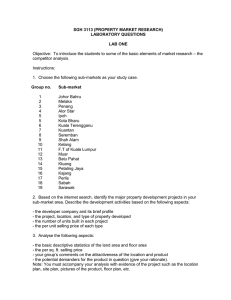

SGH 3113 (PROPERTY MARKET RESEARCH) LABORATORY QUESTIONS Lab one

advertisement

SGH 3113 (PROPERTY MARKET RESEARCH) LABORATORY QUESTIONS Lab one Objective: To introduce the students to some of the basic elements of market research – the competitor analysis. Instructions: 1. Choose the following sub-markets as your study case. Group no. 1 2 3 4 5 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Sub-market Johor Bahru Melaka Penang Alor Star Ipoh Kota Bharu Kuala Terengganu Kuantan Seremban Shah Alam Kelang F.T of Kuala Lumpur Muar Batu Pahat Kluang Petaling Jaya Kajang Perlis Sabah Sarawak 2. Based on the internet search, identify the major property development projects in your sub-market area. Describe the development activities based on the following aspects: - the developer company and its brief profile - the project, location, and type of property developed - the number of units built in each project - the per unit selling price of each type 3. Analyse the following aspects: - the basic descriptive statistics of the land area and floor area - the per sq. ft. selling price - your group’s comments on the attractiveness of the location and product - the potential demanders for the product in question (give your rationale). Note: You must accompany your analysis with evidence of the project such as the location plan, site plan, pictures of the product, floor plan, etc. Lab TWo Objective: To introduce the students to the concept of inferential analysis in property market research. [Note: Read Basic Aspects of Property Market Research, chp. 2.] Instructions: 1. Check the sub-market that you have chosen for the study case in Lab 1. Based on the sub-market, obtain the following information at the state and district levels, where the competitors’ projects are located: 1.1 Demographic factors * population structure (age, sex, ethnic, etc.) * employment by sector (agriculture, manufacturing, services, etc.) * income structure (e.g. by sector, occupation, etc.) * In- and out-migration * Pertinent factors that may affect property industry in your area of study 1.2 Economic/market factors * level of inflation * unemployment & labour force * consumer price index * property supply situation by category * property demand by category * loan facilities (including interest rate, loan margin, etc.) 3. Based on 1.1 & 1.2 above, infer the potential demand for the projects that you have studied in Lab One. Some of the information obtained from Lab One may be used for this purpose. Lab 3 Objective: To analyse potential demand for property product. In this case, residential properties are chosen as a case. Instructions: In Lab Two, you have been required to estimate ‘global demand’ for a particular geographic area in which a particular property project is proposed. In this lab, you are required to estimate specific demand for a specific product on a specific site. Background You are required to refer back to your Lab Two. Use the study area that you have chosen (e.g. Kuala Lumpur, Johor Bahru, Melaka, etc.) in Lab Two for this exercise. Choose one of the proposed project, in particular, residential development project covering the area of your selection. Your project is assumed to conform to the Local Plan provided by the Local Authority and does not infringe any of the existing law and regulations. This project is exempted from building low-cost houses by the State Government. Following the above criteria, you are to do the following: (a) Show and explain (the method of) how you estimate the demand for EACH product type that you have proposed (b) how and explain (the method of) how you recommend the selling prices of various sub products, to the developer. In conducting your demand analysis, you must clearly indicate the sources of demand viz., local area, net in-migration, spill-over effect, and alien buyers. You can assume, in doing so, mutually non-exclusive demand in the area. Otherwise, you need to consider market share of the developer and the market share of the project area. In deciding on the potential demand, use the following model: QI = [.dP x i x 1/12) / (1- 1/(1+i)n)] x 36 where QI = qualifying annual income; .d is loan margin in decimal point (e.g. loan margin of 80% means .d = 0.8; P is selling price of the property; i = interest rate (say 8%); n = number of years of monthly installment. Lab 4 Property Market Analysis (PART I) Objective: To expose students to some aspects of property market