23-Jul-12 PRELIMINARY RESULTS

23-Jul-12 PRELIMINARY RESULTS http://www.taxpolicycenter.org

Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups.

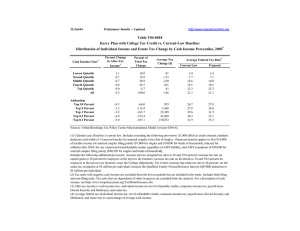

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile, 2013

1

Summary Table

Income Percentile

2,3

Tax Units with Tax Increase or Cut 4

Units

With Tax Cut

Pct of Tax

Avg Tax Cut

With Tax Increase

Pct of Tax

Units

Avg Tax

Increase

Percent

Change in

After-Tax

Income

5

Share of

Total

Federal Tax

Change

Average

Federal Tax

Change ($)

Average Federal Tax Rate

Change (%

Points) Proposal

6

Under the

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

23.1

75.5

92.8

98.7

99.5

71.9

99.6

99.5

99.1

99.2

99.6

-320

-736

-1,197

-2,254

-9,565

-2,916

-4,179

-5,448

-10,870

-78,634

-398,184

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

0

0

0

0

0

0

0.6

1.7

2.1

2.6

4.2

3.1

3.3

3.2

3.8

6.1

7.0

1.0

6.2

10.7

17.1

65.0

100.0

14.4

9.3

14.4

26.9

14.2

-74

-554

-1,098

-2,194

-9,183

-2,042

-4,069

-5,272

-10,132

-75,644

-391,081

-0.6

-1.5

-1.7

-2.1

-3.1

-2.5

-2.6

-2.5

-2.9

-4.2

-4.7

4.0

9.2

14.0

16.3

22.4

17.9

18.4

19.5

21.9

27.9

29.0

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

Number of AMT Taxpayers (millions). Baseline: 21.7 Proposal: 4.0

* Less than 0.05

** Insufficient data

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others

($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of

$10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2012 dollars): 20% $24,125; 40% $48,424; 60% $80,181; 80% $133,185; 90% $180,192; 95% $252,055; 99% $596,998; 99.9% $2,858,701.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile, 2013

1

Detail Table

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

23.1

75.5

92.8

98.7

99.5

71.9

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

Average Federal Tax Change

Dollars Percent

0.6

1.7

2.1

2.6

4.2

3.1

1.0

6.2

10.7

17.1

65.0

100.0

-74

-554

-1,098

-2,194

-9,183

-2,042

-12.1

-14.2

-11.0

-11.4

-12.3

-12.1

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

0.0

-0.1

0.2

0.1

-0.2

0.0

1.0

5.1

12.0

18.2

63.6

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-0.6

-1.5

-1.7

-2.1

-3.1

-2.5

4.0

9.2

14.0

16.3

22.4

17.9

99.6

99.5

99.1

99.2

99.6

0.0

0.0

0.0

0.0

0.0

3.3

3.2

3.8

6.1

7.0

14.4

9.3

14.4

26.9

14.2

-4,069

-5,272

-10,132

-75,644

-391,081

-12.4

-11.4

-11.7

-13.0

-13.9

-0.1

0.1

0.1

-0.3

-0.3

14.0

9.9

14.9

24.8

12.1

-2.6

-2.5

-2.9

-4.2

-4.7

18.4

19.5

21.9

27.9

29.0

Baseline Distribution of Income and Federal Taxes by Income Percentile, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

41,971

35,970

31,622

25,162

22,869

158,260

11,472

5,670

4,576

1,151

117

26.5

22.7

20.0

15.9

14.5

100.0

7.3

3.6

2.9

0.7

0.1

13,406

36,245

63,644

104,502

292,311

83,068

155,802

210,881

351,008

1,820,417

8,392,360

4.3

9.9

15.3

20.0

50.9

100.0

13.6

9.1

12.2

15.9

7.5

616

3,895

9,998

19,266

74,718

16,925

32,783

46,316

86,936

583,942

2,820,368

1.0

5.2

11.8

18.1

63.8

100.0

14.0

9.8

14.9

25.1

12.4

12,790

32,351

53,646

85,236

217,592

66,143

123,019

164,565

264,072

1,236,475

5,571,992

5.1

11.1

16.2

20.5

47.5

100.0

13.5

8.9

11.5

13.6

6.2

4.6

10.8

15.7

18.4

25.6

20.4

21.0

22.0

24.8

32.1

33.6

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

Number of AMT Taxpayers (millions). Baseline: 21.7 Proposal: 4.0

* Less than 0.05

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2012 dollars): 20%

$24,125; 40% $48,424; 60% $80,181; 80% $133,185; 90% $180,192; 95% $252,055; 99% $596,998; 99.9% $2,858,701.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

