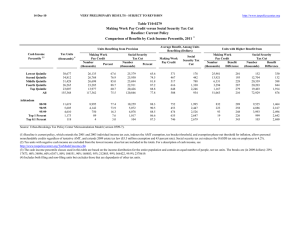

21-Mar-06 Preliminary Results Lowest Quintile Second Quintile

advertisement

21-Mar-06 Preliminary Results http://www.taxpolicycenter.org Table T06-0065 Impose $10,000 Limit on Individual Income Tax Cuts in EGTRRA, JGTRRA, and WFTRA With Extension of 2005 AMT Relief, Indexed for Inflation Distribution of Federal Tax Change by Cash Income Percentile, 2011 1 Cash Income Percentile2 Percent of Tax Units 3 With Tax Cut With Tax Increase Percent Change in After-Tax Income4 Share of Total Federal Tax Change Average Federal Tax Change Dollars Percent Share of Federal Taxes Change (% Points) Under the Proposal Average Federal Tax Rate 5 Change (% Points) Under the Proposal Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 5.2 1.0 0.0 0.0 0.0 0.0 -1.2 -0.7 0.0 0.0 0.0 0.0 100.0 100.0 0 0 0 0 2,082 416 0.0 0.0 0.0 0.0 3.7 2.6 0.0 -0.1 -0.2 -0.5 0.7 0.0 0.5 2.6 8.0 17.6 71.1 100.0 0.0 0.0 0.0 0.0 0.9 0.5 3.8 8.7 15.2 19.3 25.4 21.5 Addendum Top 10 Percent Top 5 Percent Top 1 Percent Top 0.5 Percent Top 0.1 Percent 0.0 0.0 0.0 0.0 0.0 10.4 20.6 72.8 85.5 94.6 -1.6 -2.2 -4.0 -4.8 -5.6 100.0 100.0 97.6 90.0 59.3 4,164 8,325 40,659 74,975 247,017 4.8 6.1 10.5 12.1 13.3 1.1 1.5 1.9 1.8 1.2 55.6 43.6 26.0 21.1 12.8 1.2 1.6 2.9 3.4 3.9 26.9 28.1 30.7 31.7 33.5 Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2011 1 Cash Income Percentile2 Tax Units3 Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After-Tax Income4 (Dollars) Average Federal Tax Rate5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All 30,620 31,187 31,196 31,195 31,197 155,984 19.6 20.0 20.0 20.0 20.0 100.0 9,918 24,924 43,588 75,268 230,709 76,577 378 2,157 6,639 14,552 56,559 16,078 9,540 22,767 36,949 60,716 174,150 60,499 3.8 8.7 15.2 19.3 24.5 21.0 2.5 6.5 11.4 19.7 60.3 100.0 3.1 7.5 12.2 20.1 57.6 100.0 0.5 2.7 8.3 18.1 70.4 100.0 Addendum Top 10 Percent Top 5 Percent Top 1 Percent Top 0.5 Percent Top 0.1 Percent 15,599 7,799 1,560 780 156 10.0 5.0 1.0 0.5 0.1 341,597 511,855 1,399,560 2,196,271 6,282,917 87,592 135,566 388,886 622,031 1,858,156 254,005 376,289 1,010,674 1,574,240 4,424,761 25.6 26.5 27.8 28.3 29.6 44.6 33.4 18.3 14.3 8.2 38.0 28.1 15.1 11.8 6.6 54.5 42.2 24.2 19.3 11.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0305-3A). (1) Calendar year. Baseline is extended law with the extension of the 2005 AMT exemption levels ($58,000 for married couples and $40,250 for singles and heads of household), indexed for inflation after 2005; allowance of personal non-refundable credits regardless of tentative AMT; and extending the non-refundable credit for elective deferrals and IRA contributions (the "saver's credit"). Proposal includes extending but limiting the individual income tax cuts due to the following provisions in EGTRRA, JGTRRA, and WFTRA to $10,000 (indexed for inflation after 2007): marginal tax rates; the 10-percent bracket; the child tax credit; the child and dependent care credit; the standard deduction, 15-percent bracket, and EITC for married couples; tax rates on long-term capital gains and dividends; pension and IRA provisions; expansion of student loan interest deduction (excludes other education provisions). The effect of these provisions is measured against a current-law baseline with the extension of the 2000 AMT exemption levels ($45,000 for married couples and $33,750 for singles and heads of household), indexed for inflation after 2000; and allowance of personal non-refundable credits regardless of tentative AMT. (2) Tax units with negative cash income are excluded from the lowest quintile but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units. Tax units that are dependents of other taxpayers are excluded from the analysis. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.