[AP: my impression is that your headings and subheadings... dense to be helpful roadsigns. I too a quick...

advertisement

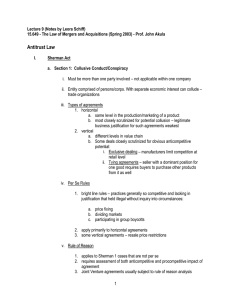

[AP: my impression is that your headings and subheadings are too dense to be helpful roadsigns. I too a quick stab at simplifying.] Antitrust SCRUTINY OF HEALTHCARE MERGERS: CONSISTENT WITH THE PATIENT PROTECTION AND AFFORDABLE CARE ACT? BY CORY H. HOWARD TABLE OF CONTENTS INTRODUCTION……………………………………………..………3 I. ROLE OF ANTITRUST LAW IN THE CONTEXT OF HEALTHCARE PROVIDER MERGERS…………………………………4 A. HISTORICAL TRENDS IN ENFORCEMENT LEAD AND COMMON MISPERCEPTIONS………………………………….4 B. POST-PPACA FTC MERGER SCRUTINY………………….8 II. CONSISTENCY OF PPACA AND RECENT TRENDS IN FTC ENFORCEMENT ..........................................................16 A. GOALS OF THE PPACA………………..16 B. FTC SCRUTINY OF MERGERS IN THE HEALTHCARE INDUSTRY……………………………………………………19 III. RETHINKING THE APPLICATION OF ANTITRUST LAW TO HEALTHCARE MERGERS ……………………………………………24 A. REDUCING THE ROLE OF ANTITRUST LAW AS MEANS TO CORRECT A MARKET FAILURE……….…24 B. FLEXIBLE ANTITRUST STANDARDS FOR A POST-PPACA WORLD….25 CONCLUSION……………………………………………………...29 ABSTRACT The Patient Protection and Affordable Care Act has fundamentally transformed the healthcare industry – specifically by changing Medicare payment processing systems and incentivizing intra-industry collaboration and cooperation. In an attempt to capture some of the benefits afforded to firms that engage in this type of activity, healthcare providers, especially hospitals, have engaged in widespread consolidation, namely through mergers. However, in an effort to protect competition, the Federal Trade Commission and federal courts in injunction actions have strictly interpreted and 1 applied antitrust law to block some of these mergers. This has created tension between the legislative intent of the Affordable Care Act and antitrust law, a tension which has proved problematic for healthcare providers seeking through mergers to capture revenue, cost, and infrastructure efficiencies anticipated by the Affordable Care Act. This article details this tension and proposes as framework through which the FTC and courts should view and balance the competing concerns and goals of federal antitrust law and the Affordable Care Act. 2 Introduction Mergers in the healthcare industry have always been a pressing issue for scholars and policymakers and the potential for monopolization and anticompetitive behavior has been a sticking point long before the Patient Protection and Affordable Care Act1 (“PPACA” or the “Affordable Care Act”) dominated national headlines.2 Although enacted in a comprehensive effort to solve a litany of issues plaguing the United States healthcare industry, the sweeping legislation’s general goals were to improve both the quality and efficiency of healthcare services.3 To create more efficient healthcare delivery mechanisms, the Affordable Care Act sought to incentivize synergistic consolidation in the healthcare energy to increase efficiency. However, efforts to consolidate have been hampered by challenges brought by the Federal Trade Commission (“FTC”) and inflexible interpretations adopted by the courts in analyzing the FTC’s requests to enjoin potential mergers. Although the FTC’s new 2010 Merger Guidelines have stressed that the agency will use flexible guidelines in analyzing potential mergers, this has proved to not be the case.4 This rigid interpretation of antitrust law, as 1 Pub. L. No. 111-148, 124 Stat. 119 (2010)(codified as amended in scattered sections of 24 U.S.C.). 2 See Allison Evans Cuellar and Paul J. Gertler, Trends in Hospital Consolidation: The Formation of Local Systems, 22 HEALTH AFFAIRS 77, 85 (2003)(questioning what effects consolidation of healthcare organizations would have on efficiency, patient costs, the well-being of consumers, and individual firm market power – all concerns are traditionally associated with antitrust considerations in non-healthcare firms). [AP: typically prentheticals don’t have multiple sentences] 3 Amy E. Zilis, Note, The Doctor Will Skype You Now: How Changing Physican Licensure Requirements Would Clear the Way for TeleMedicine to Achieve the Goals of the Affordable Care Act, 2012 U. ILL. J.L. TECH. & POL’Y 193, 195 (2012)(noting that efficiency and quality were two of the general, paramount concerns promoting the passage of the Affordable Care Act). 4 Bradley C. Weber, DOJ and FTC Issue New Horizontal Merger Guidelines, ABA HEALTH ESOURCE (AMERICAN BAR ASS’N HEALTH LAW SECTION, WASHINGTON, D.C.), Sept. 2010, available at http://www.americanbar.org/content/newsletter/publications/aba_heal 3 applied to post-PPACA healthcare organization mergers, is contrary to the goals of theAffordable Care Act. Part I of this article offers an overview of the role antitrust law plays in mergers in the healthcare industry, with particular attention to how antitrust law applies to healthcare nonprofits. Part II examines the role of the FTC and the federal courts in the healthcare merger process and whether FTC antitrust enforcement is stymieing the goald of the Affordable Care Act. Part III examines whether, in the face of the clear legislative objectives of the PPACA, the FTC or the Supreme Court should rethink the strict application of antitrust laws to healthcare organizations. [AP: excellent introduction. Notice how I believe you can usefully cut most of your sentences by 25-50%. Until you’re paid by the word, enjoy being succinct.] II. The Role of Antitrust Law in the Context of Healthcare Provider Mergers A. Historical Trends in Enforcement Lead to Common Misperceptions The relationship between the application of antitrust law, especially the Sherman and Clayton Acts, has long been a source of contention between hospitals and government regulators, especially as it applies to non-profit healthcare providers.5 Although healthcare providers, including those that are non-profits, operate in a manner that is fundamentally different from tradition corporations, the same antitrust framework is employed by the DOJ and FTC to evaluate potential mergers between healthcare providers as it would utilize in evaluating transactions in any other industry.6 Therefore, before discussing the tension between antitrust law and the Affordable Care th_esource_home/weber.html (noting that the 2010 Merger Guidelines expressly emphasized that “the merger analysis flexible and does not use a single methodology”) 5 John B. Saville & James Vincequerra , Note, Antitrust Issues of NonProfit Hospital Mergers, 13 ST. JOHN’S J. LEGAL COMMENT.. 427, 434 (1998)(noting that despite the long-held judicial principle that antitrust law is applicable to non-profit entities, there is confusion among the courts as to how to apply it effectively, especially as to the healthcare industry). 6 Deborah A. Daccord and Rachel Irving, Pitfalls in Healthcare Mergers and Acquisitions-Emerging Issues, 25 No. 1 HEALTH LAW 42, 42 (OCT. 2012). 4 Act, this Article begins with an overview of the historical trends in antitrust enforcement and the traditional conceptions of antitrust law. [AP: good opening explanation. Maybe a bit more on ] 1. The General Application of Antitrust Law to Nonprofits Examining how courts have historically applied antitrust law to nonprofit entities is important in the context of this article, as a significant number of healthcare organizations, including hospitals, are nonprofit entities.7 The Supreme Court has consistently reiterated the doctrine that antitrust law applies to nonprofits, including hospitals. In NCAA v. Board of Regents of the University of Oklahoma8, the Court was quick to dismiss the argument that nonprofit status exempts an entity from antitrust compliance, relying on a long line of case law that has held the opposite. Building on Goldfarb v. Virginia State Bar9 and American Society of Mechanical Engineers, Inc. v. Hydrolevel Corp.10, the Court went beyond merely asserting that antitrust law applied to nonprofits; it also questioned whether the label “nonprofit” meant anything at all when organizations were designed for profit maximization. Nonprofit healthcare organizations have also been found to fall well within the sweeping grasp of antitrust law, as courts around the country have applied traditional antitrust analysis to healthcare organizations charged with such violations.11 Although the Supreme Court has found time and time again that nonprofits are not exempt from antitrust scrutiny, the law does provide nonprofits with limited explicit exclusions. For example, the 7 See AMERICAN HOSPITAL ASSOCIATION, FAST FACTS ON US HOSPITALS (last visited on Mar. 14, 2014), http://www.aha.org/research/rc/stat-studies/fast-facts.shtml (noting that almost 3/5 of all community hospitals in the U.S. are nongovernment not-for-profit entities). 8 468 U.S. 85, 100 n.22 (1984)(unequivocally stating that “there is no doubt that the sweeping language of § 1 applies to nonprofit entities”.). 9 421 U.S. 773, 786-787 (finding that professional services were still bound by antitrust regulations). 10 456 U.S. 556, 576 (1982)(find that it is “beyond doubt” that nonprofit organizations can be held liable under antitrust law). 