Administration's FY 2015 Budget Proposal All Major Tax Provisions

advertisement

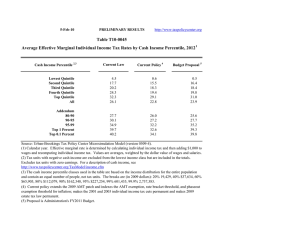

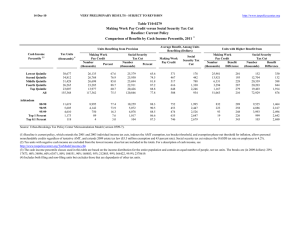

30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2015 ¹ Summary Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units Number (thousands) Percent of Total Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate 5 Change (% Points) Under the Proposal 43,476 36,374 32,412 26,575 23,244 163,798 26.5 22.2 19.8 16.2 14.2 100.0 0.7 -0.1 -0.1 -0.1 -1.2 -0.6 -6.9 1.6 2.3 2.9 100.2 100.0 -104 29 46 72 2,835 402 -0.7 0.1 0.1 0.1 0.9 0.5 2.4 8.4 14.0 17.1 26.6 20.1 11,605 5,784 4,668 1,186 122 7.1 3.5 2.9 0.7 0.1 -0.1 -0.2 -1.1 -2.9 -3.9 2.6 2.6 21.7 73.3 44.0 148 293 3,058 40,669 237,717 0.1 0.1 0.8 1.9 2.5 19.2 21.1 25.1 36.2 39.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.4 (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2013 dollars): 20% $24,844; 40% $48,286; 60% $82,182; 80% $137,646; 90% $188,937; 95% $271,750; 99% $638,232; 99.9% $3,279,269. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2015 ¹ Detail Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 5 Change (% Points) Under the Proposal 0.7 -0.1 -0.1 -0.1 -1.2 -0.6 -6.9 1.6 2.3 2.9 100.2 100.0 -104 29 46 72 2,835 402 -22.3 0.9 0.5 0.4 3.4 2.3 -0.2 -0.1 -0.2 -0.3 0.7 0.0 0.5 3.9 10.2 17.1 68.1 100.0 -0.7 0.1 0.1 0.1 0.9 0.5 2.4 8.4 14.0 17.1 26.6 20.1 -0.1 -0.2 -1.1 -2.9 -3.9 2.6 2.6 21.7 73.3 44.0 148 293 3,058 40,669 237,717 0.5 0.6 3.3 5.6 6.7 -0.2 -0.2 0.2 1.0 0.7 12.5 9.6 15.3 30.7 15.6 0.1 0.1 0.8 1.9 2.5 19.2 21.1 25.1 36.2 39.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income 4 Average (dollars) Percent of Total Average Federal Tax Rate 5 43,476 36,374 32,412 26,575 23,244 163,798 26.5 22.2 19.8 16.2 14.2 100.0 15,006 37,120 66,179 111,245 325,092 89,403 4.5 9.2 14.7 20.2 51.6 100.0 466 3,097 9,220 18,924 83,522 17,604 0.7 3.9 10.4 17.4 67.3 100.0 14,541 34,023 56,959 92,321 241,570 71,799 5.4 10.5 15.7 20.9 47.7 100.0 3.1 8.3 13.9 17.0 25.7 19.7 11,605 5,784 4,668 1,186 122 7.1 3.5 2.9 0.7 0.1 165,124 232,934 383,706 2,109,944 9,678,353 13.1 9.2 12.2 17.1 8.1 31,623 48,827 93,287 722,424 3,542,476 12.7 9.8 15.1 29.7 15.0 133,502 184,107 290,419 1,387,520 6,135,877 13.2 9.1 11.5 14.0 6.4 19.2 21.0 24.3 34.2 36.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.4 (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2013 dollars): 20% $24,844; 40% $48,286; 60% $82,182; 80% $137,646; 90% $188,937; 95% $271,750; 99% $638,232; 99.9% $3,279,269. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Average Federal Tax Rate 5 Share of Federal Taxes Change (% Points) Under the Proposal Change (% Points) Under the Proposal 0.8 0.0 -0.1 -0.1 -1.1 -0.6 -5.8 0.0 1.6 3.3 100.9 100.0 -107 0 32 72 2,196 402 123.9 0.0 0.5 0.5 3.2 2.3 -0.1 -0.1 -0.1 -0.3 0.6 0.0 -0.2 2.5 7.9 16.4 73.2 100.0 -0.8 0.0 0.1 0.1 0.8 0.5 -1.4 6.5 12.3 16.5 26.2 20.1 -0.1 -0.2 -0.9 -2.9 -3.9 2.6 4.1 19.8 74.4 46.6 112 350 2,199 34,679 213,357 0.4 0.8 2.8 5.5 6.8 -0.3 -0.2 0.1 1.0 0.7 14.1 10.9 16.5 31.7 16.3 0.1 0.2 0.7 1.9 2.5 19.3 21.5 24.7 35.9 39.