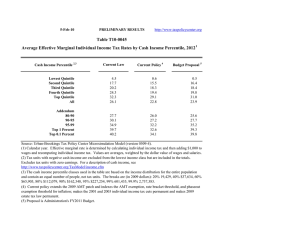

Major Individual Income Tax Provisions Outlined in President Obama's State... Baseline: Current Law

advertisement

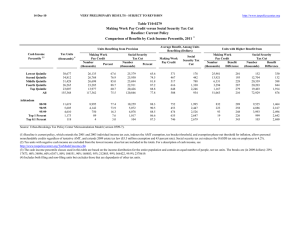

28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2016 ¹ Summary Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units with Tax Increase or Cut 4 With Tax Cut Pct of Tax Units Avg Tax Cut With Tax Increase Avg Tax Pct of Tax Units Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate6 Change (% Points) Under the Proposal 30.4 18.4 24.7 43.6 43.0 30.4 -617 -452 -557 -668 -533 -580 0.8 3.7 6.1 4.1 6.9 3.9 1,295 1,549 2,076 4,901 26,308 8,730 1.2 0.1 0.0 0.1 -0.6 -0.2 -28.6 -3.5 -1.4 -9.0 138.2 100.0 -177 -26 -12 -91 1,590 164 -1.1 -0.1 0.0 -0.1 0.5 0.2 2.0 8.3 14.0 17.1 26.4 20.1 58.9 46.4 9.2 3.2 1.0 -584 -353 -731 -1,707 -1,818 3.7 0.8 4.3 77.8 93.3 4,222 40,005 33,248 34,488 167,234 0.1 -0.1 -0.4 -1.8 -2.4 -8.1 3.5 23.7 119.0 71.0 -186 164 1,362 26,777 156,014 -0.1 0.1 0.3 1.2 1.5 19.3 21.5 24.9 35.5 38.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). Number of AMT Taxpayers (millions). Baseline: 4.8 Proposal: 4.8 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2013 dollars): 20% $25,260; 40% $49,086; 60% $84,055; 80% $141,662; 90% $200,181; 95% $279,647; 99% $663,130; 99.9% $3,446,944. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2016 ¹ Detail Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units With Tax Cut 4 With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal 6 Average Federal Tax Rate Change (% Points) Under the Proposal 30.4 18.4 24.7 43.6 43.0 30.4 0.8 3.7 6.1 4.1 6.9 3.9 1.2 0.1 0.0 0.1 -0.6 -0.2 -28.6 -3.5 -1.4 -9.0 138.2 100.0 -177 -26 -12 -91 1,590 164 -36.4 -0.8 -0.1 -0.5 1.8 0.9 -0.3 -0.1 -0.1 -0.2 0.6 0.0 0.4 3.7 10.1 17.1 68.4 100.0 -1.1 -0.1 0.0 -0.1 0.5 0.2 2.0 8.3 14.0 17.1 26.4 20.1 58.9 46.4 9.2 3.2 1.0 3.7 0.8 4.3 77.8 93.3 0.1 -0.1 -0.4 -1.8 -2.4 -8.1 3.5 23.7 119.0 71.0 -186 164 1,362 26,777 156,014 -0.6 0.3 1.4 3.5 4.1 -0.2 -0.1 0.1 0.8 0.5 12.7 10.0 15.2 30.6 15.5 -0.1 0.1 0.3 1.2 1.5 19.3 21.5 24.9 35.5 38.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile, 2016 ¹ Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden Average Federal Tax Rate 6 Percent of Total 43,584 36,537 32,617 26,860 23,468 164,808 26.5 22.2 19.8 16.3 14.2 100.0 15,614 38,416 68,960 116,375 346,310 94,528 4.4 9.0 14.4 20.1 52.2 100.0 487 3,230 9,677 20,002 89,769 18,855 0.7 3.8 10.2 17.3 67.8 100.0 15,127 35,187 59,283 96,373 256,541 75,672 5.3 10.3 15.5 20.8 48.3 100.0 3.1 8.4 14.0 17.2 25.9 20.0 11,738 5,828 4,701 1,200 123 7.1 3.5 2.9 0.7 0.1 175,719 249,464 405,931 2,251,054 10,363,091 13.2 9.3 12.3 17.4 8.2 34,095 53,380 99,709 771,891 