21.0

63.3

88.4

98.1

99.1

71.9

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

Average Federal Tax Change

Dollars Percent

1.0

2.1

2.0

2.4

4.0

3.1

1.3

6.3

9.5

16.3

66.5

100.0

-123

-623

-990

-1,769

-7,313

-2,042

-44.9

-21.2

-12.4

-10.9

-11.7

-12.1

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.1

-0.4

0.0

0.3

0.3

0.0

0.2

3.2

9.3

18.4

68.8

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-1.0

-1.9

-1.8

-2.0

-3.0

-2.5

1.2

7.1

12.4

16.2

22.3

17.9

99.1

99.4

99.0

98.7

99.5

0.0

0.0

0.0

0.0

0.0

2.7

3.0

3.6

6.2

7.1

13.0

9.8

15.1

28.6

14.9

-2,868

-4,228

-8,313

-67,370

-347,313

-10.4

-10.5

-11.2

-13.3

-14.0

0.3

0.2

0.2

-0.4

-0.3

15.3

11.5

16.3

25.7

12.6

-2.2

-2.3

-2.8

-4.2

-4.7

18.5

19.9

21.7

27.7

29.0

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

34,769

32,569

31,107

29,758

29,391

158,260

14,652

7,515

5,851

1,373

139

22.0

20.6

19.7

18.8

18.6

100.0

9.3

4.8

3.7

0.9

0.1

12,518

32,468

56,462

89,808

247,408

83,068

133,237

181,507

302,672

1,590,841

7,397,802

3.3

8.0

13.4

20.3

55.3

100.0

14.9

10.4

13.5

16.6

7.8

275

2,935

7,995

16,308

62,482

16,925

27,472

40,338

74,044

507,982

2,488,836

0.4

3.6

9.3

18.1

68.6

100.0

15.0

11.3

16.2

26.0

12.9

12,244

29,534

48,467

73,500

184,926

66,143

105,765

141,169

228,629

1,082,858

4,908,967

4.1

9.2

14.4

20.9

51.9

100.0

14.8

10.1

12.8

14.2

6.5

2.2

9.0

14.2

18.2

25.3

20.4

20.6

22.2

24.5

31.9

33.6

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

Number of AMT Taxpayers (millions). Baseline: 21.7 Proposal: 4.0

* Less than 0.05

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90% $109,140;

