18-Feb-10 PRELIMINARY RESULTS Percent Change in

advertisement

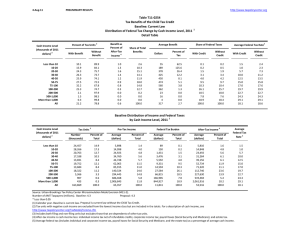

18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 0.0 0.0 0.0 0.1 0.5 0.9 5.7 13.4 36.0 22.9 15.6 3.7 With Tax Increase 69.3 68.2 79.6 86.0 88.4 90.5 90.4 83.9 62.6 74.9 82.3 79.9 1 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change Average Federal Tax Change ($) -12.2 -9.5 -7.9 -6.0 -4.7 -4.0 -3.6 -2.6 -0.9 -2.1 -3.5 -3.8 4.3 11.1 11.5 9.3 6.9 13.3 11.3 16.2 3.0 3.1 9.9 100.0 732 1,440 1,855 1,893 1,830 2,117 2,560 2,885 1,895 11,060 78,275 2,123 Average Federal Tax Rate 5 Change (% Points) 12.4 9.4 7.4 5.4 4.0 3.4 2.9 2.0 0.6 1.6 2.6 3.1 Under the Proposal 11.0 10.6 14.0 16.6 17.8 19.6 21.5 24.3 25.7 25.7 29.4 22.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 28.1 Proposal: 0.0 (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 Detail Table Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.1 0.5 0.9 5.7 13.4 36.0 22.9 15.6 3.7 69.3 68.2 79.6 86.0 88.4 90.5 90.4 83.9 62.6 74.9 82.3 79.9 Percent Change in After-Tax 4 Income Share of Total Federal Tax Change -12.2 -9.5 -7.9 -6.0 -4.7 -4.0 -3.6 -2.6 -0.9 -2.1 -3.5 -3.8 4.3 11.1 11.5 9.3 6.9 13.3 11.3 16.2 3.0 3.1 9.9 100.0 Average Federal Tax Change Dollars Percent 732 1,440 1,855 1,893 1,830 2,117 2,560 2,885 1,895 11,060 78,275 2,123 -897.1 791.6 111.6 47.4 29.3 20.6 15.7 9.1 2.6 6.6 9.5 15.7 1 Share of Federal Taxes Change (% Points) 0.6 1.5 1.3 0.8 0.4 0.4 0.0 -1.6 -2.1 -0.6 -0.9 0.0 Under the Proposal 0.5 1.7 3.0 3.9 4.1 10.5 11.2 26.3 16.5 6.7 15.5 100.0 5 Average Federal Tax Rate Change (% Points) 12.4 9.4 7.4 5.4 4.0 3.4 2.9 2.0 0.6 1.6 2.6 3.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2010 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 19,232 25,210 20,273 15,926 12,195 20,409 14,353 18,275 5,216 900 414 153,472 Percent of Total 12.5 16.4 13.2 10.4 8.0 13.3 9.4 11.9 3.4 0.6 0.3 100.0 Average Income (Dollars) 5,904 15,341 25,184 35,371 45,433 63,167 87,722 142,484 297,409 700,195 3,056,945 69,715 Average Federal Tax Burden (Dollars) -82 182 1,662 3,994 6,253 10,264 16,286 31,695 74,406 168,857 820,752 13,559 Average After4 Tax Income (Dollars) 5,986 15,159 23,521 31,377 39,180 52,903 71,436 110,789 223,002 531,338 2,236,192 56,155 Average Federal Tax 5 Rate -1.4 1.2 6.6 11.3 13.8 16.3 18.6 22.2 25.0 24.1 26.9 19.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.1 3.6 4.8 5.3 5.2 12.1 11.8 24.3 14.5 5.9 11.8 100.0 1.3 4.4 5.5 5.8 5.5 12.5 11.9 23.5 13.5 5.6 10.7 100.0 -0.1 0.2 1.6 3.1 3.7 10.1 11.2 27.8 18.7 7.3 16.