8‐Mar‐11 PRELIMINARY RESULTS With Tax Change (%

advertisement

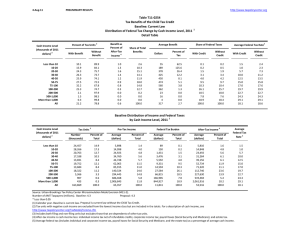

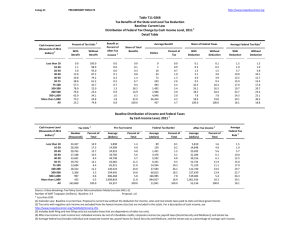

8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.3 0.5 0.0 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.2 0.1 0.3 0.2 0.4 0.5 0.4 0.3 Share of Total Federal Tax Change Average Federal Tax Change ($) 0.1 0.5 0.8 1.0 4.9 6.6 11.5 21.3 24.2 12.1 16.8 100.0 ‐1 ‐5 ‐9 ‐15 ‐93 ‐73 ‐199 ‐251 ‐958 ‐2,654 ‐7,030 ‐157 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 ‐0.2 ‐0.1 ‐0.2 ‐0.2 ‐0.3 ‐0.4 ‐0.2 ‐0.2 Under the Proposal 5.5 5.1 10.6 14.8 17.5 19.7 21.7 25.0 27.6 29.6 35.8 24.2 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 21.2 Proposal: 21.2 (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.3 0.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.2 0.1 0.3 0.2 0.4 0.5 0.4 0.3 Share of Total Federal Tax Change 0.1 0.5 0.8 1.0 4.9 6.6 11.5 21.3 24.2 12.1 16.8 100.0 Average Federal Tax Change Dollars Percent ‐1 ‐5 ‐9 ‐15 ‐93 ‐73 ‐199 ‐251 ‐958 ‐2,654 ‐7,030 ‐157 ‐0.3 ‐0.7 ‐0.3 ‐0.3 ‐1.1 ‐0.6 ‐1.0 ‐0.7 ‐1.1 ‐1.2 ‐0.6 ‐0.8 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 ‐0.1 0.0 0.0 0.0 Under the Proposal 0.2 0.7 2.0 2.9 3.5 9.5 9.4 24.8 17.1 7.9 21.9 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 ‐0.2 ‐0.1 ‐0.2 ‐0.2 ‐0.3 ‐0.4 ‐0.2 ‐0.2 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 16,372 24,763 21,537 16,514 13,080 22,835 14,507 21,341 6,329 1,147 598 159,683 10.3 15.5 13.5 10.3 8.2 14.3 9.1 13.4 4.0 0.7 0.4 100.0 Average Income (Dollars) 5,709 15,706 26,118 36,581 47,115 64,797 91,187 142,857 299,437 714,015 3,141,857 79,379 Average Federal Tax Burden (Dollars) 317 812 2,784 5,432 8,330 12,832 20,027 35,909 83,727 214,206 1,131,324 19,349 Average After‐ Tax Income 4 (Dollars) 5,392 14,894 23,334 31,150 38,785 51,965 71,160 106,948 215,710 499,809 2,010,533 60,030 Average Federal Tax Rate 5 5.6 5.2 10.7 14.9 17.7 19.8 22.0 25.1 28.0 30.0 36.0 24.4 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.7 3.1 4.4 4.8 4.9 11.7 10.4 24.1 15.0 6.5 14.8 100.0 0.9 3.9 5.2 5.4 5.3 12.4 10.8 23.8 14.2 6.0 12.5 100.0 0.2 0.7 1.9 2.9 3.5 9.5 9.4 24.8 17.2 8.0 21.9 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 21.2 Proposal: 21.2 (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 5.5 5.1 10.6 14.8 17.5 19.7 21.7 25.0 27.6 29.6 35.8 24.2 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.1 0.2 0.4 0.9 1.3 1.6 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.1 0.1 0.1 0.5 0.4 1.1 1.4 2.9 3.5 2.0 0.9 Share of Total Federal Tax Change 0.1 0.5 0.6 1.0 5.5 7.3 12.5 23.0 23.9 11.5 13.8 100.0 Average Federal Tax Change Dollars Percent ‐1 ‐7 ‐11 ‐27 ‐195 ‐172 ‐723 ‐1,363 ‐6,107 ‐16,369 ‐35,212 ‐304 ‐0.2 ‐0.5 ‐0.3 ‐0.4 ‐2.0 ‐1.2 ‐3.0 ‐3.5 ‐6.6 ‐6.8 ‐3.0 ‐2.8 Share of Federal Taxes Change (% Points) 0.0 0.1 0.2 0.2 0.1 0.3 0.0 ‐0.1 ‐0.4 ‐0.2 0.0 0.0 Under the Proposal 0.8 2.9 5.9 7.0 7.9 18.1 11.7 18.2 9.8 4.6 13.1 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 ‐0.1 0.0 ‐0.1 ‐0.4 ‐0.3 ‐0.8 ‐1.0 ‐2.0 ‐2.3 ‐1.2 ‐0.