Optimal control of a high-volume assemble-to-order expediting

advertisement

Queueing Syst (2008) 60: 1–69

DOI 10.1007/s11134-008-9085-6

Optimal control of a high-volume assemble-to-order

system with maximum leadtime quotation and

expediting

Erica L. Plambeck · Amy R. Ward

Received: 23 August 2007 / Revised: 15 August 2008 / Published online: 20 September 2008

© Springer Science+Business Media, LLC 2008

Abstract For an assemble-to-order system with a high volume of prospective customers arriving per unit time, we show how to set nominal component production

rates, quote prices and maximum leadtimes for products, and then, dynamically, sequence orders for assembly and expedite components. (Components must be expedited if necessary to fill an order within the maximum leadtime.) We allow for updating of the prices, maximum leadtimes, and nominal component production rates in

response to periodic, random shifts in demand and supply conditions. Assuming expediting costs are large, we prove that our proposed policy maximizes infinite-horizon

expected discounted profit in the high-volume limit. For a more general assembleto-order system with arbitrary cost of expediting and the option to salvage excess

components, we show how to solve an approximating Brownian control problem and

translate its solution into an effective control policy.

Keywords Assemble-to-order systems · Functional limit theorems · Diffusion

limits · Deadlines · Maximum leadtime quotation · Instantaneous control

Mathematics Subject Classification (2000) Primary 90B05 · 60F17 ·

Secondary 90B22 · 60J70

E.L. Plambeck

Graduate School of Business, Stanford University, 518 Memorial Way, Stanford, CA 94305-5015,

USA

A.R. Ward ()

Marshall School of Business, University of Southern California, Bridge Memorial Hall—BRI 401F,

Los Angeles, CA 90089-0809, USA

e-mail: amyward@marshall.usc.edu

2

Queueing Syst (2008) 60: 1–69

1 Introduction

Consumers would like to have products tailored to their individual preferences, but

they are impatient. Therefore manufacturers can gain competitive advantage by offering customizable products and delivering these products quickly. This feat is accomplished by designing a family of products that can be rapidly assembled from

various combinations of a relatively small set of modular components, in response to

customer orders.

This paper examines operations management in such an assemble-to-order system. The system manager first chooses a price and maximum leadtime to quote for

each product (which jointly determine the vector of mean demand rates for all products), and invests in production capacity for each component (which determines the

nominal rate of component production). Then, as the stochastic demand and component production processes are realized, the system manager dynamically controls

the assembly process (allocating scarce components among outstanding orders for

various products), and fine-tunes the production process (expediting component production at a high cost per unit or salvaging excess components for a low revenue per

unit). When shifts occur in the demand and/or production cost functions, the system

manager may re-set prices, maximum leadtimes and production capacity. The objective is to maximize expected discounted profit, subject to the constraint that every

customer’s order must be filled within the product-specific maximum leadtime.

The control problem is very complex, and cannot be solved exactly. We consider a high-volume asymptotic regime in which the arrival rate of prospective customers grows large (relative to the time horizon over which prices, maximum leadtimes and production capacity remain fixed). In that asymptotic regime, the optimal

prices, maximum leadtimes and component production capacity result in heavy traffic, meaning that demand for each component is nearly balanced with capacity. Then,

we are able to characterize system performance by a Brownian approximation with

dimension equal to the number of components (rather than the number of components

plus the number of products). We show how to numerically solve the approximating

Brownian control problem and translate the solution into a policy for dynamically expediting and salvaging component production and sequencing orders for assembly in

the original assemble-to-order system. For the case that expediting is expensive and

components cannot be salvaged, we prove that our proposed policy is asymptotically

optimal in the high-volume regime. Intermediate results in this proof provide heuristic motivation that our proposed policy will be effective in any assemble-to-order

system with high potential demand.

For a review of the operations management literature on assemble-to-order systems, we refer the reader to Song and Zipkin [34]. This literature takes the order

arrival process and component production capacity as given, does not allow for component expediting, and assumes that customer order assembly is FIFO. In the subset of this literature most closely related to our paper (Song [32], Lu, Song, and

Yao [22], Cheng, Ettl, Lin, and Yao [9], Song, Xu, and Liu [33], and Glasserman

and Wang [13]), the maximum leadtime and minimum fill rate (fraction of customer

orders that must be filled within the maximum leadtime) are exogenously specified

as policy constraints, whereas the remainder of the literature simply assigns a linear penalty for backorders. The focus of the operations management literature on

Queueing Syst (2008) 60: 1–69

3

assemble-to-order systems is on managing component production and inventory, and

for analytic tractability, each component is assumed to be managed independently,

without regard for the inventory positions of other components. Kushner [18] was the

first to study integrated control of component production in an assemble-to-order system. Our analysis is similar in spirit to his, in that we both consider an approximating

multidimensional Brownian control problem, but is more complete in that we prove

that optimal prices, maximum leadtimes and component production capacities result

in heavy traffic. We thus provide economic motivation for the Brownian approximation, through which integrated component control becomes tractable. In a companion

paper, Plambeck [26] incorporates transportation leadtimes for components, assumes

(unlike in this paper) that the time at which each customer pays is invariant with respect to the assembly policy, and proves that independent threshold control of each

component is asymptotically optimal.

Control of component expediting and salvaging in our assemble-to-order system

translates into instantaneous control in the Brownian control problem. Because the

directions of control are along the axes, we are able to apply the computationallyefficient method of Kumar and Muthuraman [17] to solve the Brownian control

problem. (If the system manager had to use admission control—rejecting customer

orders—rather than component expediting to avoid violating quoted maximum leadtimes, as in Plambeck, Kumar, and Harrison [27], the Brownian approximation would

exhibit instantaneous control at an oblique angle to the axis, and so the more general methods of Kushner and Dupuis [19] and Kushner and Martins [20] would be

required.) Other papers that incorporate expediting are the companion paper Plambeck [26] mentioned above, Lawson and Porteus [21] and Sethi, Yan, and Zhang [31]

in the context of single-item inventory management, Maglaras and Celik [23] in the

context of a single-server queue with dynamic pricing, and Cho and Meyn [10] in the

context of power networks.

The constraint that orders must be filled within a maximum leadtime provides

valuable flexibility to the system manager in choosing when to assemble which products. When all the necessary components are in stock, the system manager is able to

fill orders in strictly less than the maximum leadtime and thus collect revenue early.

We characterize conditions under which the flexibility inherent in maximum leadtime

quotation is extremely valuable.

In the case that customers are infinitely patient and the salvage value of all components is zero (so that leadtime quotation is irrelevant and no expediting or salvaging

occurs), the policy for setting static prices, component production capacity, and dynamically scheduling orders for assembly proposed in this paper is exactly the policy

proposed in Plambeck and Ward [28]. The reader may wish to review [28] to develop intuition, in that simplest of settings, for the optimality of heavy traffic and

the key insight that the assemble-to-order system dynamics can be approximated by

a Brownian motion with dimension equal to the number of components (rather than

the number of products plus the number of components).

The rest of the paper is organized as follows. In Sect. 2, we formulate our model.

Assuming that expediting is expensive and excess components cannot be salvaged,

we derive an upper bound on asymptotic profit in Sect. 3. We propose a control policy,

and prove that that proposed policy is asymptotically optimal in Sect. 4. We explain

4

Queueing Syst (2008) 60: 1–69

how to modify the proposed policy for systems with general expediting costs and

salvaging in Sect. 5. Finally, in Sect. 6, we consider systems in which the demand

and/or component production cost functions shift at random times, and the prices,

maximum leadtimes and component production capacity must change accordingly.

We conclude in Sect. 7. The proofs of all our results can be found in the Appendix.

2 Model formulation

We specify the evolution dynamics of our assemble-to-order system in Sect. 2.1.

In Sect. 2.2, we introduce the static planning problem (profit rate maximization in

a deterministic fluid approximation for our system). We specify our high-volume

asymptotic regime in Sect. 2.3. Finally, in Sect. 2.4, we introduce a perturbation of

the static planning problem that allows for a small imbalance in the demand and

production rate for each component, and is necessary for our asymptotic analysis.

2.1 The assemble-to-order system

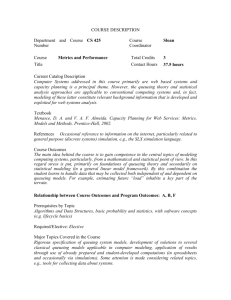

Consider a system in which J different components are assembled into K different finished products (the assemble-to-order system in Fig. 1). Product k ∈ K ≡

{1, . . . , K} requires a positive, integer amount of the type j ∈ J ≡ {1, . . . , J } component equal to akj . Each component j is required for the assembly of at least one

product, so that for any j , akj > 0 for at least one k. Assembly is instantaneous, given

the necessary components.

