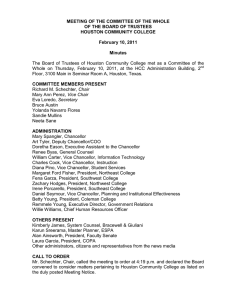

MEETING OF THE BUDGET COMMITTEE OF THE BOARD OF TRUSTEES HOUSTON COMMUNITY COLLEGE

advertisement

MEETING OF THE BUDGET COMMITTEE OF THE BOARD OF TRUSTEES HOUSTON COMMUNITY COLLEGE July 26, 2011 Minutes The Budget Committee of the Board of Trustees of Houston Community College held a meeting on Tuesday, July 26, 2011, at the HCC Administration Building, 3100 Main, 2nd Floor, Seminar Room A, Houston, Texas. COMMITTEE MEMBERS PRESENT Richard Schechter, Committee Chair Mary Ann Perez, Committee Member Bruce A. Austin, Alternate Committee Member Eva Loredo Neeta Sane ADMINISTRATION Mary S. Spangler, Chancellor Art Tyler, Deputy Chancellor/COO Destinee Waiters for Renee Byas, General Counsel Doretha Eason, Executive Assistant to the Chancellor William Carter, Vice Chancellor, Information Technology Charles Cook, Vice Chancellor, Instruction Daniel Seymour, Vice Chancellor, Planning and Institutional Effectiveness Warren Hurd for Margaret Ford Fisher, President, Northeast College Fena Garza, President, Southwest College Zachary Hodges, President, Northwest College Irene Porcarello, President, Southeast College Willie Williams, Chief Human Resource Officer Betty Young, President, Coleman College Remmele Young, Executive Director Government Relations OTHERS PRESENT Jarvis Hollingsworth, System Counsel, Bracewell & Giuliani Alan Ainsworth, President, Faculty Senate Other administrators, citizens and representatives from the news media CALL TO ORDER Mr. Schechter called the meeting to order at 10:20 a.m. and declared the Committee convened to consider matters pertaining to Houston Community College as listed on the duly posted Meeting Notice. Mr. Schechter informed that the budget must be approved by August 31, 2011. He noted that the purpose of the meeting is to hear the presentation from administration and provide the opportunity for the Board to ask questions regarding their budget concerns. Houston Community College Budget Committee – July 26, 2011 - Page 2 Operating Budgets (Unrestricted Funds) for 2011-2012 and 2012-2013 Dr. Tyler provided a budget presentation to include: • • • • • • Economic Conditions Program Growth & Development Continuing Reduction of State Allocation Taxation Local Tax Valuation Decline Tuition and Fees Dr. Tyler noted that there are concerns due to state reductions. He noted that although there is growth, the state will not be funding for program growth. Dr. Tyler informed that there is also the possibility of local tax valuation to decline. He further noted that the Board may need to have a discussion regarding tuition and fees. Dr. Tyler provided an overview of revenue forecast for 2011-2012. Mrs. Sane requested to see the approved budget. Dr. Tyler apprised that the spreadsheet reflects the approved budget for 2010-2011 as well as the projected budget for 2011-2012. Mr. Austin suggested utilizing the more conservative approach because of previous decrease funding decisions by the state. Mr. Schechter apprised that the Board needs to be cognizant of possible additional reductions by the state. Mr. Schechter inquired as to why the tuition and fees proposed for 2011-2012 are so closely the same as the projected at 2010-2011. Dr. Tyler informed that the projected amount of the spreadsheet is inaccurate and made an adjustment to reflect the actual forecast amount based on an estimated growth of 2.5%. Mrs. Sane recommended that the budget should reflect the conservative approach of estimated state funding the same as 2010-2011. Dr. Tyler apprised that the proposed state budget funding amount should be used in the budget that will be approved by the Board since that is the amount the state is scheduled to fund. Mr. Schechter recommended that the budget include 5% overage in case there is a reduction in state funding. Dr. Tyler adjusted the Tuition and Fees for the proposed budget for 2011-2012 as follows: Tuition (net) = Fees = $40,703,406 $69,085,476 Dr. Tyler noted that the adjustments made to tuition and fees would cause a bottom line shortfall of approximately $12 million. Mrs. Sane recommended offering more courses. Mr. Schechter inquired of the additional funds needed to offer more courses as discussed. Dr. Cook informed that the cost for the Houston Community College Budget Committee – July 26, 2011 - Page 3 summer to respond to the demand for the summer would have been approximately $300,000. Mr. Schechter asked administration to provide the cost for offering the additional courses. He also proposed that administration provide realistic numbers so that the Board is reviewing what is possible and most likely to take place. Ms. Loredo requested that consideration is given to the closing of buildings during the summer because that would mean that students are turned away. Dr. Seymour informed that Dr. Garza did the analysis at Southwest. Dr. Garza informed that classes were held; however, they were moved to other buildings. She noted that enrollment growth was still experienced and apprised that the classes were shifted to buildings in the vicinity of the original location. Ms. Loredo requested that the college look at