AGENDAS BOARD OF TRUSTEES COMMITTEE MEETINGS

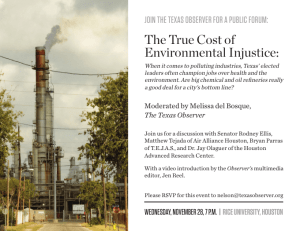

advertisement