AGENDA BOARD OF TRUSTEES REGULAR BOARD MEETING

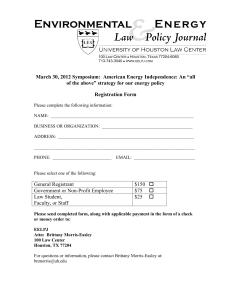

advertisement