29-May-09 PRELIMINARY RESULTS Less than 10 10-20

advertisement

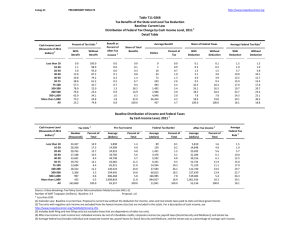

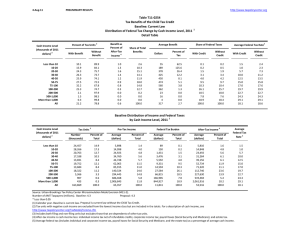

29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 65.3 62.2 67.5 77.0 81.5 86.3 87.9 75.9 30.5 8.6 4.9 71.7 With Tax Increase 0.0 0.2 0.3 0.2 0.1 0.1 0.1 0.3 26.8 84.6 90.5 2.4 Percent Change in After-Tax Income 4 5.9 3.2 2.1 1.7 1.4 1.2 0.9 0.6 -0.3 -2.6 -4.3 0.0 Share of Total Federal Tax Change 654.4 1,588.7 1,526.8 1,280.6 1,009.0 2,002.9 1,324.7 2,246.8 -700.2 -2,319.7 -8,543.5 100.0 Average Federal Tax Change ($) -323 -514 -538 -582 -606 -677 -686 -705 682 14,515 100,806 -5 Average Federal Tax Rate5 Change (% Points) -5.5 -3.1 -1.9 -1.5 -1.2 -1.0 -0.7 -0.5 0.2 1.9 3.1 0.0 Under the Proposal 0.6 1.4 6.0 10.6 13.7 16.7 18.6 21.3 24.4 27.0 30.9 20.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 6.8 Proposal: 5.5 (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 65.3 62.2 67.5 77.0 81.5 86.3 87.9 75.9 30.5 8.6 4.9 71.7 0.0 0.2 0.3 0.2 0.1 0.1 0.1 0.3 26.8 84.6 90.5 2.4 Percent Change in After-Tax Income 4 5.9 3.2 2.1 1.7 1.4 1.2 0.9 0.6 -0.3 -2.6 -4.3 0.0 Share of Total Federal Tax Change 654.4 1,588.7 1,526.8 1,280.6 1,009.0 2,002.9 1,324.7 2,246.8 -700.2 -2,319.7 -8,543.5 100.0 Average Federal Tax Change Dollars -323 -514 -538 -582 -606 -677 -686 -705 682 14,515 100,806 -5 Percent -89.9 -69.0 -24.5 -12.4 -8.1 -5.6 -3.7 -2.1 0.9 7.6 11.2 0.0 Share of Federal Taxes Change (% Points) -0.2 -0.4 -0.4 -0.3 -0.3 -0.5 -0.3 -0.6 0.2 0.6 2.2 0.0 Under the Proposal 0.0 0.2 1.2 2.3 2.9 8.6 8.8 26.2 19.9 8.3 21.4 100.0 Average Federal Tax Rate5 Change (% Points) -5.5 -3.1 -1.9 -1.5 -1.2 -1.0 -0.7 -0.5 0.2 1.9 3.1 0.0 Under the Proposal 0.6 1.4 6.0 10.6 13.7 16.7 18.6 21.3 24.4 27.0 30.9 20.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,000 24,432 22,456 17,395 13,160 23,374 15,256 25,181 8,112 1,263 670 168,027 Percent of Total 9.5 14.5 13.4 10.4 7.8 13.9 9.1 15.0 4.8 0.8 0.4 100.0 Average Income (Dollars) 5,837 16,754 27,751 38,878 50,046 68,766 96,850 152,523 314,635 759,050 3,231,782 89,404 Average Federal Tax Burden (Dollars) 360 745 2,196 4,687 7,463 12,135 18,733 33,147 75,945 190,240 896,636 18,557 Average AfterTax Income 4 (Dollars) 5,477 16,009 25,555 34,191 42,583 56,631 78,117 119,377 238,691 568,810 2,335,146 70,847 Average Federal Tax Rate 5 6.2 4.5 7.9 12.1 14.9 17.7 19.3 21.7 24.1 25.1 27.7 20.8 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.6 2.7 4.2 4.5 4.4 10.7 9.8 25.6 17.0 6.4 14.4 100.0 0.7 3.3 4.8 5.0 4.7 11.1 10.0 25.3 16.3 6.0 13.1 100.0 0.2 0.6 1.6 2.6 3.2 9.1 9.2 26.8 19.8 7.7 19.