At time t = 0, the system manager chooses the production capacity μj for each

component j ∈ J , and the price pk and maximum leadtime lk to quote for each

product k ∈ K. (Two “products” may consist of the same set of components, and differ only in price and maximum leadtime.) Given the vector of prices and maximum

Fig. 1 The assemble-to-order system. (Salvaging is incorporated as a decision variable in Sect. 5)

Queueing Syst (2008) 60: 1–69

5

leadtimes for all products (p, l), customers order product k according to a renewal

process Ok with rate λk (p, l). Specifically, Ok (t) denotes the cumulative number of

orders for product k that arrive before time t. A customer pays pk when his order for

product k is filled. Components of type j arrive at the assembly facility according to

a renewal process Cj with rate μj (the component j production capacity). Specifically, Cj (t) denotes the cumulative number of components that arrive before time t.

Each component has an associated unit production cost, cj > 0, paid upon the delivery of the component. A component of type j may also have a physical holding

cost per unit per unit time hj > 0. The component production capacity, price, and

maximum leadtime quotation decisions are irreversible, meaning that μ, p, and l are

fixed throughout the time horizon.

An order for product k must be filled within lk time units (and may be filled before

lk time units have passed). Assuming customer orders for each product are filled FIFO

within each product class, and letting Ak (t) denote the cumulative number of type

k orders assembled in [0, t], the constraint that orders are filled within the quoted

maximum leadtime can be expressed as

Ak (t) ≥ Ok (t − lk )

for all t ≥ 0 and k ∈ K.

(1)

To make (1) feasible, we assume that the system manager can immediately obtain an

extra unit of component j by paying an “expediting” cost xj > cj .

The system manager must dynamically sequence outstanding orders for assembly

and expedite components. The system manager may choose to fill an order in less than

the maximum leadtime, which generates early payment but risks using a component

needed to prevent future expediting. Specification of Ak determines order queues as

follows:

Qk (t) ≡ Ok (t) − Ak (t) ≥ 0,

k ∈ K.

(2)

When Xj is the cumulative number of components expedited up to time t, physical

inventory levels are

Ij (t) ≡ Cj (t) + Xj (t) −

K

akj Ak (t) ≥ 0,

j ∈J.

(3)

k=1

The shortage of component j is

Sj (t) ≡

K

akj Ok (t) − Cj (t) − Xj (t),

j ∈J,

(4)

k=1

which implies its representation in terms of queue-lengths and inventory levels is

Sj (t) =

K

k=1

akj Qk (t) − Ij (t),

j ∈J.

(5)

6

Queueing Syst (2008) 60: 1–69

The objective is to maximize expected infinite-horizon discounted profit E[],

where

≡

K ∞

pk e−δt dAk (t) −

k=1 0

J ∞

e−δt cj dCj (t) + hj Ij (t) dt + xj dXj (t) .

j =1 0

(6)

Customer payment occurs at the time of order fulfillment, but components must be

paid for at the time of their arrival. Therefore, an increase in component production

capacity tends to decrease expediting and delay in order fulfillment (revenue collection), but to increase the physical and financial costs of holding component inventory.

Because for any non-negative and non-decreasing process ,

s

∞

∞ ∞

∞

e−δt d(t) =

δe−δs ds d(t) =

δe−δs

d(t) ds

0

0

=

0

t

∞

0

δe−δs (s) ds,

0

where we have used Fubini’s theorem to justify interchanging the order of integration,

the definition of the queue-lengths and inventory processes in (2) and (3) implies

infinite-horizon discounted profit in (6) and can also be written in the following form

that is insightful and more convenient for analysis:

K

∞

J

=

δe−δt

pk Ok (t) −

cj Cj (t) dt

0

k=1

−

∞

e

0

−δt

K

k=1

j =1

δpk Qk (t) +

J

hj Ij (t) + δxj Xj (t) dt.

(7)

j =1

It follows that the financial holding cost per customer order in queue per unit time

is δpk .

An admissible policy u = (pu , lu , μu , Au , Xu ) specifies the product prices, quoted

maximum leadtimes, component production capacities, the sequencing rule for assembly, and the expediting rule for components. For a policy to be admissible, we

require that pu , lu and μu are non-negative, the processes Au and Xu are integervalued, non-decreasing, non-anticipating, have Au (0− ) = Xu (0− ) = 0, and satisfy

(1), (2) and (3). (In Sects. 5 and 6 below, we expand the space of admissible policies

to allow for salvaging of excess components and for the prices, maximum leadtimes

and component production capacities to change in response to random shifts in the

demand function λ(p, l) and component costs (c, x).)

For clarity of presentation, we do not subscript the system processes associated

with a particular policy whenever the policy under consideration is clear from the

context. We index products such that when there are two products i and k (i, k ∈ K),

with identical components aij = akj for all j ∈ J , the lower-indexed product has a

higher price pi ≥ pk and shorter maximum leadtime li ≤ lk .

Finding a policy that maximizes expected profit E[] for defined in (6) is

intractable. Therefore, we will perform an asymptotic analysis and search for a policy

Queueing Syst (2008) 60: 1–69

7

that maximizes expected profit asymptotically. The starting point of this analysis is to

find the maximum achievable profit when demand and component production occur

at their mean rates.

2.2 The static planning problem

Suppose that in setting p, l and μ, the system manager ignores the discrete and

stochastic nature of customer orders and component production, and simply assumes

that demand and production flow at their long run average rates. Then, to maximize

the profit rate, he solves the following static planning problem

π≡

max

p≥0,l≥0,μ≥0

K

pk λk (p, l) −

k=1

J

μj cj ,

(8)

j =1

subject to balance in the demand and production rate for each component:

K

akj λk (p, l) = μj ,

j ∈J.

(9)

k=1

We let (p , l , μ ) denote the solution to the static planning problem, and provide

sufficient conditions to guarantee uniqueness at the end of this subsection.

The optimal objective value in (8) upper-bounds the expected profit rate, which implies δ −1 π upper-bounds expected infinite-horizon discounted profit in the stochastic

system. Due to stochastic variability, sometimes components will be expedited to prevent violation of quoted leadtimes, and sometimes components will sit in inventory.

Hence the upper bound is not in general achieved. However, we will show that in

high-volume conditions, under an appropriate policy, the infinite-horizon discounted

profit is close to δ −1 π ; see Theorem 2.

Consumers tend to be averse to waiting for a product and instantaneous delivery

is free in the static planning problem (because it ignores stochastic variability). One

might therefore expect that with any realistic demand rate function λ(p, l), the optimal solution to (8)–(9) has zero leadtimes l = 0. This is true when consumers are

homogeneous in their tolerance for delay.

Example 1 Prospective customers arrive according to a Poisson process with rate λ

and have valuation vk for having product k immediately, where v = (v1 , . . . , vK ) is

drawn from a general joint distribution. Every prospective customer has the same

delay cost function f (l), regardless of which product she chooses, and will therefore

purchase a product that

max vk − f (lk ) − pk

(10)

k∈K

if the optimal objective value in (10) is non-negative, and otherwise make no purchase. We assume that f is non-decreasing and satisfies f (0) = 0, and let k ∗ (v)

denote the smallest k ∈ K that achieves the maximum in (10). Then, the demand rate

function

λk (p, l) = λP k = k ∗ (v) and vk − f (lk ) − pk ≥ 0

8

Queueing Syst (2008) 60: 1–69

K

˜

has the property that K

k=1 pk λk (p, l) ≤

k=1 p̃k λk (p̃, l) for any price and leadtime

˜ with l˜k = 0,

vector (p, l) with lk > 0 and alternative price and leadtime vector (p̃, l)

˜

p̃k = pk + f (lk ), and for i = k p̃i = pi and li = li . It follows immediately that the

static planning problem has an optimal solution with lk = 0 for all k ∈ K.

However, it is possible to construct a reasonable demand rate function such that

the optimal solution to (8)–(9) has positive leadtimes lk > 0 for a strict subset of

products in K. Consider the following example from Afeche [1].

Example 2 Suppose that J = 1 so that products may be differentiated only by price

and leadtime. Prospective customers are of two types. A type 1 customer’s valuation

for a product with zero maximum leadtime is drawn from a uniform [0, 1] distribution, and it decreases linearly with the maximum leadtime, with slope w1 ≡ 1.

A type 2 customer’s valuation for a product with zero maximum leadtime is drawn

from a uniform [0, 1/2] distribution, and it decreases linearly with the maximum

leadtime, with slope w2 = 1/4. Customers of each type arrive at rate 1. To maximize

the profit rate, it is sufficient to offer only two products, with prices and leadtimes

chosen such that customers of type 1 prefer product 1 and customers of type 2 prefer

product 2:

(11)

pi + wi li ≤ pj + wi lj for i, j ∈ {1, 2} and i = j.

Then a type i ∈ {1, 2} customer having valuation v buys product i if and only if

v − pi − wi li ≥ 0

and the demand rate for product i is

λi (p, l) = 1 − Fi (pi + wi li ) ,

where

F1 (v) = v,

0 ≤ v ≤ 1 and F2 (v) = 2v,

0 ≤ v ≤ 1/2.

