Interview with John Swannick

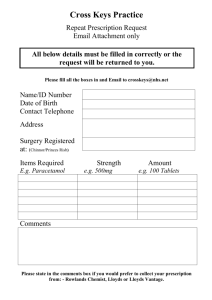

advertisement

Interview with John Swannick Interviewer: Heiko Spitzeck HS Alright John, thanks for coming to Cranfield and doing that project with us that looks at non financial performance indicators. I was wondering if you could explain what this project is about and how Lloyds TSB got into it and what is the key of non financial performance indicators. JS The laboratory that we are working on is one of twenty covering nine work streams that were set by the European Commission’s CSR Alliance Programme 2006 and one of the key themes was about transparency in communication – it’s a big area, particularly in this corporate responsibility field. But is a bringing together partners in terms of business, NGOs, EABIS as the academic partner, with the business schools that support that and deliver the research capacity that we felt we really needed. A range of businesses and advisors and participants are from a wide variety of sectors. And what it is looking at in a nutshell is about how corporate responsibility is communicated to the investment community, and by that I mean largely the mainstream investment community, although clearly we are looking at the socially responsible investment as well and the critical thing is in trying to narrow the field of what could be a very broad and diverse piece of work is actually looking at the language that is used, which we see as a key blockage in terms of the relationship between business and the investment community. I think the starting point was effectively the fact that advisors told us that research had shown that investors, when asked about non financial performance which is the sort of language that we have been using, what are the problems and what are the blockages when it comes to the relationship between business investors say investors, if we understood more about the non financial performance of business we would rate the business more highly and at the same time CEOs say that if investors only understood more about the non financial performance of the business they would rate their business more highly. HS So there is a Catch 22. JS And their information asymmetry, as we have chosen to call it, has been the fundamental starting point. That allied to the fact that despite current convention, actually when we looked at it, even the case of Lloyds TSB as a major High Street bank in the UK, the fact that when we worked out what percentage of our market capitalisation was accounted for by five year factors, we could only come up with 25% of our market cap determined by those things. So it meant that 75% of our then market capitalisation was accounted for by factors that we couldn’t really determine. Clearly earnings beyond five years are going to be a key part of that, but this non financial, this intangible value in not just Lloyds TSB John Swannick because we believe that 50 to 75% of world stock markets are similarly accounted for in areas that are not measured within five year earnings, but there had to be some more definitive way of understanding and then influencing the way that those values are measured in the investment community. HS So the project has been going on for quite a while already, and I guess the different research universities – I think Boccioni is involved? JS Gant, Lille, Bath and a number of others. HS What were the initial results like, because I think it is very interesting to know how you can then measure and manage that kind of 75% market cap? JS Well, it has been an iterative process. And in fact the research which is there almost as a parallel activity. Of course we hope that the findings of the research underpin or support the findings of the Laboratory, which is very much an intuitive led business approach that is delivering a priorie assumptions in effect, in advance of the outcomes of the research. So it is quite a strange beast in that sense. But a model has been determined, in large part drawing from current literature and current understanding that we have drawn into the Laboratory as very large umbrella exercise. So we are positive a number of what we believe are key blockages to why this information asymmetry exist between investors and business. We have created a model which we think actually is about the communication dimension. Its recognising that actually there are some very obvious non financial drivers which we believe actually constitute the vast proportion of the value of non financial performance which are clearly and intuitively linked to the classic finance strategy, drivers of market performance. And so, in trying to build and enhance those obvious linkages, as we see it, it’s also then to draw into that a whole range of factors what we call environmental, social and governance factors that we believe are in part or it may be even in whole, or at least a majority of the contributors to those key areas – those key factors as we call them. HS Which are the key factors? JS The key factors are intuitive and they should be obvious. They are about employee engagement in a business; they are about customer satisfaction and customer perception; they are about the innovation and development of new markets that the business have for the future; they are about corporate governance; they are about the environment really as a newly emerging issue compared with those others. And then we had some difficulty because we wanted to integrate the community engagement aspects, the wider societal issues in that and at one stage we did have those as embedded under those other five headings, but now we Page 2 John Swannick have actually created a separate sixth category which we have called society, but is essentially about community engagement and it’s about supplier relationships. HS And then the sub‐categories because if you think about the five main drivers, environment is still a very broad term? JS We believe that those six categories and the metrics that we are putting in underneath those, some of which we have already defined which are quite obvious, others that are under development in a sense that actually we tried to identify those metrics which (a) most obviously link the broadest range of environmental, social and governance factors, but (b) are most clearly linked to the financial drivers and that is a major challenge, clearly. But there is also in a sense what we have called the ‘black box’ concept in the fact that whilst those fundamental key areas we believe are common across markets, across sectors and are relevant for as many businesses as we believe possible. Below that there are these environmental, social and governance factors that aren’t relevant or may not be relevant for all businesses and its really part of this aspect of looking at it in the communication sense. We believe it is down to business to articulate what and where those factors are relevant and where they are material for the business and where they impact, not only on the key metrics that we have identified – those five or six key metrics, but they are about how they translate into the financial performance of business and that articulation is a critical part. Now underpinning that approach we recognise that there is lots of evidence out there of the contribution of those factors to the non financial of businesses across Europe, and beyond. HS Do you have an example? JS Well take the example of Lloyds TSB, this is the one we have used most obviously because it was most easily accessible, but clearly we are