3,789,029 12.9 10.0 15.1 29.8 15.0 141,624 196,084 306,222 1,479,163 6,574,062 13.3 9.2 11.5 14.2 6.5 19.4 21.4 24.6 34.3 36.6 Average (dollars) Percent of Total 5 Number (thousands) Average (dollars) Percent of Total After-Tax Income Average (dollars) Percent of Total Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). Number of AMT Taxpayers (millions). Baseline: 4.8 Proposal: 4.8 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2013 dollars): 20% $25,260; 40% $49,086; 60% $84,055; 80% $141,662; 90% $200,181; 95% $279,647; 99% $663,130; 99.9% $3,446,944. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units4 With Tax Cut With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 30.0 25.4 28.0 37.1 33.1 30.4 0.4 2.6 5.1 6.3 5.9 3.9 1.3 0.3 0.2 0.1 -0.6 -0.2 -24.7 -11.9 -10.4 -12.0 154.7 100.0 -188 -94 -87 -105 1,380 164 208.3 -4.0 -1.2 -0.6 1.9 0.9 -0.2 -0.1 -0.2 -0.3 0.7 0.0 -0.3 2.4 7.7 16.3 73.6 100.0 -1.3 -0.3 -0.1 -0.1 0.5 0.2 -1.9 6.5 12.2 16.5 26.1 20.1 43.5 35.4 10.9 2.6 0.9 3.5 1.2 3.0 68.0 92.7 0.0 -0.1 -0.4 -1.8 -2.4 3.1 3.7 23.6 124.3 75.6 54 132 1,062 23,519 141,465 0.2 0.3 1.3 3.5 4.2 -0.1 -0.1 0.1 0.8 0.5 14.4 11.0 16.5 31.7 16.2 0.0 0.1 0.3 1.2 1.5 19.6 21.6 24.6 35.3 38.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden Percent of Total 35,428 34,281 32,453 30,625 30,280 164,808 21.5 20.8 19.7 18.6 18.4 100.0 14,757 34,237 60,773 101,233 291,199 94,528 3.4 7.5 12.7 19.9 56.6 100.0 -90 2,327 7,516 16,810 74,754 18,855 -0.1 2.6 7.9 16.6 72.8 100.0 14,847 31,910 53,257 84,422 216,445 75,672 4.2 8.8 13.9 20.7 52.6 100.0 -0.6 6.8 12.4 16.6 25.7 20.0 15,359 7,494 5,998 1,428 144 9.3 4.6 3.6 0.9 0.1 149,959 212,543 351,455 1,970,005 9,201,391 14.8 10.2 13.5 18.1 8.5 29,309 45,758 85,272 671,522 3,362,649 14.5 11.0 16.5 30.9 15.6 120,650 166,785 266,183 1,298,483 5,838,743 14.9 10.0 12.8 14.9 6.8 19.5 21.5 24.3 34.1 36.6 Average (dollars) Percent of Total Average (dollars) Percent of Total Average Federal Tax Number (thousands) Average (dollars) Percent of Total After-Tax Income 5 Rate 6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). Number of AMT Taxpayers (millions). Baseline: 4.8 Proposal: 4.8 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table - Single Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units With Tax Cut 4 With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 39.2 23.5 12.5 9.5 5.5 21.8 0.5 3.2 6.6 10.0 3.4 4.1 2.3 0.3 -0.2 -0.4 -0.9 -0.3 -71.7 -19.5 11.6 30.8 141.4 100.0 -247 -80 61 204 1,237 100 -43.3 -3.4 1.0 1.5 2.6 1.1 -0.8 -0.3 0.0 0.1 0.9 0.0 1.0 5.8 12.4 21.7 58.8 100.0 -2.1 -0.3 0.1 0.3 0.7 0.2 2.8 8.7 13.8 19.0 26.6 19.0 6.8 5.3 2.6 1.0 0.8 2.5 0.6 0.7 48.9 89.5 -0.7 -0.3 -0.5 -2.2 -2.9 37.3 8.5 18.2 77.4 47.1 597 297 947 19,168 119,149 2.7 0.9 1.6 4.1 4.7 0.2 0.0 0.1 0.6 0.4 15.2 10.3 12.5 20.9 11.1 0.6 0.2 0.4 1.4 1.8 21.9 23.3 24.9 36.6 40.