26-Jan-09 PRELIMINARY RESULTS Under the Proposal

advertisement

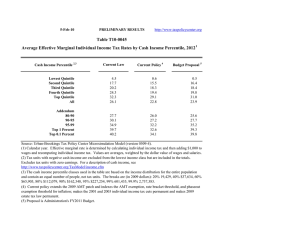

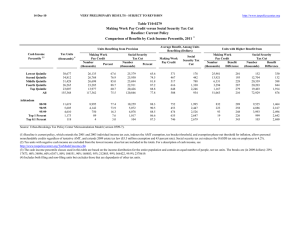

26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile, 2009 Summary Table Percent of Tax Units 4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change ($) 1 Average Federal Tax Rate 6 Change (% Points) Under the Proposal 72.3 91.9 97.5 98.3 93.4 89.1 0.0 0.0 0.0 0.0 0.0 0.0 4.7 2.7 1.7 1.2 0.9 1.4 15.0 17.8 17.3 17.4 32.2 100.0 -477 -669 -714 -859 -1,794 -826 -4.4 -2.4 -1.4 -1.0 -0.6 -1.1 0.2 8.2 15.4 18.8 25.6 20.6 94.7 95.4 87.1 96.2 99.2 0.0 0.0 0.0 0.0 0.0 1.0 0.7 0.5 1.2 1.6 9.3 4.1 4.6 14.3 8.8 -1,019 -938 -1,273 -15,693 -95,360 -0.8 -0.5 -0.4 -0.8 -1.1 21.9 23.9 26.0 28.7 30.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-7). Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 30.0 NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable bu recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2008 dollars): 20% $18,981, 40% $37,595, 60% $66,354, 80% $111,645, 90% $160,972, 95% $226,918, 99% $603,402, 99.9% $2,871,682. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile, 2009 1 Detail Table Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 72.3 91.9 97.5 98.3 93.4 89.1 0.0 0.0 0.0 0.0 0.0 0.0 4.7 2.7 1.7 1.2 0.9 1.4 15.0 17.8 17.3 17.4 32.2 100.0 -477 -669 -714 -859 -1,794 -826 -95.1 -22.5 -8.2 -4.9 -2.5 -5.1 -0.8 -0.7 -0.4 0.0 1.8 0.0 0.0 3.3 10.3 17.9 68.4 100.0 -4.4 -2.4 -1.4 -1.0 -0.6 -1.1 0.2 8.2 15.4 18.8 25.6 20.6 94.7 95.4 87.1 96.2 99.2 0.0 0.0 0.0 0.0 0.0 1.0 0.7 0.5 1.2 1.6 9.3 4.1 4.6 14.3 8.8 -1,019 -938 -1,273 -15,693 -95,360 -3.3 -2.0 -1.4 -2.8 -3.4 0.3 0.3 0.6 0.6 0.2 14.3 10.7 17.0 26.4 13.2 -0.8 -0.5 -0.4 -0.8 -1.1 21.9 23.9 26.0 28.7 30.3 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 39,102 32,942 30,075 25,152 22,287 150,241 26.0 21.9 20.0 16.7 14.8 100.0 10,744 28,057 51,924 87,992 279,244 75,289 501 2,980 8,717 17,415 73,229 16,327 10,243 25,076 43,207 70,577 206,015 58,962 4.7 10.6 16.8 19.8 26.2 21.7 3.7 8.2 13.8 19.6 55.0 100.0 4.5 9.3 14.7 20.0 51.8 100.0 0.8 4.0 10.7 17.9 66.5 100.0 11,264 5,439 4,454 1,131 114 7.5 3.6 3.0 0.8 0.1 135,143 192,266 340,985 1,889,937 8,929,410 30,642 46,915 89,899 558,384 2,798,307 104,500 145,351 251,086 1,331,553 6,131,103 22.7 24.4 26.4 29.6 31.3 13.5 9.3 13.4 18.9 9.0 13.3 8.9 12.6 17.0 7.9 14.1 10.4 16.3 25.7 13.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 30.0 NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2008 dollars): 20% $18,981, 40% $37,595, 60% $66,354, 80% $111,645, 90% $160,972, 95% $226,918, 99% $603,402, 99.9% $2,871,682. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 74.7 85.1 96.2 98.1 94.1 89.1 0.0 0.0 0.0 0.0 0.0 0.0 6.2 2.6 1.8 1.3 0.9 1.4 16.1 15.2 16.3 18.0 34.1 100.0 -618 -608 -691 -786 -1,486 -826 -549.5 -28.1 -9.6 -5.3 -2.4 -5.1 -0.9 -0.7 -0.4 0.0 2.0 0.0 -0.7 2.1 8.2 17.3 73.0 100.0 -6.1 -2.4 -1.5 -1.0 -0.6 -1.1 -5.0 6.2 14.2 18.4 25.4 20.6 97.9 91.4 87.3 96.1 99.0 0.0 0.0 0.0 0.0 0.0 1.0 0.6 0.5 1.2 1.6 9.8 4.3 4.9 15.0 9.2 -853 -747 -1,087 -13,685 -84,199 -3.3 -1.9 -1.4 -2.8 -3.4 0.3 0.4 