analysis. In particular, students will be exposed to a preliminary market investigation for a particular property development. Instructions: Read the following description of a parcel of land which is under consideration for a project development. Each group is required to execute the necessary steps in the investigation and collect information from the activities involved. You are investigating a parcel of land having the following particulars: Lot. No. Title No. Mukim District State Land Area Tenure Annual Rent Category of Land Use : : : : : : : : : P.T. 8249 H.S. (M) 1779 Senai – Kulai Kulai Johor Darul Ta’azim 3.224 ha. (7.967 ac.) Freehold RM73.00 Agriculture (Rubber) Some description of the property: The subject property is located within a locality called Kg. Melayu Seelong, about 10 km due north-east of Senai village. It is accessible via two directions. Firstly, via Jalan Kempas Lama for about 15 km, before turning right for about 4 km and finally turning left onto a road leading to the subject property. Secondly, via Skudai-Senai highway before turning right to Senai Airport road and turning right again to Seelong for about 6 km. Steps to be executed: Group Activities to be undertaken Remarks 1. Title search (hint: Johor Bahru PTG) Check the planning information (hint: Department of Planning, MBJB) Ascertaining comparable property value in the surrounding area (hint: JPPH, Johor Bahru) Explain in detail why you need to do title search and how you do it. Explain in detail why you need to do check on planning, how you do it and what information you gather. Explain in detail why you need to do check on property value in the surrounding area, how you do it and what information you gather. 2. 3. 4. Description of the property and site analysis Describe in details the subject property, including its site and location. You must provide a clear and informative site and location plan of the property using a scaled map and photographs. Describe in details the immediate and surrounding areas of the subject property. You must provide a clear and informative site and location plan of the property using a scaled map and photographs. Conduct a simple site analysis of the property. Describing the local competition Search for information on developer companies and profiles of their projects (e.g. location, type of property, number of units built, and selling price) Local economic and market study Search for information on the local population structure (age, sex, ethnic, etc.), employment, income structure, in- and out-migration, and other pertinent factors that may affect property development in the study area. Search for information on the local economic and market factors such as level of inflation, unemployment & labour force, consumer price index, property supply and demand situation, and loan facilities. Inferential analysis Based on the local economic and market study, perform an inferential analysis of the area. Conversion process You are required to secure information from the relevant authorities and describe the process involved to convert the parcel from agriculture to building. Clearly indicate all the relevant the costs involved in the process. 5. Market valuation of the property under its present use With the cooperation from other Group 1 above, carry out valuation on the subject property using the information from the comparable properties. Preliminary feasibility study With cooperation form other groups, you are required to assess the site for possible development of a small-scale project comprising bungalows and semi-detached houses. Indicate a simple project plan. Among other things, your focus will be on the main development activities and the related costs and selling prices. Make sure you collect real cost figures. 6. Preliminary feasibility study With cooperation form other groups, you are required to assess the site for possible conversion from agriculture to bungalow lots. Indicate a simple project plan. Among other things, your focus will be on the main development activities and the related costs and selling prices. Make sure you collect real cost figures. 