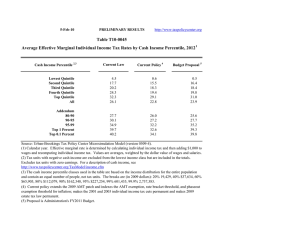

13-Mar-09 PRELIMINARY RESULTS Change (% Under the

advertisement

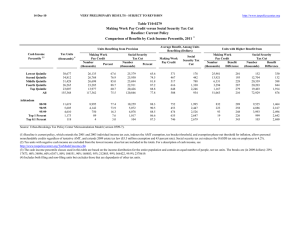

13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Percentile, 2012 1 Summary Table Percent of Tax Units4 2,3 Cash Income Percentile With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) Average Federal Tax Rate6 Change (% Points) Under the Proposal 76.9 86.2 94.7 95.4 76.8 85.6 0.1 0.1 0.1 0.3 15.0 2.4 4.4 2.3 1.5 1.0 -1.7 0.0 -1,892.1 -2,139.2 -2,082.0 -1,860.0 8,098.2 100.0 -491 -616 -665 -704 3,476 6 -4.2 -2.1 -1.2 -0.8 1.2 0.0 0.8 8.4 15.2 18.1 26.0 20.6 91.6 89.6 39.8 11.0 2.4 0.5 1.4 50.3 88.6 97.6 0.7 0.3 -1.0 -5.3 -6.4 -902.4 -289.2 1,228.2 8,061.5 4,385.3 -766 -505 2,652 69,073 371,675 -0.6 -0.3 0.8 3.8 4.4 20.8 22.3 25.3 32.6 35.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 4.9 Proposal: 3.2 (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,957, 40% $37,919, 60% $66,635, 80% $111,847, 90% $160,851, 95% $224,521, 99% $590,626, 99.9% $2,706,134. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile, 2012 Detail Table Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 76.9 86.2 94.7 95.4 76.8 85.6 0.1 0.1 0.1 0.3 15.0 2.4 4.4 2.3 1.5 1.0 -1.7 0.0 -1,892.1 -2,139.2 -2,082.0 -1,860.0 8,098.2 100.0 -491 -616 -665 -704 3,476 6 -83.8 -19.9 -7.5 -4.1 5.0 0.0 -0.8 -0.9 -0.8 -0.8 3.2 0.0 0.2 3.5 10.3 17.6 68.3 100.0 -4.2 -2.1 -1.2 -0.8 1.2 0.0 0.8 8.4 15.2 18.1 26.0 20.6 91.6 89.6 39.8 11.0 2.4 0.5 1.4 50.3 88.6 97.6 0.7 0.3 -1.0 -5.3 -6.4 -902.4 -289.2 1,228.2 8,061.5 4,385.3 -766 -505 2,652 69,073 371,675 -2.6 -1.1 3.1 13.1 14.2 -0.4 -0.1 0.5 3.2 1.8 13.8 10.1 16.4 28.0 14.2 -0.6 -0.3 0.8 3.8 4.4 20.8 22.3 25.3 32.6 35.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2012 1 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 39,109 35,235 31,797 26,816 23,648 157,316 24.9 22.4 20.2 17.1 15.0 100.0 11,727 29,685 53,843 91,347 279,733 77,851 586 3,104 8,856 17,257 69,307 16,014 11,141 26,580 44,987 74,090 210,426 61,837 5.0 10.5 16.5 18.9 24.8 20.6 3.7 8.5 14.0 20.0 54.0 100.0 4.5 9.6 14.7 20.4 51.2 100.0 0.9 4.3 11.2 18.4 65.1 100.0 11,954 5,808 4,701 1,185 120 7.6 3.7 3.0 0.8 0.1 139,760 197,580 346,049 1,831,745 8,392,568 29,763 44,515 85,032 527,460 2,614,774 109,996 153,065 261,016 1,304,284 5,777,794 21.3 22.5 24.6 28.8 31.2 13.6 9.4 13.3 17.7 8.2 13.5 9.1 12.6 15.9 7.1 14.1 10.3 15.9 24.8 12.4 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 4.9 Proposal: 3.2 (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2009 dollars): 20% $19,957, 40% $37,919, 60% $66,635, 80% $111,847, 90% $160,851, 95% $224,521, 99% $590,626, 99.9% $2,706,134. