Document 14840208

advertisement

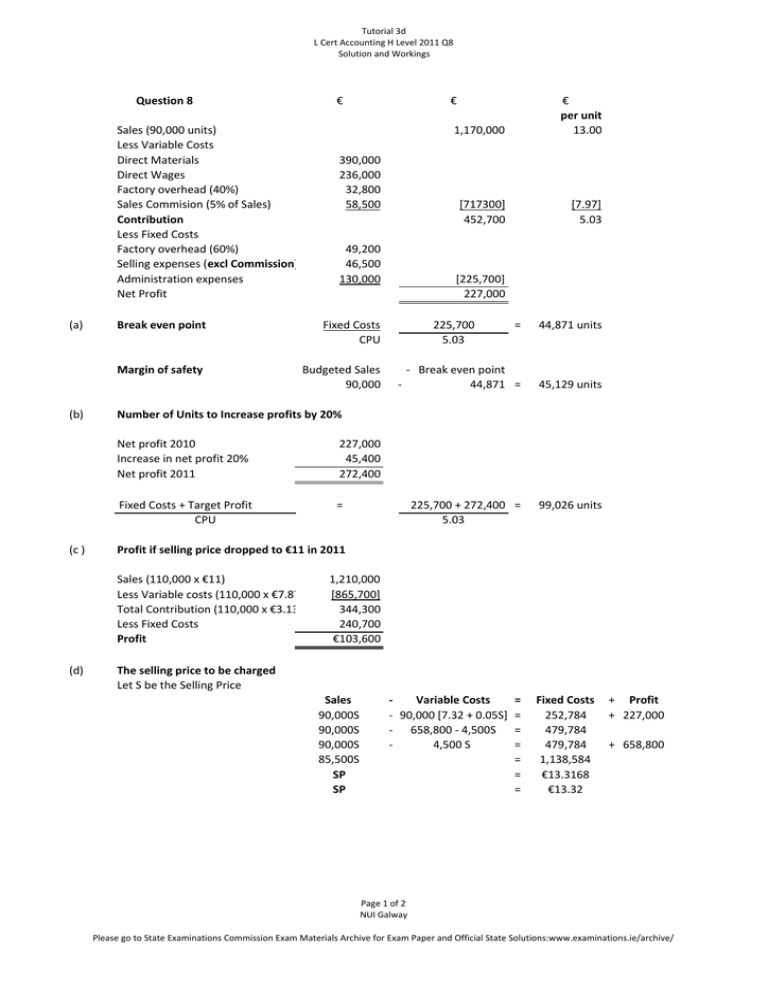

Tutorial 3d L Cert Accounting H Level 2011 Q8 Solution and Workings Question 8 € Sales (90,000 units) Less Variable Costs Direct Materials Direct Wages Factory overhead (40%) Sales Commision (5% of Sales) Contribution Less Fixed Costs Factory overhead (60%) Selling expenses (excl Commission) Administration expenses Net Profit (a) (b) (c ) 390,000 236,000 32,800 58,500 49,200 46,500 130,000 Break even point Fixed Costs CPU Margin of safety Budgeted Sales 90,000 1,170,000 € per unit 13.00 [717300] 452,700 [7.97] 5.03 [225,700] 227,000 225,700 5.03 = 44,871 units -­‐ Break even point -­‐ 44,871 = 45,129 units Number of Units to Increase profits by 20% Net profit 2010 Increase in net profit 20% Net profit 2011 227,000 45,400 272,400 Fixed Costs + Target Profit CPU = 225,700 + 272,400 = 5.03 99,026 units Profit if selling price dropped to €11 in 2011 Sales (110,000 x €11) Less Variable costs (110,000 x €7.87) Total Contribution (110,000 x €3.13) Less Fixed Costs Profit (d) € 1,210,000 [865,700] 344,300 240,700 €103,600 The selling price to be charged Let S be the Selling Price Sales 90,000S 90,000S 90,000S 85,500S SP SP -­‐ Variable Costs -­‐ 90,000 [7.32 + 0.05S] -­‐ 658,800 -­‐ 4,500S -­‐ 4,500 S = = = = = = = Fixed Costs 252,784 479,784 479,784 1,138,584 €13.3168 €13.32 + Profit + 227,000 + 658,800 Page 1 of 2 NUI Galway Please go to State Examinations Commission Exam Materials Archive for Exam Paper and Official State Solutions:www.examinations.ie/archive/ Tutorial 3d L Cert Accounting H Level 2011 Q8 Solution and Workings e) Let the number of units = N Sales Revenue = Profit = 16N 1.6N Sales = Variable Costs + 16N = 8.12N + 6.28N = 225,700 N = 35,939.49 N = 35,940 units f) 12 Fixed Costs 225,700 + + Profit 1.6N Limitations/assumptions: Variable costs are assumed to be completely variable at all levels of output. However variable costs may decrease due to economies of scale or may increase because of increased costs. It is assumed that in marginal costing fixed costs remain the same although most fixed costs are step-­‐fixed and are only fixed within a relevant range. It is assumed that all mixed costs are easily separated into fixed or variable. The High Lo method can be used for this purpose but it is not always possible to do this. It is assumed that the selling price per unit is constant and does not allow for discounts. Production in a period usually equals sales. Fixed costs are charged in total to a period and are not carried forward to next period. Step Fixed Cost Step fixed costs are costs that are fixed within a certain range of activity but change outside of that range. E.g. Rent could be fixed up to a certain level of production. However, if production increases and results in the rental of more factory space, then the rent would increase to a new level. Thus the fixed costs would increase in steps. Page 2 of 2 NUI Galway Please go to State Examinations Commission Exam Materials Archive for Exam Paper and Official State Solutions:www.examinations.ie/archive/