Disbursement Voucher User Guide (Word)

Kuali Financial System

Process Documentation – Disbursement Voucher

___________________________________________________________________________________________

UNIVERSITY OF HAWAII

Disbursement Voucher

User Guide

Fiscal Services Office

January 2016

Table of Contents

Process Document – Disbursement Voucher Page 2 of 35 4/12/2020

Disbursement Voucher (DV) Workflow

Creates DV, attach supporting docs, and

Submits

UH Employee

Reimbursement ?

No

Is DV less than $25?

No

Yes

Yes

Account

Supervisor

Reviews DV

Yes

Approved?

No *

Acknowledge sent to DV

Initiator’s

Action List

Fiscal

Administrator reviews DV

Approved?

No *

Acknowledge sent to DV

Initiator & AS’s

Action List

Yes

Disbursement

Manager

(or Tax Mgr)

Reviews DV

Approved?

No *

Acknowledge sent to DV

Initiator, AS, and FA’s Action

List

Yes

General Ledger

(GL) Entries posted to KFS

Extracts data and creates file for check cutting

* - If an approver in the routing disapproves the DV, an Acknowledge notification is automatically sent to the previous initiator and approvers. For

example if the Disbursement Manager disapproves the DV, an Acknowledge notification is sent to the FA, Account Supervisor, and DV Initiator.

** - If vendor is foreign, DV will route to Tax Managers for possible tax withholding purposes. Currently, Tax Managers also have the role of

Disbursement Manager.

How to Process a Disbursement Voucher

The disbursement voucher (DV) is used to reimburse employees and nonemployees for expenses incurred while conducting University of Hawaii (UH) business or pay recurring payments to vendors such as utility payments.

Most often these payments are in the form of a check although direct deposit (ePayment) and wire transfer options are available.

The DV may be used in situations in which a payment is not processed through another procurement method, such as purchase order or procurement card (PCard).

The following are some instances in which a DV may be used:

1.

Automobile Allowance

2.

Mileage

8.

Relocation

9.

Royalties and Commissions

3.

Post Death Payments

4.

Postage and Postal Charges

5.

RCUH

10.

11.

12.

Scholarships and Fellowships

Stipends

Utility Expenses

6.

Refunds

7.

Reimbursement

Each DV must include the following information:

1.

Why the payee is being paid (Payment Reason).

13.

Uniform Maintenance Allowance

14.

Vacation Leave Credits

Process Document – Disbursement Voucher Page 3 of 35 4/12/2020

2.

Who is to be paid (Payee and Payee Type).

3.

How much the payee is to be paid and how the payment is to be made (Amount and Payment Method).

4.

Where supporting documentation is stored (Documentation Location).

5.

Accounting information (Chart, Account Number, and Object Code).

Note: Before a DV is created, a vendor record must be setup in Kuali Financial System (KFS). For vendor information that includes how to search for and create a vendor, click the following link and then click on the

Vendor Maintenance user guide: http://www.fmo.hawaii.edu/financial_systems/index.html#tab8 .

DV payments to UH faculty and staff are made without creating vendor records. Employee home addresses are uploaded nightly from PeopleSoft into the KFS Kuali Identity Management (KIM) systems. KIM will provide address data for employees. In KFS, the 8-digit UH ID Number is called the Payee ID or Payee Number.

However students, RCUH employees, and businesses are required to have a KFS vendor record before initializing

DV payment processing.

To submit a DV, users will also need to know the payment reason in addition to the account and object codes to use in the accounting line. These items are covered in this user guide.

Object codes typically used for POs may be used when a DV is used for processing reimbursements to employees. DVs do not take the place of POs. POs are used for the procurement of goods and services. For more information on goods and services procurement, begin with the Office of Procurement and Real Property

Management’s (OPRPM) AP 8.220, General Principles. Go to UH System Policies and Procedures Information

Systems (PPIS) at: https://www.hawaii.edu/policy/?action=viewChapter&policySection=ap&policyChapter=8&menuView=closed .

A sample list of object codes used with corresponding payment reasons is provided at the end of this user guide.

For the most current Payment Reason Payee Types and Object Codes List, go to: http://www.fmo.hawaii.edu/financial_systems/index.html#tab10 . Click on Financial Systems Training

Financial Processing Training Manuals and References DV Payment Reason Payee Types and Object Codes

List link. Or for just the most current list, click: http://www.fmo.hawaii.edu/financial_systems/docs/PaymentReason6_PayeeType_ObjCd_LIST.pdf

Business Rules

1.

A DV payee cannot be the same as the initiator. The following error message will appear.

2.

A DV employee payee must be in an Active status. KFS will not allow a DV to be processed for employees in

LWOP status.

3.

Check amount cannot be negative.

4.

There must be at least one accounting line and account(s) must be active.

5.

Accounting lines total must not be negative.

6.

Total of accounting lines must match the Check Total field.

7.

Certain object codes, object levels, and object sub-types can be restricted from this document or from certain payment reasons.

Process Document – Disbursement Voucher Page 4 of 35 4/12/2020

Buttons

1.

Click the “submit” button to route for approval.

2.

Click the “save” button to continue editing in the future.

3.

Click the “close” button to close the eDoc.

4.

Click the “cancel” button to cancel the eDoc.

5.

Click the “copy” button to copy the eDoc and start a new one.

After the DV eDoc is in "Final" status, the following buttons will appear:

6.

Click the “send ad hoc request” button to send the eDoc to someone for FYI. When the DV eDoc is in "Final" status, the Approve and Acknowledge options will not be available.

7.

Click the “close” button to close out of the document.

8.

Click the “copy” button to copy the eDoc and start a new DV.

Process a Disbursement Voucher

The following pages explain each component of the DV and how to process a DV.

Note: To make DV processing smoother, ensure the payee’s vendor record exists in KFS prior to initiating a DV.

For vendor information that includes how to search for and create a vendor, click the following link and then click on the Vendor Maintenance user guide: http://www.fmo.hawaii.edu/financial_systems/index.html#tab8 .

To open a DV, go to the Main Menu and click on the Disbursement Voucher link. Go to:

Main Menu Transactions Financial Processing Disbursement Voucher.

Process Document – Disbursement Voucher Page 5 of 35 4/12/2020

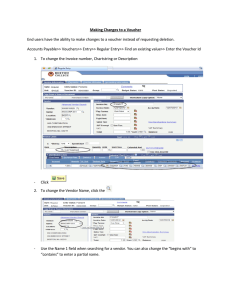

The DV consists of a document header and 15 tabs but only four tabs are required to make a simple payment.

The four tabs include: Document Overview, Payment Information, Accounting Lines, and Notes and

Attachments. Here’s a screenshot (scrnshot) of all the DV tabs.

Process Document – Disbursement Voucher Page 6 of 35 4/12/2020

DV Document Header

1.

