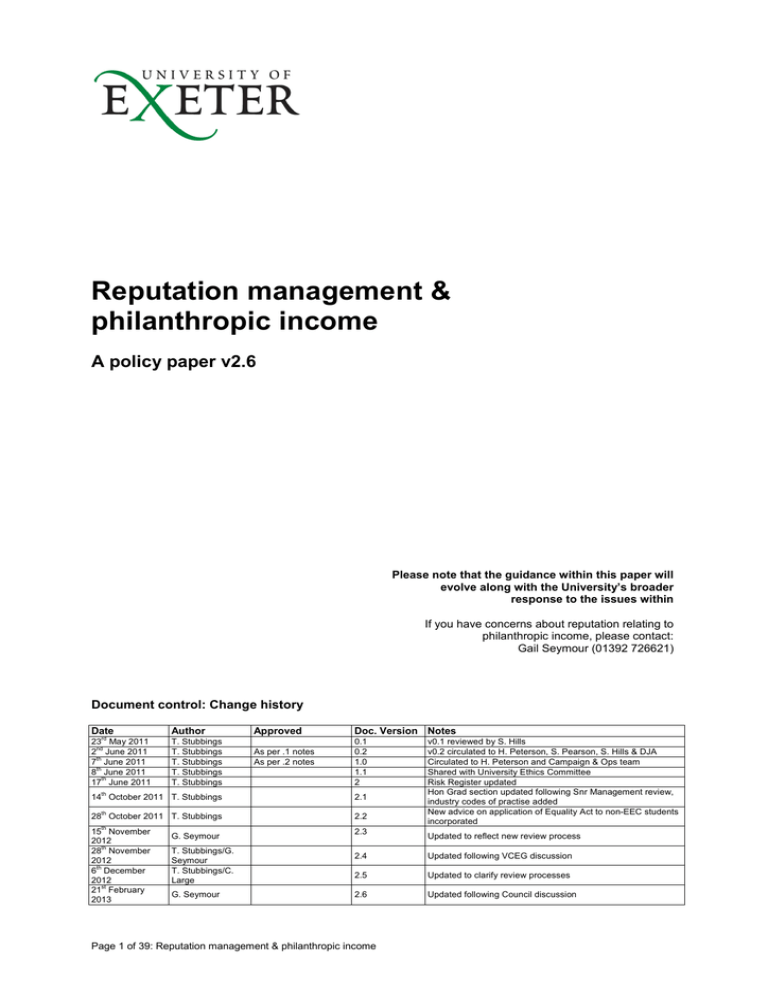

Reputation management & philanthropic income A policy paper v2.6

advertisement