Public Economics II

advertisement

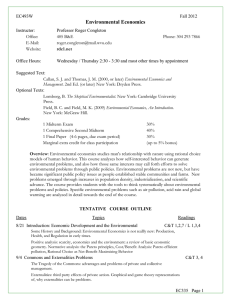

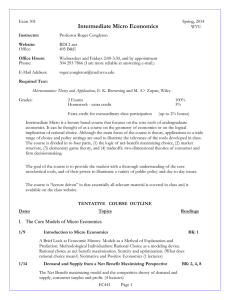

Econ 742 Spring 2016 WVU Public Economics II Instructor: Professor Roger Congleton Office: Office Hours: E-mail 405 B&E Tuesdays 2:30-3:45, Thursday: 2:30 - 3:45, and most other times by appointment. roger.congleton@mail.wvu.edu Website: RDC1.net Suggested Texts: Hillman, A. L. (2009) Public Finance and Public Policy, Responsibilities and Limitations of Government. Cambridge: Cambridge University Press. Tanzi, V. and L. Schuknecht (2000) Public Spending in the 20th Century: A Global Perspective. Cambridge: Cambridge University Press. Knight, F. H. Risk Uncertainty and Profit. (1985/1921) Midway Reprint edition, University of Chicago Press. Congleton, R. D. and B. Swedenborg (2006) Democratic Constitutional Design and Public Policy. Cambridge Mass: MIT Press. Grades: 1 Take-Home Exam 1 Final Research Paper (14-20 pages) 8 1-pagers 1 class presentation Course Focus Marginal extra credit for class participation 37% 45% 8% 10% (up to 5% bonus) Public economics is the study of government policies. It analyzes the effects of those policies on economic activities and the political processes by which those policies are adopted. Public Finance studies the subset of public policies that are fiscal in nature. These include government taxation, debt, and expenditures. The aim of this course is to provide students with the micro-economic tools to understand the impacts of basic regulatory and fiscal policies. Students will also use models and concepts from microeconomics to analyze the political pressures that generate a nation's fiscal and regulatory policies. Modern democratic governments directly control more than a third of their gross national products and influence much of the rest through their fiscal and regulatory policies. TENTATIVE COURSE OUTLINE** Dates I. 1/12 Topics Readings An Introduction to Public Economics (1) Introduction to Public Economics II AH: 1, T&S: 1-3 Private and Public Economics in the 21st Century: Growth of public sector: constraints, expenditures, and influence. Causality and public policy, is public policy exogenous? Is public policy endogenous? Dictatorships v. Democratic policy making. Economics 742, page 1 i. Congleton, R. D. (2003) “The Future of Public Choice,” Public Choice Studies 40: 5-23. ii. Knack, S. and Keefer, P. (1997) “Does Social Capital Have and Economic Payoff? A Cross-Country Investigation,” Quarterly Journal of Economics 112: 1251-88. iii. Caplan, B. (2001) “Rational Irrationality and the Microfoundations of Political Failure,” Public Choice 107: 311-331. iv. Sugden, R. (1991) “Rational Choice: A Survey of Contributions from Economics and Philosophy,” Economic Journal 101: 751-785. 1/14 (2) A Review of Micro Economic Tools The geometry of the net benefit maximizing model of rational choice, markets, efficiency, and externalities. The basic calculus of the same phenomena. The burden of taxation. Samuelson and Lindahl solutions to public goods problems. i. Samuelson and Public Goods (1954) ii. Demsetz (1970) iii. Dahlman (1979) 2/2 (3) Productive Models of the State The cooperative model of government, the need for collective decision making and enforcement, some implications of majority rule, the median voter model. A voter's preferred level(s) of public services and regulation. i. Buchanan, Limits to Liberty (1975) ii. Median Voter Model: Congleton and Bose (2010) iii. the Jury Theorem: Grofman and Feld (1988), Congleton (2007) 2/11 (4) Extractive and Rent-Seeking Models of the State Extractive models of the state: Leviathan, principle