11 See California Dental Ass’n v. F.T.C., 526 U.S. 756, 793 (1999)(Justice stating approving the usual outcome that resulted from the Court of Appeals applying ordinary antitrust principles to a nonprofit healthcare organization). 5 Nonprofit Institutions Act provides immunity for purchasers and sellers of goods from liability under the Robinson-Patman Act as long as: (1) the purchaser is a nonprofit and (2) the goods purchased are to be used by the nonprofit.12 Nonprofits can also be protected from antitrust scrutiny under the State Action Antitrust Exemption, which allows nonprofits to engage in anticompetitive activity if they can show those actions were done pursuant to a clear state government mandate and the nonprofit was actively monitored by the state.13 Even though federal courts recognize these and other explicit exceptions, they also recognize that they are to be applied strictly and it is antitrust law that should be applied broadly.14 One non-statutory exception to the antitrust laws that is particularly important to this article’s analysis of health care law is the judicially-created Implied Repeal Doctrine, which protects entities from antitrust scrutiny when they undertakes activities to implement a federal regulatory scheme that is inconsistent with antitrust law.15 This doctrine first appeared in the seminal case Keogh v. Chicago & N.W. Ry.16 and was later held to preempt antitrust scrutiny where: (1) provisions of two acts are in irreconsibile conflict, in which case the later act to the extent of the conflict constitutes an implied repeal of the earlier one and (2) where the later act covers the whole subject of the earlier one and is clearly intended as a substitute, it will operate similarly as a repeal of the earlier act.17 However, courts are even more skeptical of shielding nonprofits from antitrust scrutiny under the Implied Repeal Doctrine then they are through other more narrow exceptions, as the federal courts have interpreted Golden State Transit 12 See 15 U.S.C. § 13c. Bazil Facchina et al., Privileges & Exemptions Enjoyed by Nonprofit Organizations, 28 U.S.F. L. REV. 85, 107-108 (1993)(relying on the reasoning of the Court in Patrick v. Burget, 486 U.S. 94, 100 (1988) and California Retail Liquor Dealers Ass’n v. Midcal Aluminum, Inc., 445 U.S. 97, 105 (1980) to explain the state action exception). 14 See Hawkeye Foodservice Distribution Inc. v. Martin Bros. Distributing Co., Inc., 854 F.Supp.2d 646, 650 (D.S.D.IA. 2012). 15 See John J. Miles & Mary Susan Philip, Hospitals Caught in the Antitrust Net: An Overview, 24 DUQ. L. REV. 489, 602 (1985)(explaining the implied repeal doctrine). 16 260 U.S. 156 (1922). 17 Posadas v. National City Bank of New York, 296 U.S. 497, 503 (1936)(stating the two conditions under which the implied repeal doctrine operates). 13 6 Corp. v. Los Angeles18 and its progeny as disfavoring judicial use of the implied repeal doctrine.19 Despite these holdings, there is a significant amount of commentary arguing that nonprofits should be exempt from antitrust law, whether because antitrust law does not take into account any potential benefits from cooperation among nonprofits20, or because nonprofits inherently fall outside the scope of traditional antitrust concerns.21 Some scholars have questioned whether Congress even intended smaller nonprofits to be subject to the same laws that governed corporate giants.22 Others have more specifically questioned whether federal healthcare laws, albeit pre-PPACA laws, and antitrust laws are so incompatible, that healthcare providers should be exempted from specific conduct that is done to implement a federal regulatory scheme mandated by legislation.23 18 493 U.S. 103, 106, 110 S.Ct. 444, 448 (1989). Golden State Transit was quickly followed by two other cases that created a judicial disfavor of using the implied repeal doctrine. See Suter v. Artists M, 503 U.S. 347, 112 S.Ct. 1360 (1992) and Livadas v. Bradshaw, 512 U.S. 107, 114 S.Ct. 2068 (1994). 19 See Mummelthie v. City of Mason City, Ia., 873 F.Supp. 1293, 1314 (N.D.IA. 1995)(stating that implied repeals are disfavored and that courts will only find they occur where there is “clear repugnancy”). 20 See generally Srikanth Srinivasan, Note, College Financial Aid and Antitrust; Applying the Sherman Act to Collaborative Nonprofit Activity, 46 STAN. L. REV. 919, (1994)(explaining that cooperation among nonprofits is a benefit that traditional antitrust inquiries fail to account for when determining potential market impact). 21 Richard Elhauge, The Scope of Antitrust Process, 104 HARV. L. REV. 667, 739-743 (1991)(arguing that since the Sherman Act is traditionally concerned with “financially interested restraints on competition”, courts should find that nonprofits’ “financially disinterested restraints” fall outside the scope of antitrust inquiries). 22 See Steven N.J. Wlodychak, Note, Antitrust-Nonprofit Health Maintenance Organization Pricing Policies and the Scope of the Robinson-Patman Price Discrimination Act-De Modena v. Kaiser Foundation Health Plan, 743 F.2d 1388 (9th Cir. 1984), cert. denied, 105 S.Ct. 1230 (1985), 16 SETON HALL L. REV. 220, 241 (1986) (questioning whether there was ever a congressional intent to subject nonprofits to antitrust regulations and if an exception should be carved out for nonprofits). 23 John J. Miles & Mary Susan Philip, supra note 14, at 602(questioning whether the doctrine of implied repeal could be used to protect healthcare organizations from antitrust scrutiny). 7 2. Antitrust Law and the Merger of Healthcare Organizations: An Uneasy Fit The application of antitrust law to the evaluation of mergers in the healthcare industry has always been an awkward fit that has, over the years, challenged the way regulators and policy makers view healthcare. Some scholars have argued that the mere application of antitrust laws to healthcare mergers fundamentally transforms how we conceive of the delivery of healthcare services.24 For example, some policy makers view the provision of health care services under the health planning umbrella, wherein healthcare is considered a “system”, with debate predicated on the delivery of high-quality, cost-efficient services to patients.25 However, the application of antitrust law to the merger of healthcare firms inherently and categorically changes our conception of healthcare, from the social services “system” vision, to a view of healthcare as an industry, where economic principles such as supply and demand dictate how we view the issues affecting trade and commerce within the industry.26 This has not gone unnoticed by healthcare scholars, such as James Blumstein, who has noted that “the application of the antitrust laws to the health care industry reflects a challenge-a Kulturkampf- to a traditional culture that often has resisted the incorporation of economic considerations into its process of making decisions”.27 This means that any discussion of the role of antitrust law in non-profits, and nonprofit healthcare organizations in particular, is going to be colored by the terms employed by this article. Therefore, this article must be aware of this already inherent uneasy fit that colors the healthcare law/antitrust law debate. 24 James F. Blumstein, Health Care Reform and Competing Visions of Medical Care: Antitrust and State Provider Cooperative Legislation, 79 CORNELL L. REV. 1459, 1482 (1994) [hereinafter referred to as Blumstein 1]. 25 James F. Blumstein, The Application of Antitrust Doctrine to the Healthcare Industry: The Interweaving of Empirical and Normative Issues, 31 IND. L. REV. 91, 94 (1998) [hereinafter referred to as Blumstein 2]. 26 Id. at 94-95 (noting that antitrust law brings with it a conception of healthcare as an industry dominated by the analysis of economic principles). 27 James F. Blumstein, Antitrust Enforcement in the Healthcare Industry: A Battleground of Competing Paradigms, 156 U. PA. L. REV. PENNUMBRA 421, 421 (2008). 8 B. Post-PPACA FTC Merger Scrutiny 1. Healthcare Mergers in the Post-PPACA World The Affordable Care Act provides tremendous incentives for small healthcare providers to merge into larger units, namely by providing access to new delivery system models such as the affordable care organization.28 Although the ACA appears to encourage mergers in the healthcare industry, these transactions are being subjected to increased scrutiny by officials in the Obama Administration.29 Increased regulatory scrutiny has not only led to increased transaction costs for any proposed healthcare merger of significant size, but has also resulted in unfavorable judicial decisions enjoining potential mergers30. This section looks at three recent, important cases in which federal courts, at the request of the FTC, enjoined proposed healthcare mergers. These cases seem to misapply pre-ACA logic and reasoning to mergers happening in a post-ACA world. a. Federal Trade Commission v. OSF Healthcare System31 The first case involved two nonprofit healthcare providers in Illinois. OSF, a nonprofit operates acute care hospitals in the state, such as St. Anthony Medical Center; Rockford Health System (“RHS”), a nonprofit healthcare system operates Rockford Memorial Hospital (“RFM”).32 After engaging in extensive due diligence, the two entities entered into an “affiliation agreement”, which would have given OSF all of the operating assets and sole corporate authority over RHS.33 However, after the FTC investigated the merger it determined that the merger would have led to a violation of Section 7 of the 28 Alicia Gallegos, Physician Groups Eye Mergers but Blindsided by Legal Fights, AMERICAN MEDICAL NEWS (Dec. 10, 2013) http://www.amednews.com/article/20121210/profession/312109971/2/ . 