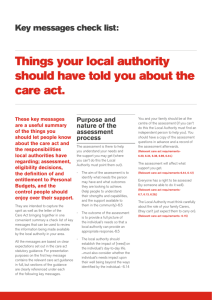

Discussion P apers Assessing the New

advertisement