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) 4 Percent of Total Average Federal Tax Rate 5 35,361 33,995 32,189 30,310 30,227 163,798 21.6 20.8 19.7 18.5 18.5 100.0 14,169 33,076 58,384 96,483 272,313 89,403 3.4 7.7 12.8 20.0 56.2 100.0 -86 2,164 7,167 15,872 69,267 17,604 -0.1 2.6 8.0 16.7 72.6 100.0 14,255 30,912 51,218 80,610 203,046 71,799 4.3 8.9 14.0 20.8 52.2 100.0 -0.6 6.5 12.3 16.5 25.4 19.7 15,280 7,613 5,921 1,412 144 9.3 4.7 3.6 0.9 0.1 141,165 196,601 333,072 1,845,253 8,564,806 14.7 10.2 13.5 17.8 8.4 27,135 41,934 79,978 627,750 3,131,551 14.4 11.1 16.4 30.7 15.6 114,030 154,667 253,094 1,217,503 5,433,255 14.8 10.0 12.7 14.6 6.7 19.2 21.3 24.0 34.0 36.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.4 (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Single Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Average Federal Tax Rate 5 Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal 1.7 0.1 -0.1 -0.1 -0.8 -0.2 -64.9 -9.5 7.7 10.9 156.4 100.0 -176 -31 32 57 1,082 79 -33.1 -1.4 0.5 0.5 2.4 0.9 -0.6 -0.1 0.0 -0.1 0.9 0.0 1.2 5.9 12.6 21.4 58.6 100.0 -1.6 -0.1 0.1 0.1 0.6 0.2 3.2 8.8 13.9 18.7 26.5 18.9 -0.1 -0.1 -0.5 -3.1 -4.9 4.5 3.7 20.0 128.3 93.0 58 94 838 25,421 184,221 0.3 0.3 1.5 5.7 7.8 -0.1 -0.1 0.1 1.0 0.7 14.4 11.0 12.3 20.9 11.3 0.1 0.1 0.4 2.0 3.0 21.3 23.2 24.8 37.1 41.4 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income 4 Average (dollars) Percent of Total Average Federal Tax Rate 5 21,755 17,975 14,155 11,194 8,551 74,471 29.2 24.1 19.0 15.0 11.5 100.0 11,102 25,209 43,007 68,398 173,155 47,608 6.8 12.8 17.2 21.6 41.8 100.0 533 2,238 5,941 12,761 44,838 8,920 1.8 6.1 12.7 21.5 57.7 100.0 10,569 22,971 37,066 55,637 128,317 38,688 8.0 14.3 18.2 21.6 38.1 100.0 4.8 8.9 13.8 18.7 25.9 18.7 4,538 2,301 1,414 299 30 6.1 3.1 1.9 0.4 0.0 99,922 138,499 234,525 1,262,728 6,143,359 12.8 9.0 9.4 10.6 5.2 21,205 32,067 57,330 443,315 2,360,001 14.5 11.1 12.2 19.9 10.6 78,718 106,432 177,195 819,413 3,783,358 12.4 8.5 8.7 8.5 3.9 21.2 23.2 24.5 35.1 38.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Average Federal Tax Rate 5 Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal 0.0 -0.1 -0.1 -0.1 -1.1 -0.7 0.0 0.4 0.8 2.3 96.6 100.0 -4 25 34 82 2,662 885 1.4 1.0 0.4 0.5 3.3 2.7 0.0 0.0 -0.1 -0.3 0.5 0.0 -0.1 1.0 4.9 13.9 80.0 100.0 0.0 0.1 0.1 0.1 0.8 0.6 -1.6 5.8 11.1 15.5 26.1 21.6 -0.1 -0.3 -0.9 -2.8 -3.8 2.4 4.0 20.5 69.6 41.7 137 451 2,641 36,529 219,172 0.5 1.0 3.0 5.4 6.6 -0.3 -0.2 0.1 0.9 0.7 14.2 11.2 18.6 36.0 18.0 0.1 0.2 0.7 1.8 2.4 18.6 20.9 24.5 35.7 38.7 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income 4 Average (dollars) Percent of Total Average Federal Tax Rate 5 5,320 8,306 12,244 15,779 19,975 62,259 8.6 13.3 19.7 25.3 32.1 100.0 20,017 44,644 74,496 117,945 318,232 154,113 1.1 3.9 9.5 19.4 66.3 100.0 -322 2,561 8,251 18,157 80,351 32,396 -0.1 1.1 5.0 14.2 79.6 100.0 20,339 42,083 66,245 99,788 237,881 121,717 1.4 4.6 10.7 20.8 62.7 100.0 -1.6 5.7 11.1 15.4 25.3 21.0 9,739 4,911 4,276 1,049 105 15.6 7.9 6.9 1.7 0.2 162,018 226,510 368,149 1,993,841 9,187,150 16.5 11.6 16.4 21.8 10.0 29,980 46,855 87,711 674,583 3,335,598 14.5 11.4 18.6 35.1 17.3 132,038 179,654 280,438 1,319,258 5,851,553 17.0 11.6 15.8 18.3 8.1 18.5 20.7 23.8 33.8 36.