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 80.7 81.3 91.5 96.2 79.6 85.6 0.0 0.2 0.2 0.3 11.7 2.4 5.8 2.4 1.6 1.0 -1.5 0.0 -2,003.2 -1,899.2 -1,964.6 -2,012.0 8,003.8 100.0 -629 -595 -634 -677 2,683 6 -486.0 -24.9 -8.9 -4.6 4.6 0.0 -0.8 -0.8 -0.8 -0.8 3.2 0.0 -0.6 2.3 8.2 17.0 73.1 100.0 -5.7 -2.2 -1.3 -0.9 1.1 0.0 -4.6 6.7 13.8 17.8 25.8 20.6 95.0 83.1 51.4 13.5 3.6 0.1 1.4 36.8 85.9 96.4 0.7 0.3 -0.9 -5.1 -6.3 -956.3 -308.3 1,130.1 8,138.4 4,504.9 -636 -411 1,926 57,706 323,041 -2.5 -1.1 2.7 12.7 14.1 -0.4 -0.1 0.5 3.3 1.8 15.0 11.5 17.5 29.1 14.7 -0.5 -0.2 0.7 3.6 4.4 20.8 22.5 25.0 32.3 35.4 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 32,338 32,399 31,437 30,153 30,278 157,316 20.6 20.6 20.0 19.2 19.3 100.0 10,962 27,043 47,482 79,882 236,122 77,851 129 2,392 7,165 14,861 58,147 16,014 10,833 24,650 40,316 65,020 177,975 61,837 1.2 8.9 15.1 18.6 24.6 20.6 2.9 7.2 12.2 19.7 58.4 100.0 3.6 8.2 13.0 20.2 55.4 100.0 0.2 3.1 8.9 17.8 69.9 100.0 15,269 7,622 5,955 1,432 142 9.7 4.9 3.8 0.9 0.1 119,425 168,851 296,127 1,589,334 7,406,757 25,444 38,331 71,972 454,939 2,298,277 93,982 130,520 224,155 1,134,396 5,108,481 21.3 22.7 24.3 28.6 31.0 14.9 10.5 14.4 18.6 8.6 14.8 10.2 13.7 16.7 7.4 15.4 11.6 17.0 25.9 12.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 4.9 Proposal: 3.2 (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Single Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 76.0 72.0 89.2 95.4 80.3 81.6 0.0 0.3 0.0 0.0 6.5 1.0 4.6 1.8 1.5 0.9 -1.0 0.5 48.1 43.8 53.4 41.9 -87.8 100.0 -341 -335 -440 -432 1,099 -174 -52.4 -14.7 -7.6 -3.7 2.8 -1.9 -0.9 -0.7 -0.8 -0.4 2.8 0.0 0.8 4.8 12.4 20.9 60.9 100.0 -4.2 -1.6 -1.3 -0.8 0.7 -0.4 3.8 9.4 15.3 19.7 26.2 20.4 95.2 70.1 64.0 16.3 3.7 0.0 0.0 18.1 82.4 96.2 0.6 0.2 -0.3 -4.5 -6.4 15.8 2.8 -6.6 -99.9 -58.1 -374 -143 448 33,015 221,943 -1.9 -0.5 0.9 10.2 12.2 0.0 0.2 0.4 2.2 1.3 15.5 10.9 14.1 20.5 10.1 -0.4 -0.1 0.2 3.1 4.2 22.5 23.8 24.5 33.7 38.4 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 16,855 15,642 14,507 11,601 9,540 68,506 24.6 22.8 21.2 16.9 13.9 100.0 8,088 20,751 35,163 57,652 153,955 45,237 651 2,276 5,832 11,814 39,161 9,381 7,438 18,474 29,332 45,838 114,794 35,856 5,053 2,377 1,749 362 31 7.4 3.5 2.6 0.5 0.1 86,100 121,430 207,161 1,058,983 5,306,728 19,722 29,028 50,235 323,951 1,815,969 66,378 92,402 156,925 735,032 3,490,759 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 8.1 11.0 16.6 20.5 25.4 20.7 4.4 10.5 16.5 21.6 47.4 100.0 5.1 11.8 17.3 21.7 44.6 100.0 1.7 5.5 13.2 21.3 58.1 100.0 22.9 23.9 24.3 30.6 34.2 14.0 9.3 11.7 12.4 5.4 13.7 8.9 11.2 10.8 4.4 15.5 10.7 13.7 18.2 8.8 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Married Tax Units Filing Jointly Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 79.0 84.8 91.5 97.0 81.0 87.2 0.0 0.1 0.4 0.5 14.3 4.6 6.3 3.1 1.7 1.1 -1.6 -0.4 -22.7 -32.0 -38.6 -50.6 244.5 100.0 -896 -988 -930 -900 3,458 440 -653.9 -34.1 -10.9 -5.2 5.1 1.6 -0.4 -0.5 -0.7 -1.0 2.6 0.0 -0.3 1.0 5.0 14.5 79.8 100.0 -6.2 -2.9 -1.5 -0.9 1.2 0.3 -5.3 5.5 12.3 16.7 25.6 21.7 97.6 91.0 47.3 12.9 3.6 0.2 1.7 44.4 86.7 96.3 0.8 0.4 -1.0 -5.2 -6.3 -28.0 -10.1 37.9 244.8 131.7 -822 -554 2,588 65,415 348,788 -2.9 -1.3 3.2 13.2 14.5 -0.7 -0.4 0.3 3.4 1.9 15.0 12.2 19.6 33.0 16.4 -0.6 -0.3 0.8 3.7 4.4 20.1 22.0 25.1 31.9 34.