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden 5 Average Federal Tax Rate 6 Number (thousands) Percent of Total 21,601 18,079 14,176 11,244 8,516 74,432 29.0 24.3 19.1 15.1 11.4 100.0 11,534 26,152 44,707 71,949 183,916 50,088 6.7 12.7 17.0 21.7 42.0 100.0 571 2,366 6,126 13,469 47,766 9,438 1.8 6.1 12.4 21.6 57.9 100.0 10,963 23,786 38,581 58,480 136,150 40,650 7.8 14.2 18.1 21.7 38.3 100.0 5.0 9.1 13.7 18.7 26.0 18.8 4,646 2,137 1,433 301 29 6.2 2.9 1.9 0.4 0.0 105,943 147,173 247,647 1,345,525 6,634,759 13.2 8.4 9.5 10.9 5.2 22,560 33,982 60,811 472,829 2,549,367 14.9 10.3 12.4 20.3 10.7 83,383 113,191 186,835 872,696 4,085,392 12.8 8.0 8.9 8.7 4.0 21.3 23.1 24.6 35.1 38.4 Average (dollars) Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) Percent of Total Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units With Tax Cut 4 With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 15.4 27.9 45.3 60.0 46.6 44.3 0.3 2.5 4.3 4.6 7.2 4.7 0.4 0.2 0.3 0.3 -0.6 -0.3 -2.2 -4.2 -12.0 -23.9 139.7 100.0 -88 -105 -200 -312 1,452 332 25.2 -3.8 -2.3 -1.6 1.7 1.0 0.0 -0.1 -0.2 -0.4 0.6 0.0 -0.1 1.0 4.8 13.7 80.3 100.0 -0.4 -0.2 -0.3 -0.3 0.4 0.2 -2.1 5.8 11.0 15.3 26.0 21.5 64.0 50.2 13.8 3.0 1.0 4.4 1.5 3.7 73.4 94.0 0.1 0.0 -0.4 -1.7 -2.4 -9.2 1.6 23.0 124.3 74.4 -199 68 1,109 24,470 147,240 -0.6 0.1 1.2 3.4 4.1 -0.2 -0.1 0.0 0.8 0.5 14.3 11.6 18.6 35.9 17.8 -0.1 0.0 0.3 1.2 1.5 18.8 21.0 24.4 35.1 37.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden 5 Average Federal Tax Rate 6 Number (thousands) Percent of Total 5,267 8,390 12,478 16,009 20,116 62,924 8.4 13.3 19.8 25.4 32.0 100.0 20,832 46,070 77,299 123,418 339,932 163,166 1.1 3.8 9.4 19.2 66.6 100.0 -349 2,782 8,718 19,247 86,746 34,788 -0.1 1.1 5.0 14.1 79.7 100.0 21,181 43,288 68,581 104,171 253,186 128,378 1.4 4.5 10.6 20.6 63.1 100.0 -1.7 6.0 11.3 15.6 25.5 21.3 9,725 4,992 4,336 1,062 106 15.5 7.9 6.9 1.7 0.2 172,894 243,068 388,266 2,127,421 9,838,688 16.4 11.8 16.4 22.0 10.1 32,655 51,067 93,644 721,593 3,571,583 14.5 11.7 18.6 35.0 17.2 140,239 192,001 294,622 1,405,828 6,267,105 16.9 11.9 15.8 18.5 8.2 18.9 21.0 24.1 33.9 36.3 Average (dollars) Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) Percent of Total Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units With Tax Cut 4 With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 16.4 28.4 31.7 24.2 13.5 23.8 0.2 1.6 3.9 3.0 2.0 1.7 0.5 0.3 0.4 0.3 -0.2 0.3 27.5 28.5 39.4 18.0 -13.4 100.0 -104 -123 -248 -215 390 -129 6.1 -7.8 -3.0 -1.3 0.7 -2.2 -0.8 -0.5 -0.2 0.3 1.2 0.0 -10.7 7.5 28.9 31.1 43.1 100.0 -0.5 -0.3 -0.4 -0.2 0.2 -0.2 -9.4 3.5 12.2 16.9 24.8 10.8 17.6 6.5 7.9 3.9 2.8 0.1 0.1 1.4 61.5 84.8 0.1 0.0 -0.1 -1.3 -1.8 2.7 0.0 -1.3 -14.9 -9.4 -127 -5 250 15,133 104,852 -0.4 0.0 0.3 2.5 3.3 0.3 0.2 0.2 0.6 0.4 14.0 6.7 8.7 13.6 6.7 -0.1 0.0 0.1 0.8 1.2 20.7 22.2 24.6 34.2 36.