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 6.8 Proposal: 5.5 (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 65.1 54.4 58.5 73.0 80.8 85.8 82.0 25.2 12.7 8.8 1.6 64.2 0.0 0.3 0.1 0.0 0.0 0.0 0.0 0.0 41.3 79.2 87.3 1.0 Percent Change in After-Tax Income 4 5.3 2.0 1.4 1.3 1.1 0.9 0.5 0.1 -0.5 -2.2 -4.0 0.5 Share of Total Federal Tax Change 22.4 33.3 30.1 25.0 18.0 32.3 13.1 3.6 -8.0 -14.3 -55.8 100.0 Average Federal Tax Change Dollars Percent -281 -311 -336 -415 -428 -474 -394 -115 1,084 11,907 86,604 -191 -54.1 -24.4 -11.2 -7.1 -4.7 -3.2 -1.8 -0.3 1.4 6.2 9.1 -1.8 Share of Federal Taxes Change (% Points) -0.4 -0.6 -0.5 -0.3 -0.2 -0.3 0.0 0.3 0.3 0.3 1.2 0.0 Under the Proposal 0.4 1.9 4.4 6.1 6.8 18.0 13.5 20.9 10.9 4.6 12.4 100.0 Average Federal Tax Rate5 Change (% Points) -4.8 -1.9 -1.2 -1.1 -0.9 -0.7 -0.4 -0.1 0.3 1.6 2.8 -0.4 Under the Proposal 4.1 5.8 9.7 14.1 17.5 21.0 23.0 24.1 25.1 27.6 33.2 20.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,563 15,502 12,950 8,694 6,099 9,865 4,817 4,580 1,072 174 93 75,772 15.3 20.5 17.1 11.5 8.1 13.0 6.4 6.0 1.4 0.2 0.1 100.0 Average Income (Dollars) 5,853 16,653 27,626 38,753 50,008 68,138 95,751 148,129 317,350 744,198 3,141,841 51,323 Average Federal Tax Burden (Dollars) 519 1,278 3,009 5,886 9,159 14,790 22,365 35,876 78,483 193,554 955,184 10,527 Average AfterTax Income 4 (Dollars) 5,334 15,374 24,618 32,867 40,849 53,348 73,387 112,253 238,867 550,644 2,186,657 40,797 Average Federal Tax Rate 5 8.9 7.7 10.9 15.2 18.3 21.7 23.4 24.2 24.7 26.0 30.4 20.5 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.7 6.6 9.2 8.7 7.8 17.3 11.9 17.4 8.8 3.3 7.5 100.0 2.0 7.7 10.3 9.2 8.1 17.0 11.4 16.6 8.3 3.1 6.6 100.0 0.8 2.5 4.9 6.4 7.0 18.3 13.5 20.6 10.5 4.2 11.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 48.1 64.6 68.5 67.2 70.8 81.6 89.8 91.6 34.0 8.7 5.7 74.0 0.0 0.0 0.1 0.7 0.2 0.1 0.2 0.1 23.5 85.2 90.8 4.9 Percent Change in After-Tax Income 4 5.9 4.6 3.2 2.3 1.9 1.5 1.1 0.7 -0.2 -2.6 -4.4 -0.4 Share of Total Federal Tax Change -1.9 -8.7 -13.4 -12.2 -11.7 -27.7 -25.2 -58.5 13.6 53.7 192.5 100.0 Average Federal Tax Change Dollars -270 -760 -862 -844 -871 -921 -879 -894 583 14,904 101,303 463 Percent -89.1 -130.8 -63.5 -28.4 -17.9 -10.0 -5.4 -2.8 0.8 7.8 11.6 1.4 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.2 -0.2 -0.4 -0.4 -1.2 -0.2 0.6 2.3 0.0 Under the Proposal 0.0 0.0 0.1 0.4 0.7 3.5 6.2 28.6 24.6 10.2 25.6 100.0 Average Federal Tax Rate5 Change (% Points) -5.5 -4.4 -3.1 -2.2 -1.7 -1.3 -0.9 -0.6 0.2 2.0 3.2 0.3 Under the Proposal 0.7 -1.0 1.8 5.4 8.0 11.9 15.9 20.5 24.2 26.9 30.4 21.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,074 3,301 4,500 4,187 3,878 8,722 8,317 18,981 6,785 1,044 551 62,623 3.3 5.3 7.2 6.7 6.2 13.9 13.3 30.3 10.8 1.7 0.9 100.0 Average Income (Dollars) 4,875 17,259 28,008 39,068 50,194 69,670 97,674 154,413 313,960 761,886 3,195,340 152,719 Average Federal Tax Burden (Dollars) 303 581 1,357 2,967 4,869 9,219 16,379 32,487 75,454 190,129 871,481 33,000 Average AfterTax Income 4 (Dollars) 4,572 16,679 26,650 36,101 45,325 60,451 81,295 121,926 238,506 571,757 2,323,859 119,718 Average Federal Tax Rate 5 6.2 3.4 4.9 7.6 9.7 13.2 16.8 21.0 24.0 25.0 27.3 21.6 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.1 0.6 1.3 1.7 2.0 6.4 8.5 30.7 22.3 8.3 18.4 100.0 0.1 0.7 1.6 2.0 2.3 7.0 9.0 30.9 21.6 8.0 17.1 100.0 0.0 0.1 0.3 0.6 0.9 3.9 6.6 29.8 24.8 9.6 23.