95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table - Single Tax Units

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

14.2

52.1

89.6

97.9

98.6

60.0

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

0.3

1.0

1.2

1.5

4.9

2.6

0.9

5.5

8.3

13.8

71.4

100.0

Average Federal Tax Change

Dollars Percent

-27

-212

-407

-791

-5,734

-909

-4.5

-8.6

-6.4

-6.3

-13.3

-10.3

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

0.1

0.1

0.6

1.0

-1.9

0.0

2.1

6.8

14.0

23.7

53.3

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-0.3

-0.9

-1.0

-1.2

-3.6

-2.0

5.8

9.2

14.4

18.5

23.4

17.8

98.4

98.9

98.8

98.4

99.5

0.0

0.0

0.0

0.0

0.0

2.5

3.6

5.4

9.2

8.8

12.0

11.1

19.4

28.9

13.1

-1,832

-3,558

-8,313

-64,144

-293,263

-8.7

-11.2

-15.1

-16.9

-15.2

0.3

-0.1

-0.7

-1.3

-0.5

14.4

10.1

12.5

16.3

8.4

-2.0

-2.7

-4.0

-6.0

-5.6

20.6

21.8

22.4

29.2

31.1

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

21,632

17,103

13,372

11,409

8,154

72,035

4,293

2,037

1,529

295

29

30.0

23.7

18.6

15.8

11.3

100.0

6.0

2.8

2.1

0.4

0.0

9,749

24,450

41,483

64,084

159,695

44,475

93,366

129,733

208,423

1,078,755

5,264,934

6.6

13.1

17.3

22.8

40.7

100.0

12.5

8.3

9.9

9.9

4.8

587

2,468

6,388

12,636

43,054

8,834

21,023

31,866

54,987

378,876

1,930,527

2.0

6.6

13.4

22.7

55.2

100.0

14.2

10.2

13.2

17.6

8.9

9,162

21,982

35,095

51,449

116,641

35,641

72,343

97,867

153,436

699,879

3,334,408

7.7

14.6

18.3

22.9

37.1

100.0

12.1

7.8

9.1

8.1

3.8

6.0

10.1

15.4

19.7

27.0

19.9

22.5

24.6

26.4

35.1

36.7

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

* Less than 0.05

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90%

$109,140; 95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table - Married Tax Units Filing Jointly

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

29.8

66.5

83.7

98.1

99.5

85.5

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

2.1

2.8

2.3

2.7

3.8

3.3

0.8

4.0

8.0

16.7

70.5

100.0

Average Federal Tax Change

Dollars Percent

-366

-1,145

-1,443

-2,472

-8,091

-3,732

-72.9

-29.7

-15.8

-13.0

-11.4

-12.3

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.1

-0.3

-0.3

-0.1

0.8

0.0

0.0

1.3

5.9

15.7

76.9

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-2.0

-2.6

-2.0

-2.2

-2.8

-2.6

0.8

6.1

10.8

15.0

22.0

18.7

99.4

99.7

99.6

99.4

99.6

0.0

0.0

0.0

0.0

0.0

2.7

2.8

3.3

5.8

6.8

14.0

10.3

15.4

30.7

16.3

-3,355

-4,540

-8,524

-68,138

-361,562

-11.0

-10.4

-10.5

-12.6

-13.8

0.2

0.3

0.4

-0.1

-0.2

15.9

12.5

18.5

30.0

14.4

-2.2

-2.2

-2.5

-4.0

-4.6

17.7

19.3

21.5

27.4

28.6

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

5,058

7,907

12,517

15,281

19,753

60,744

9,475

5,151

4,104

1,022

102

8.3

13.0

20.6

25.2

32.5

100.0

15.6

8.5

6.8

1.7

0.2

18,078

44,396

71,333

110,309

286,327

142,360

152,668

203,608

340,075

1,726,181

7,928,538

1.1

4.1

10.3

19.5

65.4

100.0

16.7

12.1

16.1

20.4

9.4

501

3,861

9,114

19,011

70,995

30,324

30,439

43,811

81,475

541,790

2,629,493

0.1

1.7

6.2

15.8

76.1

100.0

15.7

12.3

18.2

30.1

14.6

17,576

40,535

62,219

91,298

215,332

112,036

122,229

159,797

258,600

1,184,391

5,299,045

1.3

4.7

11.4

20.5

62.5

100.0

17.0

12.1

15.6

17.8

8.0

2.8

8.7

12.8

17.2

24.8

21.3

19.9

21.5

24.0

31.4

33.2

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

* Less than 0.05

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90%

$109,140; 95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table - Head of Household Tax Units