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income 2,3 Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden 5 Average Federal Tax Rate 6 Number (thousands) Percent of Total 8,242 7,252 4,967 2,623 1,074 24,338 33.9 29.8 20.4 10.8 4.4 100.0 19,385 40,938 66,664 97,918 225,261 52,994 12.4 23.0 25.7 19.9 18.8 100.0 -1,712 1,571 8,377 16,745 55,555 5,864 -9.9 8.0 29.2 30.8 41.8 100.0 21,097 39,367 58,287 81,173 169,706 47,130 15.2 24.9 25.2 18.6 15.9 100.0 -8.8 3.8 12.6 17.1 24.7 11.1 669 217 157 31 3 2.8 0.9 0.6 0.1 0.0 141,530 193,985 314,767 1,810,389 8,960,600 7.4 3.3 3.8 4.3 2.0 29,404 42,996 77,028 603,340 3,192,127 13.8 6.5 8.5 13.0 6.3 112,126 150,990 237,739 1,207,049 5,768,472 6.5 2.9 3.3 3.2 1.4 20.8 22.2 24.5 33.3 35.6 Average (dollars) Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) Percent of Total Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table - Tax Units with Children Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units4 With Tax Cut With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 9.8 28.9 50.8 66.1 46.6 39.5 0.3 2.5 5.2 4.4 6.6 3.6 0.3 0.3 0.5 0.4 -0.3 0.1 17.4 32.4 80.0 121.0 -148.5 100.0 -67 -128 -329 -498 710 -82 3.2 -6.9 -3.2 -2.3 0.7 -0.4 -0.1 -0.1 -0.3 -0.4 0.8 0.0 -2.0 1.6 8.6 18.6 73.0 100.0 -0.3 -0.3 -0.4 -0.4 0.2 -0.1 -10.4 3.7 12.1 16.0 25.9 18.9 68.5 37.4 10.9 4.3 1.4 2.6 0.3 7.9 77.2 92.7 0.2 0.0 -0.1 -1.1 -1.7 38.3 4.8 -9.0 -182.6 -117.0 -360 -89 229 18,065 122,238 -0.9 -0.2 0.2 2.1 2.9 -0.1 0.0 0.1 0.8 0.5 14.4 11.5 16.1 31.0 14.6 -0.2 0.0 0.1 0.7 1.1 19.3 21.3 24.9 35.1 37.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden Percent of Total 11,016 10,740 10,294 10,291 8,856 51,650 21.3 20.8 19.9 19.9 17.2 100.0 20,654 46,531 82,170 134,442 378,160 122,065 3.6 7.9 13.4 21.9 53.1 100.0 -2,080 1,852 10,257 22,000 97,322 23,105 -1.9 1.7 8.9 19.0 72.2 100.0 22,734 44,680 71,914 112,442 280,839 98,959 4.9 9.4 14.5 22.6 48.7 100.0 -10.1 4.0 12.5 16.4 25.7 18.9 4,499 2,272 1,658 428 41 8.7 4.4 3.2 0.8 0.1 197,506 281,552 463,763 2,458,904 11,400,810 14.1 10.1 12.2 16.7 7.3 38,400 60,173 115,238 844,667 4,161,344 14.5 11.5 16.0 30.3 14.1 159,106 221,379 348,525 1,614,237 7,239,466 14.0 9.8 11.3 13.5 5.7 19.4 21.4 24.9 34.4 36.5 Average (dollars) Percent of Total Average (dollars) Percent of Total Average Federal Tax Number (thousands) Average (dollars) Percent of Total After-Tax Income 5 Rate 6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0004 