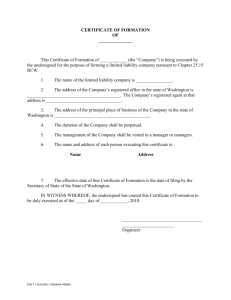

REVISED UNIFORM LIMITED LIABILITY COMPANY ACT

advertisement