7 – 20. Sample survey on the prospective buyers Each of Group 7 to 20 is required to conduct a local survey in the Senai-Kulai area and the surrounding areas among at least 30 qualified respondents (e.g. based on age and income) Among other things you should include profiles of the prospective buyers such as the current address, place of work, age, sex, type of occupation, category of occupation (private, government, etc.) income, family size, working family members, state of property ownership (e.g. own a house, renting, looking for another house, etc.), buying interest (e.g. interested, not interested), preferred product type (e.g. bungalow, semi-detached, etc.) preferred price, preferred location, etc. Lab 5 Property Market Analysis (PART II) Objective: To expose students to some aspects of property market analysis. In particular, students are required to carry out a basic valuation of the subject property that is proposed for a certain development. Instructions: Read the questions carefully before answering. This lab work is a continuation of Lab 4 (Part I). In this Lab, you are required to come up with a valuation report. You must be able to identify the question that your can answer from your own data collection as per activities required under Lab 4 (Part I) and the answer that you need to obtain information from other groups. These questions are not arranged in order. You must decide on the appropriate format for reporting and then organize your sections of valuation report accordingly. Write your report in English using Microsoft Word. If your answer involves calculation, use Excel. All maps, pictures, photographs, and exhibits or appendices must be presented in a clear and meaningful manner. The key questions that you must address in the valuation report are as follows: 1. Based on title search, write down the details of the title, including title restrictions. 2. Based on the planning information, describe the zoning surrounding the subject property. Wherever is possible, show the planning map. 3. Based on the latest evidence of comparable properties, describe the market condition in the surrounding area of the subject property. Comment on your observation. 4. Describe the subject property in details, including its site and relative location. Also, describe the immediate and surrounding areas of the subject property in detail. You must provide a clear and informative site and location plan of the property using a scaled map and photographs. 5. Based on the evidence of the comparable properties, carry out valuation of the subject property in its current status. Show the valuation steps clearly, including the schedule of value adjustment. 6. Conclude your opinion about the value of the subject property in its current status. Lab 6 Property Market Analysis (PART III) Objective: To expose students to some aspects of property market analysis. In particular, students are required to carry out consumer profiling that will be incorporated into the market and feasibility analysis. Instructions: Read the questions carefully before answering. This lab work is a continuation of Lab 4 and Lab 5. In this Lab, you are required to come up with a consumer analysis. This is a sample-based description of the essential characteristics of the prospective property buyers in the study area. Use the information from the survey that you have conducted before. You must make use of all the sample surveys conducted by groups 7-20. Questions: 1. Use a spreadsheet/statistical program (e.g. Excel, SPSS, etc.) and summarise your data from the consumer survey. Create a data matrix containing all the information that you have collected. Make sure you label each of the variable. 2. Based on the data matrix, do consumer profiling in the area of study. Format your analysis so that it reflects the essential information of consumer characteristics that will be used as part of demand analysis. Your analysis must be accompanied by the necessary tables, chart, figures, etc. 3. Make some conclusions about the prospective buyers and demand potential from your analysis. Lab 7 Property Market Analysis (PART IV) Objective: To expose students to some aspects of property pricing analysis. In particular, students are required to carry out property price modeling as part of a market analysis. Instructions: You are given a set of transaction records of condominium properties in various places in the vicinity of Johor Bahru;s Central Business District (CBD) in 2007 (see Table 7.1). Although theoretically there are a number of pertinent factors affecting the prices of condominium properties, you are given only some selected ones for this exercise. Using the evidence, you are required to propose the prices and rentals of residential units of a proposed condominium project in the Seelong (Senai-Kulai) area. [See your previous laboratory works.] The