29 Daccord and Irving, supra note 4. 30 Tom Campbell, Defending Hospital Mergers After the FTC’s Unorthodox Challenge to the Evanston Northwestern-Highland Park Transaction, 16 ANNALS HEALTH L. 213, 213-214 (2007)(noting that before the ACA, the FTC has at one point in the early 2000s lost 7 straight merger challenges). 31 852 F.Supp.2d 1069 (N.D.Ill. 2012). 32 Id. at 1071-72. 33 Id. at 1072. 9 Clayton Act and began judicial proceedings to challenge the acquisition of RHS by OSF.34 What is especially notable about the court’s detailed analysis of the affected market is that it goes to great lengths to differentiate OSF Healthcare from earlier, pre-ACA merger cases in which district courts denied the FTC’s request for preliminary injunction. Arguing against the injunction, the defendants referenced cases such as United States v. Long Island Jewish Medical Center35 and FTC v. Butterworth Health Corp.36, in which federal courts had denied injunctions despite allegations that the proposed mergers would have led to control over 100% of the market in the former and when the latter proposed merger would have resulted in sky-high HHI levels.37 While the Long Island court disputed the accuracy of the government’s definition of the affected market (stating that in defining the market the government limited the scope of its investigation to anchor hospitals and excluded other area hospitals that provided general acute care inpatient services), the OSF court refused to consider that a similar argument could have been made in case. Following the trend of differentiation, the district court distinguished OSF from Butterworth, a case in which the federal district court explicitly denied granting a preliminary injunction to stop a merger despite a high post-transaction HHI number. In distinguishing OSF from Butterworth, the Illinois court noted that in Butterworth, the court only denied the preliminary injunction because of evidence that 1) “non-profit hospitals operate different in highlyconcentrated markets than do profit-maximizing firms” and 2) that the two hospitals entered into an agreement to freeze prices after the merger and limit price increases for the four subsequent years.38 b. F.T.C. v. ProMedica Health System, Inc.39 ProMedica is another example of the Federal Trade Commission attempting to black a merger between nonprofit hospitals, alleging that such a joinder would violate Section 7 of the Clayton Act.40 This case involved a potential merger that took place in September 2010 between ProMedica Health System, Inc., which 34 Id. 983 F.Supp. 121 (E.D.N.Y. 1997) 36 946 F.Supp. 1285, 1294 (W.D.Mich. 1996). 37 Id. at 1081. 38 Id. at 1081-1082. 39 2011 WL 1219281, No. 3:11 CV 47 (N.D.Oh. Mar. 29, 2011). 40 Id. at *1, ¶ 4. 35 10 operated a number of hospitals including three in Lucas County, Ohio and St. Luke’s Hospital, which operated a strategically desirable hospital in southwest Lucas County.41 Although labeled a “joinder agreement” the transaction that the FTC challenged was a prototypical merger, leaving ProMedica as the corporate parent and economic decision-maker of St. Luke’s Hospital.42 This merger concerned the FTC because of the resulting increase in market share that ProMedica would have gained in the General Acute Care (“GAC”) and Inpatient Obstetrical (“OB”) service markets in Lucas County. 43 What is interesting about the court’s decision in ProMedica is the limited definition of a geographical market that it chose. Relying on testimony from health plan experts, the court agreed that Lucas County was a suitable geographic market, as patients would be unlikely to travel outside of their county to receive inpatient general acute care and obstetrics services. Therefore, a merger that gave one hospital a large market share in Lucas County could allow ProMedica Health System to charge minor, but still significant price increases.44 The FTC argued, and the district court ultimately concluded that, the potential for abuse of a monopoly, combined with the limited geographical reach for these services would culminate in antitrust violations. However, in determining that ProMedica would have abused its power, the federal court focused on the aggregate size and increased bargaining power that ProMedica would have had with insurers, employers, and patients.45 Although it began to engage in what should be considered a modern antitrust analysis of a healthcare merger, the court quickly dismisses the idea that ProMedica could have improved patient services, as ProMedica was the provider of inferior services and St. Luke’s actually provided superior patient care.46 There was no discussion given as to whether the merger would have resulted in synergies or culture changes that would have improved ProMedica’s patient care both within Lucas County and outside the state of Ohio. The district court also engaged in a discussion as to the possible efficiencies that the ProMedica-St. Luke’s merger would have 41 Id. at *2-3, ¶¶ 9-23. Id. at *3, ¶ 30-31. 43 Id. at *12, ¶ 95.(noting that the GAC market share would have shot up to 58.3% and the OB market share of ProMedica would have increased to 80.5%). 44 Id. at *10, ¶ 76-77 (noting that residents in Lucas County would rarely cross county lines in search of similar services). 45 Id. at *16, ¶ 123. 46 Id. at *30-31, ¶¶ 217-220. 42 11 yielded. However, it quickly, and without must analysis, concluded that any efficiencies, including revenue enhancements and capital cost avoidances were general, not foreseeable, and could have been accomplished by other non-anticompetitive means.47 Recognizing that the Affordable Care Act is conducive to mergers, and goes so far as to encourage them, the court briefly considers whether the ACA justifies allowing a merger with anticompetitive effects.48 Although the court mentions non-economic, patient care efficiencies that the merger sought to take advantage of, such as the creation of a more efficient electronic medical record system (“EMR”), it quickly decided that St. Luke’s could have done so alone.49 While that may have been true, the court’s rigid adherence to a narrow market definition colored its analysis, as it failed to see that an “EMR” controlled by ProMedica would not just have, for example, benefited residents of Southwest Lucas County, but many more beyond the FTC’s artificial border. c. F.T.C. v. Phoebe Putney Health System, Inc.50 In what has become a seminal case in the fields of healthcare and antitrust law, the Eleventh Circuit Court of Appeals (and later the Supreme Court) considered the FTC’s challenge a merger proposed by the Phoebe Putney Health System, Inc. and Palmyra Park Hospital (”Palmyra”) in Albany, Georgia. Unlike traditional hospital mergers that either involve for-profit or nonprofit entities, Phoebe Putney Health System, Inc., and the Phoebe Putney Memorial Hospital, Inc. was actually acquired and held by the Hospital Authority of AlbanyDougherty County.51 If Phoebe Putney Memorial had acquired Palmyra, that would have given the new entity an 86% market share of the provision of hospital services for Albany and the surrounding five counties.52 When the FTC initiated its challenge to the proposed merger, Phoebe Putney Memorial raised the doctrine of state-action immunity to shield the transaction from antitrust scrutiny.53 Under the Doctrine of State-Action Immunity, states are immune from Sherman Act liability for anticompetitive conduct that occurs within their 47 Id. at *35-40, ¶¶ 235-260 (noting that the proposed efficiencies were speculative, not related to the specific merger at hand, and were outweighed by anticompetitive concerns). 48 Id. at *41, ¶ 274-75. 49 Id. at *41, ¶ 275. 50 663 F.3d 1369 (11th Cir. 2011). 51 Id. at 1373. 52 Id. at 1374. 53 Id. 12 jurisdiction54, although this does not always protect political subdivisions of the state, such as municipalities or their agencies (like the Phoebe Putney Health System)55. Therefore, Phoebe Putney Memorial, in order to be eligible for protection under the Doctrine of State-Action Immunity, would have to show that “the state generally authorizes it to perform the challenged actions and that through statutes; the state has clearly articulated a state policy authorizing anticompetitive conduct”56. Finding that the Georgia State Legislature had given municipalities the power to act under § 31-7-75 of the O.C.G.A. and that those statutes were intended to displace competition; the Eleventh Circuit sanctioned the merger and dismissed the FTC’s complaint57. However, the Supreme Court was not as willing to find a valid defense to antitrust scrutiny as was the Eleventh Circuit. Instead, the Court found that “because Georgia had not clearly articulated and affirmatively expressed a policy allowing hospital authorities to make acquisitions that substantially lessen competition, state-action immunity does not apply”58 in the case of Phoebe Putney Memorial’s question of Palmyra. The Court continued on to reason that the statute relied upon by the defendant, O.C.G.A. § 31-7-75, was a standard statute conferring broad general powers and that there was no specific statute that explicitly contemplated and dismissed anticompetitive effects of actions taken under the powers granted.59 To qualify for protection under the doctrine of state-action immunity something more was required; the Authority must have been able to show that it had been delegated authority to act, but to do so anti-competitively.60 Antitrust law, according to the Court, could not be displaced by a 54 For a recitation of this doctrine see Parker v. Brown, 317 U.S. 341, 63 S.Ct. 307 (1943). 