0.7 0.6 0.2 15.6 12.0 18.0 27.4 13.8 -0.7 -0.5 -0.4 -0.8 -1.1 22.0 23.7 25.6 28.6 30.2 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 32,429 30,972 29,186 28,494 28,475 150,241 21.6 20.6 19.4 19.0 19.0 100.0 10,059 25,261 46,073 76,773 235,357 75,289 112 2,162 7,242 14,943 61,187 16,327 9,946 23,100 38,832 61,830 174,170 58,962 1.1 8.6 15.7 19.5 26.0 21.7 2.9 6.9 11.9 19.3 59.3 100.0 3.6 8.1 12.8 19.9 56.0 100.0 0.2 2.7 8.6 17.4 71.0 100.0 14,316 7,191 5,606 1,362 135 9.5 4.8 3.7 0.9 0.1 115,555 163,422 292,160 1,640,591 7,862,950 26,212 39,476 75,889 482,916 2,460,647 89,342 123,946 216,271 1,157,676 5,402,303 22.7 24.2 26.0 29.4 31.3 14.6 10.4 14.5 19.8 9.4 14.4 10.1 13.7 17.8 8.2 15.3 11.6 17.3 26.8 13.5 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 30.0 NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 20091 Detail Table - Single Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Share of Federal Taxes Change (% Points) Percent Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 68.1 77.2 95.1 97.6 91.9 83.3 0.0 0.0 0.0 0.0 0.0 0.0 4.4 2.1 1.8 1.2 0.9 1.4 18.4 16.9 19.8 17.2 27.4 100.0 -316 -352 -485 -504 -970 -475 -61.3 -17.0 -8.2 -4.4 -2.4 -5.3 -0.9 -0.7 -0.4 0.2 1.8 0.0 0.7 4.6 12.4 20.8 61.4 100.0 -4.1 -1.9 -1.5 -0.9 -0.6 -1.1 2.6 9.0 16.3 19.9 25.8 20.3 98.1 84.7 83.1 94.7 98.3 0.0 0.0 0.0 0.0 0.0 0.8 0.5 0.7 1.4 1.8 7.9 2.8 5.1 11.6 6.3 -528 -399 -986 -10,610 -65,470 -2.7 -1.4 -1.9 -3.1 -3.4 0.4 0.4 0.5 0.5 0.2 15.7 11.1 14.4 20.3 10.0 -0.6 -0.3 -0.5 -1.0 -1.2 22.9 24.1 24.9 30.6 33.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 17,979 14,788 12,570 10,552 8,719 64,958 27.7 22.8 19.4 16.2 13.4 100.0 7,650 19,082 33,514 54,870 151,432 42,053 516 2,070 5,946 11,411 39,958 8,992 7,135 17,012 27,569 43,459 111,475 33,060 4,605 2,193 1,584 338 30 7.1 3.4 2.4 0.5 0.1 82,197 116,199 201,882 1,087,643 5,550,592 19,332 28,380 51,224 343,531 1,927,489 62,864 87,819 150,659 744,112 3,623,103 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 6.7 10.9 17.7 20.8 26.4 21.4 5.0 10.3 15.4 21.2 48.3 100.0 6.0 11.7 16.1 21.4 45.3 100.0 1.6 5.2 12.8 20.6 59.6 100.0 23.5 24.4 25.4 31.6 34.7 13.9 9.3 11.7 13.5 6.1 13.5 9.0 11.1 11.7 5.0 15.2 10.7 13.9 19.9 9.9 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 20091 Detail Table - Married Tax Units Filing Jointly Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 76.2 88.7 96.2 98.6 96.4 93.5 0.0 0.0 0.0 0.0 0.0 0.0 6.6 3.3 1.9 1.4 0.9 1.3 8.0 11.6 14.7 21.2 44.2 100.0 -877 -979 -966 -1,036 -1,768 -1,221 -767.3 -37.6 -11.4 -5.9 -2.5 -4.3 -0.4 -0.5 -0.4 -0.3 1.5 0.0 -0.3 0.9 5.2 15.1 79.1 100.0 -6.6 -3.0 -1.6 -1.1 -0.6 -1.0 -5.7 5.0 12.7 17.6 25.2 21.7 99.3 95.8 90.1 97.0 99.3 0.0 0.0 0.0 0.0 0.0 1.0 0.7 0.5 1.1 1.5 13.0 6.1 5.9 19.3 11.9 -1,083 -937 -1,137 -14,486 -88,743 -3.6 -2.1 -1.3 -2.8 -3.4 0.1 0.3 0.6 0.5 0.1 15.6 12.8 20.1 30.6 15.1 -0.8 -0.5 -0.3 -0.8 -1.1 21.5 23.5 25.8 28.2 29.6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 6,621 8,578 11,027 14,829 18,163 59,479 11.1 14.4 18.5 24.9 30.5 100.0 13,343 32,397 59,438 93,284 278,505 125,155 114 2,601 8,506 17,455 72,051 28,353 13,229 29,796 50,932 