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Average Federal Tax Rate 5 Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal 0.0 -0.1 0.0 -0.1 -0.8 -0.2 2.6 16.0 5.3 9.0 66.7 100.0 7 46 22 72 1,235 86 -0.4 3.3 0.3 0.5 2.4 1.5 0.2 0.1 -0.4 -0.3 0.4 0.0 -9.8 7.5 29.1 30.4 42.7 100.0 0.0 0.1 0.0 0.1 0.6 0.2 -8.9 3.6 12.4 17.1 24.9 11.1 -0.1 -0.2 -0.9 -2.7 -3.6 3.4 2.8 16.1 44.5 26.3 98 266 2,111 30,357 192,219 0.4 0.7 2.9 5.3 6.5 -0.2 -0.1 0.1 0.5 0.3 14.4 6.4 8.6 13.3 6.5 0.1 0.2 0.7 1.8 2.3 20.5 21.8 25.1 35.2 38.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income 4 Average (dollars) Percent of Total Average Federal Tax Rate 5 7,977 7,174 4,992 2,595 1,112 24,016 33.2 29.9 20.8 10.8 4.6 100.0 18,688 39,600 63,863 93,366 209,453 51,174 12.1 23.1 25.9 19.7 19.0 100.0 -1,672 1,384 7,893 15,854 50,927 5,576 -10.0 7.4 29.4 30.7 42.3 100.0 20,360 38,216 55,969 77,512 158,526 45,598 14.8 25.0 25.5 18.4 16.1 100.0 -9.0 3.5 12.4 17.0 24.3 10.9 707 218 157 30 3 2.9 0.9 0.7 0.1 0.0 134,514 181,693 297,777 1,707,169 8,275,375 7.7 3.2 3.8 4.2 1.9 27,486 39,406 72,752 570,036 2,964,172 14.5 6.4 8.5 12.9 6.2 107,028 142,288 225,026 1,137,133 5,311,204 6.9 2.8 3.2 3.1 1.4 20.4 21.7 24.4 33.4 35.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Tax Units with Children Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Average Federal Tax Rate 5 Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal -0.2 -0.1 0.0 -0.1 -1.2 -0.6 1.9 1.8 1.1 3.0 92.1 100.0 50 50 31 85 3,050 567 -2.5 3.1 0.3 0.4 3.4 2.6 0.1 0.0 -0.2 -0.4 0.5 0.0 -1.9 1.6 8.8 18.8 72.5 100.0 0.3 0.1 0.0 0.1 0.9 0.5 -9.9 3.8 12.3 16.2 26.4 19.1 -0.1 -0.4 -1.4 -2.6 -3.3 2.6 6.1 25.9 57.5 31.4 166 825 4,449 38,671 226,680 0.5 1.5 4.2 4.9 5.8 -0.3 -0.1 0.3 0.7 0.4 13.9 10.8 16.5 31.2 14.7 0.1 0.3 1.0 1.7 2.1 19.1 21.4 25.5 36.0 38.6 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) 4 Percent of Total Average Federal Tax Rate 5 10,705 10,704 10,325 10,260 8,772 51,185 20.9 20.9 20.2 20.0 17.1 100.0 19,909 45,013 78,905 128,289 355,880 116,097 3.6 8.1 13.7 22.2 52.5 100.0 -2,030 1,641 9,670 20,729 90,823 21,631 -2.0 1.6 9.0 19.2 72.0 100.0 21,939 43,372 69,235 107,560 265,057 94,467 4.9 9.6 14.8 22.8 48.1 100.0 -10.2 3.7 12.3 16.2 25.5 18.6 4,493 2,159 1,689 432 40 8.8 4.2 3.3 0.8 0.1 184,228 265,866 434,087 2,284,464 10,700,967 13.9 9.7 12.3 16.6 7.3 35,080 56,141 106,402 782,710 3,907,987 14.2 11.0 16.2 30.6 14.2 149,148 209,725 327,685 1,501,754 6,792,980 13.9 9.4 11.4 13.4 5.7 19.0 21.1 24.5 34.3 36.