55 Phoebe Putney, 663 F.3d at 1375. 56 Id. (citing FTC v. Hosp. Bd. Of Dirs. Of Lee Cnty., 38 F.3d 1184, 1187-88 (11th Cir. 1994); Town of Hallie v. City of Eau Claire, 471 U.S. 34, 105 S.Ct. 1713 (1985)). 57 Phoebe Putney, 663 F.2d at 1376-1378 (detailing why the court believed the statutes passed by the state legislature gave the Hospital Authority the power to act and concluding that the legislature intended to displace competition by passing those statutes). 58 F.T.C. v. Phoebe Putney Health System, Inc., 133 S.Ct. 1003, 1005, 185 L.Ed.2d. 43 (2013). 59 Id. 60 Id. 13 logical or ordinary extension of a statute granting a municipal authority the power to act.61 d. Common Trends in Judicial Analysis of Post-PPACA Mergers These three cases have been part of a judicial trend …. Healthcare mergers escalated in the mid-2000s, before the most recent economic collapse, and have steadily continued since then at a pace equal to or above early 2000 numbers and well above those of even the late 1990’s, despite the poor economic climate of the post-PPACA world.62 Given these numbers, there is likely some justification for the increase in mergers, namely the efficiencies afforded to healthcare organizations of which mergers are an essential to obtaining. However, in most circumstances, federal courts are adopting prePPACA analyses to evaluate mergers in a post-PPACA world, which brought about radical regulatory, economic, and cultural changes to the healthcare industry. Although ProMedica offers the best example of how a federal court should proceed in the case of an FTC challenge to a hospital or healthcare merger, there are still systemic problems in the courts’ reasoning. First, in post-PPACA FTC challenges to healthcare organization mergers, the FTC and courts have brought challenges to mergers in less concentrated mergers or have narrowly defined the subject market area to produce clear antitrust violations. While these mixed messages are not new,63 the FTC’s 2010 Merger Guidelines seem to codify this agenda in the face of contradictory federal legislation, as the new guidelines are just as susceptible to market narrowing as were the old guidelines they were intended to replace.64 61 Id. at 1006. A Wave of Hospital Mergers, NEW YORK TIMES (Aug. 12, 2013), http://www.nytimes.com/interactive/2013/08/13/business/A-Wave-ofHospital-Mergers.html?ref=business. 63 See Jonathan Choslovsky, Comment, Agency Review of Health Care Industry Mergers: Proper Procedure or Unnecessary Burden?, 10 ADMIN. L.J. AM. U. 291, 310-11 (1996)(noting that agencies have challenged hospital mergers in less concentrated markets, while letting mergers in highly concentrated markets proceed unchallenged). 64 See Michael Doane et al., Warning: Improper Use of the New Horizontal Merger Guidelines Can Result in Overly Narrow Markets, Mistaken Inferences of Market Power, and Wrong-Headed Analysis, 2 CPI Antitrust Journal 1, 7 (2010), available at http://www.competitioneconomics.com/wp62 14 This marks a shift from the 1990s where hospital market shares were analyzed much more broadly then they are analyzed in the postPPACA regime,65 which has played an instrumental role in the decision to grant injunctions in FTC challenges. Until OSF, even market share concentration was not an absolute determination, or even a significant factor, in every courts consideration of an FTC challenge to a proposed merger.66 This is exactly the tension that appears in OSF Healthcare, where the court explicitly rejects using previous decisions that have challenged narrower market definition and the idea that a high HHI (market share percentage) automatically means the proposed merger is anticompetitive. Second, a number of courts are concerned about the potential for hospitals to abuse an ensuing monopoly by increasing prices67, but this argument has not historically carried the day when courts analyze hospital mergers.68 In fact, several courts when evaluating hospital mergers have come to the exact opposite conclusion: the fewer content/uploads/2010/10/New-Horizonal-Merger-GuidelinesArticle1.pdf (noting that the new merger guidelines are still as susceptible to market narrowing as were the 1992 guidelines). 65 David A. Ettinger, CONSOLIDATION IN A RAPIDLY CHANGING INDUSTRY: NAVIGATING OPTIONS, ANTITRUST AND OTHER OBSTACLES, AMERICAN HEALTH LAWYERS ASS’N 2-3 (2013), available at http://www.healthlawyers.org/Events/Programs/Materials/Documents/ HHS13/G_ettinger.pdf (noting that although markets for potential hospital mergers were categorized broadly by the courts in the 1990s, the definition of a market has narrowed in the 2000s); Compare United States v. Mercy Health Services, 902 F.Supp. 968, 973-74 (N.D.IA. 1995)(defining the market as including areas within 70-100 miles of the hospital’s city) with F.T.C. v. ProMedica Health System, Inc., No. 3:11 CV 47, 2011 WL 1219281, at * (N.D.Oh. Mar. 29, 2011)(defining the geographic market as Lucas County). 66 See F.T.C. v. University Health, Inc., 938 F.2d 1206, 1222 (11th Cir. 1991)(noting that market share statistics are not determinative of anticompetitive effects, but rather a tool used to illustrate potential effects a merger would have on a market). 67 See F.T.C. v. OSF Healthcare System, 852 F.Supp.2d 1069, 1082 (D.C.N.D. Ill. 2012) (noting that Butterworth’s holding can be distinguished from OSF because the Butterworth case involved safeguards to prevent price increases, which the OSF merger did not have). 68 Tom Campbell, Defending Hospital Mergers after the FTCs Unorthodox Challenge to the Evanston Northwestern-Highland Park Transaction, 16 ANNALS HEALTH L. 213, 213 (2007) 15 hospitals in an area, the lower the prices of healthcare services.69 While assertions such of these have been categorized as a simple misunderstanding of expert testimony, they do stand for the proposition that courts have been willing to approve mergers despite any anticompetitive effects on pricing.70 Additionally, in ProMedica the district court was quick to find the potential for post-merger price raises, but failed to clearly articulate any argument to a basic tenant of mergers: that mergers are designed to promote synergies, namely through lowering costs, which allow firms to subsequently reduce consumer prices.71 In addition to a narrowing of the FTC’s and courts’ definition of the relevant market and a renewed focus on potential for price increases, courts have also heavily scrutinized defenses raised by hospitals that are a party to an FTC challenged merger. Even before the Supreme Court granted certiorari to Phoebe Putney, the Eleventh Circuit was quick to find hospitals protected by the Doctrine of StateAction Immunity, as it had adopted a lax reading of the statutory requirements required by the doctrine.72 Other federal district courts have denied preliminary injunctions to merger challenges based on the “Failing Company” Defense to § 7 Clayton Act challenges73 and the “Efficiency Defense” where the court readily acknowledge that the defense was difficult to prove and there were serious questions about 69 United States v. Carilion Health System, 707 F.Supp. 840, 846 (W.D.Va. 1989). 70 Peter J. Hammer, Questioning Traditional Antitrust Presumptions: Price and Non-Price Competition in Hospital Markets, 32 U. MICH. J.L. REF. 727, 768-69 (1999). 71 Thomas A. Piraino, Jr., A New Approach to the Antitrust Analysis of Mergers, 83 B.U. L. REV. 785, 824 (2003)(discussing how mergers can produce economic efficiencies that have historically resulted in firms charging consumers lower prices). 72 See Crosby v. Hospital Authority of Valdosta and Lowndes County, 93 F.2d 1515, 1525-26 (11th Cir. 1996)(relying on policy considerations to determine that hospitals were political subdivisions and protected by the Doctrine of State-Action Immunity without inquiring as to whether there was direct authorization by the legislature to engage in anticompetitive conduct). 73 California v. Sutter Health System, 130 F.Supp.2d 1109, 1133-1137 (D.C.N.D. Ca. 2001)(applying the failing company defense to dismiss the government’s request for a preliminary injunction enjoining a hospital merger). 