State Welfare-to-Work Policies for People with Disabilities Changes Since Welfare Reform

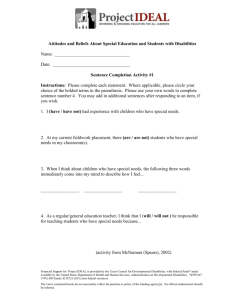

advertisement