Doc Nbr – (Display Only) KFS generated number.

2.

Initiator - (Display Only) UH username of person initiating eDoc.

3.

Status - (Display Only) Initiated, Saved, Enroute, Final, Disapproved, and Canceled. a.

Initiated – Indicates a document has been created but has not yet been saved or routed. A document number is automatically assigned by the system. b.

Saved – Indicates the document has been started but not yet completed or routed. The Save action allows the initiator of the documents to save their work and close the document. The document may be retrieved from the initiator’s action list for completion and routing at a later time. c.

Enroute – Indicates document has pending approval requests. d.

Final – Indicates document has been routed and has no pending approval or acknowledgement request.

Documents in Final status are considered fully approved and will impact the General Ledger. e.

Disapproved – Indicates the document has been disapproved by an approver as a valid financial transaction and it will not generate the originally intended transaction. f.

Canceled – Indicates the document is denoted as void and should be disregarded.

4.

Created - (Display Only) Date eDoc was initiated.

5.

Copied from Document Id - (Display Only) Original DV eDoc number from which DV was copied.

Process Document – Disbursement Voucher Page 7 of 35 4/12/2020

Document Overview Tab

1.

Description - (Required) Enter the 3-digit FO Code followed by a short description for the document. The

Description field is limited to 40 characters. Examples include: a.

029 MILEAGE LUCAS JULY 2015 b.

070 UTILITIES HECO JULY 2015 c.

055 STIPEND KIMURA FALL 2015 d.

060 REIMBURSE MORISAWA 08/01/15 e.

027 WIRE TRANSFER IMPRIEMERIE OFFICIELLE

2.

Explanation - (UH Required) Disbursing recommends the Explanation field be used to provide a detailed explanation of the Description field. (Maximum 400 characters). a.

Enter a more detailed explanation to supplement the information provided in the description field, e.g.,

“To reimburse UH Employee for purchase of essential office supplies during the SME conference used by the keynote speaker.”. b.

This may avoid Disbursing asking for further explanation and thereby, delaying the payment.

3.

Organization Document Number - (Optional) Enter an Organization Document Number that is typically an internal reference number, external system reference number. Examples include travel return date or new contract number assigned by OPRPM or DAGS. Seek further guidance from the business office whether an organization document number is required. (Maximum 10 characters). a.

Enter a departmental or organizational document number related to the transaction being recorded if available, e.g., “P551424” should be recorded as Organization Document Number. b.

For manual travel reimbursements, enter the travel return date using format MM/DD/YY. c.

For non-travel advances (Object code 7101), enter the date (MM/DD/YY) the survey or project is projected to be completed. (The corresponding “TT” document number should be entered into the Org

Ref Id field in the accounting line. Format is TTFOCodenn, e.g., TT05601)

4.

Bank Code - (Display Only) The Bank Code is automatically prefilled with Bank number and title.

5.

Total Amount - (Display Only) Updates as the DV is completed .

Process Document – Disbursement Voucher Page 8 of 35 4/12/2020

Payment Information Tab

The Payment Information tab captures information about the payee and general information about the payment.

1.

Payment Reason Code - (Required) Display-only. This code identifies the reason for the disbursement and determines whether the payment is subject to any restrictions. To select the appropriate Payment Reason

Code, the Payee Lookup screen must be opened first. This is done by clicking the Payee ID magnifying glass.

The Payment Reason Code is automatically populated to the DV when the Payee Lookup is completed.

Below is a sample of the 25 available payment reasons.

(Note: Only one Payment Reason Code may be used on one DV at a time, i.e., cannot combine payment reason codes on a DV.)

Process Document – Disbursement Voucher Page 9 of 35 4/12/2020

2.

Payee ID - (Required) Retrieve the payee Id from the Payee Lookup using the magnifying glass. The payee

Id is required on the Payment Information tab. This identifies the person or business the disbursement is paid to. Payees must exist in the system in order to be selected on the DV. KFS uses the Vendor table and the KIM Person table for reference. If the payee already exists in the system, users can use the Payee

Lookup to search for payees. Several KFS parameters exist to control which types of payees can be selected for a given payment reason. After clicking search, the restrictions for the selected payment reason are displayed at the top of the lookup. a.

To search for UH employees in the Payee Lookup, use these fields: UH Employee (Faculty/Staff) First

Name and/or UH Employee (Faculty/Staff) Last Name. Wildcards (* or %) may be used to assist with searching. b.

To search for businesses, companies, students, or RCUH employees in the Payee Lookup, use this field:

(Business, Students, RCUH Emp, etc) Vendor Name.

1) In KFS, a vendor number is required for businesses, RCUH employees, and student employees.

2) For Grant-in-Aid payments, be sure to select their vendor payee record and not their employee record.

3) Wildcards (* or %) may be used to facilitate searching. c.

In the Payee Lookup, users may also search by employee Id or vendor #.

d.

In the Payee Lookup, users may also search for Account Receivable (A/R) payees by Customer Number or Customer Name. (Note: A/R payees may only be used with Payment Reason X, Bonds, Refunds, AR,

DueState.)

3.

Payee Type - (Display-only) After the payee Id from the Payee Lookup is selected, the system automatically populates the type of payee.

4.

Address Information - (Display-only) After the payee Id from the Payee Lookup is selected, the system automatically populates the name and the address information. If an incorrect address is selected, repeat the process by clicking on the Payee ID magnifying glass and select the correct address. a.

If the correct address is not shown, Save the DV and submit a vendor request with the correct address and appropriate supports such as W-9 (Businesses) or WH-1 (Individuals). After the new address is approved by Disbursing, open the saved DV, click the Payee ID magnifying glass, and select the newly created address. b.

For security reasons, an employee’s address is masked and will display a string of asterisks. However, if an employee’s address contains two commas separated by a space, this means the employee’s address

Process Document – Disbursement Voucher Page 10 of 35 4/12/2020

is not in KFS. The employee’s home address record should be updated in PeopleSoft. In the scrnshot below, employee Lingley, Kate has an address in KFS and a DV may be created for her. However,

Lingling, Zeng does not have an address as shown by the two commas and KFS will not allow creation of a DV for her. She needs to contact her Personnel Officer to update PeopleSoft. However, if her records are up-to-date in PeopleSoft, submit a KFS trouble ticket for further research.

After clicking return value, the payment reason code and employee’s address information are populated to the DV Payment Information tab.

Process Document – Disbursement Voucher Page 11 of 35 4/12/2020

5.

Check Amount - (Required) Enter the total amount of the disbursement for this document. This check amount must equal to the total of the amounts in the accounting lines.

6.

