Estimation of Frequency in SCLM Models

advertisement

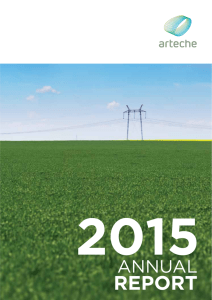

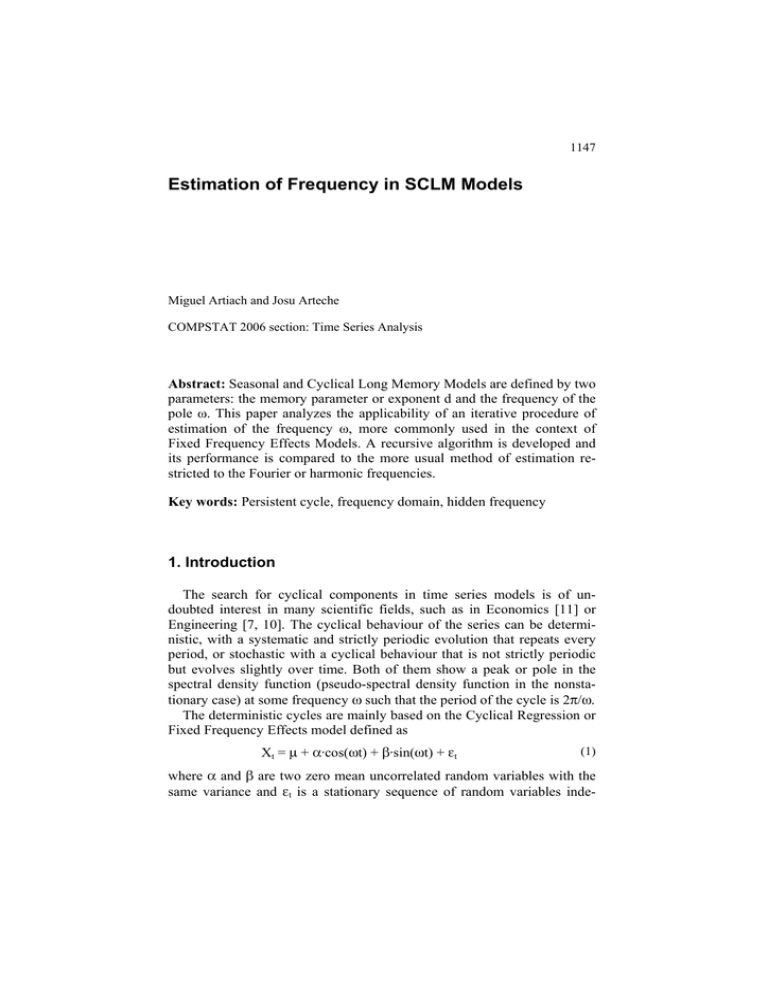

1147 Estimation of Frequency in SCLM Models Miguel Artiach and Josu Arteche COMPSTAT 2006 section: Time Series Analysis Abstract: Seasonal and Cyclical Long Memory Models are defined by two parameters: the memory parameter or exponent d and the frequency of the pole ω. This paper analyzes the applicability of an iterative procedure of estimation of the frequency ω, more commonly used in the context of Fixed Frequency Effects Models. A recursive algorithm is developed and its performance is compared to the more usual method of estimation restricted to the Fourier or harmonic frequencies. Key words: Persistent cycle, frequency domain, hidden frequency 1. Introduction The search for cyclical components in time series models is of undoubted interest in many scientific fields, such as in Economics [11] or Engineering [7, 10]. The cyclical behaviour of the series can be deterministic, with a systematic and strictly periodic evolution that repeats every period, or stochastic with a cyclical behaviour that is not strictly periodic but evolves slightly over time. Both of them show a peak or pole in the spectral density function (pseudo-spectral density function in the nonstationary case) at some frequency ω such that the period of the cycle is 2π/ω. The deterministic cycles are mainly based on the Cyclical Regression or Fixed Frequency Effects model defined as Xt = μ + α·cos(ωt) + β·sin(ωt) + εt (1) where α and β are two zero mean uncorrelated random variables with the same variance and εt is a stationary sequence of random variables inde- 1148 pendent of α and β. Once the initial conditions have been fixed and for any α and β, this model exhibits a periodic behaviour that remains constant over time. In this case, the cyclical component can be more or less clear depending on the sizes of the variance of α and β relative to that of εt. This model only shows a cycle at frequency ω but can be easily extended by simple addition of other cycles. For the stochastic cycles, it is well known that the autoregressive AR(2) process (1 - φ1L - φ2L2) Xt = εt (2) for εt ∼ iid(0,σ2) and L the lag-shift operator, displays a quasi-periodic behaviour when the roots of the polynomial (1-φ1y-φ2y2) are complex, which implies φ2<-(φ1)2/4. However, contrary to the fixed frequency effects model, the cyclical pattern of this process fades out over time. This difference turns up clearly in the frequency domain. Whereas the fixed frequency effects model possesses a spectral distribution function with a jump at frequency ω, the autoregressive AR(2) process shows a continuous spectral density function with a peak at frequency ω=cos-1[- φ1(1-φ2)/4φ2]. Between these two extreme categories there is scope for a class of intermediate models whose periodic behaviour is more persistent than that of the AR(2) processes but at the same time does not remain constant over time. Here the cyclical behaviour of the model exhibits a certain degree of memory or persistence, but this memory does not imply a constant recurrence of the cycle but evolves slightly over time. These are the SCLM (Seasonal and Cyclical Long Memory) models in the terminology of Arteche & Robinson [3], which are characterized by a spectral or pseudospectral (in the nonstationary case) density function satisfying f x (λ + ω) ≈ C λ (3) −2 d as λ → 0, around some frequency ω∈(0,π] and for C a finite constant. If d>0 the spectral density function diverges at ω showing a persistent cyclical behaviour. (If d<0 it would display a zero with an antipersistent behaviour). The main example of parametric SCLM models are the GARMA (Generalized AutoRegressive Mean Average) models of Gray et