agent problems and the state, interest groups as determinants of public policies in democracies, bureaucracy as an interest group. Just how extractive are democratic and dictatorial states? i. AH: 6.1, 6.2, 6.3, 6C ii. Tullock (1967) iii. McChesney (1987) iv. Kothenburger (2005) 2/23 (5) Problematic Properties of Majority Rule The cycling (intransitivity) problem, why do voters vote?, rational ignorance and fiscal illusion, Fiscal Illusion and Condercet's jury theorem. i. Buchanan (1998) ii. Harstad (2005) iii. Logan (1986) iv. Caplan (2001) v. Congleton (2001) Economics 742, page 2 3/3 (6) Risk, Uncertainty and the Demand for Social Insurance Private and Public risk reducing rules and other strategies. Why do private insurance markets under provide insurance? the lemons market and adverse selection. The Median Voter and the demand for social insurance. Extremal and intermediate outcomes as possibilities. i. Knight (1921) ii. Congleton Manuscript (Ch 1-3) iii. Akerlof (1970), Pauly (1986) iv. Origins of a Liberal Welfare State v. Congleton Manuscript (Ch. 5) 3/10 (7) Risk, Uncertainty, and the Demand for Social Insurance II The early "liberal" welfare state and the Emergence of the Welfare (Nanny) State in the 1970s and 1980s: Risk Aversion, Transfers, and Ideological Considerations. Empirical Evidence. Has social insurance become the "main product" of Western democracy i. Feldstein (1974) ii. Browning (1975) iii. Cutler and Johnson (2004) iv. Congleton and Bose (2010) 3/17 (8) The Demand for Crisis Management Knightian Uncertainty, Surprise, and Crisis Management. What is a surprise? What is a crisis? Personal Crises, Public Crises. Crises induced by policy mistakes. 3/17 TAKE-HOME EXAMS DISTRIBUTED 3/19 (9 ) Uninsurable Risks: On the Limits of Social Insurance Difference between insurable and uninsurable risks, Beyond the normal insurance market problems: unknown risks and uncertainty. What happens when insurance is sold or provided for such risks? AIG and Ireland's banking crisis. Can one have too much insurance? i. Knight (1921) ii. Brecher (1979), Carroll (2000 ) iii. Congleton Manuscript (Ch. 5,6) iv. Reinhart (2011) 3/31 TAKE-HOME EXAMS DUE Economics 742, page 3 3/31 (10) Evaluating Public Policies: Normative Economics The Utilitarian Foundations of Contemporary Welfare Economics, Alternatives to Utilitarian Philosophical Bases, Contractarian Theory, Natural Rights, Conventionalism, Lindalh v Samuelsonian taxation i. Arrow (1950 , 1951) ii. Samuelson and Public Goods (1954) iii. Mishan (1959) iv. Bohanon (1990) v. Besley and Coate (2003) vi. Buchanan (1987) 4/2 Take-Home Exams returned and reviewed / first paper work shop 4/7-4/14 Guest lectures / Research Time for Papers 4/16 (11) Institutions and Democratic Public Policy Two levels of analysis: the choice of rules and behavior under the rules. Effects of rules on policy choices. Economic Freedom and Polity indices as efforts to measure "rules of the game." Evaluating Institutional Quality. Are institutions exogenous? i. Tiebout (1956) ii. Mueller on Federalism iii. Knack and Keefer (1997) iv. Gwartney, Lawson, and Holcombe (1999) v. Carlsson and Lundstrom (2002) vi. Person and Tabellini (2004) vii. Besley and Persson (2009) viii. Congleton (2011) 4/23 Institutions and Public Policy (round table) / workshop for papers and presentations 4/26 Student Presentation / Paper Work shop 4/28 Overview of Class: Forest from the Trees 5/6 15-22 Page paper due on an applied public economics topic due at roger.congleton@mail.wvu.edu ** some dates may be changed during the semester because of travel obligations Economics 742, page 4