Therefore, the static planning problem reduces to

π=

max

p≥0,l≥0,μ≥0

p1 λ1 (p, l) + p2 λ2 (p, l) − μc

subject to the incentive compatibility constraint (11) and

λ1 (p, l) + λ2 (p, l) = μ.

When c < 3/7, the unique solution is

p1 =

10 15

+ c,

23 23

p2 =

9

6

+ c,

23 23

l1 = 0,

which implies that

13 15

− c > 0,

23 23

21

9

λ2 (p , l ) =

− c > 0.

23 23

λ1 (p , l ) =

l2 =

6

4

+ c,

23 23

Queueing Syst (2008) 60: 1–69

9

Then,

π = (p1 − c)λ1 (p , l ) + (p2 − c)λ2 (p , l )

2

1 =

184 − 506c + 414c2 .

23

Motivated by Example 2, our model formulation allows for products i and k to

be physically identical (aij = akj for all j ∈ J ) and differ only in quoted price and

maximum leadtime. In effect, the system manager may offer a discount to consumers

that are willing to accept a long leadtime. The key characteristic of the distribution of

consumer preferences in Example 2 is the strong positive correlation between impatience and willingness to pay a high price. Existing literature shows that this positive

correlation is necessary for price discrimination through leadtime differentiation to be

profitable (see, for example, Afeche [1], Katta and Sethuraman [16], Maglaras and

Celik [23], Plambeck [26]), which corresponds in our model to the solution of (8)–(9)

having lk > 0 for a strict subset of products in K. For convenience in presentation,

we will assign indices to products such that

lk = 0

for k ∈ K0 ≡ {1, . . . , K0 }

and lk > 0

for k ∈ K\K0

(12)

for some positive integer K0 ≤ K. (Note that for a given set S and subset S0 ⊂ S, we

/ S0 }. If S0 = S, then S\S0 is the empty

use the notation S\S0 ≡ {s ∈ S such that s ∈

set.)

Commonly, as discussed above, any solution to the static planning problem in

(8)–(9) must have l = 0, which is equivalent to K0 = K. Then, the following standard assumptions on the demand rate function ensure that the solution to the static

planning problem in (8)–(9) is unique. Let λ(p) ≡ λ(p, 0). First, assume λ(p) is

continuously differentiable, and the Jacobian matrix [∂λk /∂pm ]k,m=1,...,K is invertible everywhere. Second, assume customer demand for any one product is strictly

decreasing in the price of that product, but is non-decreasing in the price of different products, so that ∂λk (p)/∂pk < 0 while ∂λk (p)/∂pm ≥ 0, m = k. Third, assume

K

m=1 ∂λk /∂pm < 0 for each k = 1, . . . , K, which means that demand for each product decreases when

all products’ prices increase by the same amount. Finally, assume

the revenue rate K

k=1 λk pk is strictly concave. Then it follows from Lemma 3.1 in

Plambeck and Ward [28] that there is a unique optimal solution to the static planning

problem (p , l = 0, μ ), which satisfies

pk >

J

cj akj > 0 for all k ∈ K

and μ > 0.

(13)

j =1

Let us impose the natural assumption in Example 1 that the product valuation

vector v has a joint probability density function with invertible Jacobian matrix. Then

Example 1 satisfies the conditions in the previous paragraph. Example 2 also has

a unique solution to the static planning problem, which satisfies (13), even though

l2 > 0. In the remainder of the paper, we will assume that the static planning problem

in (8)–(9) has a unique solution that satisfies (13).

10

Queueing Syst (2008) 60: 1–69

2.3 The high-volume asymptotic regime

Our analysis considers a sequence of systems, indexed by n = 0, 1, 2, . . . . Order arrival rates tend to infinity in a manner that preserves the structure of the demand

functions, as follows:

λnk (p, l) ≡ nλk (p, l),

k ∈ K.

Component production rates in the nth system are

nμn .

The renewal processes O1 , . . . , OK and C1 , . . . , CJ are defined in terms of the

K + J independent sequences of mean 1 non-negative random variables {zk (i), i =

2 and σ 2 , re1, 2, . . .}, k ∈ K and {yj (i), i = 1, 2, . . .}, j ∈ J having variances σO,k

C,j

spectively. Specifically, for any t ∈ m

n

n n n

zk (i) ≤ λk (p , l )t

and

Ok (t) ≡ max m ≥ 0 :

Cjn (t) ≡ max

m≥0:

i=1

m

yj (i) ≤ nμnj t

(14)

.

i=1

We assume that E|zk (1)|2+2

1 < ∞, k ∈ K and E|yj (1)|2+2

1 < ∞, j ∈ J for

1 > 0.

Note that λn is an order n quantity but μn is an order 1 quantity. Henceforth, when

we wish to refer to any process or other quantity associated with the assemble-toorder system having order arrival rate functions λn , we superscript the appropriate

symbol by n.

An admissible policy refers to an entire sequence, u = (pun , lun , μnu , Anu , Xun ), that

specifies an admissible policy, as defined in the second to last paragraph of Sect. 2.1,

for each n. Our objective is to specify a policy having associated expected infinitehorizon discounted profit that is in some sense close to the maximum achievable

profit nδ −1 π in high volume. Note that since arrival and component production rates

are of order n, the expected profit will be as well. Define

˜n=

n − nδ −1 π

,

√

n

(15)

˜ n ≤ 0 in high volume.

and note that Definition 1 A policy is said to be asymptotically optimal if it is admissible,

˜ n ] > −∞, and

lim infn→∞ E[

n

n

˜ ≥ lim sup E ˜u

lim inf E (16)

n→∞

for any other admissible policy u.

n→∞

Queueing Syst (2008) 60: 1–69

11

In high volume, any asymptotically optimal policy has prices, maximum leadtimes, and component production rates that converge to the solution of the static

planning problem in (8)–(9).

Proposition 1 Any asymptotically optimal policy has

pn → p ,

ln → l,

and μn → μ ,

as n → ∞.

Finally, we require the following standard technical specifications. Let (, F , P )

be a probability space. For each positive integer i, let D i be the space of all functions

ω : [0, ∞) → i that are right continuous with left limits. Consider D i to be endowed with the usual Skorohod-J1 topology, and let M i denote the Borel σ -algebra

on D i associated with this topology. All stochastic processes in this paper are measurable functions from (, F , P ) into (D i , M i ) for the appropriate dimension i. For

a sequence of stochastic processes {ξ n }, each of dimension i, the notation “ξ n ⇒ ξ ”

means the probability measures induced by ξ n on (D i , M i ) converge weakly to the

probability measure induced by ξ on (D i , M i ).

2.4 The perturbed static planning problem

The static planning problem does not account for variability. Furthermore, although

we know from Proposition 1 that any asymptotically optimal policy has p n → p ,

l n → l , and μn → μ , we do not know anything about the convergence rate. Hence,

due to stochasticity in demand and component production, we will want to consider policies with prices, maximum leadtimes, and component production rates that

slightly deviate from (p , l , μ ). This leads us to consider a perturbed static planning problem, in which there can be an imbalance in the demand rate and production

rate for each component, and strictly positive maximum leadtimes for products that

have zero maximum leadtime in the solution to the static planning problem.

π(θ, l) ≡ max

p≥0,μ≥0

K

pk λk (p, l) −

J

μj cj ,

(17)

j =1

k=1

subject to the perturbation θ in the balance between demand and production rate for

each component

K

akj λk (p, l) − μj = θj ,

j ∈J,

(18)

k=1

and the lower bound on maximum leadtime quotations

lk ≥ l k ,

k ∈ K0 for l > 0.

(19)

We again assume the indexing satisfies (12). Observe that the optimal objective value

in the perturbed static planning problem π(θ, l) is a strictly increasing, linear function

12

Queueing Syst (2008) 60: 1–69

of the capacity imbalance θ , and is a decreasing, possibly nonlinear function of the

maximum leadtime perturbation l.

We require knowledge about the behavior of the perturbed static planning

problem

n , l n ) that satisfies √nθ n → θ

when

θ

and

l

are

small.

In

particular,

for

a

sequence

(θ

√

n n

and nl n →

√ l as n → ∞, it is useful for us to know the nconvergence rate of π(θ , l )

˜ in (15).

to π . The n scaling is motivated by the scaling for If l = 0 and the standard assumptions

on

the

demand

function given in the para

graph before (13) are satisfied, then K

p

λ

(p,

l)

is

differentiable

at the optimum

k=1 k k

and maximum leadtimes l = 0. It follows that for a sequence (θ n , l n ) havprices

p

√

√

ing nθ n → θ and nl n → l as n → ∞,

J

K

√ n n

n π θ ,l − π =

cj θ j −

bk l k ,

lim

n→∞

where

bk = −

K

j =1

m=1

pm

−

J

amj cj

j =1

(20)

k=1

∂λm (p , 0)

∂lk

for all k ∈ K.

