Spring 2007 - May 15, 2007 Ph.D. Qualification Examination in Microeconomics

advertisement

Spring 2007 - May 15, 2007

Ph.D. Qualification Examination in Microeconomics

Examiners: Borcherding, Denzau and Filson

100 pts. – 4 hours + 1 hour for reading and note taking

Please answer each of the three sections, below. There is choice in each section. Write

legibly. Good luck.

Part A – Basic Economics (25 pts.)

Answer question # 1 and any 4 of the remaining 7 questions.

1. Recently Waldo’s bank introduced an online savings account with an interest rate of

5%. Given that traditional savings accounts typically offer a rate of essentially zero, he

quickly attempted to sign up. However, he was told that he needed to be a new customer

of the bank to qualify. Meanwhile, several of his bank’s competitors are offering online

savings accounts with similar rates to try to attract new customers. Comment on the

likely outcomes of these offerings on consumer savings behavior, but keep in mind that

traditionally there has been substantial consumer inertia in the banking market. Is the

strategy of targeting new customers likely to be a long-run equilibrium strategy for these

banks, is the strategy optimal only in the short run, or is it just a mistake? Explain.

2. Consider a tax imposed on restaurants in a small suburban community like Claremont.

In the short run (a few months or so), who is most likely to be bearing (paying) the tax?

(I.e., whose income is reduced by the tax?) What about the long period? Explain.

3. A firm's production (scale) expansion path is a 45o-line when Q = LαKβ and α =

β > Ο, , regardless of the values for α and β. Is this true? What then is the

significance of the absolute values of α and β?

4. A grocery strike is looming in southern California. The last one, three years ago, hurt

the union badly, and, based on stock values, hardly affected the chain groceries bottom

lines. Use Marshall’s four laws, explain the decline over the last three decades in the

power of the union representing grocery checkers and shelf stockers.

5. You own two sort of “priceless” watches. They are more or less perfect substitutes. If

you sell only one at an auction an oligarch or some prince will pay $1m for it. If you sell

both, however, you will get only $50K for each watch. Why? What should you do?

Comment how this lesson has, perhaps, affected the market for diamonds, which due to

the U.S. Department of Justice, threatened the leading wholesaler, DeBeers, Ltd.

6. Suppose that in 2010 a new widget can be added to the engine of an internal

combustion engine so that it gets twice the gas mileage it previously realized.

a. What determines whether a household would use more or less fuel at the same

price for gasoline?

b. Using a supply and demand analysis, what would happen to the price of gasoline?

7. Fifty years ago textbooks always used capital as an example of fixed costs. Nowadays

some writers refer to labor as a “quasi-fixed” factor. Why the change?

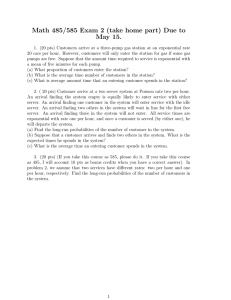

Part B – Formal Modeling Based on Econ 316 (35 pts.)

Answer either 1 or 2.

1..

2.

Acme Machinery has patented a new machine, which produces a unique product that

greatly lowers the cost for users. Acme sells this machine in two markets

(designated 1 and 2), as a onopolist in each. The firm’s cost function is given by

C = 2Q,

and the demand in each market is given by

Q1 = 10 - 2P1, and

Q2 = 40 - 4P2.

a. What is the firm’s best choice if it can price at different levels in each market?

What are its profits?

b. What is the firm’s best choice if it must charge a uniform price to all

customers? What are its profits?

c. Suppose that the firm can freely choose prices as in (a). However, one of its

old customers realizes that it can buy a machine, ship it to the other market, and

make a profit. If the cost of shipping is 1, how does this affect the firm’s best

choice? What are its profits?

Consider an economy in which each of 2 commodities using inputs of labor and

the other commodity.

Labor requirements for commodity are 4 and 1 units of labor per unit of output for

good 1 and 2, respectively.