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 30-Jun-14 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T14-0053 Administration's FY 2015 Budget Proposal All Major Tax Provisions Distribution of Federal Tax Change by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change Average Federal Tax Rate 5 Share of Federal Taxes Dollars Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal -0.1 0.0 0.0 0.0 -1.3 -0.7 0.3 0.1 0.1 1.2 98.2 100.0 8 2 1 33 2,640 447 7.7 0.3 0.1 0.3 4.1 3.3 0.0 0.0 -0.2 -0.4 0.6 0.0 0.1 1.2 5.2 12.7 80.5 100.0 0.1 0.0 0.0 0.0 1.0 0.6 0.8 2.5 6.4 12.2 25.8 17.7 0.0 -0.1 -0.5 -3.8 -5.5 0.8 0.8 9.0 87.7 60.0 40 96 1,141 42,160 268,773 0.2 0.3 1.7 7.2 9.4 -0.4 -0.3 -0.3 1.5 1.2 12.2 9.2 17.7 41.5 22.2 0.0 0.1 0.4 2.5 3.5 16.0 19.5 23.4 36.8 40.3 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Percentile Adjusted for Family Size, 2015 ¹ Expanded Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Tax Units Number (thousands) Pre-Tax Income Percent of Total Average (dollars) Federal Tax Burden Percent of Total Average (dollars) Percent of Total After-Tax Income Average (dollars) 4 Percent of Total Average Federal Tax Rate 5 6,889 9,257 8,322 6,310 6,185 37,154 18.5 24.9 22.4 17.0 16.7 100.0 13,324 28,006 51,350 86,346 262,801 79,405 3.1 8.8 14.5 18.5 55.1 100.0 98 695 3,263 10,475 65,237 13,590 0.1 1.3 5.4 13.1 79.9 100.0 13,227 27,310 48,087 75,871 197,564 65,815 3.7 10.3 16.4 19.6 50.0 100.0 0.7 2.5 6.4 12.1 24.8 17.1 3,138 1,393 1,309 346 37 8.4 3.8 3.5 0.9 0.1 126,820 175,624 301,720 1,700,630 7,752,932 13.5 8.3 13.4 19.9 9.8 20,265 34,137 69,296 583,255 2,853,283 12.6 9.4 18.0 39.9 21.0 106,554 141,487 232,425 1,117,375 4,899,649 13.7 8.1 12.4 15.8 7.4 16.0 19.4 23.0 34.3 36.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-3). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would (a) provide incentives for job creation, clean energy, and manufacturing; (b) provide incentives for investment in infrastructure; (c) increase earned income tax credit for taxpayers without qualifying children by doubling maximum credit and expanding age eligibility; (d) expand child and dependent care credit for qualifying children under 5; (e) exclude Pell Grants from income and tax credit calculations; (f) limit the value of itemized deductions and certain other deductions and exclusions to 28 percent; (g) enact the Fair Share Tax (“Buffett rule”); (h) impose a financial crisis responsibility fee; (i) tax carried interests (profits) as ordinary income; (j) limit accrual in tax favored retirement accounts; (k) conform SECA taxes for professional service businesses; (l) reinstate Superfund income and excise taxes; (m) increase tobacco excise taxes and index for inflation; (n) make unemployment insurance surtax permanent and expand FUTA base; (o) eliminate deduction for dividends from employee stock ownership plans; and (p) simplify rules for claiming the childless EITC. For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2013 dollars): 20% $17,272; 40% $31,839; 60% $52,010; 80% $82,156; 90% $114,150; 95% $160,278; 99% $376,776; 99.9% $1,971,618. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income.