P , C

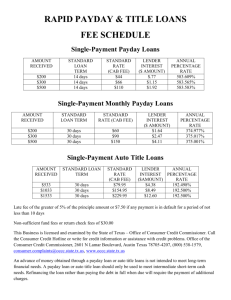

advertisement