Due Date - (Display-Only) DV Due Dates are defaulted to the next day. Checks or ACH transactions once fully approved, will be processed in that night's batch run. The checks are printed the following day and sent to the Campus Mailroom for mailing. Normally, all checks are mailed no later than a day after the Paid date.

Disbursing prints checks daily, Monday through Friday except holidays.

7.

Payment Type - (Display-Only) Payment type is determined by the payee selected for the DV. These values apply only to DV payees which are established through the use of the Payee Type document. Each Payment

Type attribute from the Payee Type record will be evaluated when the DV is submitted and may have an impact on the ability to process a particular payment on a DV and how it routes for approval. a.

Is this a foreign payee? If the payee is a nonresident alien (NRA), this is set to 'Yes'. b.

Is this payee an employee? If the Payee record is an Employee record then this is set to 'Yes'.

8.

Other Considerations (Optional) - Select these check boxes as necessary to reflect special circumstances or special requests that are needed for the payment: a.

Check Enclosure - (Optional) Refers to any documents related to the DV document that must accompany the check when it is mailed to the payee. Examples might include a registration form that must accompany a payment of a conference fee or a subscription form that must be returned with payment for a subscription to an academic journal. Selecting the check box properly indicates that there is a form or other attachment that must accompany the check. If enclosures are required with the check, the documents should be scanned and attached in the Notes and Attachments tab. In the Note

Text field (Notes and Attachments tab), enter in uppercase “ENCLOSURE” to alert Disbursing that the enclosure must be printed to be mailed with the check. b.

Special Handling - (Optional) Indicates the check(s) will be picked up by the department. For example, a check needs to be returned to the document initiator so it can be express mailed or picked up by the payee. When Special Handling is selected, a message is displayed notifying the user to enter a note in the Notes and Attachments tab that explains the need for special handling. Disbursing does not require

Process Document – Disbursement Voucher Page 12 of 35 4/12/2020

a note in the Notes and Attachments tab for special handling. Disbursing prefers users complete the

Special Handling tab for special handle transactions. (Special Handling tab information is found below.) c.

W9/W-8BEN Completed - (Optional) - Indicates if the payee has a W-9 (or W-8BEN for nonresident aliens) on file. For nonemployees this is generally completed as part of processing of the vendor document. d.

Exception Attached - (Do not use.)

9.

Payment Method - (Required) Select the method in which the payment should be made from the Payment

Method list. a.

P - Check/ACH - (Default) This selection generates a check or if Automated Clearing House (ACH) information exists in the Pre-Disbursement Processor for this payee, an ACH direct deposit is initiated.

However, if a vendor or employee has ACH direct deposit and the DV is flagged special handling, KFS will ignore the ACH direct deposit flag and cut a check instead. This is so the payment will not combine with other payments to the same vendor or employee. b. W - Wire Transfer - (Optional) This selection indicates the disbursement is requested to be wired to the recipient. For more wire transfer information, go to: http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11 Form

10.

Documentation Location Code - (Required) Do not change this code. The default Documentation Location

Code where the original documents are retained is defaulted to “S-Initiating Organization”.

11.

Check Stub Text – (Required) Enter information regarding the payment itself in the Check Stub Text field, intended for the payee. This commonly includes what is the reason for the payment, account number, invoice number, meter number, or other information to assist the payee in identifying the source and reason for the payment. Limited to 4,000 characters. This information is printed on the check’s remittance portion of the check.

Accounting Lines Tab

The Accounting Lines tab captures information about which account(s) will be charged. One accounting line will be entered for each account and/or invoice. If there are multiple accounting lines, the user may use the Import

Lines feature instead of manually entering each accounting line. See Import Multiple Accounting Lines to DV attachment at the end of this user guide.

1.

Chart - (Required) Select the chart, e.g., MA = UH-Manoa.

2.

Account Number - (Required) Enter the account number or select the magnifying glass to search.

3.

Sub-Account - (Optional) Enter the sub-account or select the magnifying glass to search.

4.

Object - (Required) Enter the object code or select the magnifying glass to search.

5.

Sub-Object - (Optional) Enter the sub-object or select the magnifying glass to search.

6.

Project - (Optional) Enter the project or select the magnifying glass to search.

7.

Org Ref Id - (Optional) Enter the organization reference Id. a.

For manual travel reimbursements, enter the T-Doc number, e.g., T056001 (TFOCodennn). b.

For non-travel advances (Object code 7101), enter the TT-Doc number, e.g., TT05601 (TTFOCodenn).

Process Document – Disbursement Voucher Page 13 of 35 4/12/2020

c.

Note: Enter the travel return date and survey or project projected completion date in the DV

Organization Document Number field. Date format is MM/DD/YY. This is so all documents associated with this document number may be easily searched and verified.

8.

Amount - (Required) Enter the amount of the invoice or the amount to be charged to the account.

9.

Line Description - (Optional) Enter a description. (Currently, information entered here does not print on the check.)

10.

Invoice Number - (Optional) Enter the invoice number. a.

If the invoice number is available, KFS will validate the invoice number and vendor for both DV and PREQ payments. If a match is found, users will receive a warning message whether to continue with the payment processing. This will give the user time to research and confirm whether the invoice is in fact a duplicate. If the invoice is not a duplicate, press Continue and continue processing the payment. b.

The invoice number is included in the direct deposit ACH (Automated Clearing House) record to the recipient. The ACH record format is: invoice number, invoice date, discount amount, net amount, contact info, and space permitting, check stub text. c.

For information on how many invoices are allowed on a DV by payment type, see the Disbursement

Voucher Multiple Invoice Matrix attachment at the end of this guide or online go to: http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11 Payment/Reimbursement Forms

Disbursement Vouchers (DV) Multiple Invoices. d.

If the invoice number is available and the vendor has direct deposit (ACH), it is highly recommended this field be completed. This will help the payee credit the proper account.

11.

Invoice Date - (Optional) Enter the invoice date.

12.

Goods/Services Rec’d Date – (Currently Required) Used to help calculate interest charges for late payments. This field is also used to facilitate the collection of accounts payable liability information for fiscal year end. Enter the current date if the Goods/Services Rec’d Date is not known. For periodical subscriptions, enter the date the subscription begins. For manual travel, enter the date travel begins.

13.

Invoice Rec’d Date – (Currently Required) Used to help calculate interest charges for late payments. Enter the current date if the Invoice Rec’d Date is not known.

(Note: The DV Initiator currently must enter a date in the Goods/Services Rec’d Date and Invoice Rec’d Date fields or KFS will not allow the DV process to continue.)

(Note: The Aging Start Date (ASD) stamp is not required by Disbursing if the DV Goods/Services Rec'd Date and

Invoice Rec'd Date fields are completed. However, confirm with the fiscal administrator (FA) or business office who may still require the ASD on invoices for internal controls.)

14.

Actions - (Required) Click the “add” button to add the accounting line to the DV.