(21)

When customers have heterogeneous preferences, as in Example 2, the revenue function may not be differentiable at the optimum prices and leadtimes, because the arrival

rate function may not be continuous. To see this, observe that p1 − p2 = l2 − l1 in

Example 2, so that the incentive compatibility constraint (11) is binding for type 1

customers, and a small change in the prices or leadtimes such that p1 − p2 > l2 − l1

will shift all orders from type 1 customers from product 1 to product 2. Our analysis

must allow for such discontinuities in λ(p, l). This motivates an assumption analogous to (20).

√

Assumption

1 Consider a sequence of perturbations (θ n , l n ) that satisfy nθ n → θ

√ n

and nl → l as n → ∞. There exists a unique b > 0 that does not depend on either

θ or l such that

K0

J

√ n n

lim n π θ , l − π =

cj θ j −

bk l k .

n→∞

j =1

(22)

k=1

Assumption 1 provides information about small perturbations in the static planning problem. In addition, we require an upper bound on the profit-impact of larger

perturbations.

Assumption 2 For any finite > 0, there exist multipliers mk > 0, k ∈ K0 , such that

π(θ, l) ≤ π +

J

cj θ j −

j =1

for all 0 ≤ l k ≤ , k ∈ K0 , and |θj | ≤ , j ∈ J .

K0

k=1

mk l k ,

Queueing Syst (2008) 60: 1–69

13

Example 1 satisfies (20)–(21), and therefore satisfies Assumptions 1 and 2 with

mk = bk as defined in (21), for all k ∈ K.

Example 2 satisfies Assumptions 1 and 2. Specifically, the perturbed static planning problem

π = max p1 λ1 (p, l) + p2 λ2 (p, l) − μc

p≥0,μ≥0

subject to

λ1 (p, l) + λ2 (p, l) = μ + θ,

p 1 − p2 ≤ l 2 − l1 ,

1

p2 − p1 ≤ (l1 − l2 ),

4

l ≤ l1

has solution

p1 (θ, l) = p1 −

l1 (θ, l) = l,

11

l,

23

p2 (θ, l) = p2 −

l2 (θ, l) = l2 +

2

l,

23

14

l.

23

In the case that c = 1/10, π = 0.26435, and

π(θ, l) = π − 0.5l + 0.261l 2 +

1

θ.

10

n n

To see

Assumptions

√ that

√ 1n and 2 are satisfied, note that for any sequence (θ , l ) such

n

that nθ → θ and nl → l as n → ∞,

√ n n

1

n π θ , l − π → −0.5l + θ.

10

Furthermore, since the linear term in the expression for π (θ, l) is negative, there

exists a multiplier m such that

π(θ, l) ≤ π +

1

θ − ml

10

for all small enough θ and l.

3 An upper bound on expected profit

We define the regulated Brownian motion that approximates the shortage process

under any candidate asymptotically optimal policy in Sect. 3.1, and use this approximation to construct an upper bound on expected profit in Sect. 3.2. In Sect. 3.3, we

calculate the upper bound explicitly in two simple examples. Finally, in Sect. 3.4, we

examine the degradation in expected profit when the system manager is no longer

allowed to fill an order in strictly less than the quoted maximum leadtime.

14

Queueing Syst (2008) 60: 1–69

3.1 The Brownian approximation

In high-volume assemble-to-order systems, heavy traffic arises from optimal capacity,

price and maximum leadtime quotation decisions. The following proposition establishes this insight. Let

θjn ≡

K

akj λk p n , l n − μnj ,

j ∈J

(23)

k=1

be the capacity imbalance rate in the supply and demand for component j .

Proposition 2 Any asymptotically optimal policy has

√

√

lim sup n|θ n | < ∞ and lim sup nlkn < ∞,

n→∞

n→∞

for all k ∈ K0 .

From Proposition 2, we can restrict attention to policies in which the capacity

imbalance θ n in (23) satisfies

√ n

nθ → θ as n → ∞,

(24)

for some θ ∈ J . Then, the functional central limit theorem and the Cramer–Wold

device

that the scaled imbalance in demand and supply of components

K dictate

−1/2 (O n − C n ) behaves in high volume as a J -dimensional Brownian

a

n

k=1 kj

k

j

motion B with drift rate θ and covariance matrix having (i, j )th entry

ij ≡

K

2

2

aki akj λk σOk

+ μj σCj

1{i = j }.

(25)

k=1

Because expediting is expensive, it should be used only as necessary to assemble

customer orders within the quoted maximum leadtime. Therefore, under any asymptotically optimal policy, the shortage process defined in (4) can be approximated by

a regulated Brownian motion (RBM). In this approximation, the shortage process

is regulated by expediting to remain in a region determined by the maximum leadtimes. Note that although the component shortage process (4) is entirely determined

by the primitive processes of order arrivals O and component production C and the

expediting process X, the assembly policy A can influence the shortage process indirectly, through the expediting process. The RBM approximation relies on the system

manager adopting an intelligent assembly policy that enables him to use the minimal

amount of expediting.1

To characterize this RBM more precisely, let us first consider the case that the

solution to the static planning problem has lk = 0 for all k ∈ K, as for the class of

1 In an example with K = 2 products having a common component, if the system manager foolishly assembles all orders for product 1 while allowing the queue of orders for product 2 to build up to its limit (26),

then he may be forced to expedite the common component to avoid violating the maximum leadtime for

product 2, even though the shortage process is strictly below its limit in (27).

Queueing Syst (2008) 60: 1–69

15

problems detailed in Example 1. Proposition 2 suggests that in the nth system, the

system manager should quote a maximum leadtime

l

lkn = √k

n

√

where l k is a non-negative constant for each product k ∈ K. To understand the 1/√n

scaling of maximum leadtimes in (32), note that queue-lengths will be of order n

because that is the size of the imbalance in the demand and supply of components,

discussed above. Furthermore, by Reiman’s “snapshot principle” [30], the leadtime

for a product-k

Qnk (t)/λnk (p n , l n ), which is

√ order placed at time t is approximately

n

n n

n n

of order 1/ n due

√ to the scale of the demand rate λk (p , l ) = nλk (p , l ). This

motivates the 1/ n scaling of maximum leadtimes in (32). Note that the difference

between the actual and maximum leadtimes is very small and will often be zero.

Regarding the region in which the shortage process and its RBM approximation

must be contained, Reiman’s “snapshot principle” implies that for large n, satisfying

the maximum leadtimes in (32) requires Qnk (t)/λnk (p n , l n ) ≤ lkn , or, equivalently,

Qnk (t)

√ ≤ λk p n , l n l k ,

n

(26)

for all k ∈ K. Substituting (26) into the expression (5) for the shortage of component

j establishes that

K

K

Sjn (t) Qnk (t) akj √ ≤

akj λk p n , l n l k .

√ ≤

n

n

k=1

(27)

k=1

Corresponding to the right-hand side of (27) in the limit as (p n , l n ) → (p , l ) under

any asymptotically optimal policy, define

sj =

K

akj λk p , l l k .

(28)

k=1

Also define B to be a J -dimensional Brownian motion with drift rate θ and covariance matrix given in (25) and suppose that (Sθ,l , Xθ,l ) jointly satisfies

Sθ,l (t) = B(t) − Xθ,l (t) ∈ S ≡ (−∞, s 1 ] × · · · × (−∞, s J ],

(29)

∞

Xθl non-decreasing, and

s j − Sθ,l,j (t) dXθ,l,j (t) = 0,

Xθ,l (0) = 0,

0

j ∈J.

(30)

In words, the condition (30) requires that the limiting expediting process Xθ,l,j increases only at times when Sθ,l,j = s j and is therefore the minimal amount of expediting required to maintain the limiting shortage process Sθ,l,j below the level s j

and thus to avoid violating the maximum leadtime for a product that requires component j. We expect that for a given l and θ , the shortage process and expediting

16

Queueing Syst (2008) 60: 1–69

process can be approximated by

Sn

√ ≈ Sθ,l

n

and

Xn

√ ≈ Xθ,l ,

n

(31)

and show in Sect. 3.2 how to optimally choose θ and l.

In the alternative case that the optimal solution to the static planning problem has

lk > 0 for at least one product k ∈ K\K0 , as in Example 2, the system manager quotes

a maximum leadtime

l

lkn = √k

(32)

for all k ∈ K0 ,

n

and can quote lkn = lk for all k ∈ K\K0 . The approximation for the shortage process

remains the same, except that the bound (28) is infinite for any component used in a

product k ∈ K\K0 . Specifically, we need only modify the definition of s j to

sj ≡

K0

k=1 akj λk (p , l )l k

∞

if akj = 0 for all k ∈ K\K0 ,

if akj ≥ 1 for some k ∈ K\K0 ,

(33)

and the approximation (31) holds, with (Sθ,l , Xθ,l ) defined as in (29)–(30). The operational implication is that a component j used in a product for patient customers

(i.e., for which akj ≥ 1 for some k ∈ K\K0 ) is never expedited in the limiting RBM

approximation. To see why expediting is unnecessary, recall that under any asymptotically optimal policy, the maximum leadtime for each product k ∈ K\K0 intended

for patient customers satisfies lkn → lk > 0. When demand exceeds nominal production of component j , the system manager can allocate units of component j to filling

orders for products k ∈ K0 within their short maximum leadtimes, while holding a

queue of orders for the products k ∈ K\K0 with akj ≥ 1 targeted to patient customers.