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 6,836 8,755 11,214 15,212 19,110 61,400 11.1 14.3 18.3 24.8 31.1 100.0 14,389 34,618 62,026 97,768 279,599 128,766 137 2,893 8,569 17,189 68,096 27,486 14,252 31,725 53,457 80,579 211,503 101,280 9,202 4,942 3,955 1,011 102 15.0 8.1 6.4 1.7 0.2 138,970 192,850 337,574 1,756,500 7,937,859 28,682 43,002 82,153 494,405 2,411,674 110,288 149,848 255,421 1,262,094 5,526,185 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.0 8.4 13.8 17.6 24.4 21.4 1.2 3.8 8.8 18.8 67.6 100.0 1.6 4.5 9.6 19.7 65.0 100.0 0.1 1.5 5.7 15.5 77.1 100.0 20.6 22.3 24.3 28.2 30.4 16.2 12.1 16.9 22.5 10.2 16.3 11.9 16.2 20.5 9.1 15.6 12.6 19.3 29.6 14.6 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Head of Household Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 91.2 95.7 97.3 95.3 54.4 92.4 0.0 0.1 0.2 0.0 8.4 0.5 6.7 2.3 1.3 0.9 -1.1 1.8 51.7 32.3 17.5 9.2 -10.8 100.0 -999 -687 -564 -546 1,512 -649 103.4 -34.8 -7.2 -3.6 3.4 -11.6 -7.6 -2.8 1.4 2.7 6.3 0.0 -13.4 7.9 29.5 32.4 43.4 100.0 -7.1 -2.2 -1.1 -0.7 0.8 -1.6 -14.0 4.1 14.1 18.7 25.0 11.8 61.7 54.4 31.6 4.6 2.0 0.0 2.4 36.0 93.5 97.8 0.3 0.2 -0.7 -5.1 -6.4 1.1 0.3 -1.6 -10.6 -5.5 -229 -259 1,555 52,499 306,703 -0.9 -0.7 2.4 12.6 14.1 1.7 0.7 1.3 2.7 1.3 15.6 6.3 9.2 12.4 5.8 -0.2 -0.2 0.6 3.6 4.4 22.4 23.1 23.8 32.5 35.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 8,355 7,578 5,002 2,726 1,153 24,862 33.6 30.5 20.1 11.0 4.6 100.0 13,999 31,423 51,564 78,373 184,854 41,756 -966 1,973 7,822 15,181 44,770 5,595 14,965 29,449 43,743 63,191 140,084 36,162 740 211 169 32 3 3.0 0.9 0.7 0.1 0.0 115,411 158,521 280,025 1,444,013 6,993,121 26,060 36,925 65,110 416,449 2,173,246 89,350 121,597 214,915 1,027,564 4,819,874 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total -6.9 6.3 15.2 19.4 24.2 13.4 11.3 22.9 24.8 20.6 20.5 100.0 13.9 24.8 24.3 19.2 18.0 100.0 -5.8 10.8 28.1 29.8 37.1 100.0 22.6 23.3 23.3 28.8 31.1 8.2 3.2 4.6 4.5 2.0 7.4 2.9 4.0 3.7 1.6 13.9 5.6 7.9 9.7 4.5 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Tax Units with Children Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 94.6 99.1 99.3 98.0 70.7 93.3 0.0 0.1 0.3 0.7 19.1 3.3 7.5 3.2 1.7 1.1 -2.0 0.2 207.6 173.9 151.5 142.7 -577.7 100.0 -1,224 -1,057 -933 -943 4,688 -129 94.0 -45.5 -9.5 -4.7 5.8 -0.7 -1.4 -1.2 -1.0 -0.8 4.4 0.0 -2.9 1.4 9.8 19.7 71.9 100.0 -8.1 -3.0 -1.5 -0.9 1.5 -0.1 -16.7 3.6 13.9 18.1 27.1 20.0 92.1 76.2 23.3 5.4 1.1 0.2 4.8 68.6 94.3 98.8 0.7 0.2 -1.6 -6.1 -6.8 56.5 11.0 -115.8 -529.4 -261.1 -885 -373 4,847 89,344 453,776 -2.5 -0.7 4.7 14.5 14.9 -0.3 0.0 0.9 3.8 1.9 15.1 10.6 17.7 28.5 13.7 -0.6 -0.2 1.2 4.3 4.7 21.7 23.1 27.0 33.9 35.9 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 10,815 10,484 