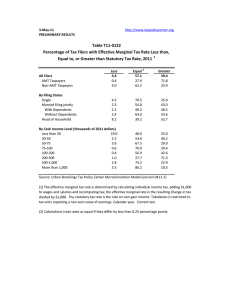

Table T09-0414 Equal to, or Greater than Statutory Tax Rate, 2009

advertisement

13-Oct-09 http://www.taxpolicycenter.org PRELIMINARY RESULTS Click on PDF or Excel for a breakdown between AMT and non-AMT taxpayers Table T09-0414 Percentage of Tax Filers with Effective Marginal Tax Rate Less than, 1 Equal to, or Greater than Statutory Tax Rate, 2009 All Filers AMT Taxpayers Non-AMT Taxpayers Less 17.5 2.3 17.9 Equal 2 50.3 16.0 51.4 Greater 32.2 81.6 30.7 By Filing Status Single Married filing jointly With Dependents Without Dependents Head of Household 18.6 14.0 11.1 17.7 23.7 61.9 45.8 43.3 48.9 32.9 19.4 40.2 45.6 33.4 43.4 44.5 57.8 64.6 58.8 45.2 12.1 40.8 28.7 18.4 36.0 29.1 35.8 49.3 85.1 53.3 63.7 By Cash Income Level (thousands of 2009 dollars) Less than 30 37.1 30-50 6.2 50-75 6.3 75-100 5.4 100-200 5.6 200-500 2.7 500-1,000 6.0 More than 1,000 7.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2) (1) The effective marginal tax rate is determined by calculating individual income tax, adding $100 to wages and salaries and recomputing tax; the effective marginal rate is the resulting change in tax divided by $100. The statutory tax rate is the rate on non-gain income. Tabulation is restricted to tax units reporting a non-zero value of earnings. Calendar year. Current law. (2) Calculations treat rates as equal if they differ by less than 0.25 percentage points. 13-Oct-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0414 Percentage of Tax Filers with Effective Marginal Tax Rate Less than, Equal to, or Greater than Statutory Tax Rate, 2009 1 AMT Paying Tax Filers Only All By Filing Status Single Married filing jointly With Dependents Without Dependents Head of Household Less 2.3 Equal 2 16.0 Greater 81.6 2.0 2.6 2.4 3.1 0.7 27.4 13.3 12.2 15.5 25.8 70.6 84.1 85.5 81.3 73.6 * * 75.8 27.1 16.0 5.1 53.4 57.1 * * 22.2 70.8 80.5 94.2 41.4 27.7 By Cash Income Level (thousands of 2009 dollars) Less than 30 * 30-50 * 50-75 2.0 75-100 2.2 100-200 3.6 200-500 0.7 500-1,000 5.2 More than 1,000 15.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2) * Insufficient data. (1) The effective marginal tax rate is determined by calculating individual income tax, adding $100 to wages and salaries and recomputing tax; the effective marginal rate is the resulting change in tax divided by $100. The statutory tax rate is the AMT rate on nongain income. Tabulation is restricted to tax units reporting a non-zero value of earnings. Calendar year. Current law. (2) Calculations treat rates as equal if they differ by less than 0.25 percentage points. 13-Oct-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0414 Percentage of Tax Filers with Effective Marginal Tax Rate Less than, Equal to, or Greater than Statutory Tax Rate, 2009 1 Non-AMT Paying Tax Filers Only All Less 17.9 Equal 2 51.4 Greater 30.7 By Filing Status Single Married filing jointly With Dependents Without Dependents Head of Household 18.8 14.7 11.8 18.3 24.0 62.2 47.7 45.6 50.3 33.0 19.0 37.6 42.6 31.3 43.0 44.5 57.8 64.6 58.9 46.5 19.2 19.2 12.7 18.4 36.0 29.1 35.6 47.9 75.9 73.5 83.9 By Cash Income Level (thousands of 2009 dollars) Less than 30 37.1 30-50 6.2 50-75 6.3 75-100 5.4 100-200 5.7 200-500 4.8 500-1,000 7.3 More than 1,000 3.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-2) (1) The effective marginal tax rate is determined by calculating individual income tax, adding $100 to wages and salaries and recomputing tax; the effective marginal rate is the resulting change in tax divided by $100. The statutory tax rate is the rate on non-gain income. Tabulation is restricted to tax units reporting a non-zero value of earnings. Calendar year. Current law. (2) Calculations treat rates as equal if they differ by less than 0.25 percentage points.