How to Handle Credit Memo on DV

15.

DV payments with credit memos (CMs) should be “netted” out. In the example below, the total of the DV is

$297.75 ($360.00 invoice less $62.25 credit memo). In the DV Check Stub Text field, cite the following to inform vendor on how the check amount was derived. a.

Invoice Number and Dollar Amount. b.

Credit Memo Number and Credit Amount. c.

Net.

Example: Invoice # 1060410 $360.00

Apply CM #1058891 ($ 62.25)

Net $297.75

Process Document – Disbursement Voucher Page 14 of 35 4/12/2020

Grant-in-Aid Tab

The Grant-in-Aid tab is used to process scholarship and fellowship payments and is required when Payment

Reason Code S, Grant-in-Aid Schship/Felwship-6500-6543, is selected. With built-in logic, this tab will also validate the object code(s) entered on the accounting line based on financial aid information, type of payment, payee residency, and withholding reason.

There are six (6) valid scholarship and fellowship object codes which include:

1. 6500, G-IN-AID, SCHSHIP/FELWSHIP

2. 6510, G-IN-AID, TUITION

3. 6514, G-IN-AID, TUITION (LOAN REPAYMENT)

4. 6540, G-IN-AID, TRAVEL

5. 6503, G-IN-AID, SCHSHIP/FELWSHIP (REPORTABLE)

6. 6543, G-IN-AID, TRAVEL (REPORTABLE)

Information for Financial Aid (Optional)

1.

Enter an 8-digit UH ID Number (found on UH ID card): - (Optional) Enter the 8-digit UH Number assigned to the student.

2.

Enter Semester/Term for Fellowship/Stipend, e.g., SPRING/20XX, SUMMER/20XX, or FALL/20XX): -

(Optional) Enter the academic term for the payment. Use the recommended format of term/academic year.

Type of Payment (Required Select One.)

1.

Qualified Educational Expenses (Includes tuition, fees, books, supplies, etc.):

2.

Non-qualified Educational Expenses (Includes room, board, travel costs, etc.):

3.

Services Performed:

4.

Expenses under Accountable Plan (Employment related):

This tab also includes a help link to AP 8.561, Tax Treatment of Non-Service Financial Assistance for Individuals, to help users complete this Tab. Click the question mark to the right the Grant-in-Aid tab title.

Other helpful information can be found in the Payment/Reimbursement section of the FMO website. Go to: www.fmo.hawaii.edu/payment_reimb/index.html#tab12 . Then click Training Grant-in-Aid Tab for

Scholarship/Fellowship Payment Process Grant-in-Aid FAQs and Grant-in-Aid Object Code Matrix.

Process Document – Disbursement Voucher Page 15 of 35 4/12/2020

Contact Information Tab

The Contact Information tab contains departmental contact information that may be used by Disbursing and

Vendors.

1.

Contact Name - (Required) Pre-filled with the name of the document initiator but may be edited.

2.

Phone Number - (Required) Pre-filled with the contact person's phone number (including area code) but may be edited. (Note: When a DV is "copied", the Phone Number field becomes blank and a phone number must be re-entered.)

3.

Email Address - (Optional) Pre-filled with contact person's email address but may be edited.

4.

Campus Code - (Display-only) Pre-filled with the campus associated with the document's initiator, derived from the user's profile. This is the physical campus location where the user works. In this above example, even though Alan Kimura is part of System, his campus is Manoa.

NOTE: The contact name and phone number from the Contact Information tab are printed on the check stub and are seen by the payee when they receive the check, e.g., “Info: Kimura, Alan 808-956-6621”. If vendor inquiries are taken by the business office, use the name and phone number of the person in the business office who will answer the calls.

Special Handling Tab

The Special Handling tab is used only when checks are picked up by the department. It is not used to send a check to an alternate address.

In the DV Special Handling tab complete only the first two fields.

1.

Special Handling Name: Enter chart code and Fiscal Office (FO) code, and Dept Name, e.g., “MA 017 HIG”.

2.

Special Handling Address 1: Enter “SPECIAL HANDLING”, all in capital letters.

3.

Special Handling Address 2: Leave blank.

4.

Special Handling City: Leave blank.

5.

Special Handling State: Leave blank.

6.

Special Handling Postal Code: Leave blank.

7.

Special Handling Country: Leave blank.

Process Document – Disbursement Voucher Page 16 of 35 4/12/2020

Special Handling takes more effort to process and may delay payments. If additional information is required by the vendor, another option is to add payment information in uppercase in the DV Check Stub Text field, such as account number, invoice number, meter number, etc. This information will be printed on the check remittance portion of the check to notify the vendor which account to properly credit. Remember the Check Stub Text field can hold up to 4,000 characters.

Nonresident Alien Tax Tab

(Only the Disbursing Office will use this tab.)

The Nonresident Alien Tax tab is only editable by a member of the KFS-SYS Tax Manager role when the document is routed to them. The information on this tab is used for reporting purposes and to add any special tax withholding that might be required as a result of the income classification of the payment. If the transaction is taxable, this function automatically adds the appropriate tax related accounting lines to the Accounting Lines tab of the document, and reduces the total check amount if tax needs to be withheld.

1.

Income Code - (Display Only) Defaulted from the vendor record’s Income Class Code.

2.

Federal Tax Rate - (Display Only) Defaulted from the vendor record.

3.

State Tax Percent - (Display Only) This field is not used.

4.

Resident Country Code - (Display Only) Required for payees identified as foreign. Select the country of residency of the nonresident alien payee from the list

5.

NQI Id - (Display Only) This field is not used.

6.

Reference Doc - (Display Only) This field is not used.

7.

Ownership Type Code - (Display Only) Defaulted from the vendor record.

8.

Ownership Type Category - (Display Only) Defaulted from the vendor record.

9.

Visa Type - (Display Only) Defaulted from the vendor record.

10.

Foreign Source - (Display Only) This field is not used.

11.

Treaty Exempt - (Display Only) This field is not used.

12.

Exempt Under Other Code - (Display Only) This field is not used.

13.

Gross Up Payment (Display Only) This field is not used.

14.

USAID Per Diem - (Display Only) This field is not used.

15.

Special W-4 Amount - (Display Only) This field is not used.

16.

Exemption Code - (Display Only) Defaulted from the vendor record.

17.

Withholding Reason - (Display Only) Defaulted from the vendor record.

18.

Last Update Date - (Display Only) Defaulted from the vendor record.

Process Document – Disbursement Voucher Page 17 of 35 4/12/2020

Wire Transfer Tab

The Wire Transfer tab is required when Wire Transfer is selected as the payment method. Wire transfers may

be made to US or foreign banks. There is no fee at this time. Please disregard the pop-up warning message that notifies the user there may be a fee.