√

As discussed in the previous paragraph,

the resulting queue will be of order n and

√

leadtimes will be of order 1/ n for those products, even with zero expediting of

component j . It follows that in the nth system for large n, under any asymptotically

optimal policy, actual leadtimes for a product k ∈ K\K0 targeted to patient customers

will consistently be strictly lower than the quoted maximum leadtime. Hence implementation issues might arise if prospective customers could obtain information about

actual leadtimes; we address this in Sect. 3.4.

Finally, note that in both the cases that lk = 0 for all k ∈ K, and that lk > 0 for

at least one product k ∈ K\K0 , Theorem 1 in Dai and Williams [12] guarantees the

existence of a unique solution to (29)–(30).

3.2 The upper bound

We first write the diffusion-scaled profit function in (15) in terms of the diffusionscaled and centered processes

n n

√ Okn (t)

n

Õk (t) ≡ n

− λk p , l t , k ∈ K,

(34)

n

Queueing Syst (2008) 60: 1–69

C̃jn (t)

17

√ Cjn (t)

n

− μj t ,

≡ n

n

j ∈J

(35)

and the diffusion-scaled processes

K

Sjn

√

S̃jn ≡ √ =

akj Õkn (t) − C̃jn (t) + nθjn t − X̃jn (t),

n

j ∈J,

(36)

k=1

Xn

X̃ n ≡ √ ,

n

(37)

Qn

Q̃n ≡ √ ,

n

(38)

In

I˜n ≡ √ .

n

(39)

Then, it follows that

˜n=

∞

δe

−δt

0

K

pkn Õkn (t) −

k=1

J

cj C̃jn (t)

dt

j =1

K

J

n n √ −1 n

n

pk λ k p , l −

cj μj − π

+ nδ

j =1

k=1

−

∞

e

−δt

0

K

δpkn Q̃nk (t) +

J

n

n

hj I˜j (t) + δxj X̃j (t) dt .

(40)

j =1

k=1

˜ n ]. The following

We use the representation (40) to obtain an upper bound on E[

n

˜

lemma shows that the first term in the expression for E[ ] in (40) converges to 0.

Lemma 1 Under any policy u with pun → p and μnu → μ

k ∈ K and j ∈ J

∞

∞

n

and

e−δt sup Õu,k

(s) dt, n ≥ 0

e−δt sup

0

0

0≤s≤t

0≤s≤t

as n → ∞, for each

n

C̃ (s) dt, n ≥ 0

u,j

are uniformly integrable families. Furthermore, as n → ∞, for each k ∈ K and j ∈ J

∞

∞

−δt n

E

e Õk (t) dt → 0 and E

e−δt C̃jn (t) dt → 0.

0

0

˜ n ] in (40), because for every n

For the second term in the expression for E[

K

k=1

J

pkn λk p n , l n −

cj μnj ≤ π θ n , l n ,

j =1

18

Queueing Syst (2008) 60: 1–69

Assumption 1 implies that for any policy satisfying (24) and (32),

K

J

K0

J

n n √ −1 n

n

−1

lim sup nδ

pk λ k p , l −

cj μj − π ≤ δ

cj θ j −

bk l k .

n→∞

j =1

k=1

j =1

k=1

To asymptotically upper-bound the third term in (40), we require a linear program

that can be used to find the queue-lengths and inventory levels that asymptotically

minimize instantaneous holding costs for a given value of the shortage process and

given upper bound on queue-lengths. Let (q , i )(S, L) solve

min δ

Q≥0,I ≥0

K

pk Qk +

J

(41)

hj Ij

j =1

k=1

subject to

Ij ≡

K

akj Qk − Sj ≥ 0,

(42)

k=1

Qk ≤ Lk ,

k ∈ K0 .

(43)

The objective function (41) follows from the third term in the representation for

diffusion-scaled infinite-horizon discounted profit in (40). Constraint (42) follows

because inventory levels must be non-negative. When

Lk = λk p , l l k , k ∈ K 0 ,

(44)

constraint (43) follows from the upper bound on queue levels in (26) required to fill

orders within the quoted maximum leadtime.

Any asymptotically optimal policy has p n → p by Proposition 1. Furthermore,

recall from Sect. 3.1 that for any sequence of capacity imbalances θ n satisfying (24)

and leadtimes l n satisfying (32), when the cost of expediting is high, so that expediting as few components as possible is desirable, we expect that

S̃ n ⇒ Sθ,l

Therefore,

lim inf E

n→∞

∞

e

−δt

0

K

and X̃ n ⇒ Xθ,l ,

δpkn Q̃nk (t) +

as n → ∞.

J

hj I˜jn (t) + δxj X̃jn (t) dt

≥ H(θ, l),

j =1

k=1

where

H(θ, l) ≡ E

∞

e

−δt

δ

0

+ δxj Xθ,lj (t)

K

k=1

.

J

hj ij Sθ,l (t), L dt

pk qk Sθ,l (t), L dt +

j =1

(45)

Queueing Syst (2008) 60: 1–69

19

The discussion in the last several paragraphs suggests that

n

˜ ≤ D(θ, l)

lim sup E n→∞

for

D(θ, l) ≡ δ

−1

J

cj θ j −

j =1

K0

bk l k − H(θ, l).

(46)

k=1

The first term in (46) represents the profit differential associated with the static decisions of price, component production capacity and maximum leadtime, while the

second term, H(θ, l) in (45), accounts for costs associated with dynamic assembly

and expediting decisions. These two terms have in common the imbalance in demand and supply for each component θ and the maximum leadtimes l for products

intended for impatient customers. Reducing the static capacity investment for component j translates to increasing the drift θj in the Brownian approximation, which

increases the dynamic costs associated with queue-lengths and expediting. Such a reduction simultaneously reduces expenditure on component production capacity and

physical component inventory holding costs. Increasing the maximum leadtime for

any product k ∈ K0 translates to increasing l k in the Brownian approximation, which

reduces expediting costs but also reduces the expected revenue rate and increases the

costs associated with having order backlogs and holding component inventory.

Define

max

D(θ, l) .

(47)

= θ ∈ J , l ∈ +,K0 : D(θ , l ) =

θ∈

J ,l∈

+,K0

Theorem 1 Assume the set is nonempty. If

J

−1

−1

akm hm

xj > max akj pk + δ

k:akj >0

and (θ , l ) ∈ , then

for all j ∈ J ,

(48)

m=1

n

˜ ≤ D θ , l .

lim sup E n→∞

We expect the function D(θ, l) to be concave, and so to have a finite maximum.

Then, there is exactly one element in the set , (θ , l ). In general, (θ , l ) must

be computed numerically. However, in very simple examples, it can be computed

analytically. We show how to do this in Sect. 3.3.

Any policy that asymptotically achieves the upper bound D(θ , l ) in Theorem 1

also has queue-lengths and inventory levels that are asymptotically determined by

the functions q and i operating on the shortage process. In Sect. 4, we propose

a policy that asymptotically achieves the upper bound D(θ , l ), which implies that

any asymptotically optimal policy must achieve the upper bound D(θ , l ). Hence

the dimensionality of the system state is reduced to J (the dimension of the shortage

process) under any asymptotically optimal policy. As assemble-to-order systems are

20

Queueing Syst (2008) 60: 1–69

designed to support a large number of products K with relatively few components J ,

this reduction in dimensionality greatly facilitates characterization of system performance.

3.2.1 The implications of the high expediting cost assumption

We employ the lower bound (48) on the cost of expediting in the proof of Theorem 1 to ensure that an asymptotically optimal policy will expedite only as many

components as are necessary to fulfill the quoted maximum leadtimes, and no more.

(If expediting were extremely cheap, it would be optimal to expedite more components and fill orders in less than the maximum leadtimes, in order to realize revenue

early. In practice, expediting is unlikely to be so cheap that it is used simply to realize

revenue early, and in this sense the lower bound (48) is not restrictive.) The lower

bound (48) is sufficient but not necessary for our proposed policy to be asymptotically optimal. In Sect. 5, we explain how to adapt our proposed policy to systems

with arbitrarily low expediting costs xj > cj for all j ∈ J ; however, we are unable

to provide a rigorous proof of asymptotic optimality with general expediting costs.