16 the validity of the defense.74 All of these cases, in contrast with the Supreme Court’s recent decision in Phoebe Putney, point towards a judicial tightening of the defenses that were once readily available to hospitals whose mergers were challenged by the FTC or DOJ. In combination with the district court’s rigid scrutiny of claims of efficiency in ProMedica, even once long-shot Efficiency Defenses, once generally accepted defenses are being heavily scrutinized by courts in an attempt to more broadly apply antitrust law. III. Do Recent Trends in FTC Enforcement Undermine the Goals of the Patient Protection and Affordable Care Act? [AP: You should start with an introductory roadmap for this new major section] A. Goals of the Affordable Care Act Paramount in President Obama and Congress’ effort to pass comprehensive healthcare legislation in 2010 was the concern over skyrocketing health care costs.75 While the controversial “individual mandate” was the centerpiece of the legislative reform, there were a number of other provisions that were aimed at reducing costs of health care financing.76 It is no surprise then that the number of hospital mergers has more than doubled from 50 in 2009 to 105 in 2012.77 Beyond specific merger synergies, the ACA has both explicitly and 74 See U.S. v. Long Island Jewish Medical Center, 983 F.Supp. 121, 147-49 (E.D.N.Y. 1997)(although the court admitted the efficiency defense would be difficult to prove and there were questions as to whether the efficiencies were merger-specific and there were other readily available, less anticompetitive options to achieve such efficiencies, the court ultimately found that the defense precluded the government’s antitrust challenge). 75 Dustin D. Berger, The Management of Health Care Costs: Independent Medical Review after “Obamacare”, 42 U. MEM. L. REV. 255, 256-57 (2010)(noting that in 2006, health care costs in America amounted to 15% of the country’s GDP, while other developed nations allocated about 8% of their GDP to health care expenditures and these escalating costs prompted congressional and presidential reform of the health care industry). 76 Id. at 257. 77 See A Wave of Hospital Mergers, NEW YORK TIMES (Aug. 12, 2013), http://www.nytimes.com/interactive/2013/08/13/business/AWave-of-Hospital-Mergers.html?_r=1&. 17 implicitly altered the health care industry and provided specific incentives that can only be achieved through the merger of healthcare organizations. 1. Lowering Prices through the Creation of Accountable Care Organizations One of the primary stated motivators for mergers and acquisitions in an industry is to reduce costs by combining two firms that were indepdendtly operating at lower than optimal efficiency levels.78 In fact, scholars have explicitly stated that the Affordable Care Act incentivizes mergers through the creation of more efficient health care delivery systems that are entitled to significant monetary benefits over smaller, independent entities.79 This has also served as one of the primary motivators in the healthcare industry since the pivotal 2010 healthcare law reduced Medicare payments to hospitals by $155 billion through 2019.80 § 3022 of the Affordable Care Act incentivizes the creation of “Accountable Care Organizations” (ACOs), which will allow the ACOs to participate in the new “Medicare Shared Savings Program”.81 ACOs are “a network of physicians and hospitals responsible for providing health care services for a minimum of 5,000 Medicare patients”82 and are a foundational 78 ROBERT B. THOMPSON, MERGERS AND ACQUISITIONS: LAW AND FINANCE 11 (2010)(noting that one of the primary financial incentives that shape mergers is synergy: the belief that the combination of two companies will produce greater economic efficiency then the operation of two independent firms). 79 See Health Care Act and Competition in Health Care Before the Subcomm. On Regulatory Reform, Commercial and Antitrust Law of the H. Comm. On the Judiciary, 112 Cong. __ (2013)(statement of Thomas L. Greaney, Chester A. Myers Professor of Law, Saint Louis University School of Law). 80 Jeffrey Young, Hospital Mergers Draw Antitrust Scrutiny, FTC Warns of High Costs, THE HUFFINGTON POST (Mar. 19, 2010), http://www.huffingtonpost.com/2012/03/19/hospital-mergers-drawscr_n_1362691.html. 81 See Patient Protection and Affordable Care Act, Pub. L. No. 111148, 124 Stat. 119, § 3022 (2010); Patricia M. Bruns, An Antirust Analysis of Accountable Care Organizations: Potential Abuses from Allowing Reduced Scrutiny Under the Affordable Care Act, 28 J. CONTEMP. HEALTH L. & POL’Y 268, 268 (2012). 82 Brian J. Carroll, Note, Getting Your Docs in a Row: Will the Patient Protection and Affordable Care Act Allow Physicians in Private 18 part of the United States’ new healthcare system. By creating these networks of primary care doctors, specialists, and hospitals, the Affordable Care Act will allow ACO’s to efficiently manage a large number of enrolled patients, while doing so in an economically efficient manner.83 That is because ACO’s benefit from several income enhancing provisions in the Affordable Care Act, from fee-forservices Medicare reimbursements and additional bonuses for meeting § 3022 cost-cutting and quality-care criteria that are unavailable to physicians and hospitals outside of the ACO network.84 Even if these benefits do not immediately lead to mergers, the changing operational dynamics brought about the creation of ACOs is at least encouraging physicians and hospitals to enter into joint ventures and partnerships that may later develop into more formal acquisitions.85 2. Mergers as a Logical Byproduct of the Affordable Care Act Consolidation in the healthcare industry after the passage of the ACA was a major concern to members of the House of Representatives.86 This was, in part, just a general outgrowth of the Affordable Care Act’s desire to increase cooperation within the healthcare system, as it is easier to coordinate within one firm as Practice to Organize and Collectively Bargain?, 9 J. HEALTH & BIOMEDICAL L. 117, 119 (2013). 83 Id. See also Elizabeth L. Rowe, Accountable Car Organizations: How Antitrust Law Impacts the Evolving Landscape of Health Care, 2012 U. ILL. L. REV. 1855, 1856 (2012)(noting that ACOs will be able to manage large numbers of patients while both improving the quality of care and simultaneously keeping costs under control). 84 Stephen E. Ronai, The Patient Protection and Affordable Care Act’s Accountable Care Organization program: New Healthcare Disputes and the Increased Need for ADR Services, 66 DISP. RESOL. J. 60, 62 (2011). 85 See John Andrews, Healthcare Mergers Take on New Shapes, HEALTHCARE FINANCE NEWS (Oct. 28, 2013), available at http://www.healthcarefinancenews.com/news/healthcare-mergerstake-new-shapes. 86 Healthcare Consolidation and Competition after the PPACA: Hearing Before the Subcomm. On Intellectual Property, Competition, and the Internet of the H. Comm. On the Judiciary, 112 Cong. 1 (2012)(May 18, 2012)(statement of Rep. Goodlatte)(stating that “consolidation in the healthcare industry is of utmost concern to me and my constituents, both in the provider and insurance markets). 19 opposed to across multiple firms.87 Just a plain-text reading of the bill, along with an understanding of the various provisions included, reveals a list of incentives that promote consolidation in the healthcare industry.88 Scholars have also recognized that the Affordable Care Act encourage healthcare consolidations through a number of provisions, including the efforts to increase clinical integration.89 While the ACA was generally designed to increase coordination and cooperation in the healthcare industry, the bill included a number of specific provisions that rewarded cost cutting and quality increase.90 However, not all of the ACA’s impetuses for mergers are benign or designed to achieve greater efficiencies in cost and patient care. There are concerns that because the ACA’s coverage expansions will be funded by reducing the rate of Medicare payment updates, that hospitals will turn to consolidation to achieve greater market power in a quest to raise prices.91 B. FTC Scrutiny of Mergers in the Healthcare Industry 87 Eduardo Porter, Health Law Goals Face Antitrust Hurdles, NEW YORK TIMES (Feb. 4, 2014), http://www.nytimes.com/2014/02/05/business/economy/health-lawgoals-face-antitrust-hurdles.html. 88 R. Dale Grimes, Collaboration vs. Consolidation Under the Affordable Care Act, HOSPITALS & HEALTH NETWORKS (Aug. 8, 2013), http://www.hhnmag.com/display/HHNnewsarticle.dhtml?dcrPath=/templatedata/HF_Common/NewsArticle/ data/HHN/Daily/2013/Aug/grimes080813-8010005186 (noting that incentives included in the ACA encourage mergers, while FTC enforcement discourages them). 