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 81.0 82.4 89.5 93.7 96.0 96.0 94.7 35.1 11.5 8.0 0.6 86.5 0.0 0.0 1.1 0.2 0.1 0.1 0.0 0.0 43.3 89.6 96.9 0.7 Percent Change in After-Tax Income 4 8.4 5.4 2.9 1.9 1.5 1.2 0.8 0.2 -0.5 -2.6 -4.6 1.5 Share of Total Federal Tax Change 7.8 29.9 21.7 16.7 10.8 16.9 6.8 1.6 -1.4 -2.8 -8.3 100.0 Average Federal Tax Change Dollars -596 -951 -785 -674 -650 -681 -642 -200 1,184 14,681 101,776 -629 Percent 139.0 125.0 -128.6 -17.8 -9.2 -5.9 -3.3 -0.6 1.5 8.5 11.5 -8.7 Share of Federal Taxes Change (% Points) -0.8 -3.1 -1.9 -0.8 -0.1 0.8 1.0 2.0 0.9 0.5 1.4 0.0 Under the Proposal -1.3 -5.1 -0.5 7.4 10.1 26.0 18.8 24.9 8.6 3.4 7.7 100.0 Average Federal Tax Rate5 Change (% Points) -9.0 -5.7 -2.8 -1.7 -1.3 -1.0 -0.7 -0.1 0.4 2.0 3.3 -1.3 Under the Proposal -15.4 -10.2 -0.6 8.0 12.8 16.1 19.4 22.8 24.5 25.1 31.7 13.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,245 5,382 4,732 4,249 2,835 4,249 1,813 1,372 197 33 14 27,175 8.3 19.8 17.4 15.6 10.4 15.6 6.7 5.1 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,658 16,742 27,809 38,937 49,870 68,240 95,879 142,970 318,955 750,220 3,120,554 49,021 Average Federal Tax Burden (Dollars) -429 -761 611 3,779 7,038 11,635 19,218 32,754 76,962 173,442 887,220 7,225 Average AfterTax Income 4 (Dollars) 7,087 17,503 27,198 35,158 42,832 56,605 76,660 110,216 241,993 576,778 2,233,333 41,797 Average Federal Tax Rate 5 -6.4 -4.5 2.2 9.7 14.1 17.1 20.0 22.9 24.1 23.1 28.4 14.7 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.1 6.8 9.9 12.4 10.6 21.8 13.1 14.7 4.7 1.8 3.3 100.0 1.4 8.3 11.3 13.2 10.7 21.2 12.2 13.3 4.2 1.7 2.7 100.0 -0.5 -2.1 1.5 8.2 10.2 25.2 17.8 22.9 7.7 2.9 6.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 80.7 95.3 96.7 98.3 98.6 98.7 98.1 92.4 34.2 4.5 1.7 89.5 0.0 0.0 0.6 0.1 0.0 0.1 0.3 0.2 24.0 92.7 96.6 3.4 Percent Change in After-Tax Income 4 9.0 6.8 4.0 2.8 2.3 1.7 1.2 0.8 -0.3 -3.3 -5.2 0.1 Share of Total Federal Tax Change 35.3 143.3 131.3 106.2 81.6 158.3 114.3 233.5 -52.1 -209.9 -644.3 100.0 Average Federal Tax Change Dollars -634 -1,249 -1,102 -985 -987 -985 -950 -984 648 18,194 117,400 -91 Percent 93.5 84.9 4,177.9 -30.3 -15.3 -9.0 -5.4 -3.0 0.8 9.0 12.8 -0.4 Share of Federal Taxes Change (% Points) -0.1 -0.6 -0.5 -0.4 -0.3 -0.6 -0.4 -0.8 0.3 0.8 2.6 0.0 Average Federal Tax Rate5 Under the Proposal Change (% Points) Under the Proposal -0.3 -1.2 -0.5 0.9 1.8 6.1 7.7 29.4 24.3 9.8 21.9 100.0 -10.0 -7.4 -4.0 -2.5 -2.0 -1.4 -1.0 -0.6 0.2 2.4 3.7 -0.1 -20.6 -16.1 -4.1 5.8 11.0 14.4 17.1 20.9 25.0 29.0 32.5 20.