If the wire transfer is to a foreign bank, the SWIFT code must be included in the Additional Wire Information field. If the Wire Transfer tab is used, please ensure W-Wire Transfer option is selected in the Payment Method field on the DV Payment Information tab .

When Wire Transfer is selected as the payment method, the user is prompted to complete the Wire Transfer tab. See APM A8.808, Bank Wire Transfer, http://www.hawaii.edu/policy/?action=viewPolicy&policySection=ap&policyChapter=8&policyNumber=808&m enuView=closed

1.

Recurring Profile No. - (Optional) Enter the user established code which quickly identifies the wire transfer profile for a payee to which frequent wire transfer payments are made.

2.

Bank Name – (Required) Enter bank name.

3.

Bank ABA Routing # - (Required for US bank.) Enter bank ABA routing number.

4.

Bank City – (Required) Enter bank city.

5.

Bank State – (Required for US bank.) Enter bank state.

6.

Bank Country – (Required) Enter bank country.

7.

Bank Account # – (Required) Enter bank account number.

8.

Bank Acct in the Name of - (Required) Enter the name on the account indicated above in the bank account# field.

Process Document – Disbursement Voucher Page 18 of 35 4/12/2020

9.

Waive wire transfer fee? - (Display only) When institutions charge departments a wire transfer fee it is possible for the fee to be waived in particular situations. Only members of the KFS-FP Disbursement Method

Reviewer role have permission to waive the fee for a wire transfer. Note: UH does not charge a fee at this time.

10.

Additional Wire Information - (Optional) Enter additional information that the financial institution may need regarding this wire transfer. Enter SWIFT code if wire is to a foreign bank.

11.

Addenda - (Optional) Enter any further information about the payment itself, similar to Additional Wire

Information.

12.

DV Amount Stated in – (Required) Select the currency type from the DV Amount Stated in list. The three choices are:

13.

a.

"U.S. Dollars" b.

"DV amount is stated in U.S. dollars; convert to foreign currency" c.

"DV amount is stated in foreign currency".

Currency Type - (Required) Enter the type or unit of currency for the payment .

Important KFS System Notes for DV Wire Transfers

14.

In the DV Description field, enter FO Code, “WIRE TRANSFER”, and vendor name. For example: “024 WIRE

TRANSFER CAMBRIDGE DATA CENTER”.

15.

Enter in the Explanation field that a wire transfer is requested and in what currency.

16.

Complete the Wire Transfer Form found at http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11 .

Then click: Payment/Reimbursement Forms Wire Transfers Wire Transfer Form.

17.

Complete DV Wire Transfer tab. See example below to a foreign bank.

18.

Scan and attach the Wire Transfer Form and supports, e.g., invoices, receipts, etc., into the Notes and

Attachments tab.

19.

UH OPRPM approval is required for purchases greater than $25,000.

Process Document – Disbursement Voucher Page 19 of 35 4/12/2020

20.

To search for DV wire transfers, go to Document Lookup Detailed Search. Enter criteria: a.

Type: DV b.

Route Status: ENROUTE c.

Ledger Document Type: DVWF d.

Search Result Type (Optional): Workflow Data

More Important Processing Notes for DV Wire Transfers

21.

Send hard copy of Wire Transfer Form, PO, and original invoice to: University of Hawaii, Disbursing Office,

1402 Lower Campus Road, Bldg H, Rm 34, Honolulu, HI 96822.

22.

The Vendor name in KFS must match the Name of the Bank Account in the wire transfer. If the name does not match, the wire transfer cannot be finalized.

23.

Overall, wire transfers are done for businesses. Wire transfers to individuals will be reviewed on a case by case basis by Disbursing for approval or disapproval.

24.

Wire transfers in USD/foreign currency can ONLY be done by Disbursing between 7:00am – 10:30am HST due to exchange rate fluctuations. Disbursing will adjust the wire transfer amount if it is different due to fluctuations.

25.

Whenever a wire transfer is completed by the Disbursing Office, a scanned copy of the wire documentation will be emailed to the fiscal administrator that requested the wire. The documentation will include the

International Wire Trace Number. The same documentation will also be attached to the DV in the Notes and Attachments tab.

26.

If the vendor does not receive the wired funds, give the vendor the International Wire Trace Number. The vendor will give the number to their bank to trace where the wire is located.

27.

The department can also request a wire trace for a fee from Bank of Hawaii to the recipient’s US bank.

Contact the UH Treasury (Bursar) office at (808) 956-8527.

28.

Wire transfer questions should be directed to the UH Disbursing Office, AP Supervisor at (808) 956-6621.

Non-Employee Travel Expenses Tab

(The Disbursing Office will not use this tab.)

1.

The Non-Employee Travel Expenses tab is not used.

2.

Employees should use and login to the University’s eTravel website: www.hawaii.edu/etravel . There, employees will also find AP 8.851, Employee Out-of-State and Intra-State Travel.

3.

Nonemployees should complete DISB-4, Travel Form, and attach applicable supports to the DV. Use

Payment Reason T. To view DISB-4, go to: http://www.fmo.hawaii.edu/travel_services/index.html#tab9 and click the Forms tab.

Process Document – Disbursement Voucher Page 20 of 35 4/12/2020

Pre-Paid Travel Expenses Tab

(The Disbursing Office will not use this tab.)

Process Document – Disbursement Voucher Page 21 of 35 4/12/2020

Pre-Disbursement Processor Status Tab

The Pre-Disbursement Processor Status tab displays information from the Pre-Disbursement Processor (PDP) so users can track the payment status and Extraction, PDP Paid, or PDP Cancellation dates. However, the

disbursement number (check number) is not displayed. The disbursement number can be found at

Maintenance Pre-Disbursement Processor Search for Payment. (Contact your FA to request KFS Payment

Viewer Role (18) to access the Search for Payment screen.)

1.

Pre-Disbursement Processor Status – (Display only) Displays the payment processing status from the Pre-

Disbursement Processor (PDP). PDP status types are listed below. a.

Pre-extraction is when the DV has not been extracted for payment. DV status maybe Saved, Enroute,

Canceled, or Disapproved. b.

Extracted is when the DV has been extracted for payment after the nightly batch runs. DV status is

Final. c.

Paid is when the check is cut. Normally, all checks are mailed no later than a day after the Paid date.

Disbursing prints checks daily, Monday through Friday except holidays. DV status is Final. d.

Canceled is when the check is canceled. DV status is Final.

2.

PDP Extraction Date- (Display only) When the DV was extracted for payment processing by the PDP.

3.

PDP Paid Date - (Display only) When the payment was disbursed by PDP, i.e., check date.

4.

PDP Cancelation Date - (Display only) When the payment was canceled within PDP.