filling the buildings. Dr. Seymour apprised that this has been reviewed by administration. He noted that other areas for cost reduction have been reviewed so that class closure is minimum. Mr. Schechter apprised that the shortfall would be approximately $15 million given that the budget taskforce recommendations must be revisited and tied into the forecasted budget. (Dr. Williams arrived at 11:50 a.m.) Dr. Tyler provided an overview of the expenses. He noted that the largest hit in the budget is benefits and retirements. He apprised that the state is not paying for a lot of the benefits. Dr. Tyler noted that there are some saving options and apprised that the employee benefit number reflects leaving the retirement as is without any reduction. Mr. Austin asked if the Chevron analysis included the reduction in utility costs. Dr. Tyler apprised that there has been approximately $3 million in savings. Ms. Perez requested to review the renewal of the insurance premiums. Mr. Austin informed that during the discussion regarding the insurance premiums it was determined a risk assessment was needed because so many of the risks are unknown. Dr. Tyler apprised that he would have to refer the discussion to the Risk Management Department. Dr. Tyler noted that the bottom line shortfall is approximately $12 to $15 million. Mr. Austin noted that consideration must be given to the rating in lieu of the federal debt ceiling issues. (Ms. Perez stepped out at 12:09 p.m.) Dr. Williams requested to discuss reduction in the worst case scenario. Mr. Schechter mentioned that there are options without general obligation bond. Houston Community College Budget Committee – July 26, 2011 - Page 4 Dr. Tyler presented the following options for reducing the shortfall: • Possible Reduction in Expenses ($2.6 million) o Provide 6% match in retirement o Shift Long Term Disability Insurance to Employees (Ms. Perez returned at 12:12 p.m.) Dr. Tyler noted that if the long term disability insurance will be considered by the Board, it would have to be done prior to the open enrollment closing period of August 5, 2011; therefore, the Board would have to hold a meeting prior to August 5, 2011. • Possible new revenue ($1.9 million) o Increase out-of-state tuition o Increase out-of-district tuition o Differential tuition for health and lab science o Dual credit fee Mr. Austin requested development of a sliding scale model regarding dual credit tuition. (Mrs. Sane stepped out at 12:20 p.m.) Ms. Loredo recommended reviewing the dual credit fee sooner. • Personnel Salary Increase ($2.1 million) o Elimination of Step and Column increases for Faculty & Secretary/Clerical • Debt Restructuring o Option 1 – minimum arbitrage ($4.5 million) o Option 2 - negative arbitrage ($6.5 million) o Option 3 – negative arbitrage ($10 million) (Mrs. Sane returned at 12:25 p.m.) • Reduce Taxes below Effective Tax Rate o Change tax rate to .0957 ($4.2 million) o Change tax rate to .0972 ($6.1 million) Dr. Tyler noted that a combination of debt restructuring and reduction of the effective tax rates could be utilized. He noted that taxes have been lowered for five of the past eight years. Dr. Tyler apprised if the Board does not take action before November 1, 2011 regarding the tax rate, the effective rate would have to be used, which would be .0957. Houston Community College Budget Committee – July 26, 2011 - Page 5 Mr. Schechter provided the opportunity for the Board to comment on possible options for reducing the shortfall. Dr. Williams noted that he is in favor of increasing tuition as well as the differential tuition and a differential scale for dual credit. He noted that the option of debt restructuring and changing tax rate to .0957 should also be considered. Ms. Loredo noted that she is in agreement to charging dual a credit fee and she is not in favor of raising tuition. Mr. Austin recommended comparison of budget projection with budget task force recommendations. Mrs. Sane apprised that she would rather wait to see the data regarding increasing students ratio and then analyze. Ms. Perez noted that the decisions should be reviewed from a long-term perspective. She requested to see the forecast for 2012-2013 proposed budget as well. She noted that she does not have an issue with raising the tax rate as well as tuition; however, the review must be from a long-term perspective. Mr. Schechter noted that if the Board is going to consider the long-term disability insurance to employees, a Special Meeting would need to be held before August 5, 2011. Ms. Perez requested that median age of employees for long-term disability. Mr. Willie Williams informed that the long-term disability plan is probably the only long-term disability that employees may have because if they have been out of social security for 5 years or more, they are no longer eligible for social securiity. He noted that the college currently covers the cost for long-term disability. ADJOURNMENT With no further business, the meeting adjourned at 12:44 p.m. Recorded, transcribed and submitted by: Sharon R. Wright, Manager, Board Services Minutes Approved: _________________________________