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,717 15,430 11,682 7,821 6,046 9,109 3,700 3,613 837 151 84 70,516 16.6 21.9 16.6 11.1 8.6 12.9 5.3 5.1 1.2 0.2 0.1 100.0 Average Income (Dollars) 5,695 15,557 26,016 36,553 47,054 63,845 90,036 139,747 304,381 705,144 2,997,275 45,439 Average Federal Tax Burden (Dollars) 486 1,372 3,714 6,673 9,822 14,884 24,001 38,587 92,411 241,693 1,191,549 10,784 Average After‐ Tax Income 4 (Dollars) 5,209 14,185 22,302 29,880 37,232 48,961 66,035 101,159 211,970 463,451 1,805,727 34,655 Average Federal Tax Rate 5 8.5 8.8 14.3 18.3 20.9 23.3 26.7 27.6 30.4 34.3 39.8 23.7 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 2.1 7.5 9.5 8.9 8.9 18.2 10.4 15.8 8.0 3.3 7.9 100.0 2.5 9.0 10.7 9.6 9.2 18.3 10.0 15.0 7.3 2.9 6.2 100.0 0.8 2.8 5.7 6.9 7.8 17.8 11.7 18.3 10.2 4.8 13.2 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 8.5 8.8 14.2 18.2 20.5 23.0 25.9 26.6 28.4 32.0 38.6 23.1 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.1 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.1 Share of Total Federal Tax Change 0.2 0.6 1.9 0.8 1.1 1.9 4.5 10.5 25.9 16.6 35.1 100.0 Average Federal Tax Change Dollars Percent ‐3 ‐5 ‐13 ‐6 ‐8 ‐6 ‐16 ‐20 ‐159 ‐562 ‐2,313 ‐53 ‐0.9 ‐0.9 ‐0.7 ‐0.2 ‐0.1 ‐0.1 ‐0.1 ‐0.1 ‐0.2 ‐0.3 ‐0.2 ‐0.2 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal 0.0 0.1 0.4 0.8 1.2 5.0 7.9 28.2 20.8 9.6 25.8 100.0 Average Federal Tax Rate5 Change (% Points) ‐0.1 0.0 ‐0.1 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.1 ‐0.1 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,132 3,870 4,833 4,426 4,060 9,605 9,045 16,613 5,275 957 490 61,567 3.5 6.3 7.9 7.2 6.6 15.6 14.7 27.0 8.6 1.6 0.8 100.0 Average Income (Dollars) 4,815 16,251 26,206 36,703 47,252 65,977 91,845 144,066 298,718 716,145 3,102,780 132,758 Average Federal Tax Burden (Dollars) 298 543 1,890 3,798 6,174 10,741 18,189 35,379 82,406 210,352 1,096,488 33,874 Average After‐ Tax Income 4 (Dollars) 4,517 15,709 24,316 32,905 41,078 55,236 73,656 108,687 216,312 505,793 2,006,292 98,884 Average Federal Tax Rate 5 6.2 3.3 7.2 10.4 13.1 16.3 19.8 24.6 27.6 29.4 35.3 25.5 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.1 0.8 1.6 2.0 2.4 7.8 10.2 29.3 19.3 8.4 18.6 100.0 0.2 1.0 1.9 2.4 2.7 8.7 10.9 29.7 18.7 8.0 16.2 100.0 0.0 0.1 0.4 0.8 1.2 5.0 7.9 28.2 20.8 9.7 25.8 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 6.1 3.3 7.2 10.3 13.1 16.3 19.8 24.5 27.5 29.3 35.3 25.5 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.3 0.2 0.3 0.0 Share of Total Federal Tax Change 0.1 0.1 0.3 1.7 1.3 7.2 15.4 22.0 23.9 8.1 19.5 100.0 Average Federal Tax Change Dollars Percent 0 0 0 ‐2 ‐2 ‐8 ‐40 ‐88 ‐552 ‐1,114 ‐5,958 ‐15 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.3 ‐0.7 ‐0.6 ‐0.6 ‐0.2 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal ‐0.7 ‐2.2 3.3 10.0 11.5 25.8 16.7 18.1 7.1 2.9 7.4 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.2 ‐0.2 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,386 5,181 4,712 3,910 2,610 3,632 1,462 952 165 28 12 25,098 9.5 20.6 18.8 15.6 10.4 14.5 5.8 3.8 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,591 15,741 26,276 36,461 47,096 64,017 90,229 134,253 294,759 688,030 2,955,354 43,104 Average Federal Tax Burden (Dollars) ‐518 ‐750 1,250 4,598 7,913 12,815 20,684 34,397 78,581 191,144 1,074,619 7,200 Average After‐ Tax Income 4 (Dollars) 7,109 16,492 25,025 31,863 39,184 51,202 69,544 99,856 216,178 496,886 1,880,735 35,904 Average Federal Tax Rate 5 ‐7.9 ‐4.8 4.8 12.6 16.8 20.0 22.9 25.6 26.7 27.8 36.4 16.7 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.5 7.5 11.4 13.2 11.4 21.5 12.2 11.8 4.5 1.8 3.4 100.0 1.9 9.5 13.1 13.8 11.4 20.6 11.3 10.6 4.0 1.5 2.6 100.0 ‐0.7 ‐2.2 3.3 10.0 11.4 25.8 16.7 18.1 7.2 2.9 7.4 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal ‐7.9 ‐4.8 4.8 12.6 16.8 20.0 22.9 25.6 26.5 27.6 36.2 16.7 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.0 Share of Total Federal Tax Change 0.1 0.1 0.2 0.7 1.0 2.9 9.1 13.1 29.6 17.2 25.2 100.0 Average Federal Tax Change Dollars Percent 0 0 0 ‐1 ‐2 ‐3 ‐12 ‐11 ‐78 ‐270 ‐847 ‐16 0.0 0.0 0.0 0.0 0.0 0.0 ‐0.1 0.0 ‐0.1 ‐0.1 ‐0.1 ‐0.