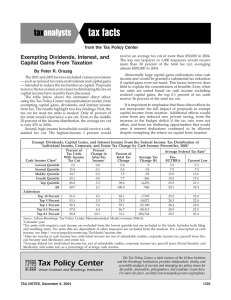

Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile, 2013

advertisement

1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile, 2013 1 Summary Table Pct of Tax Units (%) 2,3 Cash Income Percentile Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All All Tax Units (thousands) With Gains or Qualified Dividends Pay Tax on Gains or Qualified Dividends Average Gains and Dividends for Recepients4 ($) Average Tax Paid on Gains and Dividends by Those Paying Tax5 ($) Share of Total Federal Tax on Gains and Dividends Average Federal Tax Rate of Those Paying Tax on Long‐Term Gains and Dividends5 On Gains and 6 Dividends On All Income 7 43,362 37,681 32,699 27,208 24,067 166,272 3.6 8.1 13.2 23.9 50.1 16.8 0.4 3.5 10.5 22.7 49.1 13.8 1,371 1,784 2,717 4,212 44,525 21,111 185 176 400 769 11,031 5,967 0.0 0.2 1.0 3.5 95.3 100.0 10.7 9.7 16.1 18.4 24.7 24.2 17.2 13.1 16.1 20.4 30.4 28.7 12,130 5,919 4,805 1,213 124 37.7 51.8 69.9 87.8 95.2 36.9 50.5 68.7 86.8 93.8 6,360 10,819 27,977 357,590 2,114,928 1,237 2,257 7,053 89,994 528,819 4.0 4.9 17.0 69.3 45.1 19.7 21.1 25.4 25.2 24.8 24.1 25.8 28.1 35.2 38.7 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2011 dollars): 20% $17,909 40% $37,090; 60% $64,531; 80% $111,344; 90% $160,377; 95% $227,314; 99% $592,985; 99.9% $2,682,143. (4) Average among tax units with long‐term positive gains. (5) Average among tax units with positive tax paid on long‐term positive gains. (6) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains. (7) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Percentile, 2013 Detail Table Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Rate Average Tax Average Gains On Gains and On All Income or Dividend On Gains and On All Income 5 ($) ($) Dividends ($) Dividends 4 (%) (%) Percent Change in After‐Tax Income 4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) 158 1,311 3,448 6,167 11,814 22,913 0.4 3.5 10.5 22.7 49.1 13.8 14,217 30,973 53,090 89,278 363,560 221,314 1,723 1,824 2,479 4,176 44,725 24,684 185 176 400 769 11,031 5,967 2,451 4,049 8,572 18,249 110,564 63,462 10.7 9.7 16.1 18.4 24.7 24.2 17.2 13.1 16.1 20.4 30.4 28.7 ‐1.5 ‐0.7 ‐0.9 ‐1.1 ‐4.2 ‐3.6 0.0 0.2 1.0 3.5 95.3 100.0 0.0 0.4 2.0 7.7 89.8 100.0 4,471 2,989 3,301 1,053 117 36.9 50.5 68.7 86.8 93.8 137,586 195,341 346,970 1,852,621 8,027,929 6,280 10,704 27,811 357,563 2,130,164 1,237 2,257 7,053 89,994 528,819 33,138 50,340 97,447 345,498 3,107,038 19.7 21.1 25.4 25.2 24.8 24.1 25.8 28.1 35.2 38.7 ‐1.2 ‐1.5 ‐2.7 ‐7.0 ‐9.7 4.0 4.9 17.0 69.3 45.1 10.2 10.3 22.1 47.2 24.9 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends 1 by Cash Income Percentile, 2013 Tax Units With Net Long‐Term Capital Gains Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Losses Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends Percent of Total Units Percent of Total Units Average Gains or Dividend 2,3 Average Dividend Percent of Total Percent of Total Units 43,362 37,681 32,699 27,208 24,067 166,272 26.1 22.7 19.7 16.4 14.5 100.0 0.8 1.9 5.2 10.4 24.0 6.9 2,781 2,575 3,240 5,288 69,448 37,390 0.9 1.8 3.3 6.4 17.9 5.1 ‐7,426 ‐7,093 ‐6,688 ‐7,135 ‐13,145 ‐10,475 3.3 7.5 11.5 21.1 45.5 15.0 850 1,291 1,662 2,168 12,432 6,417 3.6 8.1 13.2 23.9 50.1 16.8 1,371 1,784 2,717 4,212 44,525 21,111 12,130 5,919 4,805 1,213 124 7.3 3.6 2.9 0.7 0.1 16.9 25.1 34.1 49.9 65.8 8,049 14,362 38,079 497,542 2,500,778 12.0 17.8 29.0 34.6 29.1 ‐7,049 ‐8,117 ‐12,910 ‐47,686 ‐209,944 33.9 46.1 64.4 82.4 90.4 3,059 4,341 10,230 79,924 405,464 37.7 51.8 69.9 87.8 95.2 6,360 10,819 27,977 357,590 2,114,928 Average Gains Percent of Total Units Average Loss Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. The breaks are (in 2011 dollars): 20% $17,909 40% $37,090; 60% $64,531; 80% $111,344; 90% $160,377; 95% $227,314; 99% $592,985; 99.9% $2,682,143. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains. (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare) 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains 5 On Gains and or Dividend On Gains and On All Income On All Income 4 ($) Dividends ($) ($) (%) Dividends (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) 83 578 2,673 5,802 13,762 22,913 0.2 1.7 8.1 19.0 44.9 13.8 14,296 28,064 48,302 81,387 323,559 221,314 1,607 1,635 1,889 3,096 39,328 24,684 291 176 214 515 9,665 5,967 1,300 4,070 7,209 15,825 97,401 63,462 18.1 10.8 11.3 16.6 24.6 24.2 9.1 14.5 14.9 19.4 30.1 28.7 ‐2.2 ‐0.7 ‐0.5 ‐0.8 ‐4.1 ‐3.6 0.0 0.1 0.4 2.2 97.3 100.0 0.0 0.2 1.3 6.3 92.2 100.0 4,996 3,588 3,936 1,243 138 32.4 46.6 64.7 84.8 93.2 121,974 171,450 305,189 1,631,106 7,080,466 4,946 9,058 23,292 315,696 1,873,321 970 1,849 5,760 79,540 465,628 28,571 43,651 84,982 568,554 2,730,813 19.6 20.4 24.7 25.2 24.9 23.4 25.5 27.8 34.9 38.6 ‐1.0 ‐1.4 ‐2.5 ‐7.0 ‐9.7 3.5 4.9 16.6 72.3 47.0 9.8 10.8 23.0 48.6 25.9 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 36,065 34,713 33,034 30,538 30,666 166,272 21.7 20.9 19.9 18.4 18.4 100.0 0.7 1.4 3.8 8.4 22.1 6.9 2,991 2,902 3,158 4,154 60,045 37,390 1.0 1.2 3.0 5.3 15.7 5.1 ‐7,887 ‐7,191 ‐6,848 ‐6,468 ‐12,659 ‐10,475 2.8 5.5 10.8 17.9 41.6 15.0 907 1,021 1,285 1,657 11,221 6,417 3.1 6.1 12.2 20.2 46.0 16.8 1,518 1,577 2,120 3,193 39,050 21,111 15,414 7,701 6,085 1,466 148 9.3 4.6 3.7 0.9 0.1 14.6 23.6 32.7 49.5 65.2 6,609 10,990 30,922 428,399 2,197,840 9.9 16.0 26.0 33.4 29.3 ‐7,073 ‐7,487 ‐12,131 ‐44,749 ‐192,819 29.8 43.0 60.4 80.1 89.3 718 1,778 5,349 73,014 326,984 33.3 47.8 66.0 86.1 94.5 5,051 9,149 23,404 314,549 1,861,254 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2) * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current polic baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare) 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Single Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains On Gains and or Dividend On Gains and On All Income On All Income5 ($) Dividends ($) ($) Dividends4 (%) (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) 50 286 1,246 1,801 3,655 7,041 0.2 1.5 7.9 15.4 38.1 8.7 11,310 20,359 35,355 56,424 212,400 131,834 1,328 2,020 1,802 3,232 31,370 17,527 130 172 198 610 7,483 4,084 1,804 3,529 4,740 10,612 62,542 36,176 9.8 8.5 11.0 18.9 23.9 23.3 16.0 17.3 13.4 18.8 29.4 27.4 ‐1.4 ‐1.0 ‐0.6 ‐1.3 ‐4.8 ‐4.1 0.0 0.2 0.9 3.8 95.1 100.0 0.0 0.4 2.3 7.5 89.7 100.0 1,368 961 1,028 298 30 26.7 41.2 57.4 81.7 90.8 84,042 119,441 211,510 1,104,473 5,102,350 5,622 10,301 23,412 244,958 1,450,598 1,162 2,078 5,275 61,547 361,562 20,168 30,882 57,391 376,921 1,978,352 20.7 20.2 22.5 25.1 24.9 24.0 25.9 27.1 34.1 38.8 ‐1.8 ‐2.3 ‐3.3 ‐7.8 ‐10.4 5.5 6.9 18.9 63.8 38.1 10.8 11.6 23.2 44.1 23.5 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 