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 28.1 Proposal: 0.0 (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 11.0 10.6 14.0 16.6 17.8 19.6 21.5 24.3 25.7 25.7 29.4 22.5 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.1 0.1 0.0 0.0 0.2 2.4 23.9 17.1 14.6 0.4 68.0 60.2 76.0 85.9 89.4 91.1 91.8 84.8 70.7 76.7 81.3 75.4 Percent Change in After-Tax Income 4 -7.3 -3.5 -2.9 -2.6 -2.2 -2.9 -3.2 -3.0 -1.8 -2.0 -3.2 -3.0 Share of Total Federal Tax Change 8.6 11.9 10.4 8.9 7.0 16.0 11.3 13.4 4.3 2.1 6.1 100.0 Average Federal Tax Change Dollars Percent 410 500 635 761 825 1,417 2,128 3,164 4,081 11,003 69,589 959 204.3 50.0 21.1 13.2 10.1 11.1 10.8 10.0 5.8 7.1 8.9 13.0 Share of Federal Taxes Change (% Points) 0.9 1.0 0.5 0.0 -0.2 -0.3 -0.3 -0.5 -0.6 -0.2 -0.3 0.0 Under the Proposal Average Federal Tax Rate 5 Change (% Points) 1.5 4.1 6.9 8.7 8.7 18.4 13.2 17.0 9.1 3.6 8.6 100.0 7.0 3.3 2.5 2.2 1.8 2.3 2.5 2.3 1.4 1.6 2.4 2.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 13,491 15,275 10,557 7,505 5,457 7,250 3,401 2,721 682 121 56 67,097 20.1 22.8 15.7 11.2 8.1 10.8 5.1 4.1 1.0 0.2 0.1 100.0 Average Income (Dollars) 5,823 15,188 25,082 35,408 45,383 62,323 86,929 137,783 299,180 699,028 2,928,936 39,588 Average Federal Tax Burden (Dollars) 201 999 3,012 5,750 8,135 12,804 19,639 31,804 70,362 156,156 781,013 7,376 Average AfterTax Income 4 (Dollars) 5,623 14,189 22,071 29,658 37,248 49,519 67,289 105,979 228,818 542,872 2,147,923 32,212 Average Federal Tax Rate 5 3.4 6.6 12.0 16.2 17.9 20.5 22.6 23.1 23.5 22.3 26.7 18.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 3.0 8.7 10.0 10.0 9.3 17.0 11.1 14.1 7.7 3.2 6.2 100.0 3.5 10.0 10.8 10.3 9.4 16.6 10.6 13.3 7.2 3.1 5.6 100.0 0.6 3.1 6.4 8.7 9.0 18.8 13.5 17.5 9.7 3.8 8.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 10.5 9.9 14.5 18.4 19.7 22.8 25.0 25.4 24.9 23.9 29.0 21.1 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.1 0.0 0.2 7.5 15.2 37.7 23.9 15.7 8.1 55.5 68.2 71.3 75.0 82.0 88.9 89.6 83.9 61.4 74.6 82.5 79.6 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -15.2 -11.5 -9.2 -7.1 -6.0 -4.4 -3.6 -2.5 -0.7 -2.1 -3.5 -3.2 1.1 4.7 6.4 6.0 5.9 13.8 14.4 24.0 3.8 4.7 15.0 100.0 Average Federal Tax Change Dollars Percent 800 1,854 2,306 2,386 2,512 2,472 2,657 2,855 1,534 11,043 77,572 2,919 -601.5 -590.8 688.1 132.5 65.1 30.4 17.9 9.0 2.0 6.5 9.6 12.2 Share of Federal Taxes Change (% Points) 0.1 0.5 0.7 0.6 0.5 0.9 0.5 -0.9 -2.1 -0.5 -0.4 0.0 Under the Proposal Average Federal Tax Rate 5 Change (% Points) 0.1 0.4 0.8 1.1 1.6 6.4 10.3 31.4 20.7 8.4 18.6 100.0 15.6 11.8 9.1 6.7 5.5 3.9 3.0 2.0 0.5 1.6 2.6 2.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,455 4,417 4,861 4,389 4,097 9,767 9,535 14,745 4,367 747 340 60,097 4.1 7.4 8.1 7.3 6.8 16.3 15.9 24.5 7.3 1.2 0.6 100.0 Average Income (Dollars) 5,141 15,755 25,306 35,520 45,591 64,107 88,206 143,882 297,347 701,119 3,002,884 115,873 Average Federal Tax Burden (Dollars) -133 -314 335 1,801 3,860 8,145 14,834 31,655 75,284 171,171 806,032 24,021 Average AfterTax Income 4 (Dollars) 5,274 16,069 24,970 33,718 41,731 55,962 73,372 112,226 222,063 529,948 2,196,852 91,852 Average Federal Tax Rate 5 -2.6 -2.0 1.3 5.1 8.5 12.7 16.8 22.0 25.3 24.4 26.8 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.2 1.0 1.8 2.2 2.7 9.0 12.1 30.5 18.7 7.5 14.7 100.0 0.2 1.3 2.2 2.7 3.1 9.9 12.7 30.0 17.6 7.2 13.5 100.0 0.0 -0.1 0.1 0.6 1.1 5.5 9.8 32.3 22.8 8.9 19.