al. [8]. The simplest form of the model is the GARMA (0,d,0) defined as (1 − 2L cos ω + L ) X 2 d t = εt (4) where εt is iid(0,σ2). It can be generalized to GARMA(p,d,q) by simply allowing εt to be an ARMA(p,q) process. These processes are stationary for 1149 d<0.5 and mean reverting for d<1. The case d=1 implies a cyclical unit root. Its spectral or pseudospectral density function is f x (λ) = [2(cos ω − cos λ )] −2d f ε (λ ) (5) which behaves around ω as in Eq. (3). These models assume a symmetric behaviour of the spectral density function around ω, but although this happens for ω=0,π, it is not necessarily true at any other frequency 0<ω<π as noted by Arteche and Robinson [4] and Arteche [2], permitting an asymmetric long memory behaviour with different memory parameters on the right and left of ω. The recent interest in these models has focused mainly on the estimation of the memory parameter d in the case of a known ω. This situation is common in seasonal series, but with any other type of cyclical behaviour the frequency ω of the cycle needs to be estimated. This has received recent attention by authors like Yajima [12] or Hidalgo and Soulier [9]. Yajima [12] considers that the best estimator of ω is the argument that maximizes the periodogram. The periodogram is the sampling correlative of the density function and can be defined as I(λ ) = (2πT ) −1 2 T ∑ Xte iλ t (6) t =1 where Xt is the time series and T the sample size. He proves Tαconsistency under gaussianity for α ∈ (0,1). Hidalgo and Soulier [9] focuses on the maximizer of the periodogram at Fourier frequencies λj = 2πj/T such that the estimator of ω is ˆT = ω 2π arg max I T λ j T 1≤ j≤ ñ ( ) (7) where j = 1, ..., ñ, and ñ = [(T-1)/2]. They prove that this estimator is TvT-1 –consistent for vT satisfying lim v T−2ν log(T ) = 0 with ν ∈ (0,1/2) T →∞ However, they restrict the candidate values of ω̂ T to the Fourier frequencies. Considering that the spectral density function of SCLM processes is continuous and displays a pole around ω, the Fourier frequency that maximizes the periodogram can be relatively far from the real ω, especially if the sample size is small, leading to erroneous conclusions about the cyclical nature of the data. In this paper we consider an iterative proce- 1150 dure that does not restrict to the Fourier frequencies but allows a wider range of possibilities for ω̂ T . The procedure is described in Section 2. Section 3 analyzes the finite sample performance of the procedures via Monte Carlo and finally Section 4 shows an empirical application to the wellknown sunspots data. 2. Iterative Estimation of Frequency The estimation procedure we propose is based on Ebner et al. [7]. It starts by calculating the periodogram just for the Fourier frequencies, with low computational cost, and then widens the range of frequencies in an iterative way. The procedure entails the following steps: 1. Initial estimation: Let ω̂(j0) be the Fourier frequency that maximizes the periodogram. 2. Recursive Refinement: ˆ (ji−1) a) Select the previous and following evaluated frequencies to ω ˆ (ji−−11) y ω ˆ (ji+−11) . (where i = 1, ... is the number of iteration), ω b) Refine the range of frequencies for which the periodogram is calculated by defining λ r = 2πr T ⋅ 10i where r covers the integers between (j - 1)×10 and (j + 1)×10. The result is that 20 frequency ˆ (ji−−11) , ω ˆ (ji+−11) ] where values are evaluated in the same interval [ ω only three had been in the former iteration. c) Select the new frequency where the periodogram reaches its maximum. Let ω̂ (ji ) be this frequency. ˆ (ji ) − ω ˆ (ji −1) > δ , where δ is a predetermined stopping criterion, d) If ω ˆ (ji ) − ω ˆ (ji −1) ≤ δ the algorithm stops and ω̂ (ji ) is go back to (a). If ω the best estimation of ω. Iterative algorithms have been extensively used to estimate the hidden frequency in Fixed Frequency Effects models. All these strategies are supported by the development of asymptotical properties concerning the maximum of the periodogram, as can be seen in An et al. [1], Chen [5] or more recently Davies and Mikosch [6]. These papers coincide in the great stability of the maximum of the periodogram, which supports our choice as point estimator of the ω parameter. 