10,353 9,644 7,855 49,293 21.9 21.3 21.0 19.6 15.9 100.0 15,090 35,679 64,150 105,690 316,419 95,214 -1,302 2,322 9,824 20,106 81,192 19,170 16,391 33,358 54,327 85,585 235,227 76,045 4,070 1,884 1,523 378 37 8.3 3.8 3.1 0.8 0.1 160,563 227,342 403,939 2,087,355 9,762,184 35,769 52,936 104,293 618,474 3,048,101 124,794 174,406 299,646 1,468,881 6,714,083 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total -8.6 6.5 15.3 19.0 25.7 20.1 3.5 8.0 14.2 21.7 53.0 100.0 4.7 9.3 15.0 22.0 49.3 100.0 -1.5 2.6 10.8 20.5 67.5 100.0 22.3 23.3 25.8 29.6 31.2 13.9 9.1 13.1 16.8 7.6 13.6 8.8 12.2 14.8 6.6 15.4 10.6 16.8 24.7 11.8 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0138 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions, Maintain Estate Tax at 2009 Parameters, Major Corporate Tax Provisions Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2012 Detail Table - Elderly Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Share of Federal Taxes Average Federal Tax Change Dollars Percent Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 41.0 43.2 63.8 86.8 83.0 64.6 0.0 0.0 0.1 0.2 10.6 2.6 1.2 0.5 0.4 0.5 -1.4 -0.7 -3.5 -5.5 -6.0 -12.5 127.5 100.0 -120 -104 -159 -315 2,495 477 -33.8 -11.4 -7.8 -3.8 4.8 3.2 -0.1 -0.2 -0.3 -0.7 1.3 0.0 0.2 1.3 2.2 9.9 86.3 100.0 -1.1 -0.5 -0.4 -0.4 1.1 0.6 2.2 3.5 4.6 10.7 23.3 17.9 91.9 93.3 70.3 18.8 3.4 0.0 0.2 25.3 80.4 96.5 0.4 0.2 -0.5 -4.2 -5.8 -7.8 -3.8 12.4 126.7 75.3 -326 -300 1,062 42,122 259,467 -1.9 -1.0 1.9 10.5 12.6 -0.7 -0.5 -0.3 2.7 1.8 12.4 11.3 21.3 41.5 21.1 -0.3 -0.2 0.4 3.0 4.0 15.2 18.4 21.9 31.7 35.7 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 20121 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 4,167 7,540 5,432 5,756 7,378 30,291 13.8 24.9 17.9 19.0 24.4 100.0 10,783 23,370 41,368 74,513 232,411 85,420 356 916 2,042 8,256 51,674 14,808 10,427 22,454 39,326 66,257 180,737 70,612 3,435 1,827 1,681 434 42 11.3 6.0 5.6 1.4 0.1 109,456 155,369 267,378 1,393,711 6,524,092 16,987 28,812 57,452 399,844 2,066,945 92,468 126,556 209,926 993,866 4,457,147 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 3.3 3.9 4.9 11.1 22.2 17.3 1.7 6.8 8.7 16.6 66.3 100.0 2.0 7.9 10.0 17.8 62.3 100.0 0.3 1.5 2.5 10.6 85.0 100.0 15.5 18.5 21.5 28.7 31.7 14.5 11.0 17.4 23.4 10.6 14.9 10.8 16.5 20.2 8.7 13.0 11.7 21.5 38.7 19.3 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. Corporate income tax measures included were making the research and experimentation tax credit permanent; expanding net operating loss carryback, taxing carried interest as ordinary income, repealing LIFO, and implementing international enforcement, reform deferral and other reform policies. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2009 dollars): 20% $13,636, 40% $25,075, 60% $42,597, 80% $68,949, 90% $98,059, 95% $138,184, 99% $356,154, 99.9% $1,639,811. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.