23,198 19,587 15,802 11,719 9,604 80,622 28.8 24.3 19.6 14.5 11.9 100.0 0.7 1.4 3.3 7.2 20.2 4.7 1,994 2,281 2,211 2,973 40,218 21,971 1.0 1.1 2.7 3.8 12.1 3.3 ‐5,680 ‐6,958 ‐5,936 ‐6,227 ‐11,738 ‐8,959 3.1 6.8 11.5 15.2 35.5 11.4 776 972 1,416 2,299 11,406 5,179 3.3 7.3 12.3 16.8 39.3 12.5 1,146 1,355 1,911 3,348 30,904 13,000 5,116 2,332 1,790 365 33 6.3 2.9 2.2 0.5 0.0 13.0 22.7 31.5 48.6 62.7 5,532 9,609 26,147 306,641 1,653,987 7.8 12.8 19.2 32.0 29.4 ‐7,464 ‐7,155 ‐11,029 ‐40,143 ‐158,291 24.9 38.7 53.5 75.1 83.9 3,374 5,725 10,258 71,519 350,422 27.8 42.7 59.0 82.6 91.8 5,604 10,291 23,282 245,288 1,449,755 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2) * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current polic baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare) 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains On Gains and or Dividend On Gains and On All Income On All Income5 ($) Dividends ($) ($) Dividends4 (%) (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) 22 200 1,217 3,644 9,605 14,699 0.5 3.0 10.5 23.6 49.8 25.4 19,510 37,956 61,185 94,401 364,619 267,260 2,672 1,395 2,018 3,086 41,307 27,960 748 198 232 480 10,271 6,856 1,079 5,196 9,499 18,378 109,835 77,197 28.0 14.2 11.5 15.6 24.9 24.5 5.5 13.7 15.5 19.5 30.1 28.9 ‐3.9 ‐0.6 ‐0.4 ‐0.6 ‐3.9 ‐3.5 0.0 0.0 0.3 1.7 97.9 100.0 0.0 0.1 1.0 5.9 93.0 100.0 3,418 2,517 2,772 898 100 37.2 49.9 69.0 86.2 94.4 138,039 192,036 341,899 1,780,973 7,562,196 4,654 8,491 23,121 328,957 1,958,467 902 1,750 5,900 83,316 488,995 32,015 48,673 95,780 620,877 2,908,899 19.4 20.6 25.5 25.3 25.0 23.2 25.3 28.0 34.9 38.5 ‐0.8 ‐1.2 ‐2.3 ‐6.7 ‐9.5 3.1 4.4 16.2 74.2 48.6 9.6 10.8 23.4 49.1 25.7 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 4,398 6,664 11,624 15,415 19,298 57,802 7.6 11.5 20.1 26.7 33.4 100.0 1.6 2.4 5.4 10.2 23.9 12.3 5,719 4,137 3,998 4,823 66,052 44,876 2.1 2.6 4.3 6.9 18.0 9.3 ‐12,443 ‐7,717 ‐7,604 ‐6,614 ‐12,796 ‐11,160 4.8 6.3 13.4 21.9 46.0 25.2 1,415 1,086 1,186 1,372 11,072 7,295 5.7 7.5 15.8 24.8 50.8 28.3 2,835 2,214 2,380 3,182 41,153 25,978 9,190 5,048 4,018 1,042 106 15.9 8.7 7.0 1.8 0.2 16.4 24.5 33.8 50.0 66.2 6,873 11,281 32,590 454,302 2,300,629 11.4 17.7 29.4 33.9 29.3 ‐7,072 ‐7,622 ‐12,487 ‐43,817 ‐185,722 33.9 45.7 64.7 82.3 91.8 2,062 3,568 8,309 72,350 370,014 38.0 51.0 70.3 87.6 95.9 4,800 8,614 23,324 327,188 1,942,515 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2) * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current polic baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare) 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 1 Detail Table ‐ Head of Household Tax Units Cash Income Percentile2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains On Gains and or Dividend On Gains and On All Income On All Income5 ($) Dividends ($) ($) Dividends4 (%) (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) * 78 190 277 320 874 * 1.0 3.9 10.0 25.3 3.5 * 31,689 51,702 77,562 282,701 142,285 * 693 1,759 2,722 36,858 14,834 * 130 208 415 8,330 3,240 * 3,352 8,669 16,525 84,877 38,503 * 18.7 11.8 15.2 22.6 21.8 * 10.6 16.8 21.3 30.0 27.1 * ‐0.5 ‐0.5 ‐0.7 ‐4.0 ‐3.0 * 0.4 1.4 4.1 94.1 100.0 * 0.8 4.9 13.6 80.7 100.0 140 74 80 26 * 17.2 32.0 43.4 78.0 * 118,635 169,133 288,334 1,464,571 * 6,427 12,052 23,449 311,227 * 936 2,268 5,406 74,059 * 29,764 43,317 