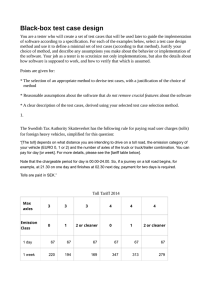

E-ZTax Finkelstein

advertisement