Discussion Papers

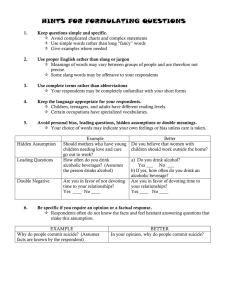

advertisement