General Ledger Pending Entries Tab

The General Ledger Pending Entries tab displays the debit/credit information based on the accounts used in the

Accounting Lines tab. The data on this tab will only be available after the document has been saved and while the transactions are pending. Once the document is approved and the transactions post to the GL in the nightly process, the data on this tab will no longer be displayed.

Process Document – Disbursement Voucher Page 22 of 35 4/12/2020

Notes and Attachments Tab

On this tab, enter any note or attachment that supports the DV payment. The Note Text field is required when a file is attached to the DV. Notes and attachments may be added to the eDoc even after it is in Final status if the user is an approver in the route log.

The Note Text field is where a user would enter in uppercase “ENCLOSURE” to alert Disbursing that an enclosure is attached to be enclosed with the check.

To view what supports, i.e., itemized receipts, invoices, proof of purchase, etc., should be attached to the DV, go to http://www.fmo.hawaii.edu/payment_reimb/index.html#tab10 and click on Policies and Guidelines

Process Documents and open DV Supporting Documentation Matrix. The matrix will inform users by payment reason code what type of supports are required to process the DV.

KFS is an open system, meaning other people with the proper permissions may be able to view other user’s attachments. Sensitive information should be redacted before attaching. After adding an attachment and note, don’t forget to click the Add button.

If an attachment or note with sensitive information is added to the Notes and Attachments Tab and the DV eDoc is in Enroute or Final status, users should attach a redacted replacement and submit a trouble ticket to request deletion of the attachment containing sensitive information. Submit a trouble ticket by either clicking Help

Resources in the upper right hand corner of the KFS screen or go to http://www.hawaii.edu/kualifinancial/feedbackForm.php

.

If an attachment or note does not contain any sensitive information and doesn't belong to the DV, add a note in the Notes and Attachments Tab to disregard the attachment or note.

Also Approvers in the route log are allowed to delete notes or attachments if the eDoc’s status is INITIATED,

DISAPPROVED, CANCELED or SAVED. Approvers are not allowed to delete attachments when the eDoc’s status is ENROUTE, PROCESSED, or FINAL.

In the above example, the DV was disapproved by Disbursing and approvers within the route log are allowed to delete any note or attachment. (Note highlighted Delete buttons.)

How to Handle Multiple Receipts and Disapproval Reason

Requests for employee reimbursement often involve a myriad of cash register receipts. To help Disbursing’s

Disbursement Managers process payments more efficiently, please follow these tips.

1.

Before scanning the receipts: a.

Ensure the name of the store is on the receipt or legible if hand-written.

Process Document – Disbursement Voucher Page 23 of 35 4/12/2020

b.

Paste or tape receipts on 8.5 X 11 inch plain white paper. Try to avoid taping over the amount as this sometimes makes the amount unreadable. c.

Label each receipt in order, e.g., #1, #2, #3, etc. d.

Circle the total cost (amount) due as shown on the receipt. Try not to use highlighting as they tend to blur the amount when scanned. e.

If there are more than three receipts, include an adding machine tape on the first page. The tape should list all receipt amounts and the total amount to be reimbursed. Illegible receipts or invoices without proof of payment may be rejected, the DV disapproved, and payment delayed. An Excel spreadsheet may be used in place of an adding machine tape.

2.

If the DV is disapproved, the reason will be annotated in the Notes and Attachments in the Note Text section and in the DV Route Log tab. In the example scrnshot, the disapproval reason is found in both the Notes and

Attachments and Route Log tabs.

Ad Hoc Recipients Tab

Users may use Ad Hoc routing to route to another person or group in addition to the normal routing.

Remember however, that each time the eDoc is routed to another approver it increases the time to final approval. The scrnshot below shows the three different ad hoc actions: FYI, Approve, and Acknowledge.

Process Document – Disbursement Voucher Page 24 of 35 4/12/2020

1.

Action Requested – Prior to submitting the eDoc, ad hoc options include: FYI, Approve or Acknowledge. a.

Approve means action is requested to approve or disapprove and until one of these actions is completed, the eDoc will not route to the next approver. b.

FYI can be cleared from the results page of the individual’s action list. The FYI action is for informational purposes only and does not require action. c.

Acknowledge means the eDoc must be opened and viewed before its status becomes Final.

Note: While Approve will stop the routing until the eDoc is approved, FYI and Acknowledge will not stop the routing to the next approver.

2.

If the eDoc is not in the Action List for approval and is not in Final status, users can still ad hoc route the eDoc but options will only be limited to FYI and Acknowledge; Approve is no longer an option.

3.

Person – Enter the UH username or select the magnifying glass to search.

4.

Actions – click Add to complete action and select a person.

5.

When the DV Initiator clicks the Submit button, the ad hoc request is sent. Note: Before clicking Submit, the action requested options are FYI, Approve, or Acknowledge. After clicking Submit, the action requested options are now only FYI or Acknowledge.

Route Log Tab

Route Log tab is the final tab in the DV. View the Route Log to determine where the eDoc is in the approval routing. Click on the “show” button for additional information about a particular action.

The normal DV approver routing is:

1. DV Initiator creates the DV.

2. Account Supervisor approves use of their accounts.

3. Fiscal Administrator (Delegate) certifies fund availability.

Process Document – Disbursement Voucher Page 25 of 35 4/12/2020

4. Disbursement Manager preaudits and approves DV for payment. Preauditing includes reviewing for: a. Legality. The application of the statutes of each encumbrance and payment transaction. b. Propriety. The proper application of State and University rules, regulations and administrative directives. c. Authorization. The appropriate approving, purchasing, and fiscal authorities.

In the example below, the DV’s Actions Taken tab shows (Follow the red steps.):

1. The DV was initiated, saved, and completed by Lee, Deborah.

2. The Account Supervisor, Lin, Susan, was bypassed because the DV was less than the $25 “de minimus” threshold.

3. The FA’s delegate, Kashiwaeda, Justin approved the DV.

4. The Disbursement Manager, Shimizu, Maliwan, disapproved the DV.

The DV’s Pending Action Requests tab (Follow the yellow steps.):

A. Acknowledge actions were sent to Kashiwaeda, Justin and Lee, Deborah concerning the Disapproval.

B. An FYI was sent to Lin, Susan that her approval was bypassed because the DV was less than the $25 “de minimus” threshold.

Process Document – Disbursement Voucher Page 26 of 35 4/12/2020

DV User Guide Attachments

The following attachments include:

1. Common Object Code Acronyms

2. Fiscal Administrators May Adjust Accounting Line Amounts

3. DV Coversheet

4. ACH/EFT Direct Deposit

5. Payment Reason, Payee Type, & Object Code List

6. Disbursement Voucher Multiple Invoice Matrix

7. Disbursement Voucher Supporting Document Matrix

8. Import Multiple Accounting Lines to DV

Common Object Code Acronyms

1. E - Employee

2. NE - NonEmployee

3. FNE - Foreign NonEmployee

4. R - Reportable (1099/1042)

5. NR - NonReportable

6. T - Taxable (W-2)

Fiscal Administrators May Adjust Account Line Amounts

Once the DV is Enroute, the FA may adjust the accounting distribution, i.e., accounting line amounts. However, the FA cannot change the Check Amount total due to internal controls. If the account line amounts do not equal the Check Amount total, the FA will receive an error message.

