Securities Fraud Rule 10b-5 Exclusive? Class action – business model

advertisement

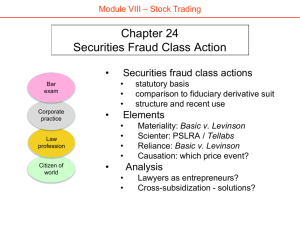

Securities Fraud Rule 10b-5 Exclusive? Class action – business model (last updated 19 Mar 13) Schedule • Tues, Mar 19 - Assignment 29 & 31 (including 10b-5 hypos) • Thurs, Mar 21- Assignment 32 / visit of Coleman Cowan (WF law grad and 60 Minutes producer - please watch http://www.cbsnews.com/video/watch/?id=6945451n • Tues, Mar 26 - Please read attached E&E (insider trading) / visit of Beth Southern (Associate General Counsel - Hanesbrands / Securities) • Thurs, Mar 28 - Assignment 35 & 36 Coleman Cowan WebEx 60 Minutes • European debt crisis • High-frequency – – – Transcript How grew SEC investigating (Mar ‘12) Securities Fraud Action William Rehnquist: When we deal with private actions under Rule 10b-5, we deal with a judicial oak which has grown from little more than a legislative acorn. Blue Chip Stamps v. Manor Drug Stores (US 1975) Fan of Gilbert and Sullivan operas (Lord Chancellor stripes) Securities Exchange Act of 1934 Section 10 -- Manipulative and Deceptive Devices It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange-- (b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered … any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. Securities Fraud Action Rule 10b-5 • Transaction (“in connection with • purchase Plaintiff or sale of securities”) •• Plaintiff (“purchasers or sellers” / Defendant unless SEC) • Elements • Defendant (“primary violator” / • Procedure including company) • Elements – – – – – Material misrep or omission Scienter Reliance Causation Damages • Procedure – Jurisdictional nexus (federal court) – Limitations / repose: 3 yrs / 5 yrs – Special rules for class actions Compare to other private actions Exchange Act Rule 10b-5 Fraud icw purchase or sale of security Securities Act § 18(a) § 9(c) §11 §12(a)(1) §12(a)(2) Materially false statement in SEC filing Specified manipulative practice (pools, etc) False statement in registration statement Offer or sale of unregister ed, nonexempt securities Offer or sale by means of materially false prospectus Compare to other private actions Exchange Act Securities Act Rule 10b-5 §11 Fraud icw purchase or sale of security False statement in RS statement Herman & MacLean v. Huddleston (US 1983): 1969 – IPO / 1970 – bankruptcy / 1972 – class action Accounting firm concealed TIS financial condition • Section 11 (’33 Act) – False statements in RS – Due diligence defense – 1-year statute of limitations • Rule 10b-5 (’34 Act) – Fraud icw sale of securities – [prior law} state S/L Securities Fraud Class Action “when talk is not cheap” “King of Pain” “Loathed because Curriculum Vitae he's so mean, because he's so powerful, • feared 1946: born in working-class Bill Lerach is the lawyer everyone in Pittsburgh Silicon Valley hates.” • 1970: U Pittsburgh law grad • 1976: joins Milberg Weiss Sep. (San 2000 Fortune Magazine, Diego) •“"In 2004: to Lerach 10 ormoves 15 years you willCoughlin be holding another Stoia Geller hearing Rudman about&aRobbins debacle in the (Sansecurities Diego) market that will make remember therecovery S&L mess with • you 2005: $7.2 billion in Enron fondness." litigation ($45 over career) • 2007: pleads guilty to obstruction of Bill Lerach, justice (later Milbergtestimony Weiss) (1995) congressional • 2009: disbarred by California State Bar • 2010: released from prison / “Circle of Greed” published Federal Securities Fraud Class Action Litigation (lawsuits filed) Pre-Reform Post-Reform Stanford Class Action Clearinghouse Anatomy of 10b-5 class action … Class Counsel – Business Model • Get started – identify material corporate misrepresentations – find appropriate shareholders to act as class representatives – file a complaint in a court of class counsel’s choosing • Take care of legalities – defend the complaint against motion to dismiss (on legal grounds) – urge the judge to grant class action status to the litigation – send notice to class members, giving them an option to withdraw from the lawsuit – undertake discovery of information from the company and other sources • Close the deal – – – – enter into settlement negotiations with company officials champion any settlement before the judge administer settlement funds appeal any adverse decisions by the trial court judge Effect of settlement (circularity) Settlement with “corporation” Selling shareholders (windfall winners!) Buying shareholders (plaintiffs) Shareholders Payment Nominal payments subsidy Corporation Corporate execs (insider trading) Corporate execs (D&O insurance) Why pay lawyers to move money between shareholder pockets? (Is Bill Lerach hero or knave?) How do you become “lead counsel”? Private Securities Litigation Reform Act Lead plaintiff • Notice of lawsuit to class members • Appointment of lead plaintiff – – Presumption: “largest financial interest” Rebut: “Not adequately represent class” • Selection of lead counsel – – Most adequate plaintiff Subject to approval of court Elliott Weiss Univ of Arizona PSLRA Appointment of “lead plaintiff” Not later than 90 days after the date on which a notice [of class action] the court shall consider any motion made by a purported class member in response to the notice, … and shall appoint as lead plaintiff the member or members of the purported plaintiff class that the court determines to be most capable of adequately representing the interests of class members (hereafter in this paragraph referred to as the "most adequate plaintiff") Who is “lead plaintiff”? …the court shall adopt a presumption that the most adequate plaintiff in any private action arising under this title is the person or group of persons that-– – – has either filed the complaint or made a motion in response to a notice under subparagraph (A)(i); in the determination of the court, has the largest financial interest in the relief sought by the class; and otherwise satisfies the requirements of Rule 23 of the Federal Rules of Civil Procedure. The presumption described in subclause (I) may be rebutted only upon proof by a member of the purported plaintiff class that the presumptively most adequate plaintiff-– – will not fairly and adequately protect the interests of the class; or is subject to unique defenses that render such plaintiff incapable of adequately representing the class. Selection of lead counsel The most adequate plaintiff shall, subject to the approval of the court, select and retain counsel to represent the class. Restrictions on professional plaintiffs Except as the court may otherwise permit, consistent with the purposes of this section, a person may be a lead plaintiff, or an officer, director, or fiduciary of a lead plaintiff, in no more than 5 securities class actions brought as plaintiff class actions pursuant to the Federal Rules of Civil Procedure during any 3-year period. The end Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … (e.g. Bay Networks, Inc) Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations … Anatomy of 10b-5 class action … (1) Investigate corporate disclosures … (2) Identify corporate “fiction” … followed by “surprise” … resulting in “price drop” (3) Identify “scienter” – such as … (4) File a complaint (in federal court) … that must tell “fraud” story … … to withstand “motion to dismiss” (5) If so, start settlement negotiations …