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,575 5,305 5,512 4,988 3,825 7,434 5,566 10,981 3,723 534 254 50,838 5.1 10.4 10.8 9.8 7.5 14.6 11.0 21.6 7.3 1.1 0.5 100.0 Average Income (Dollars) 6,368 16,859 27,793 38,974 50,034 69,037 97,327 153,420 312,848 758,319 3,186,906 113,062 Average Federal Tax Burden (Dollars) -678 -1,472 -26 3,250 6,467 10,891 17,621 33,105 77,624 201,717 916,933 23,692 Average AfterTax Income 4 (Dollars) 7,046 18,331 27,819 35,724 43,567 58,145 79,706 120,315 235,224 556,601 2,269,973 89,369 Average Federal Tax Rate 5 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total -10.7 -8.7 -0.1 8.3 12.9 15.8 18.1 21.6 24.8 26.6 28.8 21.0 0.3 1.6 2.7 3.4 3.3 8.9 9.4 29.3 20.3 7.0 14.1 100.0 0.4 2.1 3.4 3.9 3.7 9.5 9.8 29.1 19.3 6.5 12.7 100.0 -0.1 -0.7 0.0 1.4 2.1 6.7 8.1 30.2 24.0 8.9 19.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0292 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 15.4 12.5 17.5 25.4 26.4 35.0 47.2 43.0 19.6 10.8 4.5 25.5 0.0 0.0 0.0 0.1 0.0 0.1 0.0 0.2 28.6 75.1 88.6 2.3 Percent Change in After-Tax Income 4 0.8 0.4 0.3 0.4 0.3 0.3 0.4 0.2 -0.2 -1.3 -3.3 -0.5 Share of Total Federal Tax Change -0.8 -3.6 -4.9 -4.6 -3.2 -7.3 -7.7 -10.4 7.2 18.8 116.6 100.0 Average Federal Tax Change Dollars Percent -48 -63 -87 -132 -145 -212 -316 -290 566 7,749 78,450 334 -24.6 -18.0 -10.1 -7.0 -5.2 -3.5 -2.5 -1.1 0.8 4.4 8.6 2.3 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.3 -0.3 -0.7 -0.3 0.2 2.0 0.0 Under the Proposal 0.1 0.4 1.0 1.4 1.3 4.6 6.8 20.7 19.8 10.3 33.6 100.0 Average Federal Tax Rate5 Change (% Points) -0.8 -0.4 -0.3 -0.3 -0.3 -0.3 -0.3 -0.2 0.2 1.0 2.4 0.4 Under the Proposal 2.4 1.7 2.8 4.6 5.3 8.4 12.6 16.6 21.2 24.2 30.0 16.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,070 6,680 6,674 4,077 2,564 4,073 2,877 4,202 1,489 285 175 35,193 5.9 19.0 19.0 11.6 7.3 11.6 8.2 11.9 4.2 0.8 0.5 100.0 Average Income (Dollars) 6,166 17,135 27,542 38,630 49,862 69,426 96,871 152,477 322,237 765,472 3,283,902 87,173 Average Federal Tax Burden (Dollars) 195 351 866 1,890 2,795 6,059 12,502 25,557 67,668 177,479 907,740 14,262 Average AfterTax Income 4 (Dollars) 5,971 16,785 26,676 36,741 47,067 63,367 84,370 126,920 254,569 587,993 2,376,162 72,912 Average Federal Tax Rate 5 3.2 2.1 3.1 4.9 5.6 8.7 12.9 16.8 21.0 23.2 27.6 16.4 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.4 3.7 6.0 5.1 4.2 9.2 9.1 20.9 15.6 7.1 18.7 100.0 0.5 4.4 6.9 5.8 4.7 10.1 9.5 20.8 14.8 6.5 16.2 100.0 0.1 0.5 1.2 1.5 1.4 4.9 7.2 21.4 20.1 10.1 31.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold; (g) reinstate the 39.6 percent bracket; (h) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (i) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (j) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (k) limit value of itemized deduction to 28 percent; (l) maintain the estate tax at its 2009 parameters. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.