76,787 522,318 * 14.6 18.8 23.1 23.8 * 25.1 25.6 26.6 35.7 * ‐1.0 ‐1.8 ‐2.5 ‐7.3 * 4.6 5.9 15.4 68.2 * 12.4 9.5 18.4 40.5 * Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends by Cash Income Percentile Adjusted for Family Size, 2013 1 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 8,232 8,034 4,869 2,769 1,263 25,256 32.6 31.8 19.3 11.0 5.0 100.0 0.2 0.4 1.8 4.4 12.0 1.7 2,065 2,310 2,554 4,145 65,026 26,019 0.3 0.3 1.2 2.9 10.5 1.3 ‐11,735 ‐6,398 ‐6,595 ‐5,903 ‐9,784 ‐8,391 1.0 1.8 3.8 9.1 22.8 3.8 750 1,176 896 1,145 7,287 2,926 1.1 2.0 4.4 10.8 26.1 4.4 1,098 1,515 1,824 2,658 36,288 12,344 814 230 186 33 3 3.2 0.9 0.7 0.1 0.0 7.3 15.0 23.2 44.0 57.2 11,883 21,200 34,448 472,689 2,614,671 6.8 13.0 19.2 34.4 29.5 ‐4,699 ‐7,203 ‐9,343 ‐42,295 ‐150,392 15.9 27.8 38.3 69.2 79.7 1,805 2,769 6,072 54,178 263,438 18.1 32.4 44.2 78.8 87.1 6,403 12,195 23,363 311,675 1,958,101 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2) * Insufficient data (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current polic baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare) 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 Detail Table ‐ Tax Units with Children Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains On Gains and or Dividend On Gains and On All Income On All Income5 4 ($) ($) Dividends ($) (%) Dividends (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) 28 173 781 1,847 4,005 6,844 0.3 1.6 7.8 18.6 48.0 13.8 19,945 39,434 67,150 108,343 399,996 272,040 2,261 1,134 1,836 2,714 37,381 22,887 690 243 222 407 9,071 5,456 493 4,852 12,377 24,804 125,796 81,875 30.5 21.5 12.1 15.0 24.3 23.8 2.5 12.3 18.4 22.9 31.4 30.1 ‐3.4 ‐0.7 ‐0.4 ‐0.5 ‐3.2 ‐2.8 0.1 0.1 0.5 2.0 97.3 100.0 0.0 0.1 1.7 8.2 89.9 100.0 1,578 1,020 1,080 328 33 35.9 51.5 68.0 85.8 93.8 160,018 225,159 406,875 2,076,210 9,362,987 3,970 7,486 21,225 344,417 2,327,589 707 1,516 5,428 84,829 566,968 40,766 60,946 119,341 758,045 3,708,801 17.8 20.3 25.6 24.6 24.4 25.5 27.1 29.3 36.5 39.6 ‐0.6 ‐0.9 ‐1.9 ‐6.0 ‐9.1 3.0 4.1 15.7 74.5 50.0 11.5 11.1 23.0 44.4 21.8 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends 1 by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 10,088 10,789 10,009 9,950 8,349 49,418 20.4 21.8 20.3 20.1 16.9 100.0 0.5 0.9 3.4 7.6 21.4 6.2 4,983 4,045 4,106 4,747 69,512 42,886 0.6 0.9 2.5 5.7 19.2 5.3 ‐13,036 ‐6,936 ‐7,464 ‐6,637 ‐12,396 ‐10,815 1.2 2.2 7.9 17.3 44.4 13.4 866 745 806 1,045 7,748 4,782 1.5 2.7 9.3 19.4 48.9 15.1 2,387 1,940 2,205 2,779 37,429 21,865 4,396 1,981 1,589 382 35 8.9 4.0 3.2 0.8 0.1 14.2 24.9 30.8 45.9 64.7 7,710 11,582 35,586 547,964 2,940,020 12.4 20.9 31.1 37.9 29.7 ‐6,270 ‐7,786 ‐13,011 ‐46,604 ‐240,237 33.1 46.8 63.7 81.5 89.5 1,239 2,391 6,211 59,075 334,593 36.6 52.9 68.8 87.0 94.6 4,123 7,564 21,713 344,253 2,326,889 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Insufficient data Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains. (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare). 