Consider the linear program

K

J

pk Qk +

(hj Ij + δxj j )

(49)

δ

γ (p, S, L) ≡

min

Q≥0,I ≥0,

≥0

k=1

j =1

subject to

Ij =

K

akj Qk + j − Sj ≥ 0,

j ∈J,

(50)

k=1

Qk ≤ Lk ,

k ∈ K0 ,

(51)

which provides the minimum cost arrangement of queues and inventory levels for

given prices p ∈ +,K , shortage S ∈ J , and upper bound on queue-lengths L ∈

+,K0 , allowing for extra expediting. As increases, Q may decrease, and so the

formulation of the linear program defining γ captures the cost trade-off of expediting

to achieve lower queue-levels than would be necessary to satisfy quoted maximum

leadtimes. The following lemma provides the conditions under which extra expediting is suboptimal.

K0

akj Lk for all j ∈ J so that the linear program definLemma 2 Assume Sj ≤ k=1

ing γ (p, S, L) in (49)–(51) is feasible. If

J

−1

−1

xj > max akj pk + δ

akm hm

for all j ∈ J ,

(52)

k:akj >0

m=1

then any optimal solution to γ (p, S, L) has = 0 and, for the special case that

Lk = λk (p , l )l k for all k ∈ K0 , is also an optimal solution for the linear program

in (41)–(43).

Queueing Syst (2008) 60: 1–69

21

Lemma 2 and the upper bound on the shortage process (27) suggest that in the

high-volume limit, under assumption (52), the expediting process of any asymptotically optimal policy should behave as

+

K

n

n

n

n

akj Ok s − lk − Cj (s) , j ∈ J .

(53)

Xj (t) ≡ sup

0≤s≤t

k=1

The process X is the minimal cumulative amount of expediting required to satisfy

quoted maximum leadtimes. Let

S nj (t) ≡

K

akj Okn (t) − Cjn (t) − Xnj (t),

j ∈J,

(54)

k=1

be the associated shortage process. Our third lemma establishes the behavior of

(X n , S n ) in the high-volume limit.

√

√

√

Lemma 3 Suppose nθ n → θ ∈ J , nlkn → l k for k ∈ K0 , and nlkn → ∞ for

k ∈ K\K0 as n → ∞. Then,

n

S Xn

⇒ (Sθ,l , Xθ,l ),

√ ,√

n

n

as n → ∞.

3.3 Numerical examples

We show how to find in (23) analytically in an extremely simplified version of

Example 1, and also in Example 2. In both cases, the set has exactly one element,

(θ , l ).

The two examples are chosen to show how the parameters that determine our

proposed asymptotically optimal policy, θ and l , differ between settings in which

price discrimination through leadtime differentiation is, versus is not, optimal. When

there is no leadtime differentiation (every physical product is offered at exactly one

price and

√ leadtime), each element of the shortage process has an upper bound of

order n that is determined by l . Otherwise, the shortage of any component

√used

in a product that is offered at two distinct prices and leadtimes, divided by n, is

arbitrarily large, and the maximum leadtime quoted for the higher-priced product is 0

under any asymptotically optimal policy.

Example 1 (Continued and Extremely Simplified) We reduce the assemble-to-order

system to a pure inventory system, in which there is one product and one component. Then, we can compute (θ , l ) analytically. In general, the computation must

be done numerically, using the approach shown in Sect. 5 for a more general problem

formulation.

Let

λ(p, l) = 2 − 2p − l,

22

Queueing Syst (2008) 60: 1–69

and assume c = 1/2. Then, the static planning problem

π=

max

p≥0,l≥0,μ≥0

pλ(p, l) − μc

subject to

λ(p, l) = μ

has solution

p = 3/4,

λ = μ = 1/2,

and l = 0.

The linear program in (41)–(43)

3

min δ Q + hI

4

Q≥0,I ≥0

subject to

I = Q − S ≥ 0,

1

Q≤ l

2

has solution

(q , i )(S) =

(0, S),

(S, 0),

S < 0,

S ≥ 0.

Suppose the arrival and component production processes are both Poisson so that

σ 2 = λ + μ = 1. Then, B is a Brownian motion with drift θ and variance σ 2 that

satisfies

1

Sθ,l (t) = B(t) − Xθ,l (t) ≤ l

2

for

∞

1

Xθ,l (0) = 0,

l − Sθ,l dXθ,l (t) = 0.

Xθ,l non-decreasing, and

2

0

Our objective is to maximize

1

D(θ, l) = δ −1 cθ − δ −1 l − H(θ, l),

4

over θ ∈ and l ≥ 0, where

∞

H(θ, l) = E

e−δt δp Sθ,l (t)1 Sθ,l (t) > 0 + hSθ,l (t)1 Sθ,l (t) ≤ 0 dt

0

+ x dXθl (t) ,

recalling that D(θ, l) was defined in (46), and H(θ, l) in (45).

Queueing Syst (2008) 60: 1–69

23

Following the same arguments as in Proposition 5.11 in Harrison and Taksar [14]

or Theorem 2 in Constantinides and Richard [11], it follows that

H(θ, l) = k(0),

where k is twice continuously differentiable on (−∞, (1/2)l], and satisfies

1 k (t) + θ k t1{t ≥ 0} − ht1{t < 0} = 0.

2

The solution is

k(t) =

k1 (t),

t ≥ 0,

k2 (t),

t < 0,

where

k1 (t) = c1 er1 t + c2 er2 t + p t +

θp ,

δ

θh

h

k2 (t) = d1 er1 t − t − 2

δ

δ

for

θ 2 + 2δ,

r2 = −θ − θ 2 + 2δ,

r1 = −θ +

c1 =

x − p −r1 1 l (p + hδ )( θδ r1 − 1) (r2 −r1 ) 1 l

2 ,

e 2 −

r2 e

r1

r2 − r1

(p + hδ )( θδ r1 − 1)

,

r2 − r1

θ

h

d1 = c1 + c2 +

p +

.

δ

δ

c2 =

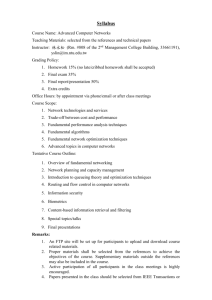

Figure 2 graphs the function D(θ, l) when x = 6, h = 0.25, and δ = 0.1. The

function is concave, and the maximum is attained at

θ , l = (−0.0898, 1.0760),

for D(θ , l ) = −16.134. Consistently with intuition, as holding cost increases, the

capacity imbalance θ becomes positive, and the allowable leadtime for products,

(1/2)l , also increases. Specifically, increasing h to 1/2 while keeping all other parameters the same yields the solution (θ , l ) = (0.0292, 1.5478) for D(θ , l ) =

−19.98. Also consistently with intuition, as the expediting cost increases, the capacity imbalance decreases, and the allowable leadtime for products, (1/2)l , also

increases. In particular, changing the expediting cost x to 10 from 6, keeping the

holding cost h = 1/4 as it was before, and having all other parameters the same results in the solution (θ , l ) = (−0.1900, 2.2834) for D(θ , l ) = −19.94.

24

Queueing Syst (2008) 60: 1–69

Fig. 2 D(θ, l) graphed as a

function of θ and l when

p = 3/4, c = 1/2, δ = 0.1,

h = 1/4, and x = 6

The condition in Theorem 1 requires that x > p + h/δ. However, the computation

of (θ , l ) does not require this condition. In the general model setting with K products and J components, it continues to be the case that we can compute (θ , l ) without the condition on the expediting costs. Furthermore, we expect the upper bound in

Theorem 1 to hold for any expediting cost xj > cj . However, the proof of asymptotic

optimality is very challenging in this more general setting, for reasons explained in

Sect. 5.1.

Example 2 (Continued) Assume c = 1/10 in Example 2, which implies

1

p1 = ,

2

4

μ = .

5

p2 =

3

,

10

1

λ1 = ,

2

λ2 =

3

,

10

l1 = 0,

1

l2 = ,

5

and

When holding costs are zero, the linear program in (41)–(43) becomes

1

3

min δQ1 + δQ2

Q 2

10

subject to

Q1 + Q2 − S ≥ 0,

which has solution

q1 , q2 , i =

1

0 ≤ Q1 ≤ l,

2

(0, 0, S),

S ≤ 0,

(0, S, 0),

S ≥ 0.

Because one customer class is patient, the system manager can fill orders within the

quoted maximum leadtime in high volume without expediting, and so s = ∞ for s

Queueing Syst (2008) 60: 1–69

25

defined in (33). Then, the process Sθ,l defined in (29)–(30) is such that Sθ,l (t) has a

normal distribution with mean θ t and variance σ 2 t, where

1 2

3 2

4

σ 2 = σO1

+ σO2

+ σC2 ,

2

10

5

as defined in (25).

We now calculate

max D(θ, l)

θ∈

,l≥0

for D(θ, l) defined in (46). The function H(θ, l) defined in (45) is

∞

3

H(θ, l) = E

δe−δt Sθ,l (t)1 Sθl (t) ≥ 0 dt

10

0

∞

3 δe−δt E Sθl (t)1 Sθl (t) ≥ 0 dt,

=

10

0

where the interchange of expectation and integral sign follows because the integrand

is non-negative. By Proposition 18.3 in Browne and Whitt [6], letting φ and be the

probability density and cumulative distribution functions, respectively, of a standard

normal random variable,

√

E Sθl (t)|Sθl (t) ≥ 0 = θ t + σ t

√

φ( −θσ t )

√

1 − ( −θσ t )

.

