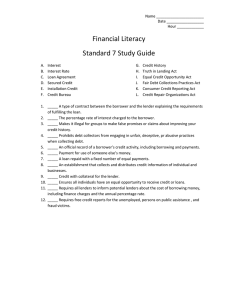

Trust and Social Collateral

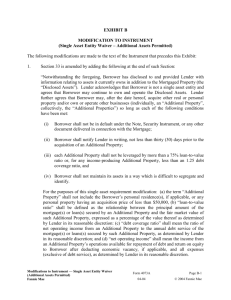

advertisement