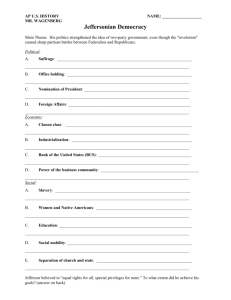

The Comparative Perspectives of the Impacts of Political

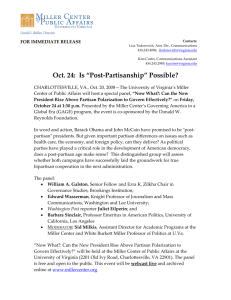

advertisement