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

33.6

85.1

96.7

99.4

99.1

71.9

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

1.3

2.8

2.6

2.3

3.1

2.5

7.7

30.1

25.8

16.9

19.5

100.0

Average Federal Tax Change

Dollars Percent

-231

-997

-1,320

-1,619

-4,471

-1,020

30.1

-34.3

-14.0

-9.7

-9.2

-15.8

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-2.2

-3.1

0.6

2.0

2.6

0.0

-6.3

10.8

29.8

29.4

36.1

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-1.4

-2.6

-2.2

-1.9

-2.3

-2.2

-6.0

4.9

13.4

17.3

22.7

11.4

98.8

99.9

99.3

98.6

99.7

0.0

0.0

0.0

0.0

0.0

2.2

2.4

2.7

6.0

6.8

6.0

2.6

3.6

7.3

3.9

-2,161

-3,160

-5,458

-61,977

-335,273

-7.8

-8.0

-8.0

-12.6

-13.5

1.2

0.5

0.7

0.4

0.1

13.3

5.6

7.8

9.6

4.7

-1.7

-1.8

-2.0

-4.0

-4.5

20.2

21.0

23.3

28.0

28.9

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

7,853

7,113

4,602

2,452

1,028

23,101

652

193

156

28

3

34.0

30.8

19.9

10.6

4.5

100.0

2.8

0.8

0.7

0.1

0.0

16,583

38,657

60,601

86,842

194,442

47,399

126,141

171,752

268,596

1,532,857

7,432,229

11.9

25.1

25.5

19.4

18.3

100.0

7.5

3.0

3.8

3.9

1.9

-768

2,903

9,436

16,652

48,527

6,443

27,682

39,280

67,907

491,160

2,479,677

-4.1

13.9

29.2

27.4

33.5

100.0

12.1

5.1

7.1

9.2

4.6

17,350

35,754

51,165

70,190

145,915

40,956

98,459

132,472

200,689

1,041,697

4,952,552

14.4

26.9

24.9

18.2

15.9

100.0

6.8

2.7

3.3

3.1

1.4

-4.6

7.5

15.6

19.2

25.0

13.6

22.0

22.9

25.3

32.0

33.4

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

* Less than 0.05

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90%

$109,140; 95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table - Tax Units with Children

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

37.0

89.7

98.2

99.7

99.7

83.8

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

1.9

3.6

3.2

3.4

4.0

3.6

2.4

10.0

13.4

21.6

52.5

100.0

Average Federal Tax Change

Dollars Percent

-343

-1,434

-2,041

-3,337

-9,461

-3,069

38.7

-39.2

-17.4

-14.6

-11.5

-14.2

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

-0.5

-1.1

-0.4

-0.1

2.1

0.0

-1.4

2.6

10.5

20.9

67.3

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-2.0

-3.3

-2.7

-2.8

-3.0

-2.9

-7.1

5.0

12.7

16.2

22.9

17.4

99.9

99.8

99.4

99.3

99.7

0.0

0.0

0.0

0.0

0.0

3.2

3.2

3.3

6.0

6.8

13.0

7.4

10.3

21.9

10.8

-4,334

-5,978

-9,790

-79,879

-418,441

-11.8

-10.8

-9.8

-12.5

-13.4

0.4

0.4

0.8

0.5

0.1

16.0

10.1

15.8

25.5

11.5

-2.5

-2.5

-2.5

-4.0

-4.5

18.7

20.3

22.8

28.3

29.1

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

10,614

10,772

10,131

9,943

8,545

50,150

4,601

1,899

1,624

421

40

21.2

21.5

20.2

19.8

17.0

100.0

9.2

3.8

3.2

0.8

0.1

17,423

44,074

75,908

120,141

319,974

106,480

172,811

242,779

396,122

1,981,464

9,255,195

3.5

8.9

14.4

22.4

51.2

100.0

14.9

8.6

12.1

15.6

6.9

-885

3,657

11,703

22,813

82,640

21,587

36,644

55,227

100,059

641,347

3,115,188

-0.9

3.6

11.0

21.0

65.2

100.0

15.6

9.7

15.0

25.0

11.4

18,308

40,417

64,205

97,327

237,334

84,892

136,167

187,552

296,063

1,340,117

6,140,007

4.6

10.2

15.3

22.7

47.6

100.0

14.7

8.4

11.3

13.3

5.7

-5.1

8.3

15.4

19.0

25.8

20.3

21.2

22.8

25.3

32.4

33.7

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

* Less than 0.05

Note: Tax units with children are those claiming an exemption for children at home or away from home.

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90%

$109,140; 95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.

23-Jul-12

Income Percentile

2,3

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

PRELIMINARY RESULTS

Table T12-0164

S. 3413 The Tax Hike Prevention Act of 2012

Senate Republican Proposal to Extend 2001-3 Tax Cuts and 2011 Estate Tax Law

Baseline: Current Law

Distribution of Federal Tax Change by Income Percentile Adjusted for Family Size, 2013

1

Detail Table - Elderly Tax Units

Percent of Tax Units

4

With Tax Cut

With Tax

Increase

0.7

10.4

66.3

93.9

98.0

51.2

0.0

0.0

0.0

0.0

0.0

0.0

Percent Change in After-Tax

Income

5

Share of Total

Federal Tax

Change

0.1

0.2

0.9

1.9

5.3

3.3

0.1

0.7

4.2

10.7

84.3

100.0

Average Federal Tax Change

Dollars Percent

-9

-61

-400

-1,331

-9,632

-2,108

-5.8

-9.2

-13.0

-14.0

-16.9

-16.2

Share of Federal Taxes

Change (%

Points)