1‐Sep‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0332 Taxes on Long‐Term Capital Gains and Qualified Dividends Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Percentile Adjusted for Family Size, 2013 Detail Table ‐ Elderly Tax Units Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Number (thousands) Pct of All Units (%) Average Income ($) Tax Units with Tax On Positive Long‐Term Gains or Qualified Dividends Average Tax Average Tax Rate Average Gains On Gains and or Dividend On Gains and On All Income On All Income5 ($) Dividends ($) ($) Dividends4 (%) (%) Percent Change in After‐Tax Income4 (%) Share of Tax on Gains and Dividends (%) Share of Total Tax Burden (%) * 81 1,143 2,355 4,460 8,039 * 0.9 13.7 36.8 64.5 21.7 * 27,730 42,402 71,369 277,744 181,294 * 2,205 1,963 3,859 48,409 28,287 * 255 238 740 12,082 6,955 * 3,357 3,472 9,549 77,288 46,200 * 11.6 12.1 19.2 25.0 24.6 * 12.1 8.2 13.4 27.8 25.5 * ‐1.0 ‐0.6 ‐1.2 ‐5.7 ‐4.9 * 0.0 0.5 3.1 96.4 100.0 * 0.1 1.1 6.1 92.8 100.0 1,729 1,147 1,205 379 42 54.5 65.4 77.4 88.7 96.4 107,172 152,663 272,003 1,452,189 6,354,528 7,362 14,847 37,202 372,717 1,990,676 1,532 3,139 9,172 96,488 507,835 19,982 33,192 69,427 496,975 2,413,778 20.8 21.1 24.7 25.9 25.5 18.6 21.7 25.5 34.2 38.0 ‐1.7 ‐2.6 ‐4.3 ‐9.2 ‐11.4 4.7 6.4 19.8 65.4 38.4 9.3 10.2 22.5 50.7 27.5 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Long‐Term Capital Gains and Qualified Dividends 1 by Cash Income Percentile Adjusted for Family Size, 2013 Tax Units 3 Cash Income Percentile Number (thousands) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units With Net Long‐Term Capital Gains Tax Units With Net Long‐Term Capital Losses Percent of Total Units Percent of Total Units Tax Units With Qualified Dividends Tax Units With Long‐Term Gains or Qualified Dividends 2,3 Percent of Total Average Gains Average Loss Percent of Total Units Average Dividend Percent of Total Units Average Gains or Dividend 5,988 9,396 8,334 6,402 6,913 37,068 16.2 25.3 22.5 17.3 18.6 100.0 0.1 1.3 6.6 17.9 35.9 11.7 4,063 2,026 2,183 4,076 57,900 34,786 0.5 1.3 5.8 10.8 21.3 7.6 ‐7,573 ‐5,136 ‐6,208 ‐6,226 ‐14,014 ‐10,387 2.7 10.8 22.7 35.1 60.0 25.5 774 1,074 1,529 2,362 18,021 8,891 2.8 11.4 24.6 39.6 66.0 28.1 955 1,254 1,994 3,933 47,905 22,541 3,175 1,753 1,557 427 44 8.6 4.7 4.2 1.2 0.1 28.0 36.9 44.7 58.8 72.4 7,284 13,557 38,251 405,061 1,976,452 16.1 22.9 27.8 29.1 24.3 ‐8,622 ‐7,841 ‐14,761 ‐53,468 ‐277,308 50.2 61.3 71.8 83.7 91.8 4,276 8,104 16,811 112,818 540,641 56.3 66.7 78.1 90.4 96.8 7,434 14,938 37,348 368,115 1,990,758 Addendum 80‐90 90‐95 95‐99 Top 1 Percent Top 0.1 Percent Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Insufficient data Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law with no tax on long‐term positive capital gains or qualified dividends that would be eligible for the lower rates. Proposal is current law. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. The cash income percentile classes used in this table are based on the income distribution for the entire population and contain an equa number of people, not tax units. The incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. The resulting percentile breaks are (in 2011 dollars): 20% $12,690; 40% $24,714; 60% $41,203; 80% $67,700; 90% $97,816; 95% $138,772; 99% $358,601; 99.9% $1,621,178. (4) Average federal tax on long‐term positive capital gains as a percentage of positive long‐term gains. (5) Average federal tax (includes individual and corporate income tax as well as payroll taxes for Social Security and Medicare) as a percentage of average cash income. (6) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; and payroll taxes (Social Security and Medicare).