If the FA discovers the DV amounts are incorrect and adjusting the accounting lines is not an option, the DV should be disapproved. Then the DV Initiator should use the DV Copy option, adjust the amounts, and resubmit the DV.

DV Coversheet

The Coversheet can be used to submit receipts or other supporting documents to the business office, especially if there are documents that are not scanned and attached. Do not send DV Coversheets to Disbursing.

Process Document – Disbursement Voucher Page 27 of 35 4/12/2020

ACH/EFT Direct Deposit

Automated Clearing House/Electronic Funds Transfer (ACH/EFT) is another way to electronically send payments to our payees. Payees will receive their payments quicker and save a trip to the bank to deposit checks. This type of payment will also reduce the manual work involved with check printing and distribution as well as checks are susceptible to damage or loss.

1.

UH employees are highly encouraged to enroll in ePayment so their reimbusements, travel advances and refund payments are electronically sent directly to their checking or savings account. This will avoid lost, damaged, or misrouted checks in addition to lowering mailing and handling costs. To enroll, go to http://www.hawaii.edu/epayment .

2.

For all other payees, e.g., vendors , nonemployees, students, etc., who will be paid through KFS, they should complete two forms and attach a voided check with valid bank routing and account numbers (NOT a deposit ticket.). The two forms can be found at http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11.

Go to: Payments/Reimbursement Forms ACH/EFT. Both forms should be sent to the UH Disbursing

Office for processing (see address at the bottom of the forms.) The two forms are: a.

UH Electronic Funds Transfer Authorization form. b.

UH International Electronic Funds Transfer Certification form.

Note: ACH/EFT is not permitted to foreign banks.)

Payment Reason, Payee Type, Object Code List

This attachment can be found at FMO website Financial Systems Training Financial Processing

Training Manuals and References DV Payment Reason Payee Types and Object Codes List: http://www.fmo.hawaii.edu/financial_systems/docs/PaymentReason6_PayeeType_ObjCd_LIST.pdf

Process Document – Disbursement Voucher Page 28 of 35 4/12/2020

PR Payment Reason (PR) Title

A

B

C Computer Srvc, etc-7215-7217

D Dues/Subscriptions-3500-3507

G Supplies-3000-3478

H

I

J

E Equipment-777U

F Other Curr Exps,Fees-7200,7245

K

L

N

P

Q

R

CashAwards,Advances-7244,7101

Resale,Books,Library-6206,780A,781A,etc

Insurance,Interest-0521,0522,0541,5900,

Uniform Maint,Allowances-4192,7246,7248

Print/Advertise,Photocopy-3900-4002,7220

Rental of Land,Equipment,Bldg-5500-5705

M Use Payment Reason T, Travel

Relocation-4891-4899

Freight,Postage,Telephone-3600-3870,6204

Repairs and Maintenance-5800-5871

Services,Royalty-7100&7102-7190,7105

S Grant-in-Aid Schship/Felwship-6500-6543

T Tvl-4140-4250,4301,4501,4240-4893,7230

U Utilities-1730,1740,54XX,6204

V Vacation Credits,Post Death-2071,2961

W Ceded Land Pmts/Cr to OHA-7203-7204

X Bond,Refunds,AR,DueState-0010,5110,6000,

Y

Z

Res Corp Univ Hawaii (RCUH) & Petty Cash

Short Term Loan

Other

Payee

Types * Object Codes

E,V

7101,7244;

E,V

7300,780A,780F,780G,780U,781A,781F,781G,781U,782A,782F,782G,782U,783A,783F,783G,783U;

E,V

7215,7216,7217;

E,V 3500,3501,3502,3507;

E,V 777U;

E,V

7200,7245;

E,V

3000,3005,3010,3015,3018,3020,3025,3028,3030,3035,3040,3041,3042,3045,3048,3050,3055,3060,3

100,3105,3110,3120,3200,3201,3208,3300,3305,3310,3400,3401,3403,3405,3407,3408,3411,3422,34

24,3470,3471,3472,3473,3478;

V,VRF

0035,0643,0647,0750,0790,0830,0832,1730,1740,2071,2087,2097,2987,2997,3000,3005,3010,3015,3

018,3020,3025,3028,3030,3035,3040,3041,3042,3045,3048,3050,3055,3060,3100,3105,3110,3120,32

00,3201,3208,3300,3305,3310,3400,3401,3403,3405,3407,3408,3411,3422,3424,3470,3478,3500,350

1,3507,3600,3700,3800,3801,3802,3805,3810,3815,3820,3825,3830,3835,3840,3845,3900,3905,3910

,4000,4001,4150,4240,4241,4250,4251,4252,4310,4320,4330,4340,4341,4350,4351,4352,4440,4441,

4450,4463,4470,4471,4480,4502,4540,4541,4550,4551,4552,4570,4571,4580,4581,4582,4820,4821,4

840,4841,4850,4851,4852,4870,4871,4891,4892,4899,4900,5000,5200,5400,5420,5440,5500,5501,55

02,5505,5570,5600,5605,5606,5610,5700,5705,5800,5805,5810,5815,5823,5835,5900,6206,6561,710

0,7115,7120,7125,7135,7150,7172,7173,7200,7212,7215,7216,7217,7220,7221,7222,7225,7230,7232

,7235,7240,7245,7271,7284,7280,7281,7282,7283,7285,7300,7531,7600,7625,7650,7700,7709,7719,

7730,7739,7760,7761,760U,762U,770A,770F,770G,770U,771A,771F,771G,771U,772A,772F,772G,7

72U,773A,773F,773G,773U,774U,775G,775U,776A,776F,777U,8381,8697,9233,9259;

E,V

0521,0522,0541,5900,5905,6200,6201,6202,6203,6204,6205,6206;

E,V

4192,7246,7248;

E,V 3900,3905,3910,4000,4001,4002,7220;

E,V 5500,5501,5502,5505,5570,5600,5605,5606,5610,5700,5705;

E,V

(Do Not Use. Mileage object codes merged with Payment Reason T, Travel, Feb 2013.)