75,829 206,454 96,802 8,717 4,700 3,780 965 97 14.7 7.9 6.4 1.6 0.2 134,567 186,829 332,302 1,813,978 8,464,842 30,028 44,909 86,888 525,568 2,593,746 104,539 141,920 245,414 1,288,411 5,871,096 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.9 8.0 14.3 18.7 25.9 22.7 1.2 3.7 8.8 18.6 68.0 100.0 1.5 4.4 9.8 19.5 65.1 100.0 0.0 1.3 5.6 15.4 77.6 100.0 22.3 24.0 26.2 29.0 30.6 15.8 11.8 16.9 23.5 11.1 15.8 11.6 16.1 21.6 9.9 15.5 12.5 19.5 30.1 14.9 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 20091 Detail Table - Head of Household Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 6 Change (% Points) Under the Proposal 88.6 96.5 98.7 97.8 76.8 93.5 0.0 0.0 0.0 0.0 0.0 0.0 8.1 2.5 1.5 1.0 0.5 2.3 44.9 26.8 16.4 7.5 4.2 100.0 -1,116 -700 -632 -570 -703 -807 126.6 -40.0 -8.3 -3.7 -1.6 -14.2 -8.2 -2.9 1.9 3.5 5.7 0.0 -13.3 6.6 30.1 32.2 44.3 100.0 -8.6 -2.4 -1.3 -0.8 -0.4 -2.0 -15.4 3.5 14.3 19.6 24.9 12.1 80.7 66.7 70.4 87.4 98.6 0.0 0.0 0.0 0.0 0.0 0.4 0.2 0.5 1.1 1.5 1.2 0.3 0.8 1.9 1.2 -301 -270 -971 -11,651 -78,316 -1.2 -0.7 -1.4 -2.6 -3.3 2.2 0.9 1.2 1.4 0.6 16.4 6.7 9.4 11.8 5.6 -0.3 -0.2 -0.4 -0.8 -1.0 23.2 24.4 24.6 28.4 30.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes 1 by Cash Income Percentile Adjusted for Family Size, 2009 Tax Units4 Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 7,558 7,198 4,877 2,482 1,128 23,292 32.5 30.9 20.9 10.7 4.8 100.0 12,952 29,592 49,284 75,584 179,427 40,351 -882 1,748 7,665 15,365 45,427 5,702 13,834 27,844 41,618 60,219 134,000 34,650 730 209 158 31 3 3.1 0.9 0.7 0.1 0.0 109,967 149,881 276,495 1,510,258 7,770,538 25,852 36,811 69,076 441,162 2,410,886 84,115 113,070 207,418 1,069,096 5,359,652 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total -6.8 5.9 15.6 20.3 25.3 14.1 10.4 22.7 25.6 20.0 21.5 100.0 13.0 24.8 25.2 18.5 18.7 100.0 -5.0 9.5 28.2 28.7 38.6 100.0 23.5 24.6 25.0 29.2 31.0 8.6 3.3 4.7 5.0 2.3 7.6 2.9 4.1 4.1 1.8 14.2 5.8 8.2 10.4 5.0 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Tax Units with Children Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 93.3 99.4 99.6 99.4 92.3 96.9 0.0 0.0 0.0 0.0 0.0 0.0 8.9 3.3 1.9 1.3 0.7 1.6 23.2 18.5 17.4 18.0 22.6 100.0 -1,374 -1,045 -953 -1,079 -1,577 -1,189 112.6 -51.3 -10.0 -5.2 -1.9 -5.8 -1.5 -1.0 -0.5 0.1 2.9 0.0 -2.7 1.1 9.7 20.1 71.7 100.0 -9.7 -3.1 -1.6 -1.1 -0.5 -1.3 -18.3 3.0 14.0 19.3 26.4 20.2 96.3 89.0 84.5 95.5 99.2 0.0 0.0 0.0 0.0 0.0 0.9 0.4 0.3 1.0 1.5 7.8 2.1 2.6 10.2 6.7 -1,040 -612 -927 -15,334 -103,344 -2.8 -1.1 -0.9 -2.4 -3.2 0.5 0.6 0.9 0.9 0.3 16.5 11.6 18.0 25.7 12.3 -0.7 -0.3 -0.2 -0.7 -1.0 23.2 25.2 27.0 29.3 30.1 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 9,648 10,138 10,440 9,539 8,194 48,094 20.1 21.1 21.7 19.8 17.0 100.0 14,150 33,628 61,157 101,199 306,666 95,281 -1,220 2,036 9,541 20,635 82,662 20,453 15,370 31,591 51,616 80,564 224,004 74,827 4,292 1,951 1,572 379 37 8.9 4.1 3.3 0.8 0.1 153,064 218,471 392,713 2,144,629 10,295,847 36,572 55,618 106,796 644,140 3,201,831 116,491 162,854 285,917 1,500,489 7,094,016 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -8.6 6.1 15.6 20.4 27.0 21.5 3.0 