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 13.0 9.8 10.4 11.8 14.0 16.6 19.8 24.0 25.8 26.0 29.4 23.3 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.1 0.0 0.0 0.0 0.2 3.0 15.8 34.9 16.5 15.2 0.8 85.4 89.8 95.8 97.9 98.6 98.1 96.1 84.0 64.7 81.0 82.3 93.3 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -25.9 -22.5 -16.9 -11.5 -7.9 -5.4 -4.6 -2.8 -1.3 -2.2 -3.2 -10.3 8.0 24.8 23.7 16.5 8.8 9.9 4.6 2.3 0.4 0.3 0.7 100.0 Average Federal Tax Change Dollars 2,111 3,893 4,300 3,725 3,136 2,799 3,170 2,763 2,843 11,434 66,335 3,453 Percent -162.1 -206.3 -1,953.0 135.1 54.9 26.8 18.1 8.8 4.2 7.5 8.5 82.3 Share of Federal Taxes Change (% Points) 5.4 15.6 11.1 2.9 -2.0 -9.3 -7.3 -8.7 -3.6 -1.4 -2.9 0.0 Under the Proposal Average Federal Tax Rate 5 Change (% Points) 1.4 5.8 10.1 13.0 11.2 21.3 13.5 12.8 4.8 1.9 4.2 100.0 30.8 25.2 17.0 10.6 6.9 4.5 3.7 2.1 1.0 1.7 2.3 9.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,099 5,220 4,519 3,634 2,292 2,913 1,183 683 123 21 9 23,770 13.0 22.0 19.0 15.3 9.6 12.3 5.0 2.9 0.5 0.1 0.0 100.0 Average Income (Dollars) 6,866 15,424 25,284 35,054 45,331 62,050 86,451 131,866 292,662 672,994 2,883,601 37,673 Average Federal Tax Burden (Dollars) -1,303 -1,887 -220 2,758 5,715 10,465 17,545 31,417 68,052 153,525 783,066 4,196 Average AfterTax Income 4 (Dollars) 8,168 17,311 25,504 32,295 39,616 51,585 68,906 100,449 224,610 519,469 2,100,535 33,477 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -19.0 -12.2 -0.9 7.9 12.6 16.9 20.3 23.8 23.3 22.8 27.2 11.1 2.4 9.0 12.8 14.2 11.6 20.2 11.4 10.1 4.0 1.6 2.9 100.0 3.2 11.4 14.5 14.8 11.4 18.9 10.2 8.6 3.5 1.4 2.4 100.0 -4.1 -9.9 -1.0 10.1 13.1 30.6 20.8 21.5 8.4 3.3 7.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 11.8 13.0 16.1 18.5 19.5 21.4 24.0 25.9 24.2 24.5 29.5 20.3 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.2 1.3 6.9 31.0 12.9 8.7 3.1 86.5 96.9 99.1 99.6 99.6 99.6 98.6 93.1 68.9 86.4 90.9 95.2 Percent Change in After-Tax 4 Income Share of Total Federal Tax Change -30.1 -26.6 -20.1 -13.8 -9.9 -7.1 -5.5 -3.5 -1.1 -2.8 -4.0 -6.2 4.2 13.5 13.8 10.4 7.2 12.4 11.1 15.4 2.7 2.7 6.6 100.0 Average Federal Tax Change Dollars Percent 2,431 4,866 5,344 4,612 4,047 3,879 4,007 3,847 2,355 14,615 86,993 4,440 -155.6 -181.3 -442.3 259.5 87.4 41.8 25.8 11.8 3.0 8.1 10.0 25.7 1 Share of Federal Taxes Change (% Points) 1.0 3.2 3.0 1.9 1.0 1.0 0.0 -3.7 -4.1 -1.2 -2.1 0.0 Under the Proposal 0.3 1.2 2.2 2.9 3.2 8.6 11.0 29.7 18.7 7.2 14.9 100.0 5 Average Federal Tax Rate Change (% Points) 37.3 31.2 21.1 13.1 8.9 6.1 4.6 2.7 0.8 2.1 2.8 5.