1151 3. Monte Carlo Analysis In order to assess the applicability of these strategies to SCLM models we generated a number of series with different sample sizes, memory parameters, and periods of the cycle. For this purpose we used the method described by Arteche and Robinson [4], for the GARMA (0,d,0) model based on standard normal innovations. Overall, two different sample sizes, T=75 and T=150, were employed, together with four memory parameters d1=0.2, d2=1/3, d3=0.45 (stationary series) and d4=0.8 (nonstationary and mean-reverting series). Four frequencies were used for each sample size, two extreme frequencies (near 0 and π) and two other frequencies in between. They are displayed in table 1. Table 1. Frequencies for the Monte Carlo analysis ω175 = 2π2.5 75 = 0.2094395 ω150 = 2π4.5 150 = 0.1884956 1 ω75 2 = 2π17.5 75 = 1.4660766 ω150 2 = 2π34.5 150 = 1.4451326 ω375 = 2π27.5 75 = 2.3038346 ω150 3 = 2π55.5 150 = 2.3247786 ω75 4 = 2π36.5 75 = 3.0578168 ω150 4 = 2π73.5 150 = 3.0787608 The frequencies were chosen equidistantly between two consecutive harmonic frequencies with the purpose of assessing the ability of the iterative procedure to estimate the real value of ω. Considering only Fourier frequencies, an estimation error of at least ±2π0.5/T would be expected. This provides the benchmark to show the improvement of the final estimate. A bias of the estimator smaller than this value indicates that the iterative estimate overcomes significantly its initial (Fourier) value. 1000 samples were generated in every situation resulting from the combination of the frequencies and memory parameters, summing up to a total amount of 32000 samples. In order to evaluate the improvement of the iterative Maximum of the Periodogram (MP) technique over the Fourier frequency based (FF) estimate we compare the Root Mean Squared Errors (RMSE) calculated as (8) ˆ ) = VAR (ω ˆ ) + BIAS(ω ˆ) RMSE (ω 2 1 1 ˆ)= ˆ)= ω ˆ − ω , VAR (ω BIAS(ω ∑ [ωˆ − ωˆ ] 1000 2 i i =1 1000 ˆ = 1000 and ω ∑ ωˆ i i =1 1000 . 1152 As can be seen in table 2, the MP technique gives a smaller bias in almost every situation. They also show that the technique is more appropriate for non-extreme frequencies and to some extent fails in the estimation of frequencies near 0 or π where larger biases can occur, mainly with low d. Another statement that can be made is that the accuracy increases with the value of d, the memory parameter. The biases of the higher values d3 and d4 are generally smaller than those of d1. Table 2. Biases ω1 ω2 ω3 T=75 d1 = 0.2 0.0737369 0.0093099 -0.0055839 d2 = 1/3 -0.0011136 -0.0045737 0.0260057 d3 = 0.45 -0.0070675 0.0005373 0.0096694 d4 = 0.8 -0.0014546 0.0003797 0.0005634 In bold the cases with BIAS < 2π0.5/75 = 0.041887902 ω4 -0.0906098 -0.0077746 0.0014576 0.0018661 ω1 ω2 ω3 T=150 d1 = 0.2 -0.0234916 -0.0210249 0.0053823 d2 = 1/3 -0.0076019 0.0018983 0.0147125 d3 = 0.45 -0.0062359 -0.0000236 0.0041530 d4 = 0.8 -0.0001110 0.0000686 -0.0006492 In bold the cases with BIAS < 2π0.5/150 = 0.02094395 ω4 0.0219145 0.0032140 0.0045838 0.0009000 Table 3. Roots of Mean Square Errors T=150 T=75 ω1 ω2 MP 0.27555 0.45497 d1 = 0.2 FF 0.27536 0.45660 MP 0.08288 0.19282 d2 = 1/3 FF 0.08588 0.19521 MP 0.05217 0.08795 d3 = 0.45 FF 0.06098 0.09485 MP 0.01264 0.00947 d4 = 0.8 FF 0.04255 0.04188 MP 0.19127 0.33152 d1 = 0.2 FF 0.19174 