7.4 13.9 21.1 54.8 100.0 4.1 8.9 15.0 21.4 51.0 100.0 -1.2 2.1 10.1 20.0 68.9 100.0 23.9 25.5 27.2 30.0 31.1 14.3 9.3 13.5 17.7 8.3 13.9 8.8 12.5 15.8 7.3 16.0 11.0 17.1 24.8 12.0 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Note: Tax units with children are those claiming an exemption for children at home or away from home. NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 26-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0050 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by House Ways and Means Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2009 1 Detail Table - Elderly Tax Units Percent of Tax Units4 Cash Income Percentile2,3 With Tax Cut Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All With Tax Increase Percent Change in After-Tax Income5 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate6 Change (% Points) Under the Proposal 36.0 57.7 83.6 93.8 96.6 71.8 0.0 0.0 0.0 0.0 0.0 0.0 0.9 0.7 0.8 0.8 1.2 1.1 2.6 5.9 7.4 14.9 69.2 100.0 -84 -145 -314 -518 -2,255 -648 -37.0 -16.7 -11.3 -6.0 -3.8 -4.6 -0.1 -0.2 -0.2 -0.2 0.7 0.0 0.2 1.4 2.8 11.1 84.5 100.0 -0.8 -0.7 -0.8 -0.7 -0.9 -0.9 1.4 3.4 6.0 11.5 23.4 17.9 96.4 95.4 97.6 98.8 99.7 0.0 0.0 0.0 0.0 0.0 0.9 0.9 1.0 1.7 1.9 10.5 8.7 14.7 35.3 18.8 -782 -1,094 -2,052 -16,754 -88,009 -4.4 -3.8 -3.3 -3.9 -4.0 0.0 0.1 0.3 0.3 0.1 11.1 10.6 20.8 42.1 21.4 -0.7 -0.7 -0.8 -1.2 -1.3 16.3 18.8 22.8 28.8 31.0 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile Adjusted for Family Size, 2009 1 4 Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Average Income (Dollars) Average Federal Tax Burden (Dollars) Average AfterTax Income5 (Dollars) Number (thousands) Percent of Total 5,675 7,562 4,371 5,321 5,689 28,639 19.8 26.4 15.3 18.6 19.9 100.0 9,958 21,260 41,175 69,880 246,281 75,721 227 867 2,776 8,567 59,798 14,178 9,731 20,393 38,398 61,313 186,483 61,543 2,500 1,471 1,329 391 40 8.7 5.1 4.6 1.4 0.1 105,353 147,862 266,234 1,451,124 6,768,885 17,930 28,932 62,613 434,456 2,184,214 87,423 118,931 203,621 1,016,668 4,584,672 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.3 4.1 6.7 12.3 24.3 18.7 2.6 7.4 8.3 17.2 64.6 100.0 3.1 8.8 9.5 18.5 60.2 100.0 0.3 1.6 3.0 11.2 83.8 100.0 17.0 19.6 23.5 29.9 32.3 12.1 10.0 16.3 26.1 12.4 12.4 9.9 15.4 22.5 10.3 11.0 10.5 20.5 41.8 21.3 Average Federal Tax Rate6 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. For more discussion of the proposals, see the TPC's Tax Stimulus Report Card: Ways and Means bill, available at http://www.taxpolicycenter.org/publications/url.cfm?ID=411827. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-5-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $0. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and the credit is allowable against the AMT. Forty percent of the credit is made refundable. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback with 10 percent cutback for 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2008 dollars): 20% $12,921, 40% $24,393, 60% $41,924, 80% $67,748, 90% $96,780, 95% $137,143, 99% $359,711, 99.9% $1,730,730. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.