Therefore, since

E Sθl (t)1 Sθl (t) ≥ 0 = E Sθ,l (t)|Sθ,l (t) ≥ 0 × P Sθ,l (t) ≥ 0 ,

and

√ −θ t

P Sθ,l (t) ≥ 0 = 1 − ,

σ

it follows that

√ √ √

−θ t

−θ t

E Sθ,l (t)1 Sθ,l (t) ≥ 0 = θ t − θ t

+ σ tφ

.

σ

σ

Substitution then yields that

3

3 θ

H(θ, l) =

+

10 δ 10

∞

δe

−δt

0

√ √ √

−θ t

−θ t

σ tφ

− θ t

dt,

σ

σ

and so

1

−1 θ

3

D(θ, l) =

− l−

5 δ 2

10

∞

δe

0

−δt

√ √ √

−θ t

−θ t

− θ t

dt,

σ tφ

σ

σ

26

Queueing Syst (2008) 60: 1–69

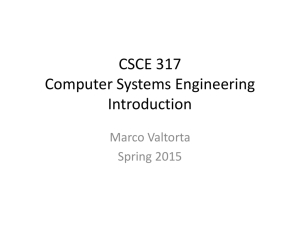

Fig. 3 D(θ , 0) graphed as a

function of θ for the parameters

in Example 2 when σ 2 = 1 and

δ = 0.1

where b = 1/2 is calculated for Example 2 at the end of Sect. 2.4. Because l ≥ 0 in

the above expression, setting l to 0 maximizes D(θ, l). We then need to maximize

D(θ, 0) over θ . Figure 3 shows graphically that D(θ, 0) is a concave function of θ .

The optimum θ , θ , occurs at −0.1038, and D(θ , 0) = −0.31.

That l = 0 in the continuation of Example 2 is not by chance. Consider any

two products k ∈ K0 and m ∈ K\K0 that are physically identical (akj = amj for all

and l = 0 < l j ∈ J ) but differentiated in price and maximum leadtime (pk > pm

m

k

in the optimal solution to static planning problem). Holding an order for product m

is cheaper than holding an order for product k and has identical effect on component

inventory, so qk (S, L) = 0 for any S ∈ J and L ∈ +,K0 . Furthermore, because the

j th component of the shortage process is unrestricted for any j such that amj > 0, for

, i )(S (t), l) does not depend on l. Therefore, in a system

any l > 0 and t > 0, (qm

θ,l

m

in which products are differentiated only by price and maximum leadtime (i.e., all

products require the same components),

∂H/∂l k = 0,

k ∈ K0 ,

and so, because bk > 0 for k ∈ K0 , by Assumption 1

∂D/∂l k < 0.

We conclude that l k = 0 for all k ∈ K0 to maximize D(θ, l) in (46).

3.4 Exact leadtime quotation

We have assumed that prospective customers know only the quoted maximum leadtimes, not the distribution of actual leadtimes. If impatient customers did have information about the actual leadtimes for products in classes K\K0 before ordering

(e.g., through word-of-mouth), and knew that delays for those products were likely

to be short, some might switch their orders from the expensive products in classes K0

with guaranteed short leadtimes to the cheaper products in classes K\K0 . This would

reduce the optimal expected discounted profit generated by the assemble-to-order

system. The effect of giving customers information about actual leadtimes would, in

equilibrium, be similar to that of requiring exact leadtime quotation

Ak (t) = Ok (t − lk )

for all t ≥ 0 and k ∈ K

(55)

Queueing Syst (2008) 60: 1–69

27

rather than (1). Under (55), the assembly process would be determined by the order

arrival process, such that discounted profit in (6) would become

K k=1 0

∞

pk e

−δ(t+lk )

dOk (t) −

J ∞

e−δt cj dCj (t) + hj Ij (t) dt + xj dXj (t) .

j =1 0

(56)

To construct an upper bound on discounted profit (56), suppose that orders flow

at their long run average rates as in the construction of the static planning problem

in (8)–(9) and, additionally, suppose that the system manager is able to produce each

component j precisely when needed to assemble products while paying only cj per

unit. The resulting upper bound on expected discounted profit

K

J

δ −1 π ≡ δ −1 max

e−δlk pk −

akj cj

(57)

p≥0,l≥0

j =1

k=1

equals δ −1 π in the case that the unique optimal solution to the static planning problem (8)–(9) has zero leadtimes for all products l = 0 and is strictly less than δ −1 π

in the case that lk > 0 for at least one product k ∈ K. It follows that, in the case that

lk > 0 for at least one product k ∈ K, requiring exact leadtime quotation will reduce

expected discounted profit in the nth system by approximately

nδ −1 π − π → ∞ as n → ∞.

Fundamentally, the reduction in discounted profit occurs because of a delay in order

fulfillment and hence revenue collection.

We conclude that in the case that lk > 0 for at least one product k ∈ K, the system

manager would strongly prefer the greater flexibility associated with maximum leadtime quotation as opposed to exact leadtime quotation. Hence there is a very strong

(of order n) financial incentive to prevent prospective customers from obtaining information about actual leadtimes.

In contrast, in the case that lk = 0 for all k ∈ K, the reduction in discounted

√ profit

from imposing the exact leadtime constraint (55) will be at most of order n. This

is because we expect that all terms in the expression for the diffusion-scaled profit

in (40) will have a limit. The loss in profit will occur because queue-length and inventory levels will not match the levels given by the linear program in (41)–(43) that

asymptotically minimize instantaneous holding costs.

4 An asymptotically optimal policy

In this section, we propose a policy for setting prices, maximum leadtimes, component production rates, and dynamically sequencing orders for assembly and expediting components. We then show that the proposed policy is asymptotically optimal.

Our proposed policy is a discrete review policy that releases orders for assembly

at times ir n , i ∈ {1, 2, . . .}, where the review period length is

rn ≡

1

nβ

(58)

28

Queueing Syst (2008) 60: 1–69

for

1 + 1 32 (1 + 1 )

1

<β <

∧

< 1.

2

2 + 1

3 + 2

1

Note that the length of the review period is tied to the number of moments (2 + 2

1

for 1 > 0) assumed on the order and component inter-arrival times.

Prices, quoted maximum leadtimes, and production capacity are

p n = p n−1/2 θ , n−1/2 l ,

l n = l n−1/2 θ , n−1/2 l ∨ r n ,

μn = μ n−1/2 θ , n−1/2 l ,

according to the solution of the perturbed static planning problem in (17)–(19) with

perturbation (n−1/2 θ , n−1/2 l ∨ r n ) where (θ , l ) ∈ . Recall that was defined

in (47). Because orders are only assembled at discrete review time points, to satisfy

the constraint that all orders must be filled within their quoted maximum leadtimes

(1) the proposed policy quotes maximum leadtimes weakly greater than the review

period, lkn ≥ r n for all k ∈ K.

In our proposed policy, the system manager expedites components and releases

orders for assembly at discrete review time points The proposed expediting and assembly processes are

Xn (t) = Xn ir n for t ∈ ir n , (i + 1)r n and i ∈ {0, 1, 2, . . .},

An (t) = An ir n for t ∈ ir n , (i + 1)r n and i ∈ {0, 1, 2, . . .}

with (Xn (ir n ), An (ir n )) defined recursively, as follows. At time 0, Xn (0) =

An (0) = 0. For every positive integer i, given the cumulative quantities expedited

and assembled at the last review period

n

X (i − 1)r n , An (i − 1)r n ,

for each j ∈ J ,

n

X,j

K

n

n

n

ir ≡ max X,j (i − 1)r ,

akj max Okn (i + 1)r n − lkn ,

k=1

An,k (i

− 1)r

n

− Cjn

n

ir

,

(59)

which is the minimum cumulative amount of expediting required to assemble orders

that are due within the review period, that is, before time (i + 1)r n , and to satisfy the

constraint that the expediting and assembly processes are non-decreasing. Finally, the

cumulative number of orders assembled by time ir n is

(60)

An ir n = O n ir n − Qn ir n ,

Queueing Syst (2008) 60: 1–69

29

where for each i, (Qn (ir n ), In (ir n )) solve

min δ

Q,I ≥0

K

pk Qk

K0

J

n

n n n

n +

Qk − λk p , l lk − r

+ζ

+

hj Ij

k=1

(61)

j =1

k=1

subject to

Ij ≡

K

akj Qk − Sjn ir n ≥ 0,

j ∈J,

(62)

k=1

Qk ≤ Lni,k , k ∈ K,

Qk ≤ Okn ir n − An,k (i − 1)r n ,

(63)

k∈K

(64)

for

ζ >δ

K

k=1

pk +

J

j =1

hj

K

akj

a finite constant

(65)

k=1

Lni,k ≡ Okn ir n − Okn (i + 1)r n − lkn .

