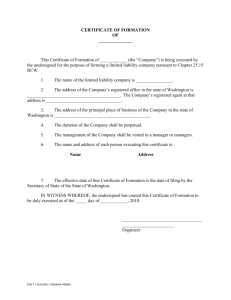

ARTICLE 1. Uniform Limited Partnership Act. Chapter 59.

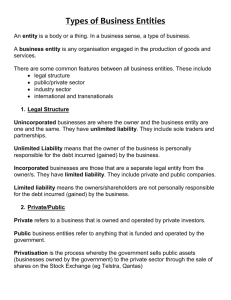

advertisement