Family Security Supporting Parents’ Employment and Children’s Development New Safety Net Paper 3

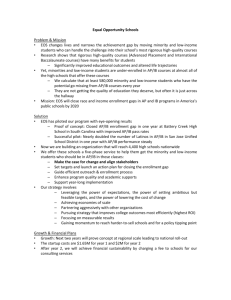

advertisement