Community Services Block Grant Administrative Expenses

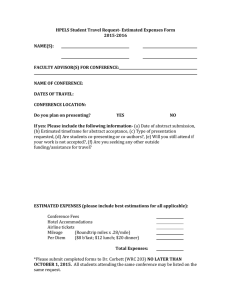

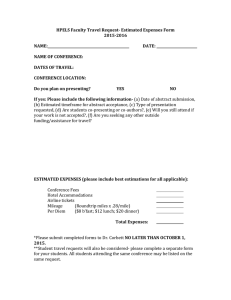

advertisement