THE APPLICATION OF “PAY WHEN PAID” PROVISIONS IN CONSTRUCTION SUB-CONTRACT

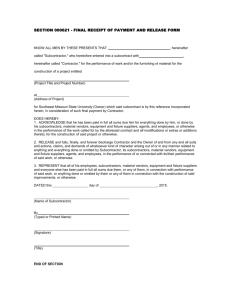

advertisement