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal ‐0.2 ‐0.6 0.4 1.8 2.5 7.5 9.3 28.1 20.3 9.0 21.9 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,836 5,625 5,645 5,039 3,930 7,341 5,725 9,407 2,939 495 231 49,348 5.8 11.4 11.4 10.2 8.0 14.9 11.6 19.1 6.0 1.0 0.5 100.0 Average Income (Dollars) 6,263 15,969 26,204 36,562 47,287 65,172 91,743 143,468 297,723 713,890 3,118,562 99,630 Average Federal Tax Burden (Dollars) ‐717 ‐1,324 832 4,270 7,596 12,284 19,708 36,063 83,554 219,964 1,141,611 24,497 Average After‐ Tax Income 4 (Dollars) 6,979 17,293 25,372 32,293 39,691 52,888 72,035 107,405 214,169 493,926 1,976,951 75,133 Average Federal Tax Rate 5 ‐11.4 ‐8.3 3.2 11.7 16.1 18.9 21.5 25.1 28.1 30.8 36.6 24.6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.4 1.8 3.0 3.8 3.8 9.7 10.7 27.5 17.8 7.2 14.7 100.0 0.5 2.6 3.9 4.4 4.2 10.5 11.1 27.3 17.0 6.6 12.3 100.0 ‐0.2 ‐0.6 0.4 1.8 2.5 7.5 9.3 28.1 20.3 9.0 21.9 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal ‐11.5 ‐8.3 3.2 11.7 16.1 18.8 21.5 25.1 28.0 30.8 36.6 24.6 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0048 Administration's FY2012 Budget Proposals Estate Tax Provisions Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.2 0.3 0.5 0.8 1.2 1.5 0.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.1 0.1 0.2 1.2 0.6 1.4 1.3 2.1 2.0 1.1 1.1 Share of Total Federal Tax Change 0.0 0.5 0.6 1.0 5.3 6.7 12.6 22.2 24.2 11.2 15.5 100.0 Average Federal Tax Change Dollars Percent ‐3 ‐17 ‐25 ‐64 ‐521 ‐336 ‐1,031 ‐1,501 ‐4,656 ‐9,782 ‐22,587 ‐689 ‐1.1 ‐4.0 ‐1.8 ‐2.5 ‐12.1 ‐4.4 ‐7.1 ‐4.9 ‐5.6 ‐4.4 ‐1.9 ‐4.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 ‐0.2 0.0 ‐0.2 ‐0.2 ‐0.3 0.0 0.8 0.0 Under the Proposal 0.1 0.6 1.4 1.6 1.7 6.4 7.1 18.6 17.8 10.4 34.4 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 ‐0.1 ‐0.1 ‐0.2 ‐1.1 ‐0.5 ‐1.1 ‐1.0 ‐1.5 ‐1.4 ‐0.7 ‐0.9 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,157 6,690 5,381 3,213 2,197 4,326 2,635 3,191 1,123 246 148 31,333 6.9 21.4 17.2 10.3 7.0 13.8 8.4 10.2 3.6 0.8 0.5 100.0 Average Income (Dollars) 6,180 15,817 25,874 36,522 47,041 65,389 90,496 143,867 305,622 717,204 3,185,815 78,111 Average Federal Tax Burden (Dollars) 223 428 1,340 2,588 4,304 7,711 14,537 30,702 83,898 220,981 1,189,568 16,681 Average After‐ Tax Income 4 (Dollars) 5,956 15,390 24,534 33,934 42,737 57,678 75,960 113,166 221,724 496,222 1,996,248 61,431 Average Federal Tax Rate 5 3.6 2.7 5.2 7.1 9.2 11.8 16.1 21.3 27.5 30.8 37.3 21.4 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.5 4.3 5.7 4.8 4.2 11.6 9.7 18.8 14.0 7.2 19.2 100.0 0.7 5.4 6.9 5.7 4.9 13.0 10.4 18.8 12.9 6.4 15.3 100.0 0.1 0.6 1.4 1.6 1.8 6.4 7.3 18.8 18.0 10.4 33.6 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would set the estate tax at its 2009 level ($3.5M exemption, 45% rate) and modify certain valuation discount rules (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 3.6 2.6 5.1 6.9 8.0 11.3 14.9 20.3 25.9 29.5 36.6 20.5