E,V 4891,4892,4893,4899;

E,V 3600,3700,3800,3801,3802,3805,3810,3815,3820,3825,3830,3835,3840,3845,3870,6204;

V

5800,5805,5810,5815,5820,5821,5822,5823,5825,5830,5835,5840,5851,5852,5853,5854,5855,5856,5

857,5858,5859,5870,5871;

E,V 2905,7100,7102,7105,7106,7110,7115,7120,7125,7130,7135,7140,7150,7170,7171,7172,7173,7174,7

190;

E,V 6500,6503,6510,6514,6540,6543;

E,V

4140,4141,4150,4151,4152,4163,4250,4301,4501,4240,4241,4215,4250,4251,4252,4263,4310,4320,4

330,4340,4341,4350,4351,4352,4363,4440,4441,4450,4463,4470,4471,4480,4493,4502,4540,4541,45

50,4551,4552,4563,4570,4571,4580,4581,4582,4593,4813,4820,4821,4840,4841,4850,4851,4852,486

3,4870,4871,7230;

V 1730,1740,5400,5410,5420,5427,5430,5440,6204;

E,V

2071,2961;

V

7203,7204;

E,V,C,

VRF

0010,0011,0030,0031,0034,0035,0270,0541,0603,0620,0640,0641,0643,0644,0645,0646,0647,0649,0

650,0700,0702,0703,0704,0721,0722,0723,0724,0730,0750,0752,0753,0754,0770,0771,0772,0773,07

78,0792,0793,0794,0800,0810,0830,1100,1721,1722,2039,2048,2098,3020,4000,5000,5110,6000,610

0,6300,8120,8130,8210,8221,8327,8361,8680,8690,8691,9213,9230,9231,9243,9253,9257,9259;

V

8410;9259

E,V 0421,1965,4830,4831,4832,4900,4910,4912,5511,5905,6600,6701,6702,6703,6704,6705,6706,6707,6

708,6709,6710,6711,6712,6713,6730,6731,6734,6736,6741,6742,6743,6744,6745,6746,6747,6748,67

49,6750,6751,6752,6753,6780,6790,6800,6900,7000,7201,7205,7206,7212,7213,7221,7222,7223,722

5,7226,7227,7231,7232,7235,7240,7247,7250,7251,7252,7260,7261,7270,7271,7272,7280,7281,7282

,7283,7284,7285,7291,7299,7400,7401,7410,7420,7429,7430,7435,7436,7438,7439,7440,7441,7442,

7448,7454,7455,7458,7472,7473,7800,8000,8200,8900,9120

* Payee Types

E - Employee

V - Vendor

C - Customer (AR)

VRF - Refund Vendor

Process Document – Disbursement Voucher Page 29 of 35 4/12/2020

Disbursement Voucher Multiple Invoice Matrix

This attachment can be found at FMO website Payment/Reimbursement Forms Disbursement

Vouchers (DV) Multiple Invoices: http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11

PR Payment Reason (PR) Title

A CashAwards,Advances-7244,7101

B Resale,Books,Library-6206,780A,781A,etc

C Computer Srvc, etc-7215-7217

D Dues/Subscriptions-3500-3507

E Equipment-777U

F Other Curr Exps,Fees-7200,7245

G Supplies-3000-3478

H Res Corp Univ Hawaii (RCUH) & Petty Cash

Invoice Level

1 to 1

Multiple

1 to 1

1 to 1

1 to 1

Multiple

Multiple

Invoice Parameter

Max 10 Invoices

Max 10 Invoices

Max 10 Invoices

1 to 1

I Insurance,Interest-0521,0522,0541,5900,

J Uniform Maint,Allowances-4192,7246,7248

K Print/Advertise,Photocopy-3900-4002,7220

M Use Payment Reason T, Travel

N Relocation-4891-4899

1 to 1

1 to 1

Multiple

1 to 1

Max 10 Invoices

P Freight,Postage,Telephone-3600-3870,6204

Q Repairs and Maintenance-5800-5871

R Services,Royalty-7100&7102-7190,7105

S Grant-in-Aid Stipends,etc-6400-6599

T Tvl-4140-4250,4301,4501,4240-4893,7230

U Utilities-1730,1740,54XX,6204

V Vacation Credits,Post Death-2071,2961

W Ceded Land Pmts/Cr to OHA-7203-7204

X Bond,Refunds,AR,DueState-0010,5110,6000,

1 to 1

Multiple

1 to 1

1 to 1

1 to 1

1 Hard Copy Trvl Doc Allowed

Multiple

1 to 1

Multiple

Max 10 Invoices

Max 10 Invoices *

Max 10 Invoices

Y Short Term Loan

Multiple

1 to 1

Max 10 Invoices

Z Other 1 to 1

* - Although the matrix lists a maximum of 10 invoices per DV, a maximum of 30 accounting lines is permitted for processing all multiple invoices. For example, 10 invoices with 5 accounting lines per invoice equal 50 accounting lines.

Users should only process 6 invoices per DV with 5 accounting lines, or 30 accounting lines.

Process Document – Disbursement Voucher Page 30 of 35 4/12/2020

Disbursement Voucher Supporting Documentation Matrix

This matrix provides a list of the acceptable documentation required or highly recommended for each type of expenditure for UH Employee Reimbursement, Non-UH Employee Reimbursement, and Regular Disbursement

Voucher Payments – Commercial Vendors.

This attachment can be found at FMO website Payment/Reimbursement Policies and Guidelines

Process Documents DV Supporting Documentation Matrix: http://www.fmo.hawaii.edu/payment_reimb/index.html#tab10

Process Document – Disbursement Voucher Page 31 of 35 4/12/2020

Process Document – Disbursement Voucher Page 32 of 35 4/12/2020

Import Multiple Accounting Lines to DV

This attachment can be found at FMO website Payment/Reimbursement Forms Disbursement

Vouchers (DV) Multiple Invoices DV Multiple Invoice Import Procedure: http://www.fmo.hawaii.edu/payment_reimb/index.html#tab11

The following procedure will illustrate how to import multiple accounting lines into the DV Accounting Lines tab rather than entering and adding each line manually.

1.

Open a DV and after completing the Document Overview and Payment Information tabs, go to the

Accounting Lines tab. Click the question mark.

2.

After clicking the question mark, the Data Import Templates will appear. Click on “DV_Import.xls”.

Process Document – Disbursement Voucher Page 33 of 35 4/12/2020

3.

The basic format of the template should appear. To open the spreadsheet, click on the DV_Import.xls link.

4.

Only the fields with red text are required. The dates must be in format MM/DD/YYYY.

Process Document – Disbursement Voucher Page 34 of 35 4/12/2020

5.

Per instructions found in Row 1, delete the first three rows and save as a CSV (comma delimited) file. (Tip:

Remember where the file is saved.)

6.

Return to the DV and click on the Import Lines button. Now click the Browse button, select the CSV file, and click the Add button.

7.

The multiple accounting lines should now be added to the DV. Continue processing the DV.

Process Document – Disbursement Voucher Page 35 of 35 4/12/2020