Rio Hondo Community College District Financial Statements and Supplementary Information

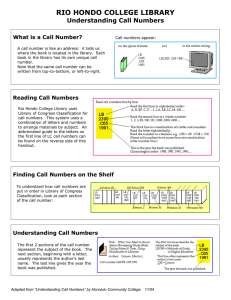

advertisement