4-Nov-08 PRELIMINARY RESULTS Regular Tax AMT

advertisement

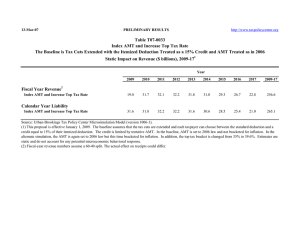

4-Nov-08 http://www.taxpolicycenter.org PRELIMINARY RESULTS T08-0253 Income Subject to Tax and Effective Marginal Tax Rates in the Regular Income Tax and the AMT Among AMT Taxpayers, Current Law 1 2008 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 0.0 0.0 87.5 94.4 94.4 65.6 6.5 5.8 58.4 100.0 100.0 12.5 5.7 5.6 34.4 93.5 94.2 41.7 1,017,530 861,977 36,676 35,370 35,710 35,154 52,208 204,415 46,641 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 0.0 0.0 5.8 1.8 14.4 65.6 62.4 22.6 100.0 100.0 100.0 93.8 95.6 85.2 33.7 33.9 76.5 Average Effective Marginal Tax Rate (percent)6 Before AMT -19.2 0.0 16.0 25.1 26.8 30.7 31.7 27.9 29.9 After AMT 17.0 26.0 26.5 31.9 31.5 34.0 29.9 27.5 32.6 2009 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 99.7 93.9 97.3 98.9 97.8 52.0 9.3 8.7 87.2 0.3 6.1 2.8 1.1 2.3 48.1 90.7 91.3 12.8 20,023 15,231 18,416 18,795 21,101 28,732 51,137 202,724 23,684 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 1.0 2.8 1.3 5.2 15.8 69.9 61.3 7.9 100.0 96.1 94.8 95.7 92.8 83.8 28.9 34.9 90.1 Average Effective Marginal Tax Rate (percent)6 Before AMT 15.2 15.4 18.2 18.1 25.0 29.2 31.2 27.9 23.8 After AMT 26.0 23.6 24.9 25.0 28.1 32.8 28.8 27.5 28.0 2010 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 99.6 95.6 97.0 99.0 97.4 48.1 9.0 6.5 86.4 0.4 4.4 3.0 1.0 2.6 51.9 91.0 93.6 13.6 20,786 15,525 18,451 18,328 20,919 29,562 54,091 201,963 23,755 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 0.0 4.1 1.3 7.4 12.8 66.5 52.8 8.5 100.0 98.6 93.5 94.9 90.7 86.2 27.9 34.3 89.2 Average Effective Marginal Tax Rate (percent)6 Before AMT 14.1 16.0 18.2 18.6 25.0 28.7 31.0 27.8 23.7 After AMT 24.3 25.7 24.6 25.6 28.1 32.7 28.7 27.6 28.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-7). (1) AMT taxpayers include those with AMT liability from Form 6251, with lost credits, and with reduced deductions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. Includes both filing and nonfiling units but excludes those that are dependents of other taxpayers. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Income subject to tax for the regular income tax is taxable income; for the AMT it is AMTI net of the AMT exemption. (4) Amounts are in nominal dollars to facilitate comparison with AMT exemption amounts. For 2007, the AMT exemption is $66,250 for married couples filing jointly and surviving spouses; $44,350 for unmarried individuals other than surviving spouses; and $33,125 for married individuals filing separately. For 2008 and 2010, the exemption amounts are $45,000, $33,750, and $22,500. (5) The marginal tax rate for each return is calculated by adding $1,000 to wages, recomputing income tax net of refundable credits, and dividing the resulting change in tax liability by 1,000. (6) Marginal tax rates represent a simple average across individuals.