Under the

Proposal

0.0

0.1

0.2

0.3

-0.7

0.0

0.2

1.4

5.4

12.8

80.1

100.0

http://www.taxpolicycenter.org

Average Federal Tax Rate

6

Change (%

Points)

Under the

Proposal

-0.1

-0.2

-0.8

-1.6

-4.0

-2.7

1.1

2.2

5.4

10.1

19.8

14.0

97.1

98.9

98.8

99.1

99.5

0.0

0.0

0.0

0.0

0.0

3.1

4.1

5.6

7.8

8.0

12.7

12.2

22.8

36.5

17.0

-3,110

-5,477

-11,805

-73,386

-354,869

-15.7

-17.0

-18.4

-16.6

-15.6

0.1

-0.1

-0.5

-0.1

0.1

13.2

11.5

19.7

35.7

17.8

-2.6

-3.3

-4.3

-5.3

-5.3

13.8

16.2

19.0

26.6

28.5

Baseline Distribution of Income and Federal Taxes by Income Percentile Adjusted for Family Size, 2013

1

Income Percentile

2,3

Tax Units

4

Number

(thousands)

Percent of

Total

Pre-Tax Income

Average

(dollars)

Percent of

Total

Federal Tax Burden

Average

(dollars)

Percent of

Total

After-Tax Income

5

Average

(dollars)

Percent of

Total

Average

Federal Tax

Rate

6

Lowest Quintile

Second Quintile

Middle Quintile

Fourth Quintile

Top Quintile

All

Addendum

80-90

90-95

95-99

Top 1 Percent

Top 0.1 Percent

6,267

8,703

7,722

5,946

6,478

35,135

3,034

1,643

1,433

369

35

17.8

24.8

22.0

16.9

18.4

100.0

8.6

4.7

4.1

1.1

0.1

12,469

26,837

50,187

81,150

238,690

77,552

120,467

165,797

276,973

1,387,789

6,729,710

2.9

8.6

14.2

17.7

56.8

100.0

13.4

10.0

14.6

18.8

8.7

146

660

3,092

9,544

56,877

12,981

19,762

32,267

64,309

443,145

2,275,237

0.2

1.3

5.2

12.4

80.8

100.0

13.2

11.6

20.2

35.8

17.7

12,323

26,177

47,095

71,606

181,813

64,571

100,705

133,531

212,665

944,643

4,454,473

3.4

10.0

16.0

18.8

51.9

100.0

13.5

9.7

13.4

15.4

7.0

1.2

2.5

6.2

11.8

23.8

16.7

16.4

19.5

23.2

31.9

33.8

Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0412-3).

* Less than 0.05

Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older.

(1) Calendar year. Baseline is current law. Proposal would a) increase the AMT exemption amounts to $79,850 for married couples filing a joint return, $51,150 for others ($39,925 for married individuals filing a separate return) and allow non-refundable credits against tentative AMT; b) extend the 2001 and 2003 tax cuts, including statutory marginal tax rates on ordinary income; repeal of limitation on itemized deductions (Pease) and the phase-out of personal exemptions (PEP); marriage penalty relief for the standard deduction, earned income tax credit, and 15 percent bracket; $1,000 per child amount for the child tax credit and partial refundability based on earnings in excess of $10,000, indexed for inflation; expansion of child and dependent care tax credit; and the 0%/15% rate structure on capital gains and qualified dividends. Proposal would extend the top estate tax rate of 35 percent and an effective exemption of $5 million, indexed for inflation. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270

(2) Tax units with negative income are excluded from the lowest income class but are included in the totals. For a description of income, see http://www.taxpolicycenter.org/TaxModel/income.cfm

(3) The income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2012 dollars): 20% $16,596; 40% $31,921; 60% $50,160; 80% $78,784; 90%

$109,140; 95% $150,645; 99% $349,271; 99.9% $1,697,732.

(4) Includes both filing and non-filing units but excludes those that are dependents of other tax units.

(5) After-tax income is income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax.

(6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average income.