basic specifications of the proposed product mix are as follows: Floor area Units Bed Bath (sq. ft.) Position 1000 1200 1500 1700 2200 Intermediate Intermediate Intermediate Corner Corner 50 50 100 20 20 3 3 3 3 4 2 2 2 2 3 Since you could not find reliable evidence in the Senai-Kulai area, you have resorted to comparing the proposed project with those already in place in the vicinity of Johor Bahru City area (Table 7.1). From your further investigation, you found that the condominium prices in the vicinity of Johor Bahru’s CBD are about 30% higher than those in other Johor Bahru’s out-skirt areas. To analyse the pricing structure of the proposed project, you have to follow a number of modeling steps: 1. Specify the model Price = f(Floor area, no. of bedroom, no. of bathroom, tenure status, furnishing, property position, view orientation) 2. Define the variables to be included in the model. For example Variable Dependent: Price Independent: Floor area Number of bedrooms Number of bathrooms Fully furnished Partly furnished Corner position North view South view West view Label Ringgit Square footage Unit Unit 1 = yes; 0 = otherwise 1 = yes; 0 = otherwise 1 = corner; 0 = otherwise 1 = yes; 0 =otherwise 1 = yes; 0 = otherwise 1 = yes; 0 = otherwise Expected sign PRICE FLOO BED BATH FNS-1 FNS-2 CORN NORTH SOUTH WEST +ve +ve +ve +ve +ve +ve ? ? ? 3. Convert the data in Table 7.1 into data matrix in Excel. 4. Use Excel’s Tool Data Analysis Regression menus to derive the regression model. 5. Test the goodness of fit of the model based on log-log, log-linear, linear-log, and linearlinear functions. 6. Based on the selected model and after some locational adjustment, estimate the proposed price structure of the product mix. You must estimate the prices and rentals of these properties based on the tenure (freehold, leasehold) status of the units as well as the view/facing positions (west, east, north, south). For convenience of analysis, assume that all the units are sold or rented unfurnished. Table 7.1: Condominium transactions in Johor Blahru in 2007 Location Stulang View Condo, Johor Bahru, JO Straits View Condo, Johor Bahru, JO Indah Samudra Condo, Johor Bahru, JO Straits View Condo, Johor Bharu, JO Straits View Condominium, Johor Bahru, JO Jalan Pahlawan, Johor Bahru, JO Aloha Towers, Johor Bahru, JO Orchid View Condominium, Johor Bahru, JO Sri Mulia Condominium, Johor Bahru, JO Permas Ville Apartment, Johor Bahru, JO Danga View, Danga Bay, Johor Bahru, JO Bayu Puteri Apartment, Johor Bahru, JO Jalan Datin Halimah, Johor Bahru, JO Jalan Datin Halimah, Johor Bahru, JO Jalan Tampoi-Johor Bahru, Tampoi Wadihana, Johor Bahru, JO Jalan Bayu Puteri, Johor Bahru, JO Danga View, Danga Bay, Johor Bahru, JO Danga View, Danga Bay, Johor Bahru, JO Bistari Impian, Johor Bahru, JO Bistari Impian, Johor Bahru, JO Danga View, Danga Bay, Johor Bahru, JO Indah Samudra Condo, Johor Bahru, JO Petria Condominium, Jln Ungku Petria, Johor Bahru, JO Tenure Floarea No.Bed No.Bath Furnish Position View Mnt.Fees Price Freehold Freehold Leasehold Freehold Freehold Freehold Freehold Freehold Freehold Freehold Leasehold Leasehold Freehold Leasehold Leasehold Freehold Leasehold Leasehold Leasehold Leasehold Leasehold Leasehold Leasehold 1911 1650 1800 1650 1600 1215 1700 1500 2000 1200 1020 1001 1250 1100 1100 1800 1001 1038 2176 1000 1000 1038 1710 3 4 4 4 3 3 3 4 4 3 3 3 3 3 3 4 3 3 3 3 3 3 4 3 2 3 2 2 2 2 2 3 2 2 2 3 2 2 3 2 2 2 2 2 2 3 Full Full Unfurn. Full Unfurn. Unfru. Full Full Full Full Full Unfurn. Partly Full Partly Partly Unfurn. Full Partly Unfurn. Unfurn. Partly Full Intermediate Corner Intermediate Corner Intermediate Intermediate Intermediate Corner Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Intermediate Corner Intermediate Intermediate Intermediate Intermediate West North West West South South North North North East East North South South East South South East West North North East South 400 300 300 300 300 200 250 300 400 300 300 200 NA NA NA NA NA NA NA NA NA NA NA 400000 450000 320000 450000 350000 140000 350000 490000 450000 210000 300000 160000 220000 230000 160000 430000 150000 350000 800000 165000 175000 285000 380000 Freehold 1300 3 2 Full Intermediate West NA 560000 Table 7.2: Rental-Price Relationship of Condominium in Johor Bahru, 2007 Rental (RM) Price (RM) 1700 2000 2500 2500 800 700 1200 1500 1600 700 2000 3500 2800 300000 210000 450000 490000 160000 150000 220000 230000 430000 150000 350000 380000 490000 ** End of Lab Questions **