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2010 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,690 5,996 5,563 4,833 3,844 6,876 5,941 8,597 2,442 393 164 48,527 7.6 12.4 11.5 10.0 7.9 14.2 12.2 17.7 5.0 0.8 0.3 100.0 Average Income (Dollars) 6,525 15,600 25,332 35,234 45,427 63,634 88,048 143,922 297,068 700,113 3,064,969 88,512 Average Federal Tax Burden (Dollars) -1,562 -2,685 -1,208 1,777 4,633 9,270 15,529 32,611 78,186 179,621 867,680 17,285 Average After4 Tax Income (Dollars) 8,087 18,285 26,541 33,457 40,793 54,364 72,519 111,311 218,882 520,492 2,197,289 71,227 Average Federal Tax 5 Rate Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -23.9 -17.2 -4.8 5.0 10.2 14.6 17.6 22.7 26.3 25.7 28.3 19.5 0.6 2.2 3.3 4.0 4.1 10.2 12.2 28.8 16.9 6.4 11.7 100.0 0.9 3.2 4.3 4.7 4.5 10.8 12.5 27.7 15.5 5.9 10.4 100.0 -0.7 -1.9 -0.8 1.0 2.1 7.6 11.0 33.4 22.8 8.4 17.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 13.3 14.0 16.3 18.1 19.1 20.7 22.2 25.3 27.1 27.7 31.2 24.5 18-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0076 Implement a Simplified Tax System Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2010 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.3 0.9 13.6 27.6 49.2 42.2 25.8 6.0 17.2 15.0 25.8 33.8 43.5 62.0 66.2 61.1 46.9 54.8 71.1 37.4 Percent Change in After-Tax 4 Income -1.8 -0.6 -0.7 -0.7 -0.9 -1.4 -1.4 -1.3 -0.3 -0.8 -3.3 -1.3 Share of Total Federal Tax Change 1.4 2.8 3.2 2.8 3.8 14.7 11.5 19.3 2.8 4.0 33.8 100.0 Average Federal Tax Change Dollars Percent 116 91 158 223 406 784 1,101 1,522 595 4,372 74,063 758 109.4 30.9 18.2 14.9 16.3 14.4 10.3 6.2 1.0 2.9 10.0 7.4 1 Share of Federal Taxes Change (% Points) 0.1 0.1 0.1 0.1 0.1 0.5 0.2 -0.2 -1.3 -0.4 0.6 0.0 Under the Proposal 0.2 0.8 1.4 1.5 1.8 8.0 8.5 22.5 19.9 9.8 25.5 100.0 5 Average Federal Tax Rate Change (% Points) 1.8 0.6 0.6 0.6 0.9 1.3 1.3 1.1 0.2 0.6 2.5 1.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2010 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,580 6,648 4,517 2,742 2,038 4,156 2,313 2,802 1,021 204 101 29,160 8.9 22.8 15.5 9.4 7.0 14.3 7.9 9.6 3.5 0.7 0.4 100.0 Average Income (Dollars) 6,461 15,269 24,959 35,251 45,587 62,690 87,183 142,175 297,063 694,961 2,965,312 69,393 Average Federal Tax Burden (Dollars) 106 295 866 1,500 2,489 5,444 10,687 24,380 62,210 150,540 739,230 10,284 Average After4 Tax Income (Dollars) 6,355 14,974 24,093 33,751 43,098 57,246 76,495 117,795 234,852 544,421 2,226,082 59,109 Average Federal Tax 5 Rate 1.7 1.9 3.5 4.3 5.5 8.7 12.3 17.2 20.9 21.7 24.9 14.8 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 5.0 5.6 4.8 4.6 12.9 10.0 19.7 15.0 7.0 14.8 100.0 1.0 5.8 6.3 5.4 5.1 13.8 10.3 19.2 13.9 6.4 13.0 100.0 0.1 0.7 1.3 1.4 1.7 7.6 8.2 22.8 21.2 10.2 24.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. In the simplified tax system proposal, there are no itemized deductions, no alternative minimum tax, no exemptions for dependents, and no personal credits. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 3.5 2.5 4.1 4.9 6.4 9.9 13.5 18.2 21.1 22.3 27.4 15.9