing the Senior Exam, which is administered by the school as a part of an overall program assessment process, have not been as proficient as the faculty would like to see in demonstrating that capability. As a result, there is a commitment by the Finance faculty to seek to improve the quantitative and discipline specific skills to meet that objective. During a WSB Assessment process conducted in April 2011, the faculty recommended a more rigorous math prerequisite for students in quantitative courses such as those that characterize the finance degree. That included a subsequent decision to recommend the upgrading of the content and rigor of a MGMT 2240 class in business calculus for finance majors. At the same time, the WSB has administered a Business Simulation Program to its graduates over the last three years that includes a significant element of financial analysis as a part of that process. Although it is not possible to distinguish finance graduates from WSB graduates in general, the scores of WSB graduates have been quite remarkable contrasted to national students completing this business simulation. WSB teams have consistently ranked in the top ten percent of students completing the simulation. For example, in the Spring of 2009, 64% of WSB graduates were in the top ten percent, nationally and in subsequent instances of this process WSB graduates continue to be strongly represented at about that same level. During that same 2011 assessment process outlined in the previous paragraph, the faculty recommended some improvements in the effort to assess written communication efforts of WSB students, and here again specialized tutoring in writing has been implemented for the capstone strategy class which finance students are required to take. Department faculty workloads have been adjusted so full-time faculty are teaching the basic finance course (FIN 3100) during the summer session, when many students take this as their beginning course in the discipline. There is evidence this will upgrade the rigor of those courses which were formerly taught by adjunct faculty who had less experience and commitment to encouraging students to achieve higher levels of academic rigor in their financial management learning. The fourth full-time faculty member was hired for Fall 2012, and it is anticipated that this level of faculty support, along with allied faculty, will enhance the effort to upgrade the rigor of courses in the program and at the same time meet the anticipated growth of student enrollment over the next several years. Students in the finance degrees have access to a state of the art finance lab, which provides a variety of industry software that enables students to become familiar with the types of analyses conducted by professionals in the industry. Finance majors have also had the opportunity to participate in industry conferences that allows them to network with professionals and experience the types of activities they will encounter after graduation. The program has recently developed an opportunity for finance majors to participate in paid internships that will further prepare them for their professional careers. A parallel financial planning program has also been developed in the department that expands the number of curriculum opportunities for finance majors. Employment Information Term Graduated Spring 2010 Fall 2010 Spring 2011 Summer 2011 Graduate School 1 1 Employed in Field Employed Other 1 3 3 2 1 Unknown