O R

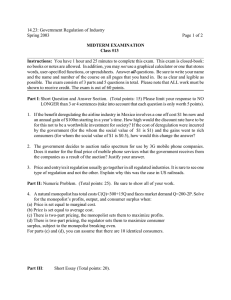

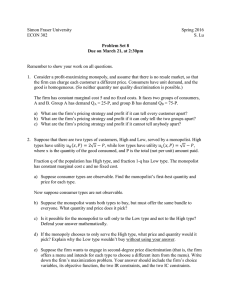

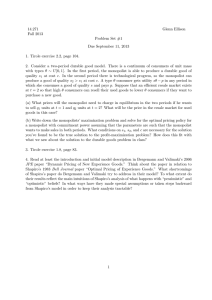

advertisement