Federal Redistribution: Supplementing Point-in-Time Analyses with a Lifetime View

advertisement

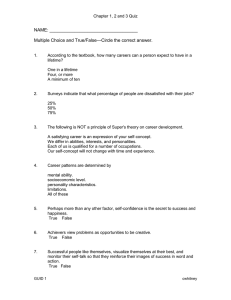

Federal Redistribution: Supplementing Point-in-Time Analyses with a Lifetime View Presentation for Tax Policy Center Event “Measuring the Distribution of Spending and Taxes” Melissa Favreault The Urban Institute December 3, 2013 URBAN INSTITUTE Motivation • Well-being is better measured based on lifetime earnings/income rather than point-in-time earnings/income • “Insurance company with a standing army”: analysts often evaluate insurance through expected value (actuarial fairness, insurance value) – Requires looking at tax contributions (payroll, personal income, other) and benefits over a lifetime, not just at a point in time – Separate analyses by age partially address this URBAN INSTITUTE Poverty at a point in time and over longer periods Shares in Poverty Using Different Accounting Periods 60 51.4 50 40 31.6 30 20 15.0 10 0 Annual 2012 At least 2 months over 3 years (2009 - 2011) At some time before age 65 Sources: DeNavas-Walt, Proctor and Smith (2013), Rank and Hirschl (1999) URBAN INSTITUTE Transitions between quintiles similarly differ by accounting period Current Earnings Quintile Compared to Last Year: Men Ages 30-54 100% 90% 0.0 18.7 13.9 10.0 100% 28.7 80% 70% 18.5 29.0 46.7 40.4 70% 60% 82.8 50% 63.9 69.2 71.0 20% 76.3 60% 75.5 30% Move up 50% Stay same 40% Move down 30% 54.5 44.9 Move up 39.9 Stay same Move down 53.3 20% 10% 0% 0.0 90% 80% 40% Current Earnings Quintile Compared to Average of Last 10 Years: Men Ages 30-54 Who Worked at Least 6 of Last 10 Years 17.4 17.0 0.0 14.6 17.1 10% 0% 19.7 26.0 26.9 23.6 0.0 Source: Favreault and Haaga (2013) based on Survey of Income and Program Participation matched to earnings records URBAN INSTITUTE Why do relatively few analysts examine redistribution over a lifetime? • Enormous data demands • A girl born in 2000 can expect to live for 85.7 years • Few panel data sources • Can use administrative data; privacy concerns limit • Families/tax units change over time • Sensitive to assumptions, including about many things that have not yet happened • Current law vs. current policy • Interest (“discount”) rates, mortality, earnings inequality • Inclusion of migrants, those who die early, etc. URBAN INSTITUTE Mortality differs greatly by social status, affecting lifetime redistribution Life Expectancy Difference by Economic Status 9 8 7.8 Education Difference in years 7 6 Community income 5.4 5 4.1 4 3 2 1 0 Men Women combined at age 25 at age 15 Sources: Meara et al. (2008); Singh and Siahpush (2006) URBAN INSTITUTE Example: Contrast Social Security at a point in time vs. on a lifetime basis • Just one component of federal budget, but large • Tax side – Flat payroll tax (subject to maximum, $117,000 in 2014) – Taxation of benefits for higher income beneficiaries • Benefit side – Retirement, survivor, and disability benefits • Marriage-based benefits and children’s benefits – Mortality (increasingly disparate by income) • Will look by race/ethnicity URBAN INSTITUTE A cross-sectional view of Social Security redistribution Aggregate Benefit to Tax Ratios by Year and Race/Ethnicity 1.9 1.8 1.7 1.6 1.5 1.4 Benefit to Tax Ratios 1.3 1.2 1.1 1 Non-Hispanic white 0.9 Non-Hispanic black 0.8 Hispanic 0.7 Non-Hispanic other 0.6 0.5 0.4 0.3 0.2 0.1 0 URBAN INSTITUTE Year Source: Based on Steuerle, Quakenbush, and Smith (2013) A lifetime view of Social Security redistribution Lifetime Benefits to Contributions by Birth Year and Race/Ethnicity Ratio of lifetime Social Security benefits to contributions 1.4 1.3 1.2 1.1 1 0.9 0.8 Hispanic (all) 0.7 Non-Hispanic black 0.6 Non-Hispanic white 0.5 0.4 0.3 0.2 0.1 0 1951-1955 1956-1960 1961-1965 URBAN INSTITUTE Source: Computations from DYNASIM3 1966-1970 1971-1975 Distribution versus mean or median: lifetime perspective Distribution of the Ratio of Lifetime Benefits to Contributions Share with benefit-to-contribution ratios of this amount or higher Ratio of 1 or higher indicates lifetime Social Security benefits exceed lifetime payroll taxes 100 90 80 70 60 50 Hispanic Non-Hispanic black 40 30 20 10 0 URBAN INSTITUTE Non-Hispanic white Conclusions • Looking at cross-sections alone gives an incomplete picture of redistribution – Many of us are likely to be poor at some point, to change income or earnings quintiles, and to face risks – Lifetime calculations are difficult but necessary • Looking at measures of central tendency (mean or median) alone masks diversity within groups like quintiles or broad age groups – A high group-specific mean may result from a subset of that group having very high outcomes , even though many or even most individuals in the group do not URBAN INSTITUTE Interpretation • Big-ticket budget items (Medicare, Social Security, and Medicaid) – Manage lifetime risks, especially from very large shocks to income • Health crises that will incur massive debts absent insurance • Permanent disability • Long-term unemployment – Affect multiple generations • Aged “pre-paid” benefits with decades of payroll taxes (“earned right”): majority have at least 35 years of contributions • Public redistribution to aged reduces need for private transfers URBAN INSTITUTE Disclaimer All views are my own and not those of the Urban Institute, its board, or sponsors. Please visit us at: www.urban.org and www.retirementpolicy.org URBAN INSTITUTE