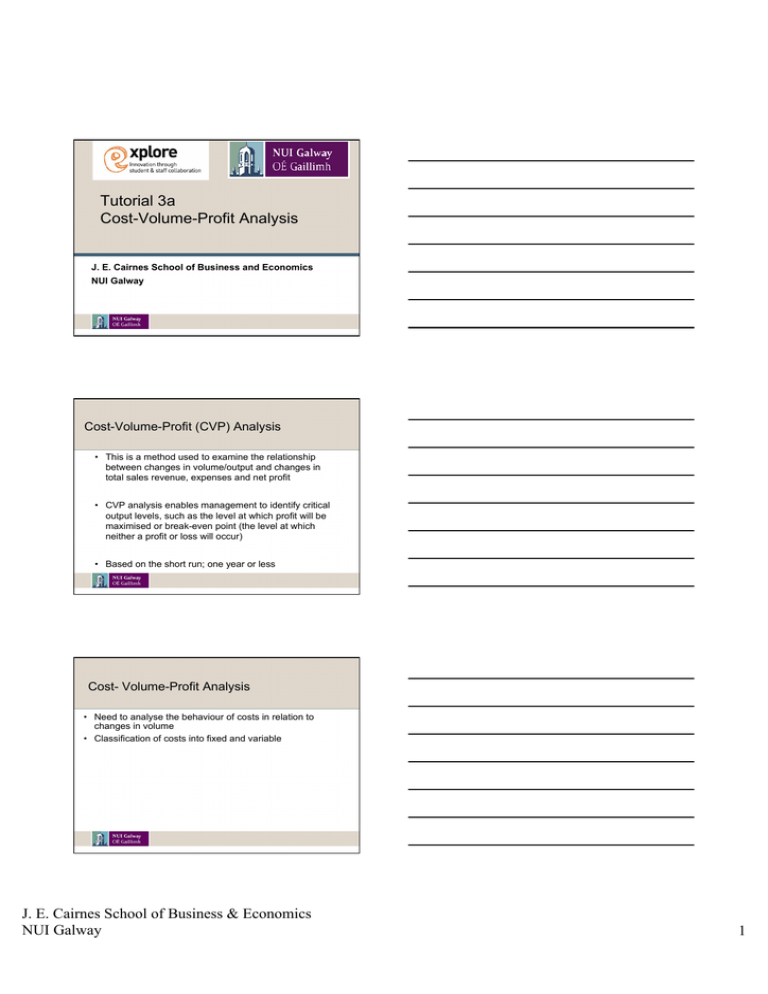

Tutorial 3a Cost-Volume-Profit Analysis Cost-Volume-Profit (CVP) Analysis

advertisement

Tutorial 3a Cost-Volume-Profit Analysis J. E. Cairnes School of Business and Economics NUI Galway Cost-Volume-Profit (CVP) Analysis • This is a method used to examine the relationship between changes in volume/output and changes in total sales revenue, expenses and net profit • CVP analysis enables management to identify critical output levels, such as the level at which profit will be maximised or break-even point (the level at which neither a profit or loss will occur) • Based on the short run; one year or less Cost- Volume-Profit Analysis • Need to analyse the behaviour of costs in relation to changes in volume • Classification of costs into fixed and variable J. E. Cairnes School of Business & Economics NUI Galway 1 Fixed Costs -> Fixed costs remain the same i.e. fixed irrespective of the level of activity or volume of output E.g. Rent, insurance, cleaning costs, depreciation € Volume Variable Costs -> varies directly with changes in the level of output e.g. raw material costs = €8 per unit of output produced € Volume Step Fixed Costs- A cost which is fixed over a certain range of production (quantity) but then increases as the capacity (and the usage of a particular activity) increases € Volume J. E. Cairnes School of Business & Economics NUI Galway 2 Semi-variable Cost-A cost which is partially fixed and partially varies with the changes in the level of quantity (activity) e.g: telephone costs; fixed line rental plus costs for the calls The slope of this line is the variable cost per unit 100 Cost 80 60 40 Variable cost element 20 Fixed cost element 0 100 200 300 400 Volume 7 CVP Analysis Y = a + bx Sales x Total Cost = Fixed Costs + Variable Costs Less Variable Costs Contribution Less Fixed Costs Profit (x) x (x) x Contribution • Contribution = Sales Revenue less Variable costs • Contribution/ unit (CPU)= Sales price/unit- Var cost/unit • Indicates revenue remaining after all variable costs have been covered • Variable costs include variable production and variable selling and administration costs J. E. Cairnes School of Business & Economics NUI Galway 3 Break-even point (BEP) At break-even point – total costs = total revenues – i.e. no profit or loss is made Where: Sales Less Variable Costs Contribution Less Fixed Costs x (x) x (x) 0 Break-even Point To calculate breakeven point in units: Total fixed costs Contribution per unit Example 1 Sales price per unit = €100 Variable cost per unit = €40 Fixed Costs = €6,000 What is Contribution per unit? What Contribution is required to breakeven? How many units need to be sold to breakeven? J. E. Cairnes School of Business & Economics NUI Galway 4 What is Contribution per unit? Sales price per unit €100 Less variable cost per unit €40 Contribution per unit €60 What Contribution is required to breakeven? At the break-even point no profit or loss is made i.e. Sales – Variable costs= Fixed costs The fixed costs are €6,000 For no profit or loss contribution needs to be €6,000 How many units that need to be sold to breakeven? Total Fixed Costs Contribution per unit = €6,000 €60 = 100 units (required to be produced to breakeven) J. E. Cairnes School of Business & Economics NUI Galway 5 Target Profit Sales required to earn target profit in units: Total fixed costs + Target profit Contribution per unit Example 2 Sales price per unit = €100 Variable cost per unit = €40 Fixed Costs = €6,000 Q- What production is required to generate a profit of €30,000? (€6,000+ €30,000) = 600 units €60 Margin of Safety (MOS) • The excess of a company’s budgeted or actual units or revenues over its BEP • Reflects the amount by which sales can drop before reaching BEP • Margin of safety (units)= Actual units – Breakeven units • Or as a percentage Actual units – Breakeven units = % Actual units J. E. Cairnes School of Business & Economics NUI Galway 6 CVP Assumptions • Fixed costs remain fixed regardless of the level of activity • Variable costs are the same at all levels of activity • No changes in stock levels – everything that is produced is sold • Sales Price will be the same at all output levels • There is no uncertainty in the estimates of fixed and variable costs Breakeven Chart Sales € Breakeven point Profit Total fixed cost Loss 0 Total cost Volume – units/€s Let’s look at some CVP examples • In Tutorial 3b we will look at Leaving Cert Ordinary Level 2010 Q8 • In Tutorial 3c we will look at Leaving Cert Ordinary Level 2012 Q8 • In Tutorial 3d we will look at Leaving Cert Higher Level 2011 Q8 • See: http://www.nuigalway.ie/cairnes/leavingcert/ for tutorials on other topics J. E. Cairnes School of Business & Economics NUI Galway 7 Interested in pursuing an accounting career? Study at NUI Galway • CAO Course Codes • GY201 B Comm • GY202 B Comm (International) with French • GY203 B Comm (International) with German • GY204 B Comm (International) with Spanish • GY207 B Comm (Accounting) • GY208 B Comm (Gaeilge) • For further information contact:accounting@nuigalway.ie J. E. Cairnes School of Business & Economics J. E. Cairnes School of Business & Economics NUI Galway 8