Major Individual Income Tax Provisions Outlined in President Obama's State of the Union Address Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units4 With Tax Cut With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 4.7 8.3 10.0 11.4 11.1 9.1 * 0.2 1.2 1.8 6.4 1.7 0.1 0.0 -0.3 -0.6 -2.1 -1.2 -0.4 -0.2 4.2 9.7 84.1 100.0 -18 -8 152 462 4,304 840 -16.7 -1.1 4.3 4.1 6.1 5.7 0.0 -0.1 -0.1 -0.2 0.3 0.0 0.1 1.2 5.6 13.2 79.5 100.0 -0.1 0.0 0.3 0.5 1.5 1.0 0.6 2.6 6.9 13.0 26.7 18.4 14.4 13.7 3.4 0.3 0.1 2.7 2.1 2.6 70.1 95.8 -1.1 -0.7 -1.7 -3.8 -4.4 11.9 4.9 16.7 50.7 27.6 1,189 1,131 4,062 45,047 232,691 5.5 3.1 5.5 7.3 7.6 0.0 -0.2 -0.1 0.6 0.4 12.5 9.0 17.5 40.6 21.1 0.9 0.6 1.3 2.5 2.8 17.3 20.1 24.6 36.8 39.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2016 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Pre-Tax Income Federal Tax Burden Percent of Total 6,667 9,295 8,764 6,660 6,202 37,787 17.6 24.6 23.2 17.6 16.4 100.0 13,772 29,100 53,476 89,749 280,824 83,961 2.9 8.5 14.8 18.8 54.9 100.0 106 764 3,553 11,157 70,625 14,622 0.1 1.3 5.6 13.5 79.3 100.0 13,667 28,335 49,923 78,591 210,199 69,339 3.5 10.1 16.7 20.0 49.8 100.0 0.8 2.6 6.6 12.4 25.2 17.4 3,165 1,378 1,303 357 38 8.4 3.7 3.5 0.9 0.1 132,840 189,406 319,055 1,806,161 8,292,142 13.3 8.2 13.1 20.3 9.8 21,817 36,919 74,436 619,560 3,045,934 12.5 9.2 17.6 40.0 20.8 111,023 152,487 244,619 1,186,601 5,246,208 13.4 8.0 12.2 16.2 7.5 16.4 19.5 23.3 34.3 36.7 Average (dollars) Percent of Total Average (dollars) Percent of Total Average Federal Tax Number (thousands) Average (dollars) Percent of Total After-Tax Income 5 Rate 6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would: (a) raise the top tax rate on long-term capital gains and qualified dividends from 20 percent to 24.2 percent; (b) tax unrealized capital gains at death (table shows the fully-phased in impact of this provision); (c) enact a credit for second earners of up to $500; (d) expand the earned income tax credit (EITC) for childless workers; (e) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (f) expand the American Opportunity Tax Credit (AOTC); (g) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); (h) enact an “auto-IRA” proposal; (i) limit the size of accumulated balances in IRA and 401(k)-type retirement accounts; and (j) repeal the deduction for student loan interest for new borrowers (table shows the fully phased in effect). Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,488; 40% $32,340; 60% $53,324; 80% $84,999; 90% $119,750; 95% $166,406; 99% $394,734; 99.9% $2,075,547. (4) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (5) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income.