89 David A. Balto & james Kovacs, CONSOLIDATION IN HEALTH CARE MARKETS: A REVIEW OF THE LITERATURE, ROBERT WOOD JOHNSON FOUNDATION 1 (Jan. 2013), available at http://www.dcantitrustlaw.com/assets/content/documents/2013/baltokovacs_healthcareconsolidation_jan13.pdf. 90 Roy Strom, Hospital Mergers Get Caught between Reform, Competition, CHICAGO LAWYER (Dec. 2012), http://chicagolawyermagazine.com/Archives/2012/12/HospitalMergers.aspx. 91 See James C. Robinson, New Evidence of the Association between Hospital Market Concentration and Higher Prices and Profits, NATIONAL INSTITUTE FOR HEALTH CARE MANAGEMENT (Nov. 2011), available at http://www.nihcm.org/images/stories/NIHCM-EVRobinson-Final.pdf. 20 In a proposed merger between two healthcare providers, the Department of Justice and the FTC have the authority to review the proposed transaction for any potential anticompetitive effects.92 The FTC has consistently used this power in an attempt to lower healthcare costs by challenging what it deems as anticompetitive mergers, not just challenging potentially egregious violations, but in imposing a systemic plan to bring more challenges against proposed hospital mergers.93 By bringing suit against consolidating healthcare providers, the FTC is not just attempting to quell contained instances of anticompetitive behavior, but trying to strengthen a regulatory regime which had suffered a series of setbacks and crucial losses just a decade ago.94 Revamping and strengthening is Health Care Division, however, seems to be directly at odds with what the Affordable Care Act seeks to accomplish, namely increasing consolidation and creating efficiency is a once dysfunctional healthcare system. a. The ACA Fundamentally Changes the Operating Models for Hospitals and Healthcare Providers In OSF, a district court in Illinois granted an injunction to halt a merger, in part by distinguishing the current case from previous decisions denying injunctions, in part because it rejected the contention that non-profit hospitals would not abuse concentrated market power.95 However, it is difficult for hospitals, even those with a large market concentration, to utilize any advantages that a 92 Nicole Harrell Duke, Comment, Healthcare Mergers Versus Consumers: An Antitrust Analysis, 30 U. BALT. L. REV. 75, 77 (2000). 93 See Brent Kendall, Regulators Seek to Cool Hospital-Deal Fever, WALL STREET JOURNAL (Mar. 18, 2012), http://online.wsj.com/news/articles/SB1000142405270230386340457 7286071837740832. 94 See Brent Kendall, FTC Gets More Muscle in Policing Hospital Mergers, WALL STREET JOURNAL (Feb. 19, 2013), http://online.wsj.com/news/articles/SB1000142412788732349510457 8314041654081664 (noting that the FTC challenge to the Phoebe Putney merger was part of a new batch of lawsuits that were brought in an “attempt to revive its hospital enforcement program”). 95 F.T.C. v. OSF Healthcare System, 852 F.Supp. 1069, 1081 (N.D.Ill. 2012)(noting that the current case was distinguishable from Butterworth in part because the Butterworth court’s reasoning that “non-profit hopsitals operate differently in high-concentrated markets than do profit-maximizing firms” was fundamentally flawed and subsequently rejected by the 7th Circuit Court of Appeals). 21 traditional monopoly would provide. One of the primary ways this could occur would is through the increased efforts at price transparency for the costs of medical services. The OSF court was fundamentally wrong when it disregarded the Butterworth court’s reasoning that non-profit hospitals operated at a different model then other profit seeking firms. Healthcare industries, unlike most traditional industries, have long been plagued by claims of disparate price transparency as compared to other firms, preventing consumers from learning the real cost of a medical procedure.96 Additionally, it is not likely that FTC challenges to new healthcare mergers would even be effective in promoting competition. After the passage of the Affordable Care Act, “80% of hospital markets and 70% of health care-health insurance markets were considered highlight concentrated by the standards used by the Department of Justice and the FTC”97. Some estimates even have 90% of Americans living in large metropolitan areas facing highlight concentrated healthcare markets.98 Most of this market concentration is the result of two previous waves of healthcare mergers, from 19952003 and 2006-2008, before the Affordable Care Act’s benefits for mergers and consolidations could be felt.99 Although the FTC challenged some of these mergers during the proposal stage, the agency was ultimately unsuccessful in its attempt to slow either wave, 96 Martha Hostetter and Sarah Klein, Health Care Price Transparency: Can it Promote High-Value Care?, QUALITY MATTERS (The Commonwealth Fund), Apr./May 2012, available at http://www.commonwealthfund.org/Newsletters/QualityMatters/2012/April-May/In-Focus.aspx (noting that the healthcare industry is unlike other industries in that a lack of price transparency left consumer with little to no idea as to what they would ultimately pay for a medical procedure). 97 Hearing on PPACA and Impact on Competition on Health Care Before the S. Comm. On Regulatory Reform, Commercial and Antitrust Law of the House Comm. On the Judiciary, 113 Cong. (Sept. 19, 2013)(statements of Rep. Spencer Bachus). 98 Barak D. Richman, CONCENTRATION IN HEALTH CARE MARKETS: CHRONIC PROBLEMS AND BETTER SOLUTIONS 4, AMERICAN ENTERPRISE INSTITUTE (June 2012), available at http://www.aei.org/files/2012/06/12/-concentration-in-health-caremarkets-chronic-problems-and-better-solutions_171350288300.pdf 99 See id. (explaining the two previous waves of mergers in hospitals that resulted in large market concentrations). 22 at one point losing nine challenges in a row.100 Given the spectacular failures that the FTC has suffered in previous attempts to slow hospital mergers, times when there were no federal benefits, legislative efficiencies, or emphasis on improving quality of patient care, why is now the time to slow the third wave, in which hospitals are making all of these concerns priorities? The Affordable Care Act fundamentally transforms the economic climate in which hospitals and healthcare organizations operate. Mergers and consolidations that create larger, more efficient networks will actually allow healthcare providers to cut costs and improve their service delivery model while lowering prices.101 Unlike pre-PPACA mergers (and other traditional mergers driven by pure price or service synergies), the Affordable Care Act encourages hospital mergers in order to improve the coordination of patient care and the provision of services.102 This is exactly the benefit that consolidated hospitals claim will occur, that the combination of two smaller organizations can achieve greater patient management programs and IT systems that would allow for better patient outcomes.103 These ancillary, non-healthcare related benefits, such as See Ankur Kapoor & Constantine Cannon, Ascension of Obama’s New FTC Chair, Edith Ramirez, Signals Greater Enforcement in Tech, Health Care, BLOOMBERG NEWS (Mar. 4, 2013), http://about.bloomberglaw.com/practitioner-contributions/new-ftcchair-edith-ramirez-signals-greater-enforcement/ (noting that from 1994 on, the FTC lost seven merger challenge cases in a row). 101 Be Well: Is Federal Health Reform to Blame for Hospital Consolidation, IDEA STREAM (Jan. 21, 2014)(statement of Robinson Memorial’s CEO, discussing how mergers create larger organizations more capable of creating efficiencies and passing on savers to consumers than are smaller community hospitals). 102 Peter Frost, Northwestern Memorial HealthCare, Cadence Health Pursuing Merger, CHICAGO TRIBUNE (Mar. 14, 2014), http://articles.chicagotribune.com/2014-03-14/business/ctnorthwestern-cadence-merger-0314-biz-20140314_1_cadence-healthmike-vivoda-possible-merger. 103 See Julie Creswell and Reed Abelson, New Laws and Rising Costs Create a Surge of Supersizing Hospitals, NEW YORK TIMES (Aug. 12, 2013), http://www.nytimes.com/2013/08/13/business/bigger-hospitalsmay-lead-to-bigger-bills-forpatients.html?adxnnl=1&adxnnlx=1395029587xwo58t5SQx8o5absf1N1eg (noting that some hospitals are merging to pool resources in an attempt to improve patient care);David Dranove, Acquiring the Competition, KELLOGG INSIGHT (Dec. 9, 2013), 100 23 strengthening oversight boards or increasing IT capabilities are now crucial to hospitals in order to received payments from Medicare. Instead of the old model, which processed payments on volume, the ACA emphasizes patient care and efficiency (such as by reducing readmissions after a procedure),104 which small hospitals might not be able to accomplish without merging with a more capable healthcare organization, even if it produces anticompetitive effects. Additionally, the ACA drastically changes the way that payments are made to healthcare providers, which requires hospitals to service more patients through the formation of large networks of providers.105 Although this article does not argue that hospitals, especially nonprofit hospitals, are exempt from financial pressures that could lead to price increases after a merger106, the changes in payment structure, incentives for reducing costs, and treating more patients, should act to mitigate these concerns. b. Contradicting Guidelines: Will Courts Adopt the FTC’s Reasoning in the Norman PHO Advisory Opinion or the Traditional Antitrust Analysis Exposed by the FTC’s 2010 Merger Guidelines? Although the FTC and DOJ have issued some formal guidelines in how the two agencies will treat accountable care organizations, the guidelines do not address ACO’s that serve only commercial health plans.107 More importantly, it was not until 2013 http://insight.kellogg.northwestern.edu/article/acquiring_the_competiti on/. 104 Strom, supra note 90. 