Commodity 1 uses 0.5 of commodity 2 per unit of commodity 1 produced, and

Commodity 2 uses 0.25 of commodity 1 per unit of commodity 2 produced.

There are M consumers, and each consumer, i, has a utility function:

ui(x1,x2) = x10.5 x20.5.

Each consumer i initially holds Li of labor to sell. There is a total of 200 labor sold

among the 100 consumers.

a.

b.

c.

What are the equilibrium prices?

What are the equilibrium outputs?

What is GDP, with labor as numeraire?

Part C – Game Theory Based on Econ 317 (40 pts.)

Answer.

1. Two firms are competing to be the first to introduce a new good. If a firm succeeds it

gets a payoff of V; otherwise it gets a payoff of 0 (it is possible that neither firm

succeeds). Each firm is either good (G) or bad (B). Each firm knows its own type but not

the other firm’s type. The ex ante probability that a firm is good is p. Each firm

simultaneously decides whether to spend c or not, where c > 0. A firm’s likelihood of

success depends on its own type, the other firm’s type, whether it spends c, and whether

the other firm spends c. The probability of success is either 0, q1 , q2 , or q3 , where 0 < q1

< q2 < q3 . If a firm does not spend c, its probability of success is 0 and it gets a payoff of

0. The following table considers the case where firm 1 spends c and describes how firm

1’s probability of success depends on each firm’s type and on whether or not firm 2

spends c. The first column lists each firm’s type; the second lists whether firm 2 spends c,

and the third lists each firm’s probability of success (firm 1 is listed first, then firm 2):

{G,G}

2 spends

q1 , q1

{G,G}or {G,B}

2 does not spend

q3 , 0

{G,B}

2 spends

q2 , 0

{B,G}

2 spends

0, q2

{B,G} or {B,B}

2 does not spend

q2 , 0

{B,B}

2 spends

q1 , q1

a. What conditions on V, p, c, q1 , q2 , and q3 make it optimal for both firms to always

spend c?

b. What conditions make it optimal for both firms to never spend c?

c. What conditions make it optimal for each firm to spend c if it is good and not spend

c if it is bad?

d. What conditions make it optimal for firm 1 to spend c if it is good and not spend c

if it is bad and for firm 2 to never spend c?

e. Describe how the Bayesian Nash Equilibrium of this game depends on the

parameters V, p, c, q1 , q2 , and q3 .

2. Consider the following principal-agent game. P wants to hire A for a one-time project.

If A works for P, A can choose high effort, eH , or low effort, eL .

Profits are either high, π H , or low, π L , where π H > π L . If A chooses eH , then profits are

π H with probability ρ H and π L with probability 1 - ρ H . If A chooses eL , then profits

are π H with probability ρ L and π L with probability 1 - ρ L , where ρ H > ρ L .

A maximizes expected utility using a utility function defined on certain outcomes:

U ( w, e) = V ( w) − e , where w is the wage, e is the effort choice, V '( w) > 0 , and V '' < 0 .

P designs a contract, A then accepts it or not, and if A accepts, A then chooses an effort

level. A has a reservation utility level of U 0 .

a. Suppose P maximizes expected profits from the project less the expected wages (P is

risk neutral). Explain how to implement eL and eH if effort is observable and verifiable.

b. Continue to assume that P is risk neutral. If e is not observable, and P wants to

implement eL , what is the optimal contract? Explain.

c. Now suppose that P is also risk averse. P evaluates certain money payoffs using the

function U p (π − w) = (π − w)1/ 2 . Further, assume that V ( w) = w1/ 2 . Show how to

implement eL and eH if effort is observable and verifiable (set up and solve the

principal’s problem).

d. Maintain the assumptions in part c. If e is not observable, and P wants to implement

eL , will the contract you derived in part c. work? Explain.

e. Maintain the assumptions in part c. If e is not observable, and P wants to implement

eH , will the contract you derived in part c. work? Explain.