collecting this base of evidence to support these relationships in other areas and these things are not new. We are talking about a methodology which essentially replicates the suppositions of the commonly used business models. If you look at the EFQM Excellence Model with its concept of red threads, the weaving of factors into the headline metrics, or even the balanced scorecard, the Caplin and Norton balanced scorecard has got four or five key headings, but under them there are a whole range of factors that the businesses themselves use to flesh out those key areas. So we are only simply replicating, but what we are saying is that the business is articulating the relevance and the tonality of these things. In our case we can look at, for example, employee engagement. Now we have worked closely with a major consultancy in this area over many years and we have built our assessment of what drives employee engagement in Lloyds TSB on a model that they have Page 3 John Swannick used over many years with many businesses. But in essence, because we have undertaken over ten years at least, thousands of interviews with employees, we have thousands of interviews with customers and we have 2,000 business units that are standalone accounting business units, we are able to match financial performance with customer satisfaction, with employee engagement. HS So what is the relationship? JS So it’s the classic happy employees equals happy customers equals happy shareholders, the difference being that we are able to put co‐efficient relationships on that model, overlay it on those relationships. And if you look at the key factors that underpin the employee engagement as a key driver of customer satisfaction and ultimately sales, the factors are almost entirely what I would call in a broad sense corporate responsibility issues. Number one is about the external perception of the business – our employees’ pride in working for Lloyds TSB is a major driver of their engagement, their emotional commitment to the business which we know underpins their performance and the business’ performance. And so we have done some deep research into exactly what our employees mean and what drives them in terms of, for example, their external perception and they are very localised factors in Lloyds TSB. It’s about pride in the organisation, it’s the willingness to go down to the pub on Friday night and say I work for Lloyds TSB. So it is driven by families, friends, peers. And it is also driven by their networks and integration in the community because most of our people tend to work and live in the same local area – so those relationships are critical. And we are about to embed this thinking into an employee engagement strategy which is being approved on the basis of this evidence to actually recognise the importance of people’s local hinterland, their community links as part of a work/life balance approach. HS So that is a very plastic example and you said you worked with a consulting firm in order to implement that – what made you engage with universities, EABIS, in a broader set to do this more holistic study and more academic approach to it? JS It’s quite simple, we believe that actually if you understand what constitutes those drivers of value that we spoke about earlier, that 75% or possibly now a little less because of current market conditions, but it influenced beyond five year factors. Then for the long term, can you manage those things more effectively? Can you measure them? Can you – and this is critical to the relation of business to investors – can you provide the compelling case for the CEO, the CFO of businesses across Europe to go to investors and say as part of our business strategy, these things are fundamental. These key areas and underpinning those are some obvious things that we recognise in our business, my business, that Page 4 John Swannick drive those fundamental factors and we believe for many businesses they will be the sorts of ESG, the sort of corporate responsibility KPIs if you like, which will therefore in that articulation will be directly linked to financial drivers. And if those stories that leadership, that strategy, which is the most obvious perception that investors have of a company’s non financial performance, if as articulated as part of that link to leadership and strategy businesses can make the links that they do internally all the time – as we have said these things are in the commonly used management models – if they are externally articulated then when that is happening more and more often the investment community are going to stand up and say actually we recognise this. As obviously many of them already do. HS So basically, the pitches to the investment community saying basically it is all about good management and sense to CSR and it’s an indicator of future success. JS Well, at the end of the day non financial performance is financial performance tomorrow. And what is underpinning that non financial performance we believe in large, or in the main part, is driven by a whole range of factors, many of which we would see as corporate responsibility. HS So probably you personally started this journey and this research as being at Lloyds TSB responsible for that area two years ago. If you look back … JS No, it’s much longer than that. We have worked towards meeting or reaching this end conclusion for some years because our corporate responsibility work over seven or eight years has been largely fostered by our Deputy Chief Executive who wanted initially to understand the drivers that we could use across the business to link what we are doing in the corporate responsibility realm to understandable, understood concepts within the business because it is important that it links with peoples’ understanding and their personal values and the business values. HS That is why I wanted to hook in because I think our students here at Cranfield would be interested – what were your personal learning’s and if you would have known the travel of the eight years when you were still at business school, what should you have done? What should you have studied? What concepts should you have looked at before in order to prepare yourself better or leapfrog some of the development? JS I think the key learning in that respect is to say that actually there is clearly in my view – and this work is simply bringing together in one place – the obvious conclusion that there is a business case for corporate responsibility because in my view I don’t think corporate responsibility is entirely new. I think it is just about doing business better and more effectively and improved allocation of resourced based on a much deeper Page 5 John Swannick and richer understanding of the external drivers and the internal drivers of business that exist because of the relationship with a broad range of stakeholders. And if you look at it in that way and simply, as we have done in Lloyds TSB, bind that into existing business strategies and management processes and use those as vehicles for embedding this, then it’s not creating a whole new paradigm, this is actually about making those systems and processes work better. And a part of that clearly is engaging with people, engaging people internally and externally, but certainly from the work we have about meeting the expectations of our employees, about the increasing demands and expectations of our customers and in doing those things actually delivering value for the business. At the end of the day that is what we are here for. Page 6