105 See id. 106 A study conducted by Wiliam J. Lynk attempted to challenge the DOJ’s claim that the designation of a hospital, whether for-profit or nonprofit, did not affect the propensity of a hospital to raise prices as it increases its market share. See Nonprofit Hospital Mergers and the Exercise of Market Power, 38 J. L. & ECON. 437 (1995). However, after that study was published a number of subsequent empirical studies have cast serious doubt on Lynk’s assertion. See Jennifer R. Conners, Comment, A Critical Misdiagnosis: How Courts Underestimate the Anticompetitive Implication of Hospital Mergers, 91 CAL. L. REV. 543, 572 (2003) (for a discussion of the studies that challenge Lynk’s hypothesis). 107 Stephen Y. Wu, Recent Developments in Antitrust Law: Leading Lawyers on Understanding the Impact of Revised Merger Guidelines, Responding to Investigations, and Anticipating Future Changes in 24 that the FTC even issued an advisory opinion as to how it would handle basic joint contracting agreement and even that opinion was devoid of specific benchmarks for passing FTC scrutiny that any hospital executive would need to be aware of before beginning to think of creating consolidated healthcare networks.108 However, this opinion is still significant in this article’s evaluation of the FTC’s policies in challenging healthcare organizations attempts to merge, consolidate, and work together to achieve the efficiencies longed for the Affordable Care Act. In February of 2013, the FTC issued an advisory opinion on a clinical integration plan proposed by the Norman Physician Hospital Organization (“Norman PHO”), which would have allowed horizontal pricing agreements for the provision of physician services.109 This clinical integration program would have been non-exclusive, allowing physicians to provide services to those that did not want to contract with Norman PHO, and called for the implementation of a number of significant programs that would benefit patient care, including: (1) developing clinical guidelines for treating 50 different conditions, (2) a new electronic medical record database and IT platform and (3) the creation of committees to oversee the quality of patient care.110 In fact, Markus Meier, the Assistant Director of the Health Care Division of the FTC’s Bureau of Competition, who authored the Norman PHO Advisory Opinion, explicitly stated that this clinical integration network “offers the potential to create a high degree of interdependence and cooperation among its participating physicians and to generate significant efficiencies in the provision of physician services.”111 Antitrust Enforcement, Aspatore (June 2013), 2013 WL 3773854, at *4. 108 John Green, FTC’s Opinion on Norman PHO-Significant but Unclear, LAW360.COM (last visited on Mar. 16, 2014), http://www.law360.com/articles/432294/ftc-s-opinion-on-normanpho-significant-but-unclear (noting that the Norman PHO advisory opinion failed to detail any specific steps that a healthcare organization would have to take to meet federal antitrust compliance requirements). 109 Molly Gamble, What the FTC’s Recent Advisory Opinion on Clinical Integration Means for Hospitals, BECKER’S HOSPITAL REVIEW (Feb. 19, 2013). 110 Id. 111 Norman PHO Advisory Opinion, Op. Off. Legal Counsel of the FTC’s Bureau of Competition: Health Care Division (Feb. 13, 2013), available at http://www.ftc.gov/sites/default/files/documents/advisoryopinions/norman-physician-hospital25 What is especially important about this advisory opinion is that it explicitly allows the proposed merger despite the assistant director’s acknowledgement that Norman’s size will allow it to negotiate higher prices from insurers, employers, and customers.112 This is a complete reversal of federal district courts’ analysis, especially the district court’s decision in ProMedica, in which the court expressed sincere concern about this phenomenon. What could be the possible differences that would allow the FTC to reverse course in one year? It’s possible that the FTC is trying to balance the demands of the Affordable Care Act with healthcare organization consolidation and was willing to allow prices to theoretically rise, as Norman’s clinical integration proposal was non-exclusive and the organization promised strict and voluminous antitrust compliance training.113 However, what is more likely is that the FTC has weighed the benefits of this nonexclusive arrangement in areas like patient care, electronic record infrastructure creation, and cost reduction.114 Unlike ProMedica, which the court believed to have a reputation of cost-cutting and price hiking, Norman is viewed by the FTC as being dedicated to the success of the clinical integration program115. Even though Norman PHO executives were not able to clearly articulate the exact expected synergies that the merger would yield116, the FTC was readily able and willing to read into the program’s description and find the significant benefits to patient care and healthcare infrastructure that the “merger” would yield, regardless of the potential anticompetitive effects. organization/130213normanphoadvltr_0.pdf [hereinafter, Norman PHO Opinion]. 112 Joe Carlson, Beyond ACOs: FTC Approves Another Path to Coordinated Care, MODERN HEALTHCARE (Mar. 9, 2013), http://www.modernhealthcare.com/article/20130309/MAGAZINE/303 099969#. 113 Norman PHO Opinion, supra note 83, at pg. 20. 114 See id. at pgs. 15-16 (detailing the non-economic healthcare benefits that the clinical integration network would implement). 115 Id. at 16 (noting that “together, the participating physician’s contributions of human capital, time, and money appears to give them a stake in the success of Norman PHO such that the potential loss or recoupment of their investment is likely to motivate them to work to make the program succeed”). 116 Id. at 11 (noting that “Norman PHO states that it cannot currently quanity…the likely overall benefits of its proposed program, or specify how overall cost or quality efficiency gains will be measured”). 26 IV. RETHINKING THE APPLICATION OF ANTIRUST LAW TO HEALTHCARE MERGERS TO ACHIEVE THE OBJECTIVES OF THE AFFORDABLE CARE ACT Given the monumental changes that the Affordable Care Act has made to the U.S. healthcare industry, specifically the provisions that it contains to incentive mergers and consolidations, the author believes it is necessary to reconsider the application of antitrust law to healthcare mergers. While this could come in the form of recognizing healthcare as a market failure and thus immune from antitrust scrutiny, that is likely to gross of an exaggeration of the healthcare industry, especially in light of the ACA. Instead, the FTC and federal courts should reinterpret antitrust law in a flexible manner that appreciates both the concerns of hospitals abusing market power to increase prices, while recognizing the inherent need for consolidation in a postPPACA healthcare industry. A. Would Reducing the Role of Antitrust Law be Necessary to Correcting a Market Failure? Healthcare in the United States could, for some time now, could be categorized as a market failure. As this article has previously discussed, opaque pricing models and a lack of transparent alternatives has skewed consumer’s traditional ability to correct a firm’s inefficient pricing mechanisms by shopping elsewhere. This problem is compounded when the consumer is not primarily responsible for paying their medical bills, as is the case when health insurance covers medical bills. When payments are made by a third party and a consumer’s decision to purchase services is divorced from price considerations, leaving providers and consumers with little reason to reduce costs, there is a market failure.117 However, not all market failures rise to the level of antitrust violations118, so the question becomes whether antitrust law is necessary to correct potential failures, whether antitrust law would increase price transparency, 117 Note, Antitrust and Nonprofit Entity, 94 HARV. L. REV. 802, 804 (1981)(noting that a “second type of market failure occurs when the consumer’s decision to purchase is independent from the price of good or service. The author continues on to explain that third-party payment of medical fees creates a moral hazard that traditional market forces are unable to correct). 118 Neil W. Averitt & Robert H. Lande, Consumer Choice: The Practical Reason for Both Antitrust and Consumer Protection Law, 10 LOY. CONSUMER L. REV. 44, 45 n. 2 (1998). 