0.33170 MP 0.05858 0.10968 d2 = 1/3 FF 0.05985 0.11069 MP 0.03401 0.05513 d3 = 0.45 FF 0.03771 0.14883 MP 0.00826 0.00750 d4 = 0.8 FF 0.02185 0.02153 In bold the cases with RMSEMP < RMSEFF. ω3 0.38843 0.38891 0.16150 0.16458 0.08902 0.09697 0.00963 0.04222 0.28258 0.28475 0.10021 0.10131 0.04845 0.05153 0.00836 0.02169 ω4 0.29521 0.29528 0.06721 0.07022 0.03904 0.04870 0.01364 0.04188 0.10418 0.10480 0.03543 0.03790 0.02550 0.02986 0.00759 0.02128 1153 Similar conclusions can be drawn from the RMSEs (table 3). As expected the MP technique is more accurate than the FF technique in almost every situation, and the improvement is more significant as d increases. For example, for d4=0.8, central ω and T=75 the RMSE of the MP estimates is less than one fourth the RMSE of the FF estimates. 4. Empirical Application. Iterative Estimation of the First Frequency of the Sunspots Series. The sunspots series is well known and has been re-analyzed by many authors. This series comprises monthly measurements of the sunspots from 1749 to 1983, displayed in the figure 1. 250 Sunspots 200 150 100 50 0 0 200 400 600 800 1000 1200 1400 1600 1800 2000 2200 2400 2600 2800 Months Fig. 1. Sunspots series According to the FF technique the frequency with the largest periodogram value is ωFF1=0.04678968, which corresponds to a period τFF1=134.2857, that is 11 years, 2 months, 8 days, 13 hours and 42 minutes. The exact periodogram value at this frequency is I(ωFF1)=1087290.33. Taking this frequency as the first step, we apply the iterative procedure of estimation with a result of ωMP1=0.0472674, or τMP1=132.9285, a period of 11 years, 27 days, 20 hours and 32 minutes. A reduction of around 1.5 months takes place. The periodogram value is in this case I(ωMP1)=1253648.68, with an increment of 166358.35 points. 1154 References [1] An, H.Z., Chen, Z.G., Hannan, E.J.: The Maximum of the Periodogram. J of Multivariate Analysis 13:383–400 (1983) [2] Arteche, J.: Semiparametric robust tests on seasonal or cyclical long memory time series. J Time Series Analysis 23, 251–285 (2002) [3] Arteche, J., Robinson, P.M.: Seasonal and cyclical long memory. In Asymptotics, Nonparametrics and Time Series (ed. S. Ghosh). New York: Marcel Dekker, Inc (1999) [4] Arteche, J., Robinson, P.M.: Semiparametric Inference in Seasonal and Cyclical Long Memory Processes. J Time Series Analysis 21, 1–25 (2000) [5] Chen, Z.G.: An alternative consistent Procedure for Detecting Hidden Frequencies. J Time Series Analysis 9, 301–317 (1988) [6] Davis, R.A., Mikosch, T.: The maximum of the periodogram of a nongaussian sequence. Annals of Probability 27-1, 522–536 (1999) [7] Ebner, A., Rohling, H., Halfmann, R., Lott, M.: Synchronization in ad hoc networks based on UTRA TDD. Proceedings of the 13th IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (2002) [8] Gray, H.L., Zhang, N.F., Woodward, W.A.: On generalized fractional processes. J Time Series Analysis 10, 233–257 (2002) [9] Hidalgo, J., Soulier, P.: Estimation of the location and exponent of the spectral singularity of a long memory process. J Time Series Analysis 25, 55–81 (2004) [10]Hinich, M.J.: Detecting a Hidden Periodic Signal when its Period is Unknown. IEEE Transactions on Acoustic, Speech and Signal Processing 30, 747–750 (1982) [11]Reiter, M., Woitek, U.: Are There Classical Business Cycles? UPF Working Paper (1999) [12]Yajima, Y.: Estimation of the frequency of unbounded spectral densities. Proceedings of the Business and Economic Statistical Section. American Statistical Association (1996) Address: M. Artiach, Departamento de Economía Aplicada III, Universidad del País Vasco, Bilbao, Bizkaia, Spain, mmartiach@yahoo.es J. Arteche, Departamento de Economía Aplicada III, Universidad del País Vasco, Bilbao, Bizkaia, Spain, josu.arteche@ehu.es