(66)

The expediting policy Xn guarantees feasibility of (61)–(64) at every discrete review

time point ir n .

The assembly policy An minimizes instantaneous holding cost except in circumstances where that myopic approach would cause excess expediting; the purpose of

the penalty ζ is to prevent excess expediting. Recall from (26) in Sect. 3.1 that to fill

orders for product k ∈ K within the quoted maximum leadtime lkn , the queue should

not exceed λnk (p n , l n )lkn . The penalty ζ is large enough to ensure

Qn,k ir n ≤ λnk p n , l n lkn − nr n , k ∈ K,

whenever feasible. Thus the penalty ζ prevents allocation of a scarce component to

fulfill an order for a product with relatively high holding cost δpk before that order

is due when, in order to prevent excess expediting, that component should instead

be allocated to another product with relatively low holding cost δpk , high queue,

and orders that are due immediately. Constraint (62) ensures the inventory process

is non-negative. Constraint (63) requires that all orders are assembled within their

quoted maximum leadtimes, which can be seen by substituting the expression for Qn

in (60) into the constraint (63) to find

An,k ir n ≥ Okn (i + 1)r n − lkn , k ∈ K.

Therefore,

An,k (t) = An,k

t

t

n

n

n

n

n

n

r

≥

O

+

1

r

−

l

k

k ≥ Ok t − lk ,

n

n

r

r

k ∈ K,

(67)

30

Queueing Syst (2008) 60: 1–69

and so, in words, the number of orders for product k assembled up to time t always

equals or exceeds the number of orders for product k received up to time t − lkn , as

required by (1). Constraint (64) maintains a non-decreasing assembly process.

Let (qn , in )(S, L) denote a solution to the optimization problem in (61)–(63). Similarly to Plambeck and Ward [28] (see the discussion following Assumption 1) or

Bassamboo et al. [3] (see Proposition 2 and the surrounding discussion), we assume

that (qn , in )(S, L) is Lipschitz continuous in (S, L) for each n, and that the sequence

of Lipschitz continuous solutions can be chosen so that the convergence

1 √ qn , in S n , Ln → q (S, L)

n

√

√

as n → ∞ holds when S n / n → S and Ln / n → L as n → ∞. This is true whenever the vector of cost coefficients

J

J

hj a1j , . . . , pK +

hj aKj

p1 +

j =1

j =1

is not parallel to (akj )k=1,...,K , the vector of products requiring component j , for

every j ∈ J . Note that whenever (qn , in )(S n (ir n ), Lni ) satisfies constraint (64), we

select

n n n n n n n n n Q ir , I ir

= q , i S ir , Li .

Asymptotic optimality

The proposed policy satisfies the conditions for an asymptotically optimal policy established in Proposition 1, that p n → p , μn → μ , and l n → l as n → ∞. The

following lemma shows that the conditions for an asymptotically optimal policy established in Proposition 2 are also satisfied.

Lemma 4 The proposed policy satisfies

√ −1/2 −1/2 nlk n

θ ,n

l ∨ r n → l k ,

k ∈ K0

as n → ∞.

√

The other condition in Proposition 2, that lim supn→∞ n|θ n | < ∞ for θ n defined in (23), is satisfied because the constraint (18) in the perturbed static planning

problem shows

θjn =

K

akj λk p n , l n − μnj = n−1/2 θj ,

j ∈J.

k=1

In high volume, under the proposed policy, the dimensionality of the limiting system equals the number of components J .

Queueing Syst (2008) 60: 1–69

31

Proposition 3 Under the proposed policy,

n n n n

⇒

Sθ ,l , Xθ ,l , q (Sθ ,l , L ), i (Sθ ,l , L ) ,

S̃ , X̃ , Q̃ , I˜

as n → ∞, where (q , i ) is the solution to (45)–(47) with Lk = λk (p , l )l k for

k ∈ K0 , and (Sθ ,l , Xθ ,l ) is the RBM defined in (29)–(30) with drift θ and state

space S = (−∞, s 1 ] × · · · × (−∞, s J ].

Furthermore, when the system operates under the proposed policy, the upper

bound on expected profit in Theorem 1 is attained.

Proposition 4 Under the proposed policy,

n

˜ = D θ , l .

lim E n→∞

We note that Propositions 3 and 4 are exactly Proposition 4.2 in Plambeck and

Ward [28] when customers are infinitely patient, so that leadtime quotation is irrelevant and there is no expediting. It is the translation of the constraint that all orders

are filled within the quoted maximum leadtime to an upper bound on the shortage of

each component that makes the proofs technically more challenging.

The asymptotic optimality stated in our next theorem follows immediately from

Propositions 3 and 4.

Theorem 2 Assume

xj > max

k:akj >0

−1

akj

pk + δ −1

J

akm hm

for every j ∈ J .

(68)

m=1

The policy proposed in Sect. 3 having

n

˜ = D θ , l

lim E n→∞

(69)

is asymptotically optimal.

5 Systems with salvaging and a general cost of expediting

The proposed assembly and expediting policies are not easily implementable in practice because of the large amount of state information required. Furthermore, up to

this point, we have focused on dynamic control of assembly sequencing and component expediting. In particular, we have assumed that component production capacity

is a fixed decision at the beginning of the time horizon, and all components that are

produced must either be assembled into products to meet customers’ orders or remain in inventory. In reality, when component inventory grows too large, most firms

will dynamically salvage excess components (or idle component production capacity). Moreover, expediting may not always be as expensive as required in Theorem 1,

32

Queueing Syst (2008) 60: 1–69

and so it may be beneficial in practice to sometimes expedite components earlier than

strictly needed to satisfy maximum leadtimes.

In this section, we generalize our formulation to allow for component salvaging

and cheap expediting. Rather than require that all orders are filled within the quoted

maximum leadtime (1), we require that all orders are filled within the quoted maximum leadtime with arbitrarily high probability: for any T > 0,

P An,k (t) ≥ Okn t − lkn for all 0 ≤ t ≤ T and k ∈ K → 1.

This relaxation allows us to propose a profitable and relatively easy-to-implement

control policy. The proposed policy is based on the numerical solution of a Brownian

control problem that is heuristically motivated by the analysis in Sects. 3 and 4.

We expect that our proposed policy with dynamic salvaging and a general cost

of expediting is asymptotically optimal; however, proving its asymptotic optimality

appears very difficult, and the reasons why will become apparent in Sect. 5.1, which

sets up the approximating Brownian control problem. However, numerically solving

the limiting Brownian control problem is tractable, and we do this in Sect. 5.2. Because most of the assemble-to-order literature assumes each component is managed

according to an independent base stock policy, we choose numerical examples that

illustrate when the profit gain from joint optimal control of all component inventory

levels is small vs. large. Finally, Sect. 5.3 discusses how to translate the solution to the

approximating Brownian control problem into our proposed policy for the associated

discrete event assemble-to-order system.

5.1 The approximating Brownian control problem

Suppose that the system manager can sell component j ∈ J for a low price of vj

per unit, and expedite production of component j at a cost of xj per unit where

vj < cj < xj . (The cost of expediting one unit, xj , should be higher than the nominal

cost of producing one unit, cj , because otherwise the system manager would only use

expedited production with instantaneous delivery, and there would be no interesting

control problem.) Note that the salvage value vj for a component may be negative; in

some applications and particularly in the electronics industry, disposal of excess components may be costly. Let V approximate the cumulative, diffusion-scaled number

of components salvaged in this manner. Then the process approximating the shortage

process, S is defined similarly to (29), except with the addition of V ,

S(t) = B(t) − X(t) + V (t) ∈ S ≡ (−∞, s 1 ] × · · · × (−∞, s J ].

(70)

Given a capacity and maximum leadtime perturbation (θ, l), for Lk = λk (p , l )l k ,

k ∈ K0 , the optimal expediting and salvaging processes are the solution to the Brownian control problem

K

J

∞

−δt

e

pk qk S(t), L +

hj ij S(t), L dt

δ

minE

X,V

+

0

J

j =1

k=1

xj dXj (t) − vj dVj (t)

j =1

(71)

Queueing Syst (2008) 60: 1–69

33

subject to

X, V ∈ D([0, ∞), ) are non-decreasing, RCLL, adapted to B,

have X(0) = V (0) = 0,

and condition (70) holds.

The definition of the expediting process X in (30) no longer applies, because expediting of component j may occur before the upper bound s j (defined in (33))

is reached. The optimal objective value in (71) substitutes for H(θ, l) in the definition of D(θ, l) in (46). Because the structure of the optimal expediting and salvaging processes in (71) is unknown, constructing an upper bound on achievable

expected diffusion-scaled and centered infinite-horizon discounted profit as in (106)

in the proof of Theorem 1 is much more difficult, and so we do not prove asymptotic

optimality.

5.2 Solving the approximating Brownian control problem

We numerically solve the Brownian problem for two particular systems with J = 2