27 lowers costs, and increase efficiencies. The healthcare industry, particularly the post-PPACA industry is radically different and the act itself is aimed at correct once prolific market failures. Given that the Affordable Care Act attempts to provide benefits for firms that can capture cost, revenue, and infrastructure efficiencies through collaboration and cooperation, including mergers, it is the ACA, not the Sherman Act that should be relied upon to cure a problematic marketplace. Favoring antitrust regulations over ACA policy considerations only weakens the healthcare industry by stifling collaboration ventures for fear of regulatory scrutiny while doing nothing but preserving the failed market status quo. While this does not mean that hospitals and healthcare organizations should be immune from antitrust scrutiny, as this article recognizes the problems associated with too much power in a limited market, the FTC and courts should instead try to reimage their approaches to the role of antitrust law in healthcare provider mergers. B. Flexible Standards for a Post-PPACA World A number of scholars have advocated for courts to be more flexible in their application of rule of reason antitrust analysis to healthcare organization mergers.119 However, this is a fine line for courts to walk, as too stringent application of antitrust law defeats the benefits from nonprofit collaboration, while application that is too deferential brings with it its own perils.120 When this article discusses a “flexible” vs. “inflexible” standard, it does not merely refer to a given court’s preference towards strict construction of the Sherman or Clayton Act, but rather extends more broadly to the heart of a court’s analysis. a. Examples of Flexible Interpretation of Antitrust Principles in the Realm of Nonprofit Law Luckily for healthcare organizations, common law is not devoid of courts using a “flexible” interpretation of antitrust laws to 119 For an example of such an approach see, Thomas L. Greaney, Antitrust and Hospital Mergers: Does the Nonprofit Form Affect Competitive Substance, 31 J. HEALTH POL. POL’Y & L. 511, 527 (2006). 120 See Peter James Kolovos, Note, Antitrust Law and Nonprofit Organizations: The Law School Accreditation Case, 71 N.Y.U. L. REV. 689, 725 (1996) (noting that benefits and drawbacks of a flexible approach to the application of antitrust law to nonprofits). 28 exempt nonprofits from Sherman Act scrutiny, even though that might appear in the form of strict adherence to the text of the statute. The Ninth Circuit Court of Appeals took such a strict reading, flexible approach in Dedication and Everlasting Love to Animals v. Humane Society of the United States.121 In DELTA, the appellant claimed that the Humane Society violated §§ 1&2 of the Sherman Act by restraining competition and attempting to monopolize the charitable contribution marketplace.122 It has been noted that the 9th Circuit, in its Delta decision, purposefully labeled the fundraising activity as failing outside of the scope of the Sherman Act in order to “smear a charitable transaction with an anticompetitive label or burden a charity with an undue legal responsibility”.123 This is similar to the approach the courts employed during their evaluations of mergers in the 1990s, where market share increases were not determinative of anticompetitive conduct and economic efficiencies could be used to thwart antitrust scrutiny. With the ACA’s changes to the way Medicare payments are processed, namely the focus on quality of care over quantity of patients served, these efficiencies are more important than ever. Mergers between large and small healthcare providers in the same market may be the only way for a small hospital to obtain the necessary quality review personnel, IT infrastructure, or hospital management expertise to increase the quality of the patient care it provides. Courts ought to take into account these non-economic and speculative synergies when weighing the benefits of a proposed merger, the mandates of the Affordable Care Act, and the potential anticompetitive effects of a transaction. Cases, such as Long Island Jewish and ProMedica, although they reach opposite conclusions, provide the necessary basis for the court’s widespread adoption of this type of flexible review of antitrust regulation. b. Non-Traditional Merger Structures The Norman PHO Advisory Opinion issued by the FTC also provides the groundwork a new type of transaction that would inherently allow the FTC and courts to take a more flexible review of antitrust law. Clinical integration agreements, already conditionally approved by the FTC, allow healthcare providers and physicians to achieve intra-industry coordination and cooperation desired by the Affordable Care Act, without many of the potential anticompetitive 121 50 F.3d 710 (9th Cir. 1995)[hereinafter, DELTA]. DELTA, 50 F.3d at 711. 123 Tara Norgard, Note, How Charitable is the Sherman Act?, 83 MINN. L. REV. 1515, 1538 (1999). 122 29 byproducts of a large-scale merger. This places readily ascertainable benchmarks on physician performance to ensure the efficient and cost effective allocation of medical resources,124 while still maintaining competition in the network’s geographic region.125 However, there are serious limitations to the widespread use of clinical integration agreements. First, they require extensive antitrust compliance in order to mollify the FTC’s concerns over potential abuses of monopoly power when negotiating with vendors, insurers, and employers.126 As a result, the training required, staff knowledge, and legal expertise required to implement a widespread compliance network is an additional cost that needs to be passed onto the consumer or insurers and is an ongoing cost not necessitated by a true merger. Additionally, the FTC acknowledges that the same concerns it has over true mergers would not necessarily be solved by a clinical integration agreement, namely that the network’s size would give it anticompetitive bargaining power. This has been a concern in judicial and FTC scrutiny of mergers since the most recent merger wave started and although Norman PHO agreed to install safeguards to ensure that it does not occur, there is no reason that merging hospitals could not agree to a similar provision and achieve the efficiencies afforded to them as a result of a full-fledged merger. Although the FTC has sanitized Norman PHO’s clinical integration network, this is a resource heavy, factually specific agreement that does not lend itself to widespread implementation as a merger or asset acquisition replacement. V. CONCLUSION The Patient Protection and Affordable Care Act radically transformed the healthcare industry and changed the operating dynamic for healthcare providers, from physicians to hospitals. As a result of these changes, there are new incentives for healthcare 124 Dennis Butts et al., The 7 Components of a Clinical Integration Network, BECKER’S HOSPITAL REVIEW (Oct. 19, 2012), http://www.beckershospitalreview.com/hospital-physicianrelationships/the-7-components-of-a-clinical-integration-network.html (describing the goals for physicians on which payment as a member of the clinical integration network is predicated). 125 Norman PHO Opinion, supra note 111, at pg. 18 (detailing the ways in which Norman PHO’s clinical integration network would preserve competition). 126 Id. at pg. 20 (noting that Norman PHO is responsible for antitrust compliance of the networks’ actions). 30 providers to consolidate in order to increase revenue, optimize healthcare infrastructure, and improve patient care. This has led to a third wave of hospital mergers, following the waves of the mid-1990s and early 2000s. Although the Affordable Care Act seems to explicitly and implicitly encourage, or at least condone, widespread consolidation, the FTC and courts have strictly imposed antitrust laws to block potential mergers. This is part of a concerted effort of the part of the FTC to better police hospital and healthcare mergers, something the agency admits it failed to do during the first two waves of hospital mergers. However, strictly interpreting antitrust law to enjoin potential mergers is fundamentally at odds with the mandate of the Affordable Care Act. While this article does not believe that this tension rises to the level of implied repeal, it does advocate for a change in thinking as to how the FTC and courts should apply antitrust law, especially the Sherman Act, to healthcare and hospital mergers. Only by relaxing the standards and adopting a flexible approach that adequately captures IT, management, and revenue efficiencies that healthcare mergers in the post-PPACA world can achieve, can federal agencies and courts properly determine whether potential anticompetitive effects of healthcare provider mergers are outweighed by the benefits to patient care and health care costs. [AP: Cory – this is really excellent work. You’ve identified a sophisticated issue and given it full, thoughtful treatment. My impression is that there are times your organization did not flow as well as it could. There were also times that you wrote as though being paid by the word. But both of these issues are easily correctable. My suggestion would be to first do an “organization” edit in which you think about my attempts to streamline your headings and subheadings. Then add roadmaps and thesis sentences throughout – sometimes moving the thesis sentences you already have at the end of sections to the front. You’ll also want to think about keeping similar ideas together. Readers get confused when we repeat points – “Why here? Didn’t he say this before? Is this different?” My further suggestion would then be to do a “phrasing and word” edit in which you work on shorter sentences and paragraphs. See if you can cut by about 25%. Remember that you’ve added about 10% in your “organization” edit. In the end, you’ll have a paper that walks your reader through your points more carefully, but that makes the points more concisely. 31 Hope all of that helps. I’m honored that you put so much effort and thought into a two-credit course. AP 32